Crypto Options Analytics, July 31st, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE THEMES:

This week we have NFP on Friday at 8:30am ET. Here’s a video on the details of this number.

VVIX is back to multi-year lows… as US stocks saw a monster rally this week.

VIX and VIX Futures took a major hit, but we’re likely not done with downside yet… I still think this month we see sub-20 VIX.

Crypto Theme

Crypto Vol. might still drop a few more points, but buying upside optionality especially with a negative RR-Skew (C-P), seems like a decent play.

There’s a lot of pent-up buying pressure in risk assets, including crypto.

Stock FANG charts look like they could explode higher and crypto could do the same.

Upside resistance is still being found in my opinion… and this means BTC could get back up to $30k (or near it) in a hurry, should this risk-rally continue.

BTC: $23,800 +4.75%

ETH :$1,716 +6.92%

SOL: $43.54 +6.40%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

DVol is within our range… and even if we hit that lower-bound (orange line), that isn’t a big cost to pay, if the upside rally trends and RR-Skew was bought with a negative price.

TERM STRUCTURE

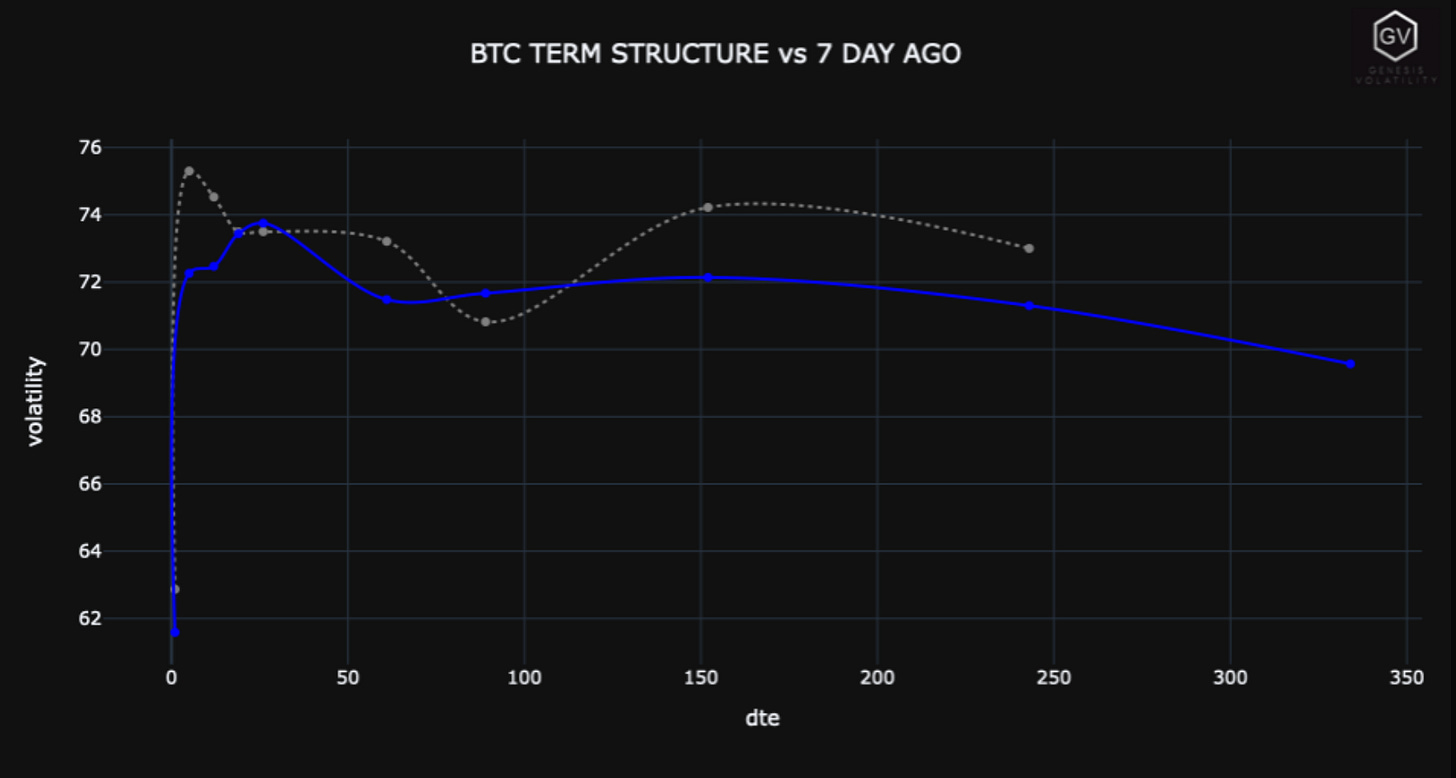

(July 31st, 2022 - BTC’s Term Structure - Deribit )

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

SOL (gvol API python module, pre-built notebook charts )

Term structures continue to be flat for all three cryptos…

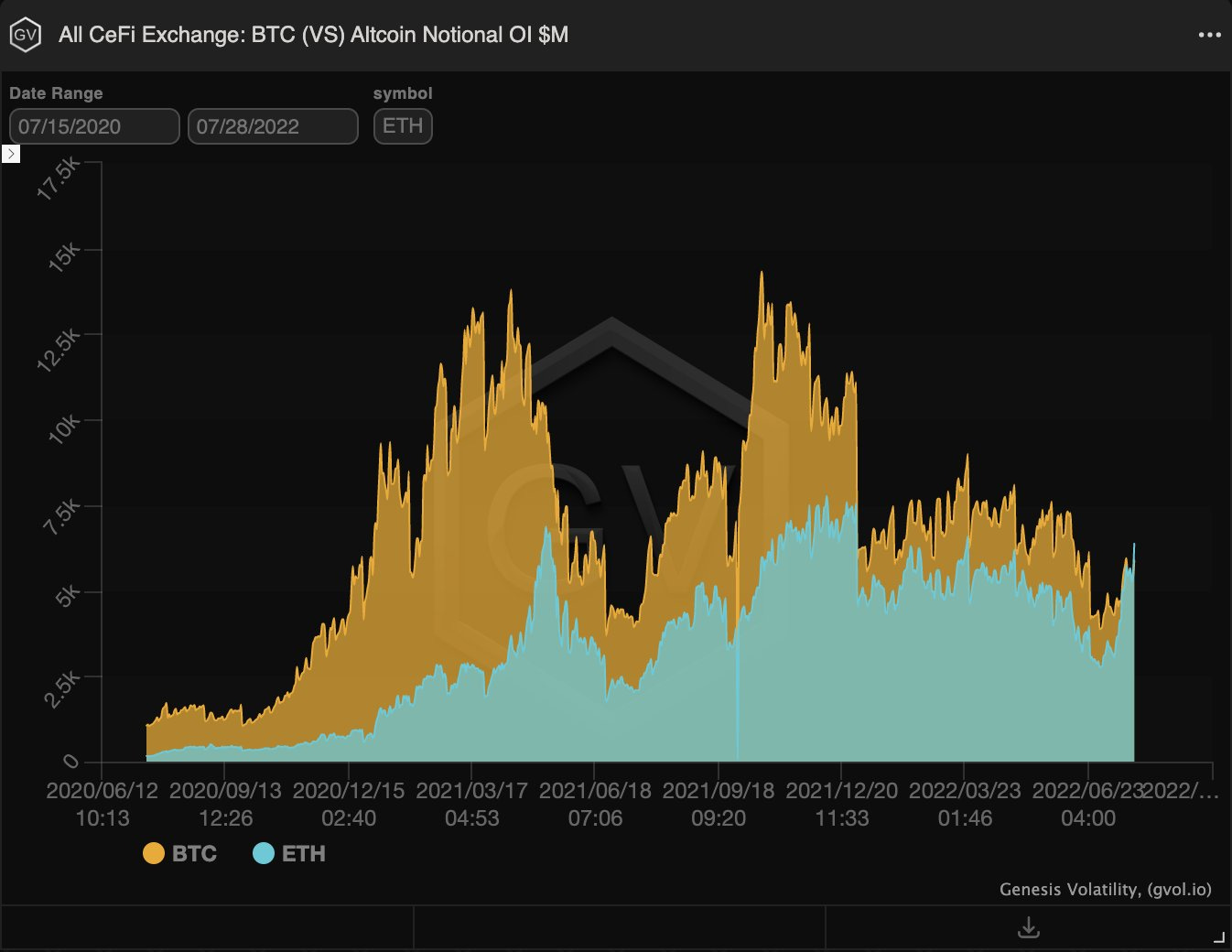

ETH is seeing a flippening in option OI and Deribit option volumes.

This is very interesting activity and a FIRST for the crypto vol. space.

Betting ETH could get back to a $2.5k range, seems like a decent play.

The ETH-BTC IV spread is widening as traders are paying up for ETH vol. expecting things to happen.

SKEWS

(July 31st, 2022 - BTC’s RR SKEW (C-P) - Deribit)

RR-SKEW is getting back towards the 0-line, but not there yet.

This is a big difference from 2021 Vol. surface activity, which basically had RR-SKEW firmly positive under most environments.

This RR-SKEW seems to be lagging reality in my opinion and is instead saddled with the “Recession” and “Contagion” fears we’ve recently been hearing about.

I think this underestimates the explosiveness crypto rallies have displayed in the past.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

The FOMC meeting served as the watershed of the week, with a moderate flow and predominantly in 29JUL expiry first, and with a decisive bullish activity after.

The preferred strategy was outright calls bought: 5AUG $22k/$25k, 26AUG $25k/$26k/$27k and 31MAR23 $36k/$38k/$40k for bitcoin, and 26AUG $1.8k/$2.2k and 30SEP $2.2k for ethereum.

Also noteworthy is BTC strangle 30SEP +$23k/+$25k and ETH call spread 30DEC +$2.6k/-$3.0k.

Participants’ view, beyond price movements, is that of an environment with a relatively cheap IV for an elevated expected realized volatility in August.

Personally, I believe that this rally can continue in the first weeks of August and I like owning bitcoin gamma here.

Both ethereum and S&P are at early June levels, bitcoin still isn’t. With the index price above the resistance of $24.5k/$25k I think the movement can easily extend up to $28k/$30k.

(25th Jun - 31st Jul, 2022 - BTC/ETH GVOL Gravity charts Weighted_VEGA - Deribit)

VOLUME

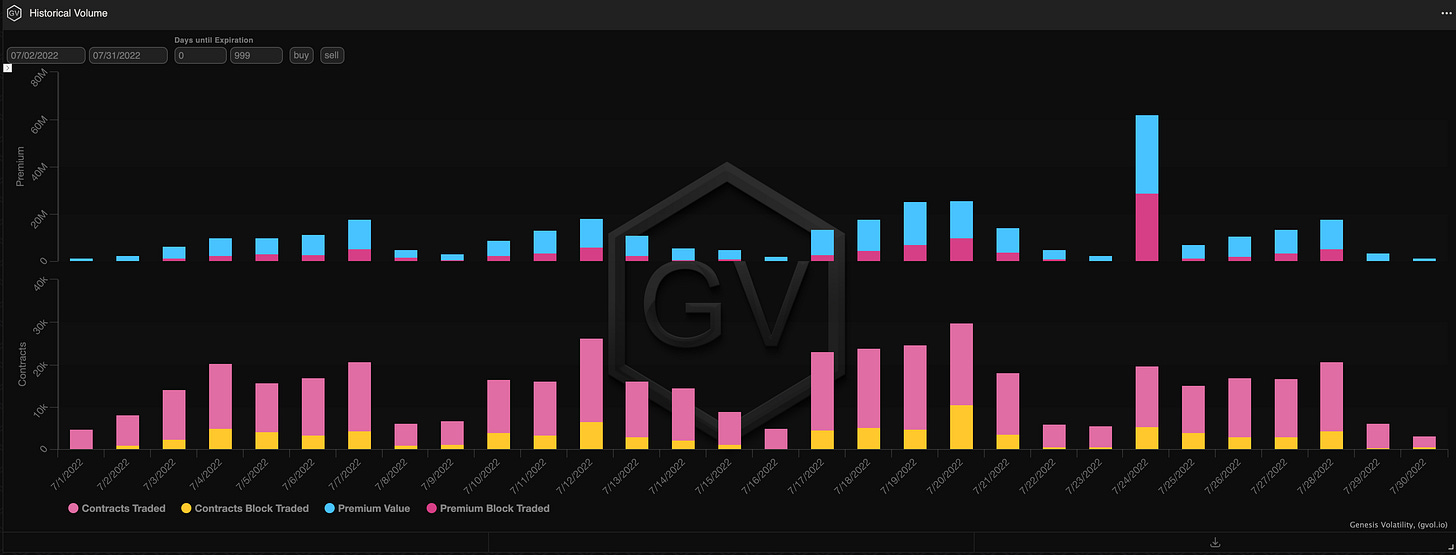

(July 31st, 2022 - BTC Premium/Contracts Traded - Deribit)

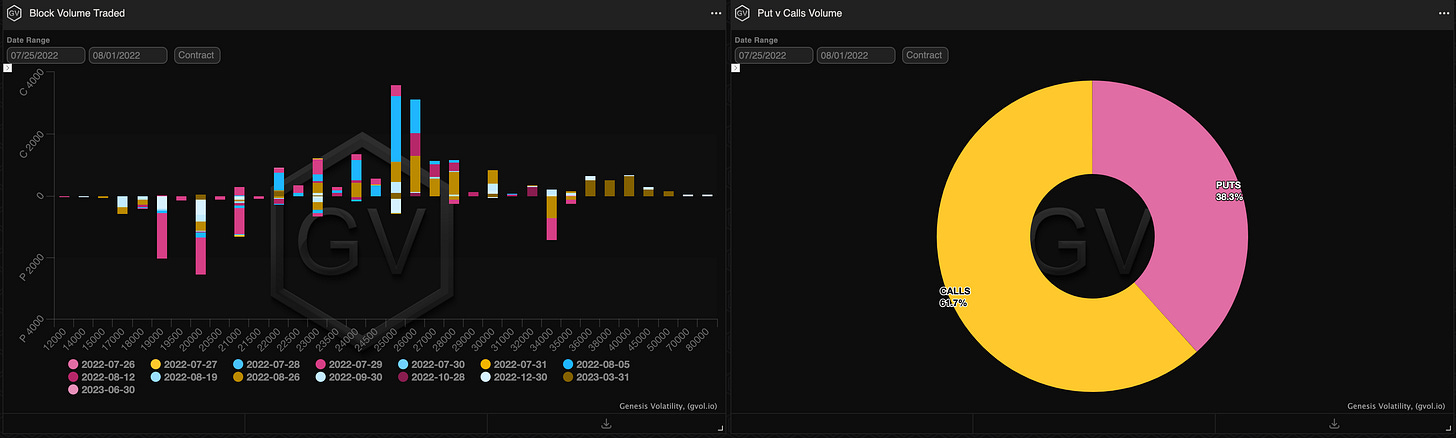

Paradigm Block Insights (25 July – 31 July)

Crypto majors finish the week relatively unchanged, but don’t let the lethargic price action feel you! EXTREMELY busy on Paradigm! 🚀

BTC -1.5% / ETH -1.4% / SOL +2.0%

BTC implied vols sold off on the range bound spot action.

We saw clients take advantage via buying short-dated tied up calls in very large size on Friday.

2k Call 5 Aug 22 25000

1.05k Call 5 Aug 22 26000

850x Call 26 Aug 22 26000

These call purchases make sense. Three reasons:

1. Short-dated BTC vols of ~70v near post-3AC lows

2. In the past month, BTC has underperformed ETH by 40% and still below 3AC liquidation levels.

3. Equities and macro picture more constructive (dovish FOMC, lower oil / rates).

ETH Flows

Dec upside continues to dominate the narrative. This expiry now has the largest open interest of all maturities with over 1.2MM contracts. 🦣

60k CSpd 30 Dec 22 2600/3000

25k CFly 30 Dec 22 2800/3000/3200

18k CFly 30 Dec 22 3000/3500/4000

There is a common theme of the Dec flow: the 3000 strike has seen mostly one-way selling by takers (dealers long).

Why? This has been the middle strike of a large number of Dec call flies, and the upper strike of Dec call spreads bot on Paradigm.

The 3000 call has almost DOUBLE the open interest of any other ETH strike, and ~320k out of the ~380k OI sits in the Dec maturity.

With dealers long this strike, takers lifted tight offers on this strike in outright and spread formats.

Future Spreads

Paradigm future spread volume set another record with $289MM notional traded this week.

On the way for another record month despite a non-quarterly expiry!

BTC

ETH

SOL

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

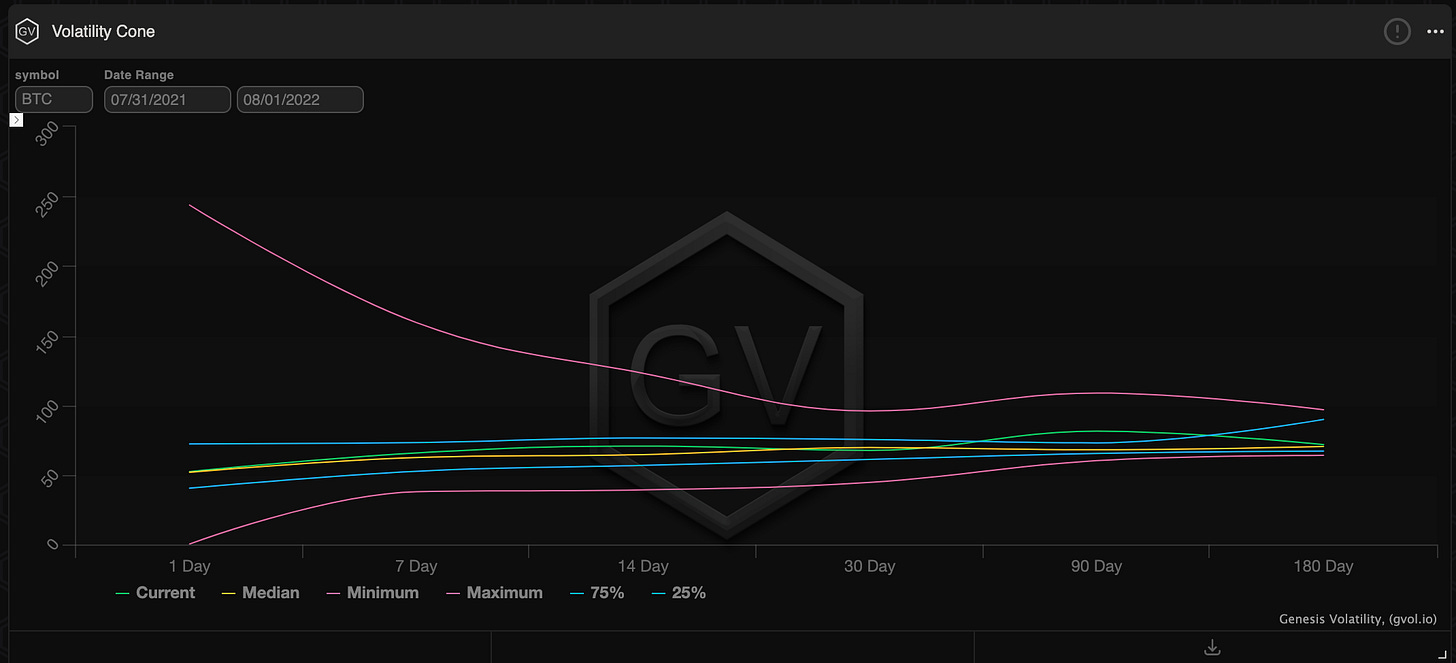

VOLATILITY CONE

(July 31st, 2022 - BTC’s Volatility Cone)

(July 31st, 2022 - BTC IV-RV)

BTC Crypto RV and IV… is humming a long here… with little fan-fare.

The RV cone is hanging out around the median.

Both of these charts… limit the downside in IV pricing… and justify buying rally premium, in my opinion.

ETH rally premium, although slightly more expensive, is likely to actually deliver, given the OI position and POS-mainnet excitement.

Squeeth Weekly Review

After what looks like a broad-based scramble for risk-on asset exposure on the back of some doveish undertones out of this week’s FOMC, oSQTH continues to outperform ETH finishing the week +17%, and remains a cheap proxy for ETH vol exposure.

Volatility

Squeeth IV saw a slight uptick starting the week, as some de-risking came into the market before big tech. earnings, and pre-FOMC announcement, which quickly reverted back to the 90s. Opyn launched v2 of its Crab strategy, which caused Squeeth IV to dip slightly to the 80s as the vault became a net seller of oSQTH with 250 worth of new ETH deposits. The vault pairs short Squeeth with long ETH to create a position with an approximate delta of 0 to the price of ETH.

Volume

Volume remained constant, seeing upticks related to market fluctuations.

Crab Strategy

Crab v1 continued to perform rebalances equating to 712.908 ETH

Crab v2 launched! Rebalances equated to 101.291 ETH

Hop in the discord: https://discord.gg/opyn to learn more about Squeeth and Crab v2!