Crypto Options Analytics, July 3rd, 2022

Congrats to Deribit launching their “test” version of combo trades!

Click here, to visit!

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE:

About 14-months ago, BlockFi raised a Series D round. The raise was $350 million as a $3 Billion valuation.

Last week, CNBC announced that FTX purchased BlockFi for $25m.

Although BlockFi disputes this final price tag, the ballpark range of $25m gives a good glimpse into the depths for the recent meltdown.

Looking at spot prices, we continue to see weakness in BTC spot prices.

The panic selling seems to have “relaxed” but the inability to retake mid-20s, even briefly, isn’t the price action we’d want to get long.

This weakness may be due to fund redemptions and the associated forced selling as Q2 ends.

Tomorrow’s US session is likely to be muted with the 4th of July Holiday, but the week ends with NFP.

NFP is essentially the biggest US economic release for bond markets and anything “out-of-line” will likely move markets.

The median forecast is +250k jobs. We saw +390k last month.

A big print will likely be bearish for risk assets, since it affords the Fed room for more aggressive rate hikes.

A weak print will likely be bullish as the Fed may respond dovishly.

Final thoughts

Currently, crypto spot prices aren’t interesting in either direction.

I think $10k, a historically VERY significant price level, likely gets tested again… This is a price point I’m very interested in buying.

Should spot prices bounce higher from here, never hitting $10k, I’d rather rebuy on the uptrend.

From a volatility perspective, I think there’s still some juice to be squeezed… and vol. can hit lower levels.

This doesn’t mean selling straddles, it means interesting structures like Broken butterfly put spreads or Call spreads.

BTC: $19,303 -9.2%

ETH :$1,072 -12.09%

SOL: $40.51 -17.7%

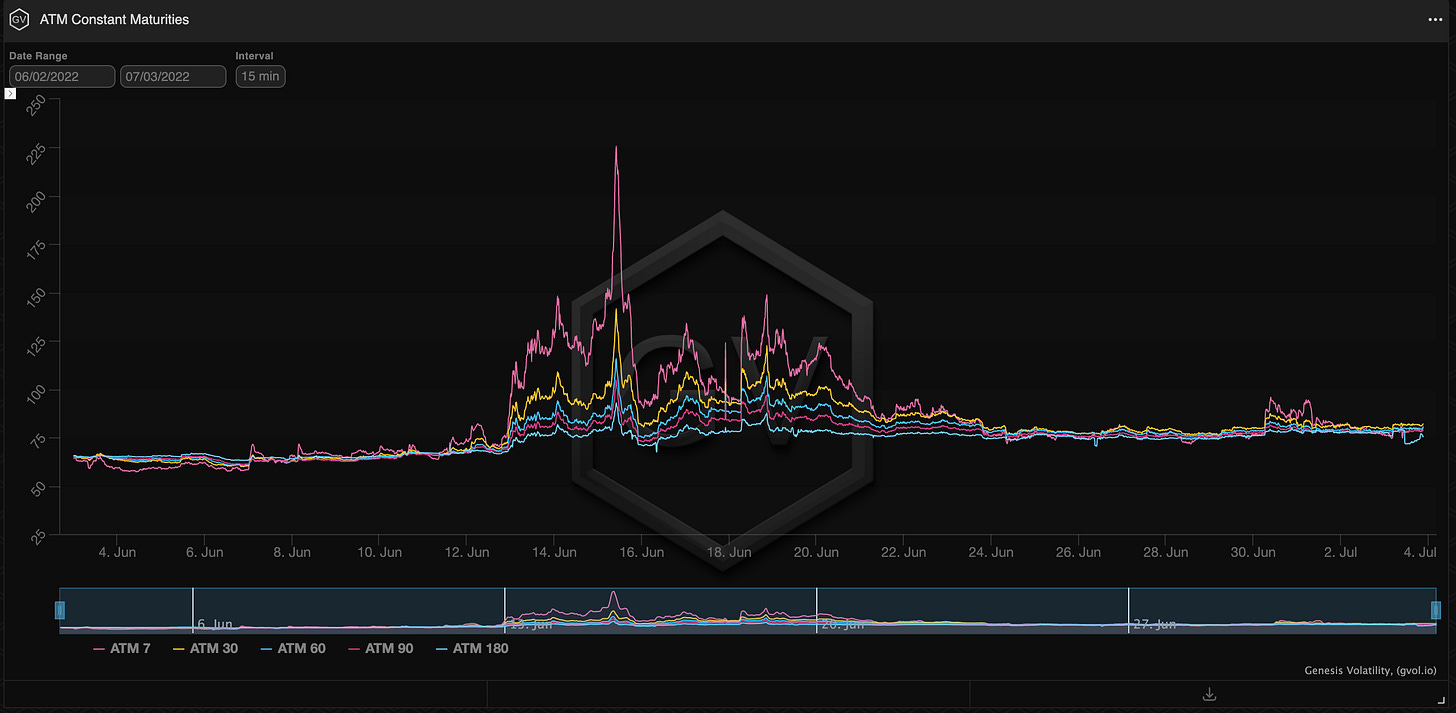

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

I maintain that DVol can hit levels seen in early June… about 75.

There’s a nice “defined” range in DVol levels. Even if you don’t like technical analysis, consider the “EVENTS” that created the May and June Dvol peaks… Luna imploding and 3ac contagion…

This is essentially the required magnitude of events needed to get back to those levels.

Likely, contagion fears become fully digested and Dvol returns to 75… then crypto spot and vol. moves with Macro risk assets for a while.

TERM STRUCTURE

(July 3rd, 2022 - BTC’s Term Structure - Deribit 30-day , 15min)

(July 3rd, 2022 -BTC’s Term Structure - Deribit 5-day,5-min)

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

SOL (gvol API python module, pre-built notebook charts )

Term Structures are mixed.

We’re seeing backwardation for BTC beyond the very short-dated options.

ETH and SOL are essentially flat.

There’s still some fear and hedging occurring in crypto options… as options approach expiration, trades are basically rolling out of short-term options and the very front-end quickly gets pushed lower.

How would I play this?

SKEWS

(July 3rd, 2022 - BTC’s RR SKEW (C-P) - Deribit 30-day , 15min)

(July 3rd, 2022 - BTC’s RR SKEW (C-P) - Deribit 5-day,5-min)

Combining the Term structure and Skew charts above, we see that 30-skew is also leading the downside.

My preferred structures would be something like a Broken July 29th expiration 16k-14k-10k put fly…

Or a ratio (+1x -3x +2x) 16k-14k-12k put spread…

My thinking is as IV rolls-down the term structure, skew rolls-up and theta decay occurs… these positions start becoming more and more dominated by the 16k put.

Should spot prices do down (my bias) and panic/contagion fear become digested (my bias) these levels make sense…

Should price break to $10k, essentially the worst case scenario, I do think significant money would be looking to buy $10k as a bounce level.

The strike selection could be lowered to capture these ideas more accurately.

Just my random thoughts… not a recommendation what-so-ever.

Open Interest - @fb_gravitysucks

WEEKLY EXPIRY

The weekly open interest profile shows the aftermath of fear of the past two weeks with many contracts opened in the put tails when any strike seemed "more" likely.

Relatively quiet week instead, with many worthless expired contracts.

Bitcoin: 28k contracts, notional $550M, $12.8M distributed premium and 78% of expired options worthless.

Ethereum: 236k contracts, notional $253M, $3.2M distributed premium and 83% of options expired worthless

(July 1st 2022 - BTC - ETH Notional - Deribit)

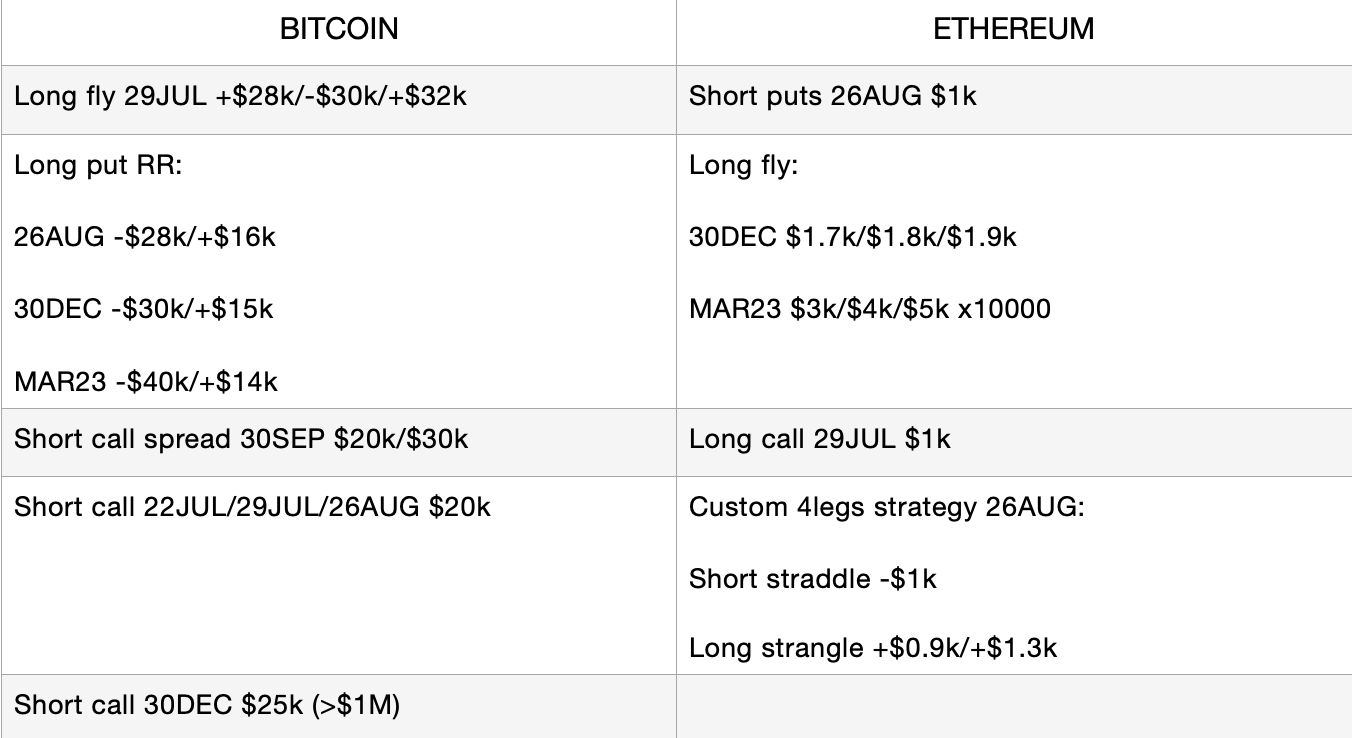

BIG TRADES IN THE FLOW

Still a light week, with average volumes and no big trades with character. The majority of trades focused between Thursday and Friday.

Although the mixed feeling is continuing, some themes are taking shape. Traders are not taking positions with too much net vega exposure, a sign that they are “cautiously” assessing a fall in volatility. From a directional perspective, on the other hand, the flow has a slight bearish orientation with the possibility of a hampered July “bear rally”.

(27th Jun - 3rd Jul, 2022 - BTC/ETH Big trades in the flow - Deribit)

VOLUME

(July 3rd, 2022 - BTC Premium/Contracts Traded - Deribit)

Paradigm Block Insights (27 June – 3rd July)

Crypto majors gave up last week’s gains and drifted lower on further negative news including GBTC’s ETF bid being rejected, and continued negative sentiment on major lenders.

BTC -11% / ETH -14% / SOL -20%

BTC vols traded sideways for the most part over the week, with term structure still range-bound from the upper 70s to low 80s. 8Jul: 77, 15Jul: 81.2, 29Jul: 80.5, Aug: 78.7, Sep: 77.6, Dec: 74.

BTC

We maintain our view of owning 29Jul PSpds to capture downside pressure. Liquidations, high macro uncertainty and recessionary pressures continue to hinder sentiment. The 29Jul expiry captures upcoming CPI data and the next FOMC interest rate decision (7/27)

BTC Notable Flows:

1000x 8Jul 13k Put bot

900x 29Jul 28k/30k/32k CFly bot

500x 22Jul 21k Call Delta Neutral bot

500x Dec 40k Call bot

500x Dec 25k/35k CSpd sold

ETH Notable Flows:

10k 31Mar 3000/4000/5000 CFly bot

6000x Aug 1000 Put sold

5900x Call 29Jul 1600 traded

5500x 22Jul 1200 Call Delta Neutral bot

4700x Aug Iron Condor bot: 1100 put bot, 900 Put sold, 1100 call bot, 1300 call sold

SOL:

SOL options are gaining more and more traction. 6/30 saw

record-breaking volume!

SOL Notable Flows

2150x CSpd 29Jul 40/45 bot

1000x Custom CFly Aug 48 Call sold, Sep 60 Call bot, Sep 70 Call sold

💥💥 June set a record for futures spreads volume @tradeparadigm 💥💥

More volume in June than all previous months combined!. 🚀 🚀

Ribbon Finance 🎀

This week we had 4 successful auctions @ribbonfinance auctions on @tradeparadigm! 🙌

WBTC Call, AAVE Call, AVAX Put + Call

Another successful auction for vault owners🔥🔥!

If you have interest in SOL, future spreads, or Ribbon Option Vaults, ping us on Telegram!

🔥 https://t.me/para_client_support 🔥

For daily flow color, follow our block commentary channel on TG! 👇👇🙏

https://t.me/Paradigm_Market_Commentary

BTC

ETH

SOL

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(July 3rd, 2022 - BTC’s Volatility Cone)

(July 3rd, 2022 - BTC IV-RV)

Longer dated RV still has big moves in their calculations, keeping them elevated in the volatility cone; but more recent RV is starting to get below the median.

I think IV/RV VRP can widen a bit more here, since I don’t think the market is ready to skip-out on hedges… There’s still some event digestion needed.

As mentioned above, harvesting VRP could be done through unbalanced structures but I wouldn’t YOLO anything here… too much weird stuff going on.

However, summer is historically a calmer season for crypto RV…

(BTC 10-years of RV bucketed by month, HV1 Parkinson calcs.)

Call side structures could also be interesting, as I assume that vol. will get quickly pushed lower on anything representing significant relief.