Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

Wednesday 2pm - Minutes of the FOMC meeting

Thursday - Fed Govs speak

Friday 2pm - Monthly Federal Budget

MACRO

There was a lot of economic news last week!!!

Let’s start with the stellar employment report that surprised to the upside:

+147k print (vs +110k expected)

Revisions higher to prior months April +11k, May +5k (instead of downward revisions)

The hourly wage growth was below expectations +0.2% m/m vs (+0.3% expected)

4.1% (vs 4.3%) unemployment rate

Altogether, this was a very nice mix of strong jobs + low wage inflation. Once again, this gives the Fed more leeway to keep things “as-is” as inflationary pressure and economic pressure both simultaneously wear-off.

This week the FOMC minutes are to be release on Wednesday, but I don’t expect much from this. The Fed has been steady in it’s communication of “higher for longer” + “wait-and-see”.

After last week’s employment report, wait-and-see is expected to continue. The July FOMC rate cut expectations dropped significantly.

Using the CME FedWatch Tool, we can see that rate cut expectations for July dropped from 18.6% → 4.7% week-over-week.

The other big item last week was the passage of the BBB and the potential market implications.

It seems that the strategy pursued by the Trump administration will be to attempt to outgrow the debt-to-GDP ratio instead of cost-cutting down the debt-to-GDP.

A lot of differing opinions on whether this will work, which makes for a very interesting trading environment (the most pure information feedback system, imo).

Raising debt issuance will likely continue to support a trend lower in the USD. The USD is down about -12% YTD.

Also, any fear of a debt debacle will only help BTC prices as USD is panic sold in that situation.

In terms of growth friendly tax cuts, I believe this will likely help “risk-on” sentiment, which has also helped BTC and crypto higher since the April risk-off dip.

Overall, the BBB passage is likely going to sustain BTC’s trend higher and help crypto trend higher.

The one sector I continue to watch with respect to “risk-off” sentiment is US housing… As yields continue to rise, house buying becomes less affordable and could affect US consumers.

BTC: $108,923 (+1.3% / 7-day)

ETH :$2,547 (+4.5% / 7-day)

SOL :$152.41 (+0.9% / 7-day)

Crypto

The Bitcoin volatility trend YTD has been distinctly lower and I can’t help but think looking for trades along this theme make sense.

This trend is a hard one to fight, especially now that IBIT and institutional flows are now participating in volatility trading.

The DVol index above shows the continued trend lower. It’s important to remember that the volatility index reflects the implied volatility of various strikes across the curve.

If we only look at the ATM (at-the-money) volatility, we’re essentially looking at the lowest volatility point across the curve for each expiration (keep that in mind) as you read.

Looking at the chart above, we can see how ATM implied volatility has trended lower YTD but realized volatility is even lower, especially since May.

This has produced a massive variance risk premium as Bitcoin implied traded a lot higher than the subsequent realized volatility “pay-off”.

Option buyers have been burned lately.

Even 90-dte options traded +10 pts above realized, which is a lot for an option with 90-dte of vega risk.

YTD the only real “pops” higher in realized volatility were during initial tariff anouncements, the April Liberation Day “risk-off” move and the US/Iran bombing event, also “risk-off”.

When I’m thinking where to lean short volatility on BTC, this brings me back to the Bitcoin call skew.

A lot of the long-term call skew premium has been squeezed out, now nearly 0% for long-term options, but this could easily go negative as BTC continues to see downside “risk-off” volatility only.

Continued institutional structural flows (sell the call, buy the protective put) can also help push this ∆25 RR negative long-term.

This trade idea seems to make sense, but it isn’t the “trade of a lifetime” either.

Just kind of the best idea out-there I see right now.

Paradigm Top Trades this Week

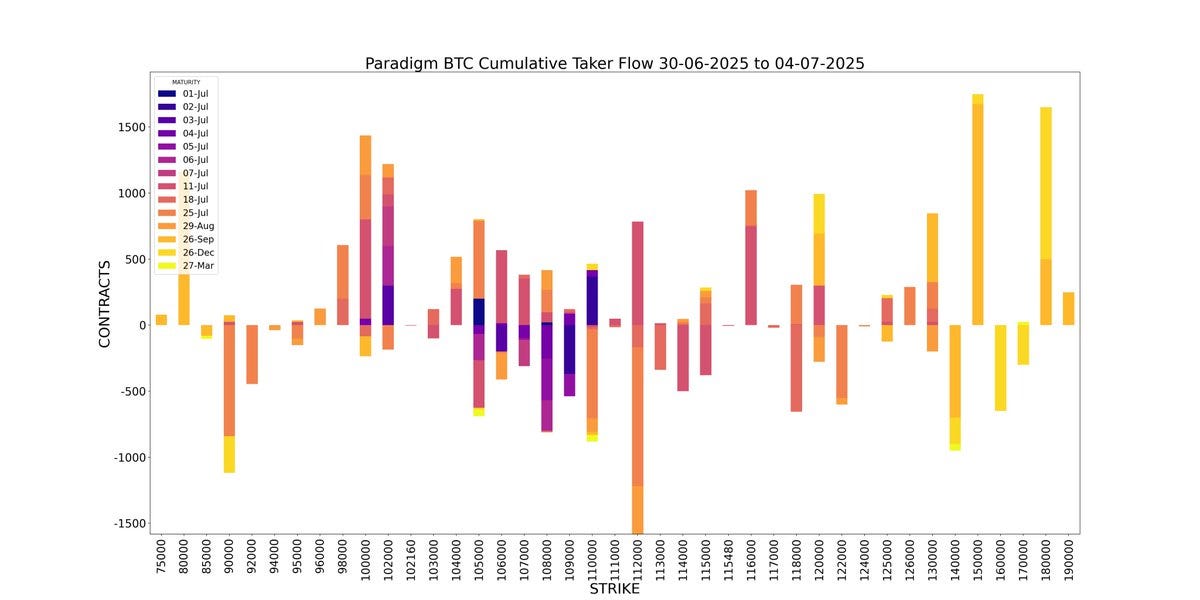

BTC Cumulative Taker Flow

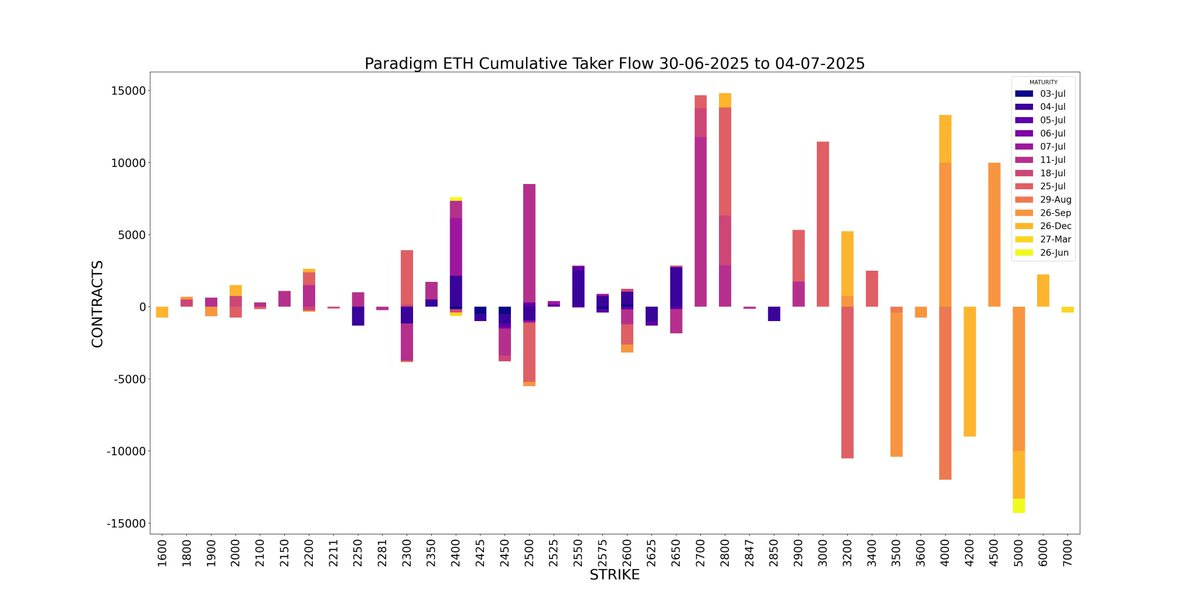

ETH Cumulative Taker Flow

BTC Cumulative OI

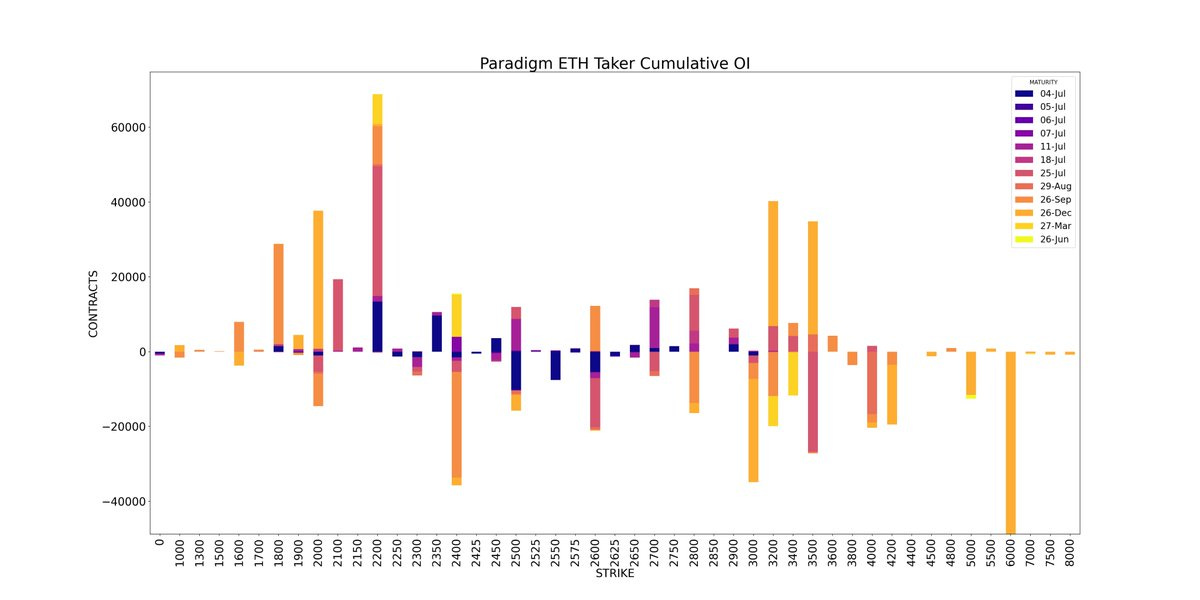

ETH Cumulative OI

BTC

ETH

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.