Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

$35,375

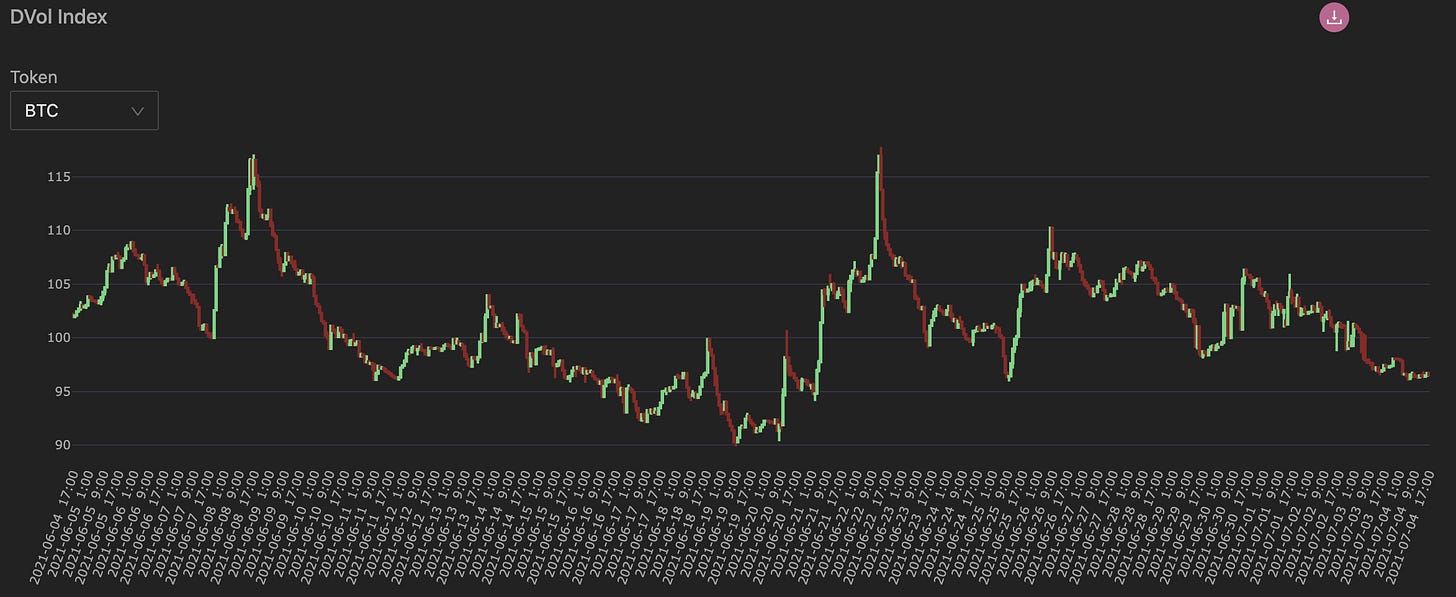

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(July 4th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Happy 4th of July everyone!

We’re happy to see that BTC spot prices have been able to hold the range and we’re now seeing a nice bounce after briefly trading below $30k about 10-days ago.

Given that support proved itself strong enough to hold, the consolidation narrative resumes.

Surprisingly, short-dated option skews remain very bid to the put side.

There hasn’t been a relief in negative skew for these expirations yet, which does provide some interesting opportunities for traders.

(July 4th, 2021 - Long-Dated BTC Skews - Deribit)

Long-dated options remain very bid to the call side.

This classic skew shape remains intact for these longer expirations.

As crypto finds support and creates a “base” range, longer-dated options seem reasonably priced as the potential for a bull market resumes.

TERM STRUCTURE

(July 4th, 2021 - BTC’s Term Structure - Deribit)

The term structure is now reflecting a Contango structure.

Since last week, short-dated IV has dropped about 25pts, medium-dated options about 10pts, and long-dated options about 5pts.

Besides the IV drop, the shape of the term structure is also congruent with falling IV.

ATM/SKEW

(July 4th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

As mentioned previously, something surprising to note in last week’s volatility activity is the divergence between falling volatility and a stubborn skew.

We’d expect skew to resume a march towards the 0 line as spot prices rally higher, but skew does seem stuck for the selected maturities above.

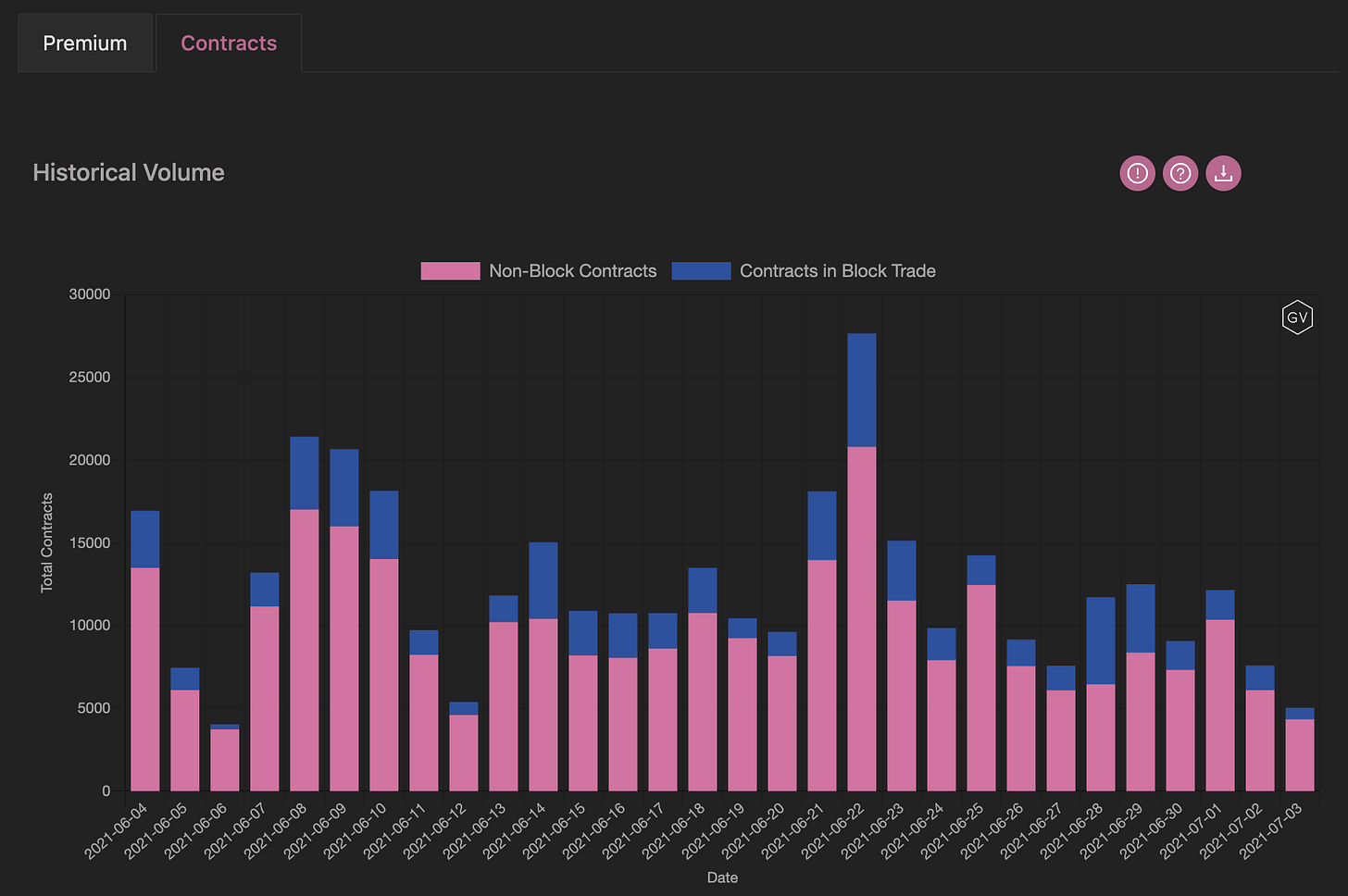

VOLUME

(July 4th, 2021 - BTC Premium Traded - Deribit)

(July 4th, 2021 - BTC’s Contracts Traded - Deribit)

Volume has dipped lower last week.

The total weekly volume does appear to be the lowest all month.

Spot prices testing support and resistance might once again invite higher volume but until then we expect option volumes to remain subdued.

VOLATILITY CONE

(July 4th, 2021 - BTC’s Volatility Cone)

Last week realized volatility saw a spike higher.

This spike appears short lived as RV now begins to resume an approach towards the median.

That said, most measurement windows do remain near the 75th percentile and because volatility is known to cluster, we should be cautious about something unexpected happening.

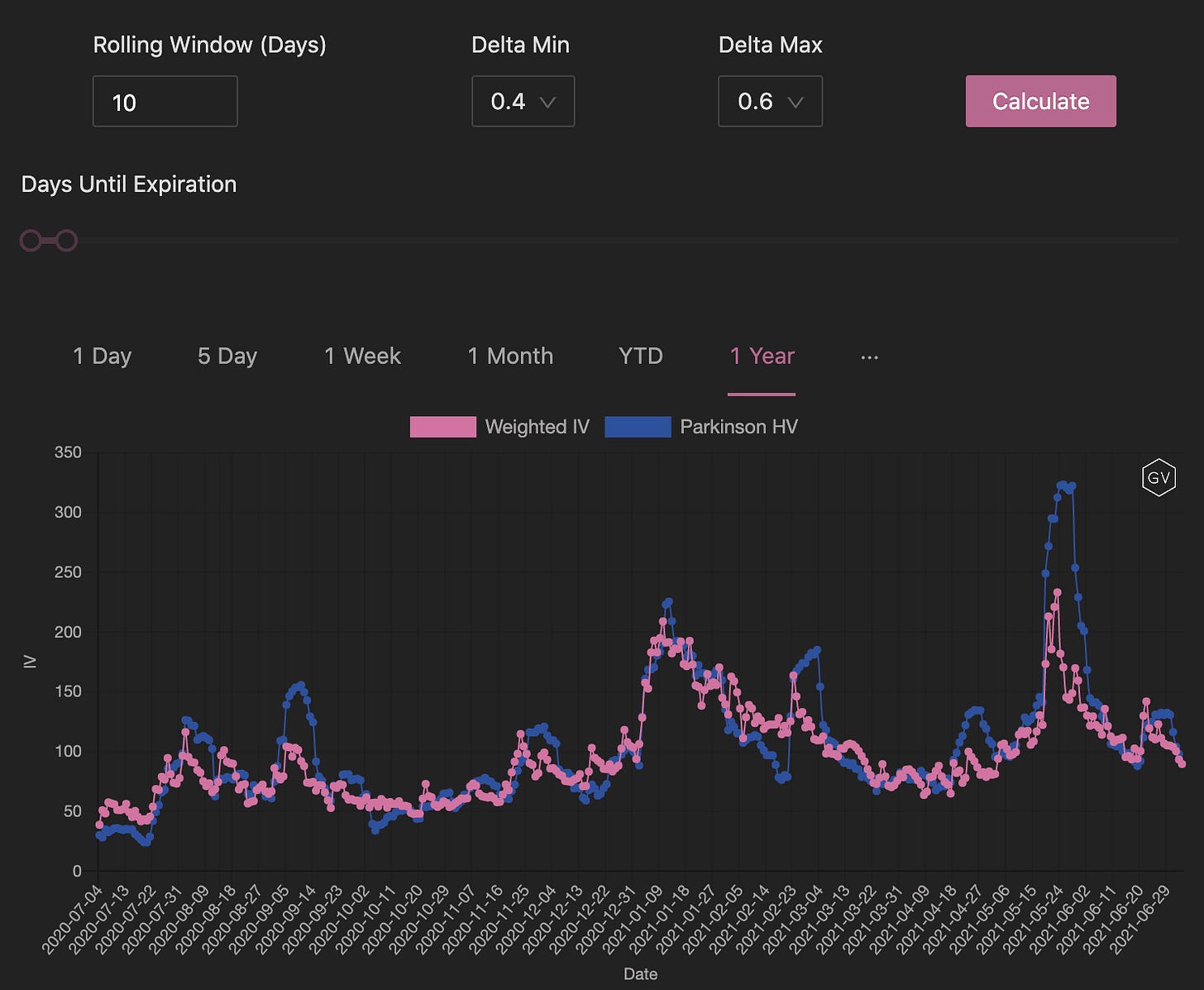

REALIZED & IMPLIED

(July 4th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV appears to be discounting RV, meaning the option markets believe the 10-day RV will likely be lower than current readings.

$2,298

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(July 4th, 2021 - ETH’s Skews - Deribit)

ETH has seen a move lower in overall IV levels as spot prices resume to hold above the $2000 level.

Short-term skew levels are negative, just like we see for BTC.

As we extend option maturities farther out, skew becomes more positive, hitting the 0 line around 90-days until expiration.

More maturities are seen holding a positive skew for ETH versus BTC.

(July 4th, 2021 - ETH’s Skews - Deribit)

As such, long-term options are more in positive territory for ETH than BTC.

ETH 180-day skew is +7.5pts while BTC is +2.5pts.

TERM STRUCTURE

(July 4th, 2021 - ETH’s Term Structure - Deribit)

ETH’s term structure has seen a significant drop in overall implied volatility along with a resumption of a Contango structure.

Short-dated options dropped nearly 30pts, medium options about 12pts and long-dated options about 5pts.

ATM/SKEW

(July 4th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is once again resuming a grind lower after a brief spike last week.

Skew is stubborn but at least remains near the 0 line.

As long as the consolidation narrative holds, the IV outlook is still most likely to be lower.

VOLUME

(July 4th, 2021 - ETH’s Premium Traded - Deribit)

(July 4th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are more steady. There isn’t as much of a significant drop seen for ETH compared to BTC.

VOLATILITY CONE

(July 4th, 2021 - ETH’s Volatility Cone)

RV had picked up last week but measurement windows are now mostly on the median, except for the longest windows.

A slow week has more impact on ETH as ETH RV was starting from a higher point.

REALIZED & IMPLIED

(July 4th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV and RV are now tightly bound but IV was discounting RV throughout the week. Now both seem to be headed lower rather quickly.