Crypto Options Analytics, July 17th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE:

Big headline CPI print of 1.3% M/M in June (+9.1% Y/Y)… the largest print in 40-years.

Macro assets and crypto initially saw weakness into (and on) CPI release, but crypto markets closed higher on the week, while stocks were about unchanged.

Federal Reserve board members spoke about 1.00% rate hikes being a possibility (or not “off-the-table”).

All together, this continues to make me think there’s seller fatigue in the market.

VIX continues to be weak and in my opinion could have a massive sell-off this week on the back of seller fatigue and the lack of important economic data released this week.

I continue to think crypto contagion is behind us, despite the absence of 3AC founders. Celsius and Voyager losses are now well defined. Losses are likely well accounted for.

I think selling put skew vol. is a good trade here.

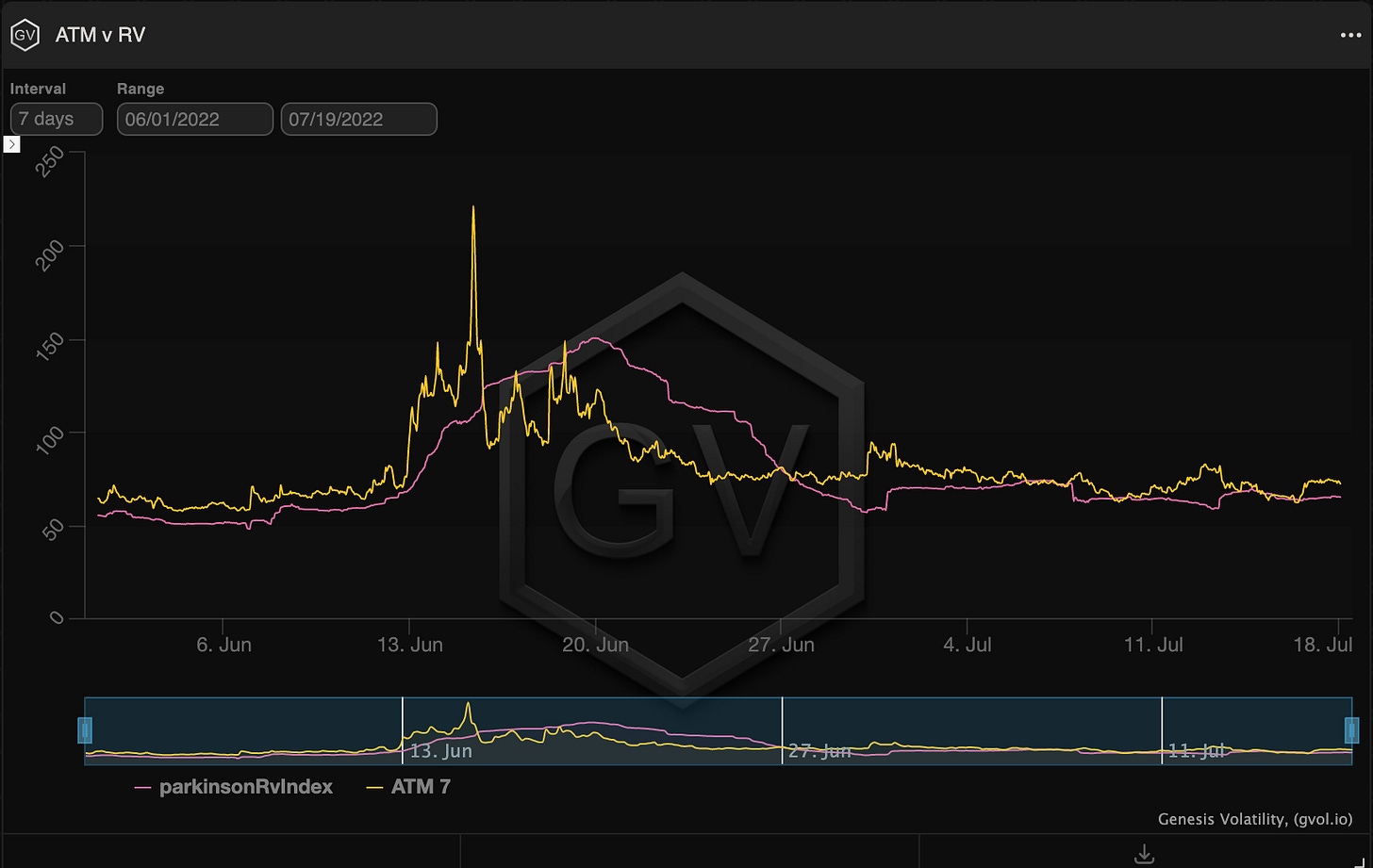

VRP is likely being overpaid due to recency bias.

BTC: $21,259 +2.18%

ETH :$1,404 +20.31%

SOL: $40.48 +9.73%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

DVol moved sideways this week.

Macro numbers, like CPI, are affecting crypto vol.

I continue to favor lower Dvol, going right through June lows.

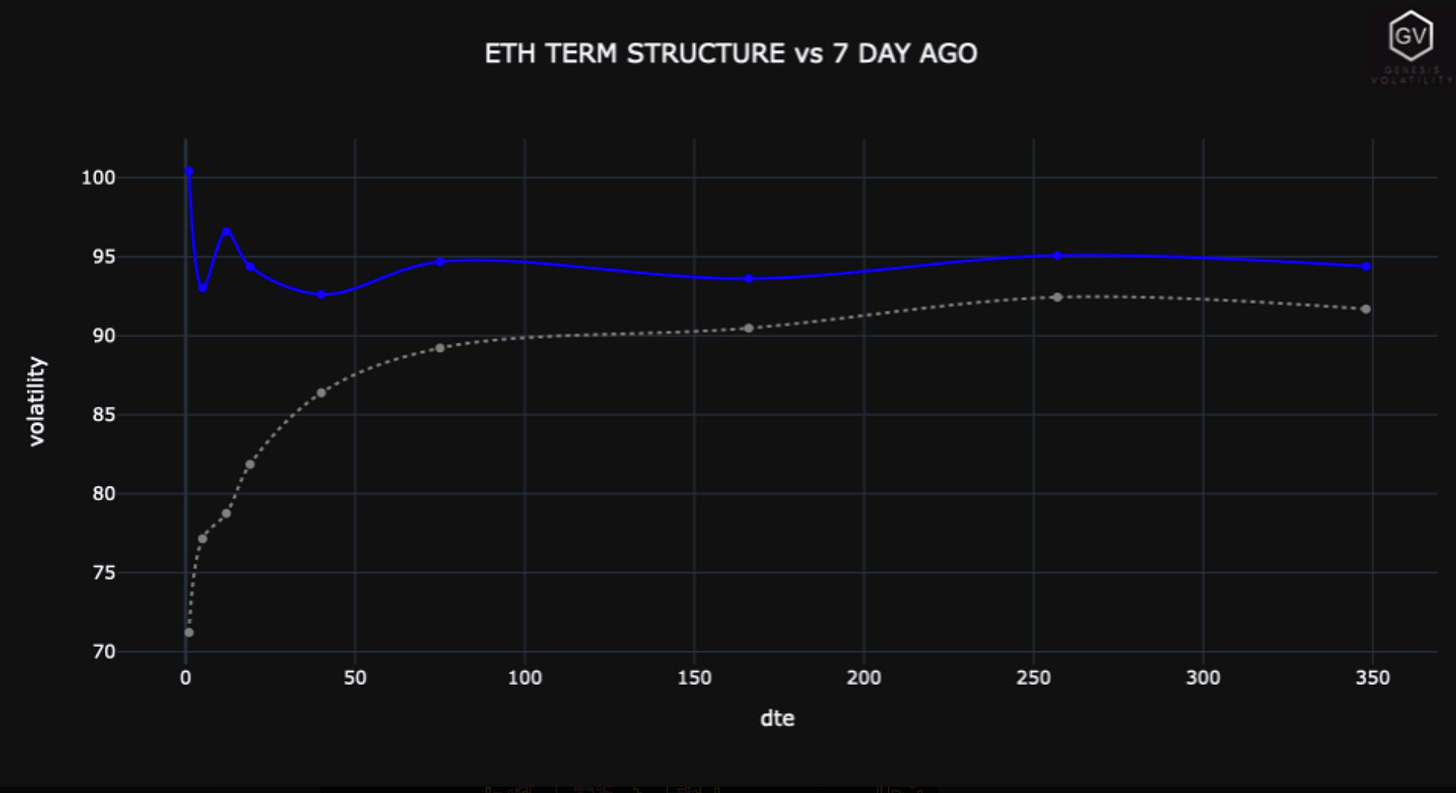

TERM STRUCTURE

(July 17th, 2022 - BTC’s Term Structure - Deribit )

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

SOL (gvol API python module, pre-built notebook charts )

BTC term structure is going back into Contango after this week.

ETH’s term structure is very interesting, however.

We’re seeing higher volatility and Backwardation on a bullish move. Likely related to successful ETH merge news.

SOL also has a peculiar hump shape.

Altogether, nearly each crypto term structure has a different shape.

Relative volatility traders could find awesome convergence trader here. SOL front-end vol. is the same as ETH front-end… This is likely a nice fade… Buy Sol, sell ETH, type of thing.

SKEWS

(July 3rd, 2022 - BTC’s RR SKEW (C-P) - Deribit)

Skews are finding some relief here… but maintain negative levels overall.

I think there’s juice to be squeezed here, given my biases.

So many people were burned recently, that there’s a segment of the market that owns insurance at any price… Selling to them seems like a trade.

@fb_gravitysucks

PROPRIETARY “GVOL-DIRECTION” FLOWS

Trading week was affected by the June CPI release.

Prior to the event, the focus was mainly on gamma purchase on July, which led the term structure in backwardation. As is often the case, IVs began to fall fast in the moments following the release, resulting in flattened term structure and “slower” traders dissatisfied.

The general sentiment is always one of caution, with short Risk Reversal August/September/December $23k-$19k/$25k-$19k/$23k-$17k, ratio spreads with body sale ($19k-$21k) and purchase of wings ($26k-$14k) on August, and the sale of ATM straddles on longer maturities. Finally, we report the biggest trade in terms of contracts: a call spread 5th August $25k/$27k.

For Ethereum, positions with large volumes in December (flies $2.5k/$3.0k/$3.5k and call ratio spreads $2.5k/$3.5k) must not mislead: net greeks and premium exposures are modest. On August, more caution with sale of straddle ATMs.

The strategy of collecting theta worked well this week. Over the weekend, we closed the position: with the general low IVs and with the FOMC event at less than 10 days, we evaluate a strategy with positive vega exposure.

Support and resistance levels are positioned at 19k-23k and we do not mind the idea of structuring a trade that takes advantage of a possible breakout.

IVs and skew levels give flexibility in execution right now.

(11th Jun - 17th Jul, 2022 - BTC/ETH “GVOL direction” charts - Deribit)

VOLUME

(July 17th, 2022 - BTC Premium/Contracts Traded - Deribit)

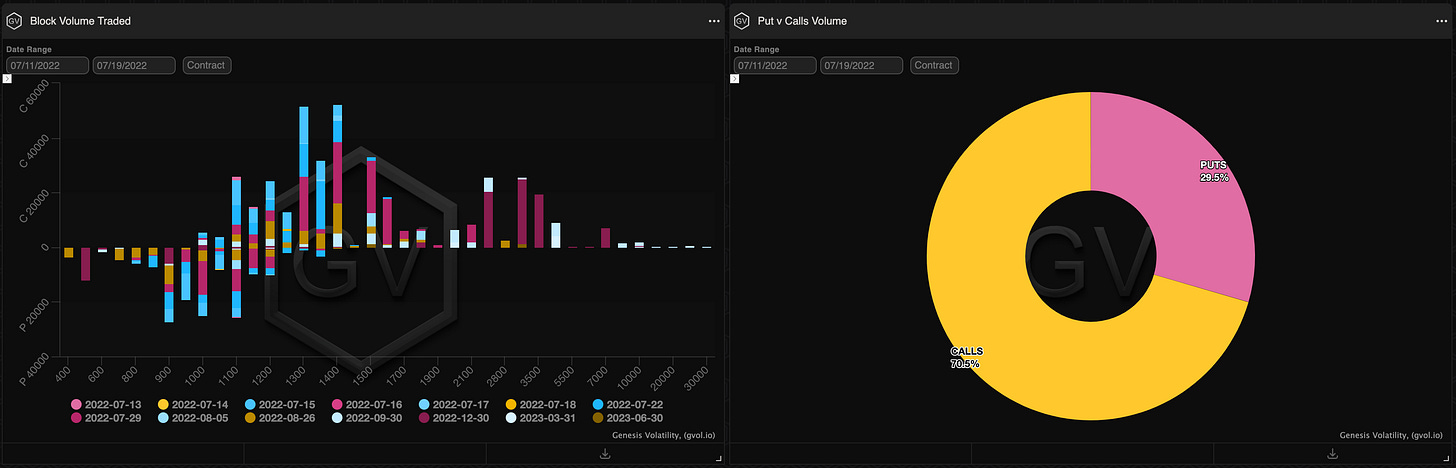

Paradigm Block Insights (11 July – 16 July)

A nice week with ETH +12.5% and SOL +6.2%, vs. BTC lagging behind +3.1%. Saturday's ETH action the main driver of the WoW outperformance.

Why ETH +10% on Saturday? Over 40k ETH 29Jul calls bot on Fri. afternoon set up spot for a gamma squeeze into an illiquid weekend tape. 🚀

Given that ETH merge news occurred on Fri., we don’t view this as the main driver.

29Jul 1400 call bot 17k

29Jul 1500 call bot 16k

Following these large 29Jul blocks, ETH call flow has been largely one-way. A busy Saturday with clients lifting outright calls in 22Jul through Dec.

2000x Call Dec 1800

1500x Call 22Jul 1400

1000x Call 29Jul 1300

1000x Call Aug 1800

ETH vols reset significantly higher from Fri to Sat, as spot moved up the smile and fixed strikes moved higher.

The aforementioned ETH 29Jul 1400 call that was bot for 87.2v on Friday traded at 97v on Saturday.

ETH 30d 15-delta skew moved significantly lower and now trades back at April levels of ~10v (puts over calls). 📉

The move makes sense, given the short-dated call flow and today's sharp rally.

While currently rich, we like ETH 29Jul if vols reset into the mid 80s.

As the 29Jul calls approach expiry, dealer short gamma exposure will increase into FOMC (all else equal).

The question is how much will DOV / overwriting flow help offset this short exposure?

Large BTC blocks skewed to hedging aside from 600x 29jul 22k calls bot on Tuesday.

400x PSpd 29Jul 16k / 19k bot

400x PSpd 29Jul 16k / 19.5k bot

300x Put 22Jul 18k bot

29Jul expiry captures FOMC. Post-CPI, rates priced a 1% hike probability as high as 85%.

BTC

ETH

SOL

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(July 17th, 2022 - BTC’s Volatility Cone)

(July 17th, 2022 - BTC IV-RV)

Small VRP holding here, while current RV is around the median for most measurement windows.

Again, likely a function of many people being burned recently.

Overall, in spot, I like the relief rally, but I think it’s much too early to call an end to the bear market… I continue to use 2018 as a model… and hold the “consolidation” period in mind.

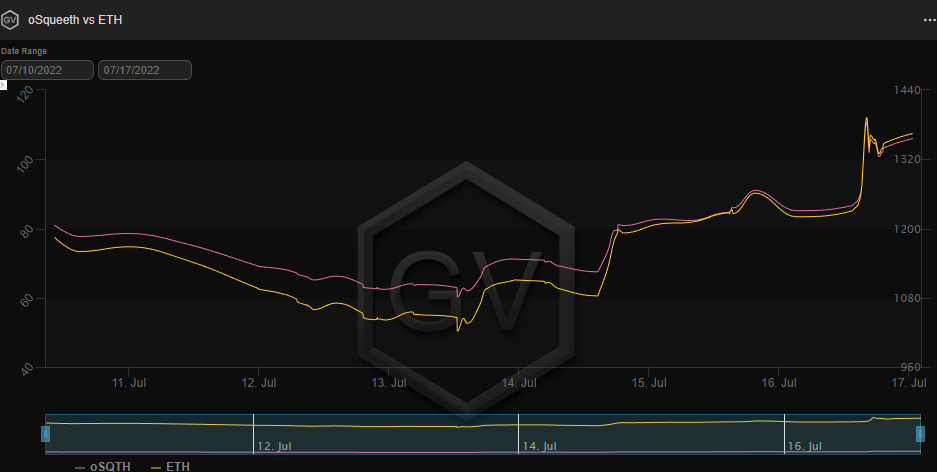

Squeeth Weekly Review

What a week it was, as the broader crypto markets sold off into a 41-year high CPI number just to reverse and end the week green. ETH saw low to high prints of $1,003.60 - $1,424.95 (via Deribit Perpetual Futures), for a range of 42%. Squeeth saw low to high prints of $60.94 - $105.19, for a range of 72.6%. ETH ended the week +15% and Squeeth ended the week +19.3%.

Volatility

Squeeth IV remained pretty steady throughout the week in the mid to low 90s. July 14th and 15th Squeeth saw sharp drops in IV to the low 60s before quickly finding its way back to the 90s. During this period it opened the door for traders to step in and buy cheap vol.

Squeeth Historical Implied Volatility

ETH DVOL Snapshot

Volume

Squeeth volume slowly tapered to begin the week and quickly picked back up after the CPI print. Volume remains to be elevated on what has been an active weekend in Crypto markets.

Crab Strategy

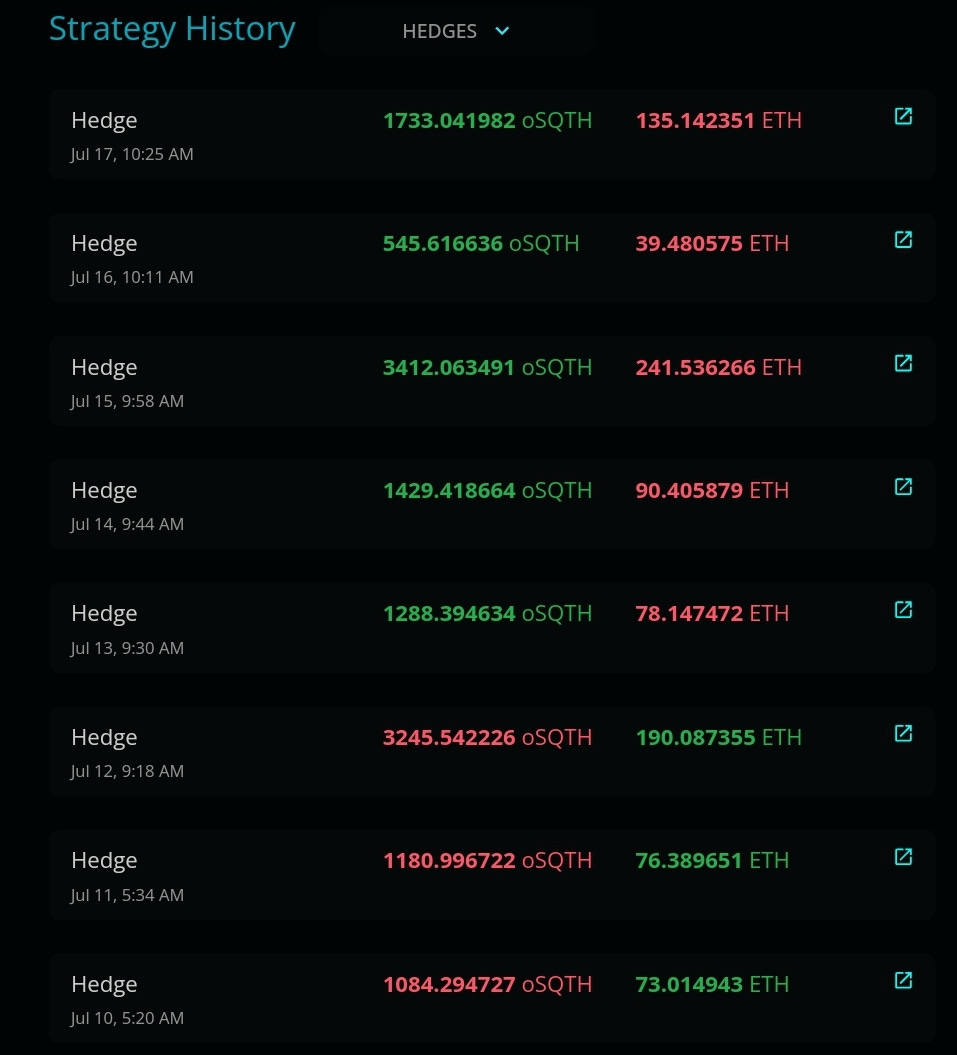

Crab performed multiple hedges this week equating to 924.20 ETH.

This week's continued positive return in Squeeth had Crab rebalancing oSQTH for ETH, leaving depositors with less ETH to end the week.

Hop in the discord: https://discord.gg/fe8YfUkUTr to learn more about Squeeth and for access in Crab V2!