Crypto Options Analytics, July 18th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

$31,786

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

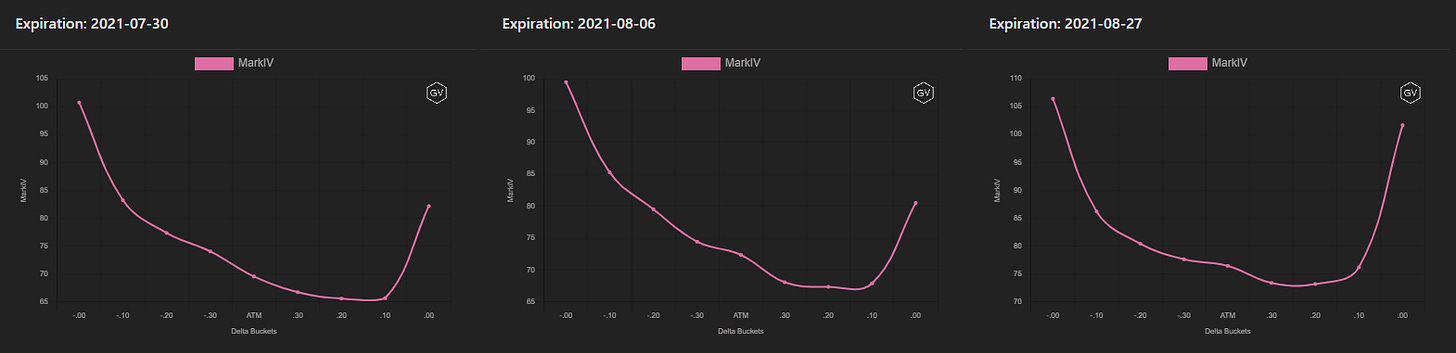

(July 18th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

The lower volatility theme proved itself true once again, this past week.

Spot price support levels are being tested as prices head south. This has been enough to entice traders to price skew in the negative (higher put IV compared to calls), but overall volatility continues to drop.

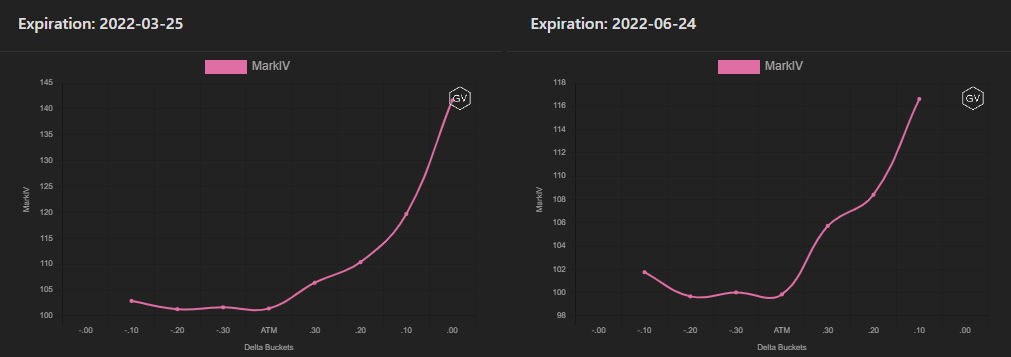

(July 18th, 2021 - Long-Dated BTC Skews - Deribit)

Long-term skews remain decidedly more bid to the calls.

TERM STRUCTURE

(July 18th, 2021 - BTC’s Term Structure - Deribit)

Along with lower volatility, the BTC implied volatility term structure remains in steep Contango.

This term structure shape provides great opportunity for volatility sellers selling longer dated options.

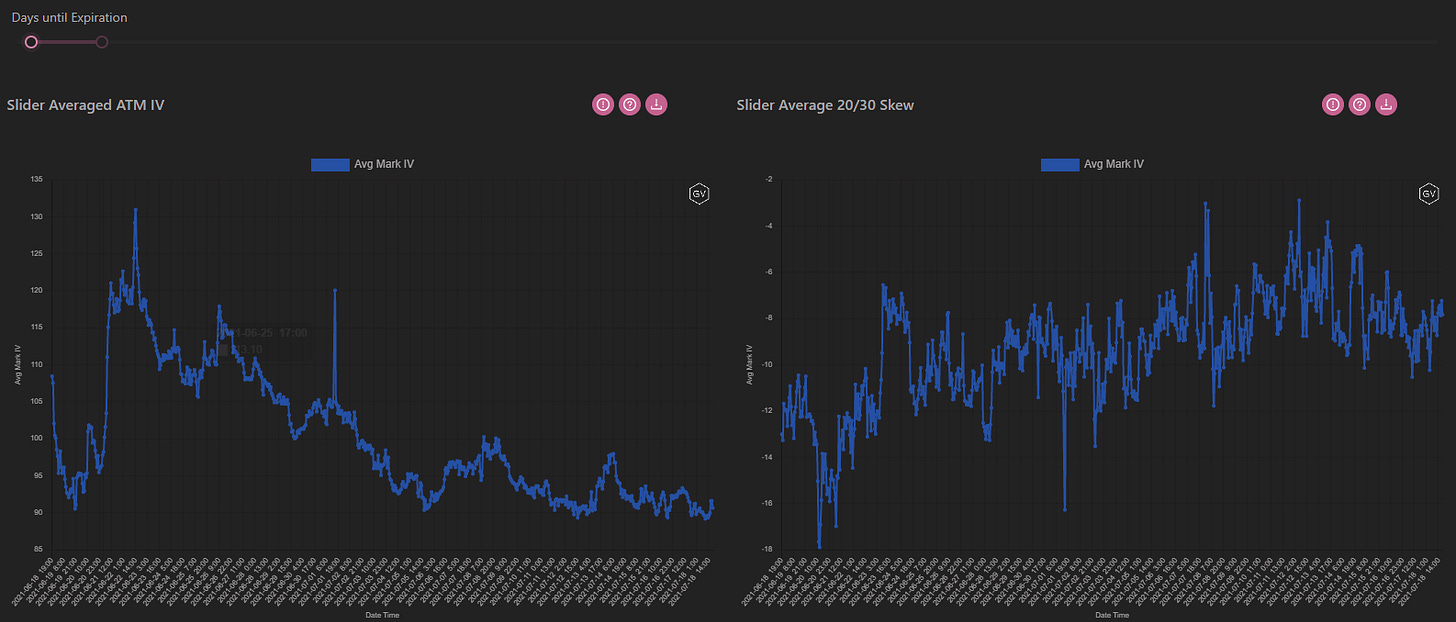

ATM/SKEW

(July 18th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) continues with the same melting of implied volatility for these selected expirations.

Option SKEW (right) has given away gains made last week. Skew is continuing to remain favored to the puts.

VOLUME

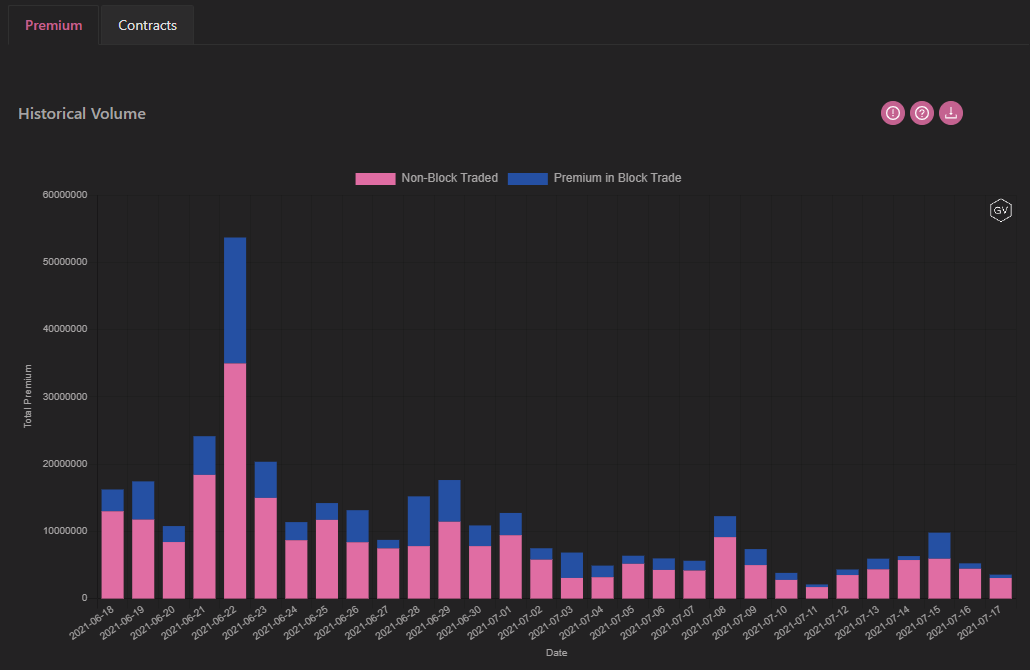

(July 18th, 2021 - BTC Premium Traded - Deribit)

(July 18th, 2021 - BTC’s Contracts Traded - Deribit)

Option volumes, especially in terms of $$$ traded, remain basically dead.

There’s very little option activity.

Even if support fails to hold, given these volumes, we suspect prices to move in a controlled and steady fashion.

VOLATILITY CONE

(July 18th, 2021 - BTC’s Volatility Cone)

Realized volatility is leading the way lower.

We are now seeing measurement windows along the 25th percentile.

Lower RV measurements will likely extend to longer measurement windows.

REALIZED & IMPLIED

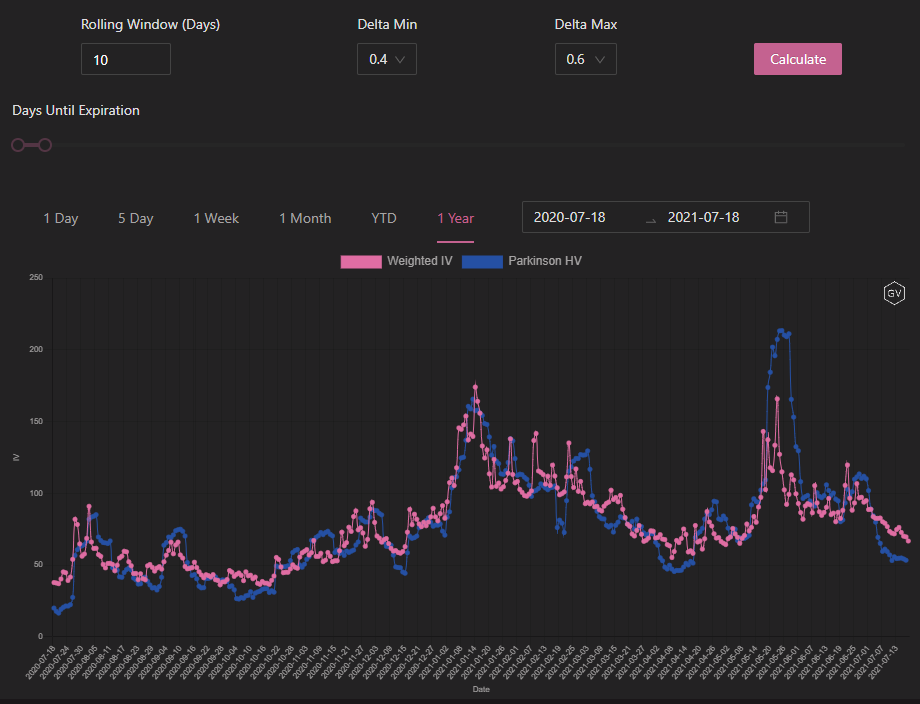

(July 18th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is pricing in a return to higher RV in the future, but if things hold constant we currently see a rather hefty variance premium for volatility sellers to enjoy.

Conditions remain favorable for volatility sellers.

$1,908

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(July 18th, 2021 - ETH’s Skews - Deribit)

Ethereum short-term skews are negative as well.

Overall volatility is seeing a drop for ETH but skews are still being led by spot prices testing support.

(July 18th, 2021 - ETH’s Skews - Deribit)

Long-term ETH skews are very bid to the call side.

Option markets continue to expect upside shocks to ETH spot prices in the big picture.

TERM STRUCTURE

(July 18th, 2021 - ETH’s Term Structure - Deribit)

The term structure of implied volatility is in Contango for ETH.

December’s expiration cycle does provide an interesting “hump” opportunity for volatility sellers.

Overall, this Contango shape is very favorable for short options strategies.

ATM/SKEW

(July 18th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) looks to be plateauing a little bit, but we think this will likely be short-lived.

We think market conditions continue to favor lower RV and IV going forward.

Skew is more firm for ETH compared to BTC but both are holding firm in the negative zones.

VOLUME

(July 18th, 2021 - ETH’s Premium Traded - Deribit)

(July 18th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are lower but not as bleak, relatively speaking.

Overall, the volume profile does match the lower volatility regime.

VOLATILITY CONE

(July 18th, 2021 - ETH’s Volatility Cone)

RV is hitting the lower 25th percentile for more windows than BTC.

We don’t expect any sustainable deviations above the median RV line without some sort of catalyst to bring excitement back into the market.

EIP-1559 could be a catalyst in the near future, but it’s likely “curtains” for volatility until then.

REALIZED & IMPLIED

(July 18th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV and RV are both pretty tightly bound but there is a slight IV premium for ETH as well, although not nearly as extreme.