Crypto Options Analytics, July 11th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

$33,886

DVOL: Deribit’s volatility index

(1 month, hourly)

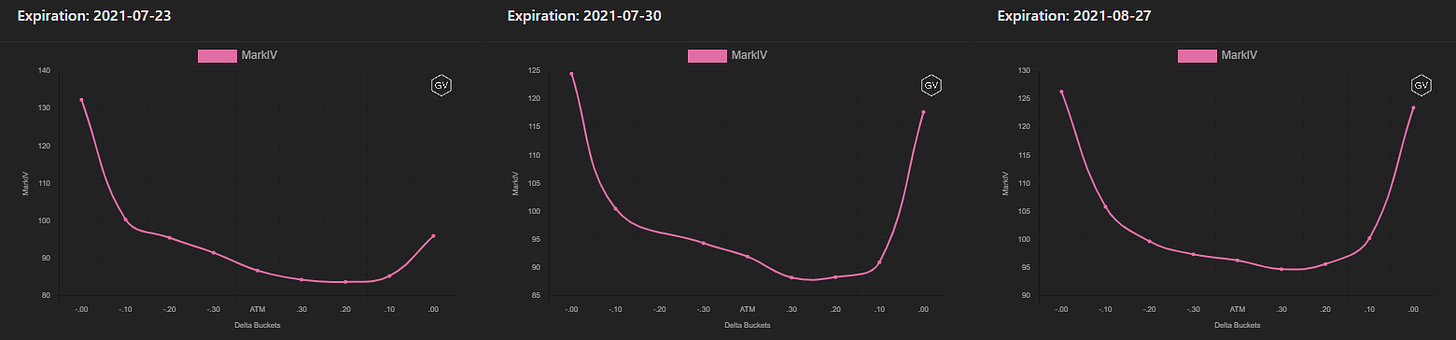

SKEWS

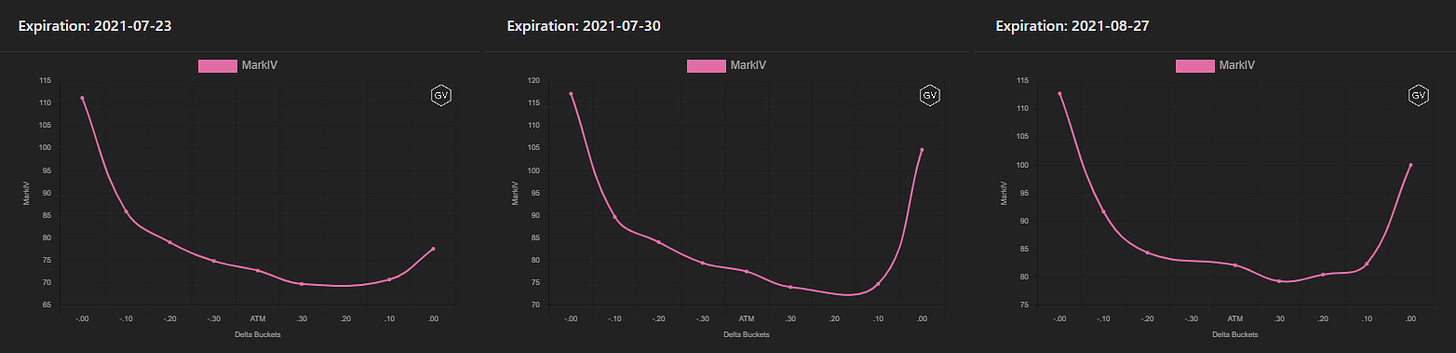

(July 11th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Markets are continuing to stabilize and as a result IV levels are dropping and skews are climbing higher toward symmetry.

Although the short-term and medium-term expirations are still slightly negative, the gap between puts and calls has narrowed considerably over the past week.

(July 11th, 2021 - Long-Dated BTC Skews - Deribit)

Long-term options have been consistently positive and they continue to become even more so.

Calls are now richer then puts for expirations as short as 90-days.

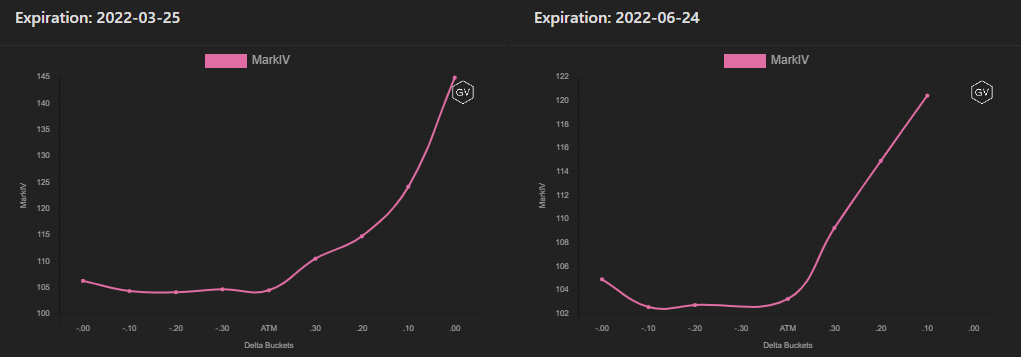

TERM STRUCTURE

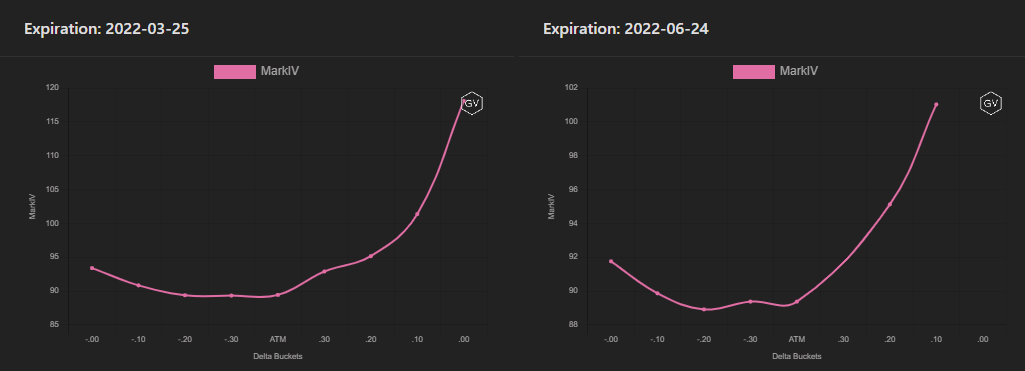

(July 11th, 2021 - BTC’s Term Structure - Deribit)

The term structure’s Contando shape is even more pronounced this week.

The deflation in volatility continues as the option market expects near-term spot price consolidation to further materialize.

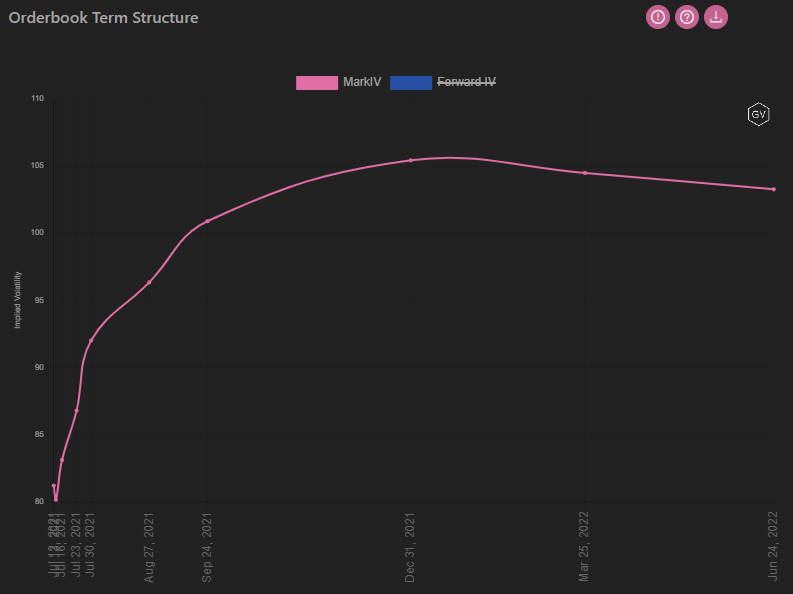

ATM/SKEW

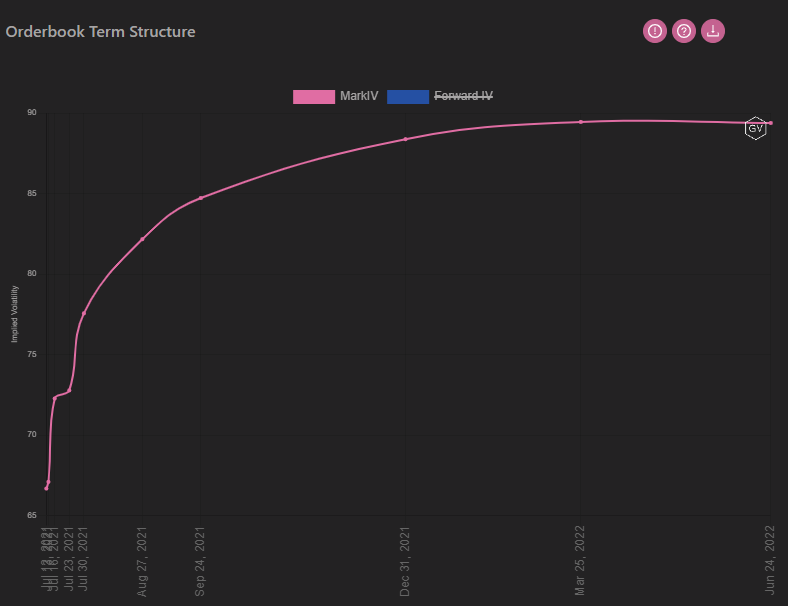

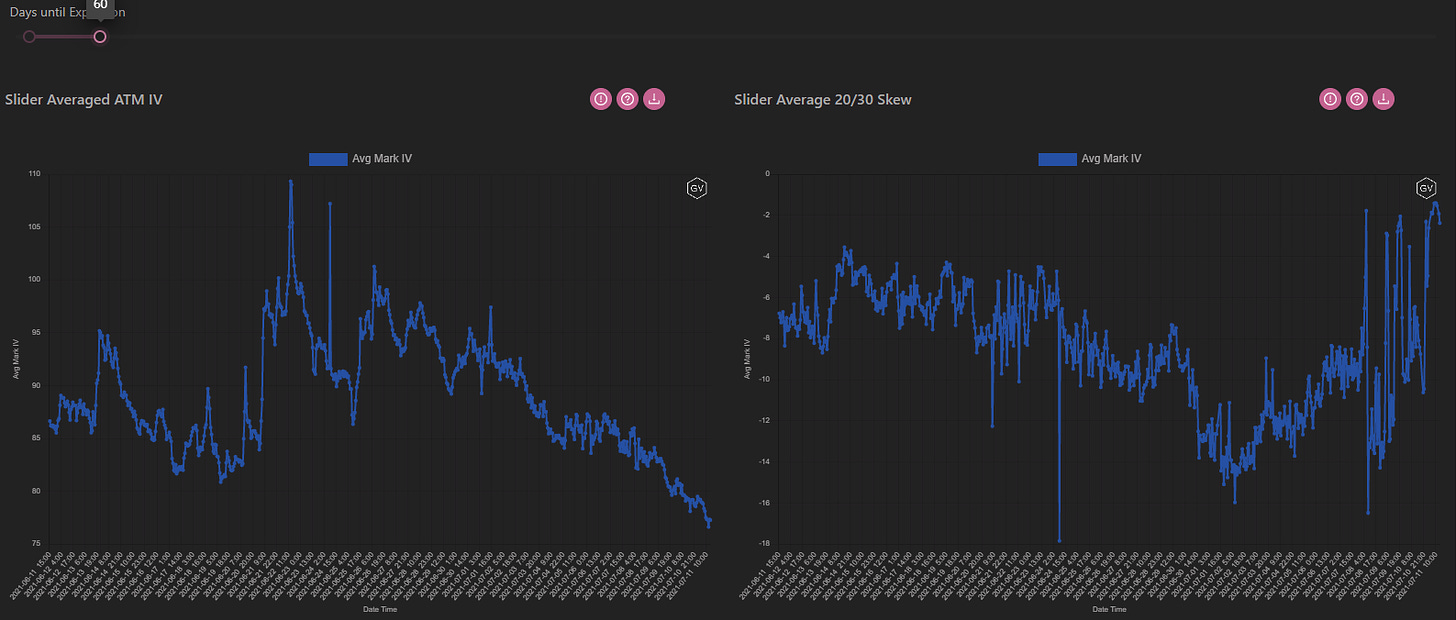

(July 11th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) clearly depicts the drastic melting of implied volatility for these selected expirations.

Option skew (right) was very erratic over the past week but has managed to climb higher.

Skews are now only -4pts negative for these select expirations, this is the narrowest spread seen recently.

VOLUME

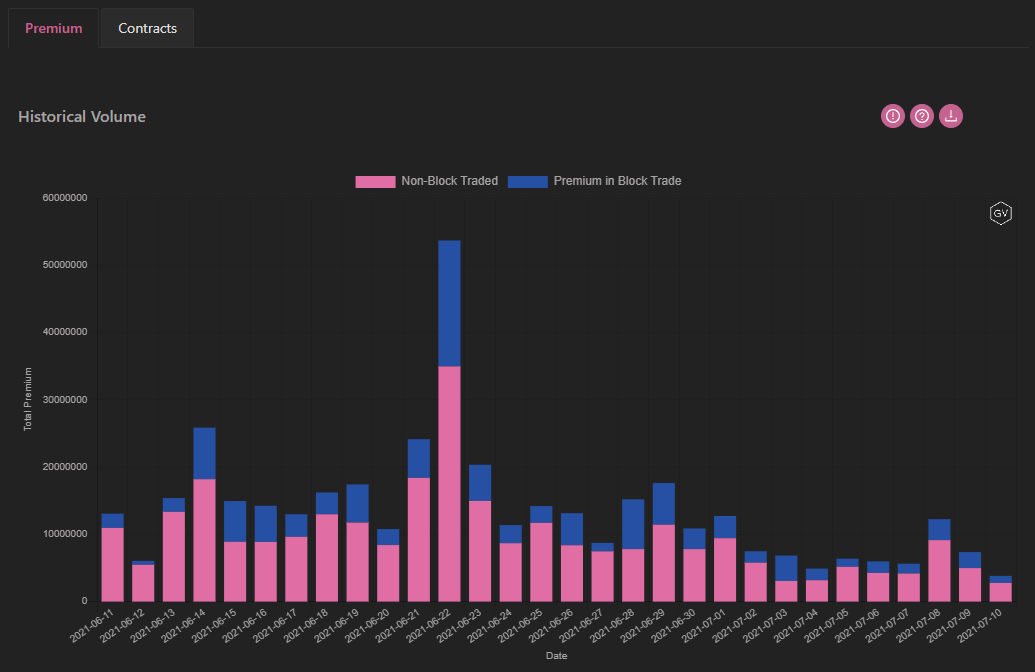

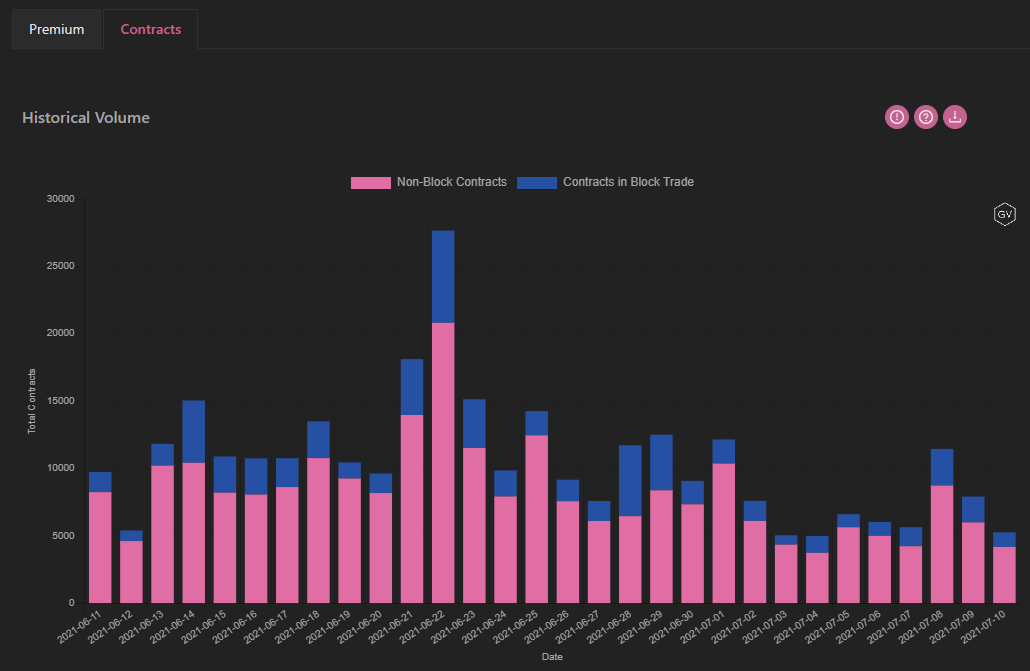

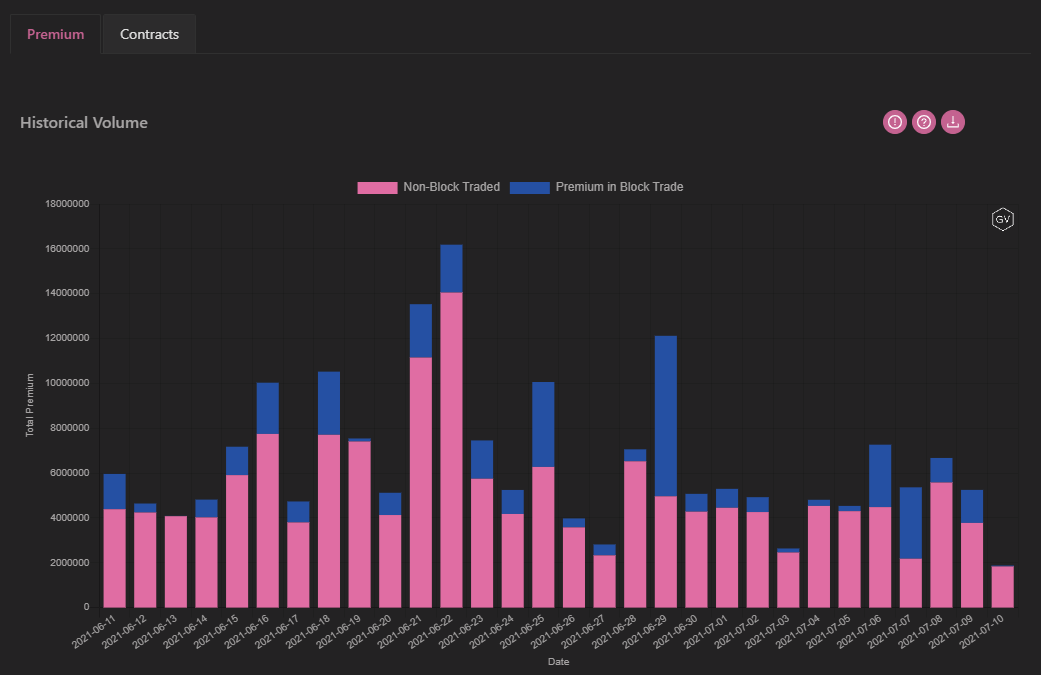

(July 11th, 2021 - BTC Premium Traded - Deribit)

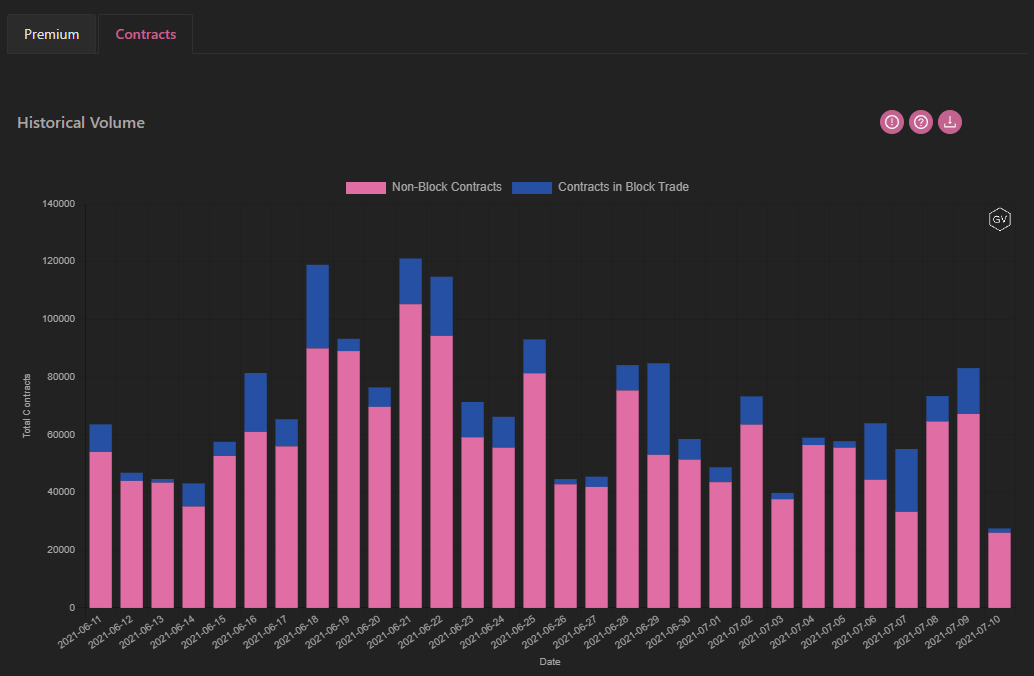

(July 11th, 2021 - BTC’s Contracts Traded - Deribit)

Contract volumes were pretty stable last week, but premium volumes diminished.

This divergence in volumes is likely due to a shift in options trading towards OTM options versus ATM/ITM.

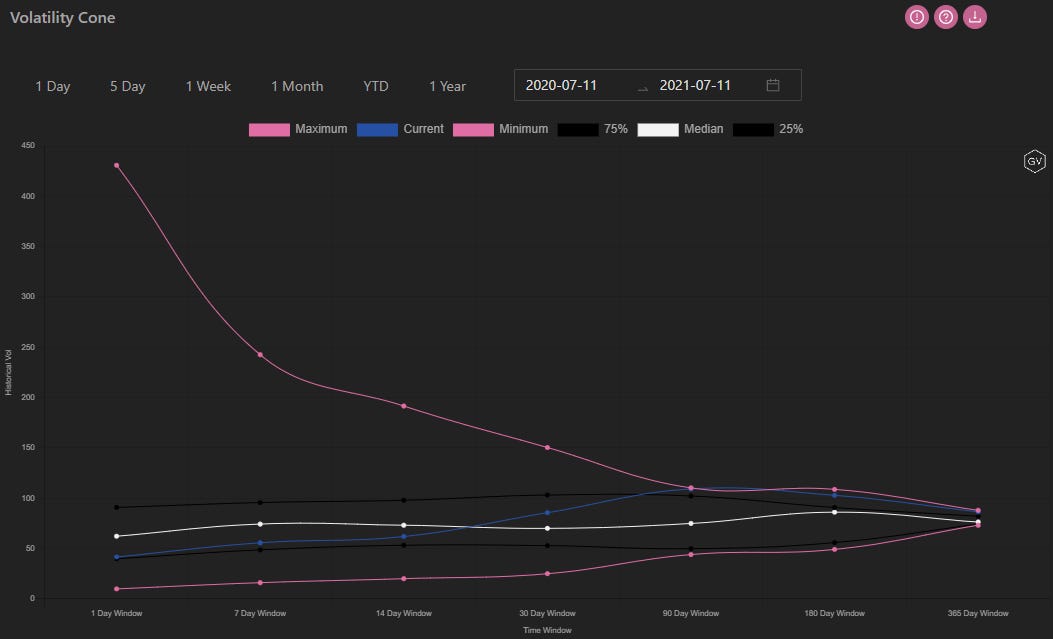

VOLATILITY CONE

(July 11th, 2021 - BTC’s Volatility Cone)

Realized volatility saw a drastic drop for short and medium measurement windows.

Last week, the 14-day window was aligned with the upper 75th percentile, and today we sit near the lower 25th percentile.

If lower RV continues due to a consolidation, volatility sellers will enjoy both a parallel shift lower in the IV term structure, and a maturity roll-down.

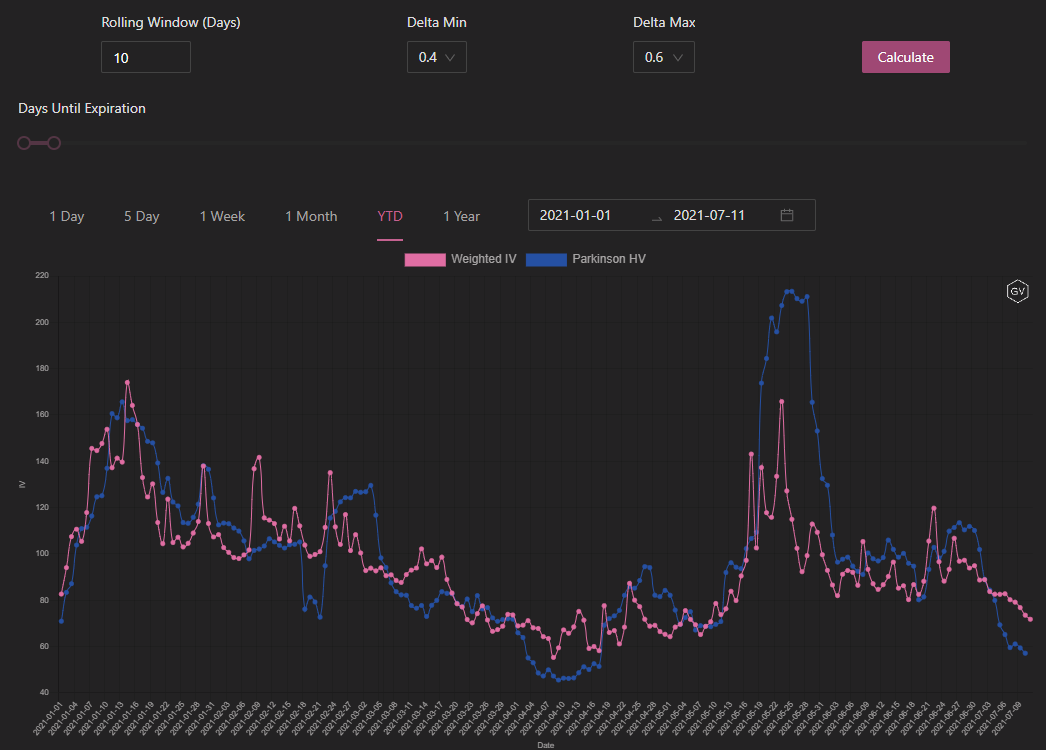

REALIZED & IMPLIED

(July 11th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)\

Due to RV’s drastic drop seen last week, we now have IV pricing at a premium.

Option markets are currently pricing a move back higher in RV over the short-term.

Again, if RV holds, vol. sellers will enjoy a confluence of favorable market conditions.

$2,138

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(July 11th, 2021 - ETH’s Skews - Deribit)

Ethereum is experiencing a similar fate as Bitcoin but starts from a higher volatility level.

Short-term and medium-term option expirations have a similar skew level as BTC, but long-term options have a more pronounced positive skew.

(July 11th, 2021 - ETH’s Skews - Deribit)

Major ETH protocol upgrades, combined by a preference for ETH over BTC from notable names such as Goldman Sachs, are likely drivers of this long-term call appetite.

TERM STRUCTURE

(July 11th, 2021 - ETH’s Term Structure - Deribit)

ETH has seen a steepening in the Contango structure over the past week too.

There’s a slight hump in the Dec. 31, 2021 expiration, but for the most part, this is a classic Contango structure.

This short-volatility shape will likely continue as ETH continues to respect its consolidation channel.

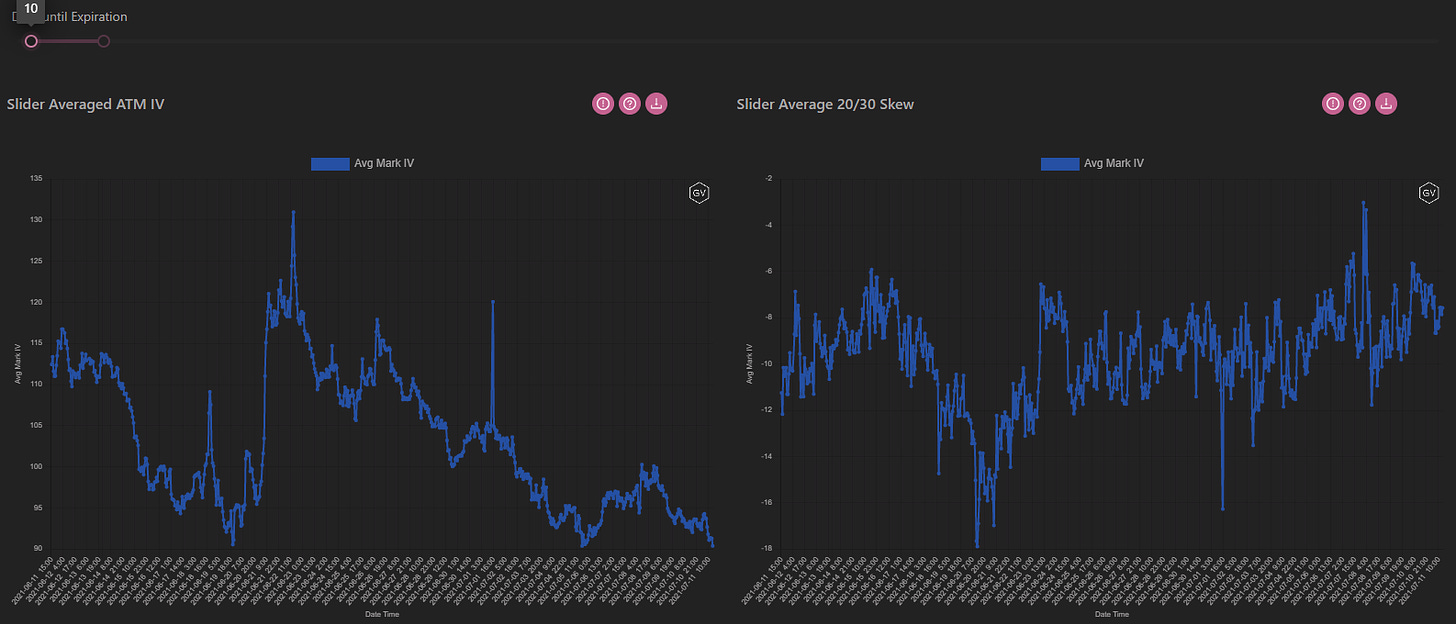

ATM/SKEW

(July 11th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is testing the recent monthly lows.

Given an IV of 80%, there’s room for IV to drop even further during a consolidation regime.

Skew (right) continues to creep higher towards symmetry for selected expirations.

VOLUME

(July 11th, 2021 - ETH’s Premium Traded - Deribit)

(July 11th, 2021 - ETH’s Contracts Traded - Deribit)

ETH volumes have been steady, with a notable percentage of volume coming from block-trades executed on Paradigm.

VOLATILITY CONE

(July 11th, 2021 - ETH’s Volatility Cone)

RV is now finally on the median for all measurement windows through 30-days.

In a way, the median is “no-man’s land”; but given a consolidation regime, it’s realistic to expect lower RV as spot prices meander around.

REALIZED & IMPLIED

(July 11th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV and RV are tightly bound. The current median readings of RV are expected to continue, judging by how IV is currently priced by the options market.