Crypto Options Analytics, July 10th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE:

Last week, US stocks rallied on the week.

This is despite a strong NFP report of +372k jobs AND a -353k drop in labor participation. The combination shows that labor markets are still tight.

The price action wasn’t bearish and SPY closed nearly unchanged.

VVIX continues to make new lows as 2nd order traders expect the VOL of VOL to reduce… This bodes well for risk assets.

At 8:30 AM ET on Wednesday, we have a CPI number release. This is likely the biggest inflection point of the week.

Short-Term

I think once we’re on the “other-side” of this announcement, risk assets might close substantially higher on the week. Granted, there isn’t a BLOWOUT CPI headline.

The way risk-assets reacted to NFP, plus the continued weakness in VVIX, makes me think there’s selling fatigue in risk.

Crypto thoughts

Volatility continues to bleed out while time passage around 3AC “contagion fears” means the worst is likely over.

Unknowns become known and the total riskiness of the situation becomes measured.

Spot price rally in the short-term, $22.5k→$25k

Medium Term

Volatility continues to drop into summer, both because of seasonality and of a bear market lunch-break.

Lower Vol. bets are interesting.

BTC: $20,805 +7.93%

ETH :$1,167 +8,86%

SOL: $36.89 +13.7%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

BTC Dvol weakness performed very nicely last week… getting to the orange line made sense, as the fundamental catalysts clearly defined our levels.

Luna event (May high)

Vol. Retracement

3AC (June high)

Vol. Retracement

Don’t think of it as Technical analysis, but instead as “markers” around where vol. was (and could go back to), as option markets reacted to the developing events of related magnitude.

Once we’re back below the orange line, Vol. can trend much lower- should summer truly be quiet.

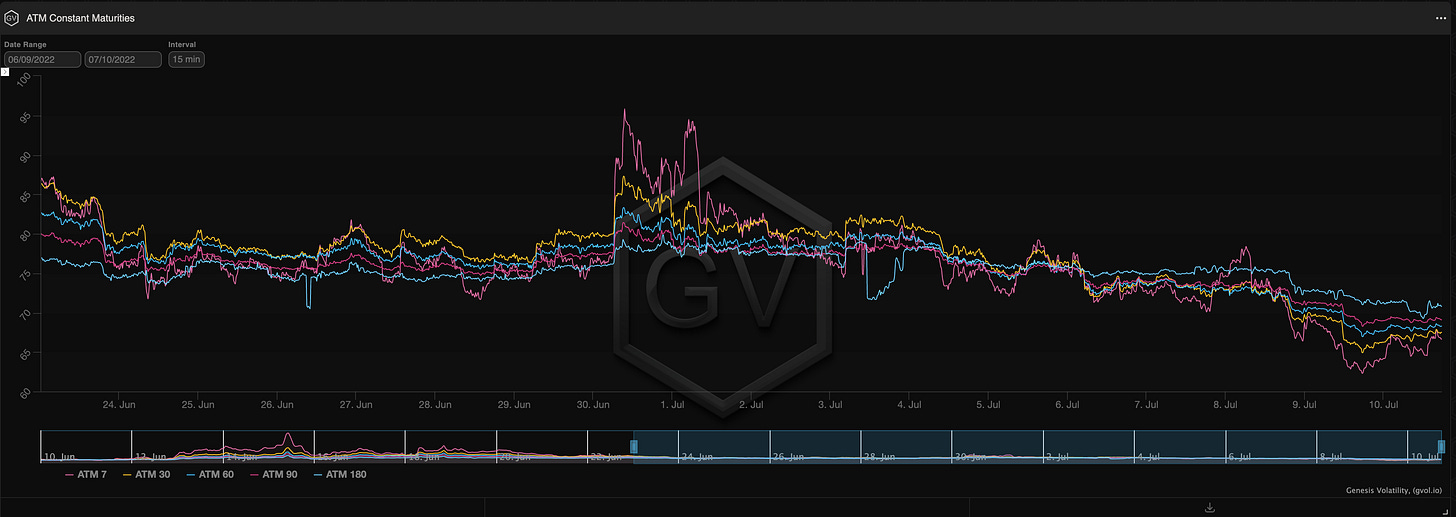

TERM STRUCTURE

(July 3rd, 2022 - BTC’s Term Structure - Deribit 10-day , 15min)

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

SOL (gvol API python module, pre-built notebook charts )

Term Structures lost a ton of juice.

All three cryptos are back into clear Contango.

BTC 50-day options lost nearly 15pts of IV… a massive drop week-over-week.

Think about 3AC contagion fears for a second… would traders be willing to smash IV so hard, should we not be beyond the worst of the contagion?

I think the contagion risks are now behind us.

SKEWS

(July 3rd, 2022 - BTC’s RR SKEW (C-P) - Deribit 30-day , 15min)

Short-term expirations saw the largest recovery in RR skew (C-P) this week.

Everything is still negative but the magnitude of the put demand has now eased.

Like the term structure activity, this bodes nicely for the contagion fears.

Medium-term, going into the summer season, the environment feels like a “short-the-skew” and “short-the-vol.” environment.

@fb_gravitysucks

PROPRIETARY “GVOL-DIRECTION” FLOWS

Last week, we talked about the two themes that were emerging a little sharper from the options’ flow: decreasing volatility and the possibility of a limited “bear rally”.

Themes that have gained more consistency this week with the purchase of outright calls in July in strikes $22k-$25k, call spreads $25k-$35k 30DEC and short strangles on 22JUL and 30SEP. Similar action on Ethereum with $1.2k/$2.4k call spreads 30DEC, and selling across maturities of strike $1k.

The quick profit-takings with the index around $22k, make us lean towards caution again. The overall picture remains unchanged and caution for both net vega exposure and directionality is evident from the participants’ actions.

The feeling is: another week of waiting (ideal to collect some theta decay), in view of a more marked action in the last two weeks of July, when the “rate hikes” narrative will dominate the scene again, ahead of the FOMC meeting.

(4th Jun - 11th Jul, 2022 - BTC/ETH Gravity charts - Deribit)

BTC

ETH

VOLUME

(July 10th, 2022 - BTC Premium/Contracts Traded - Deribit)

Paradigm Block Insights (4 July – 10 July)

Crypto majors moved higher this week given US tech outperformance (NDX +5.7% WoW), dissipating crypto contagion risk, and rates / oil prices still well off the highs. All eyes on US CPI (Wed) and retail sales data (Fri).

BTC +7.6% / ETH +8.3% / SOL +9.6%

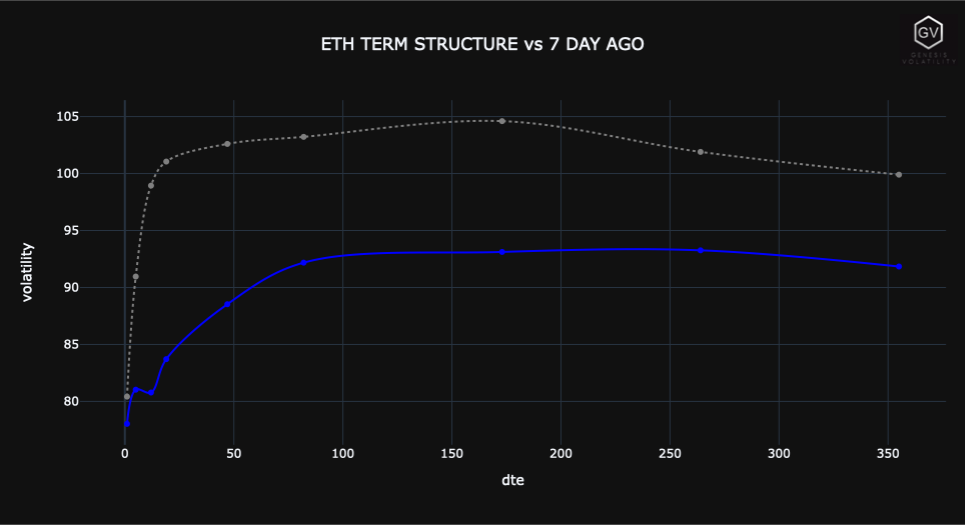

Term structures back to upward sloping given the spot rally, with the belly of the BTC curve trading in the high 60s (30D realized: 67.5v).

Risk-reward for owning vol has improved, and we like owning gamma ahead of next week.

15Jul: 67.5

29Jul: 67.6

Aug: 68.7

Sep: 69.6

Dec: 71.2

Mar: 71.4

Jun: 72.5

Composition of Block Trades

In BTC, notable blocks of gamma bought on Paradigm below. We expect more buying ahead of next week’s CPIs and Retail Sales data if vols continue trending lower.

900x 8Jul 20.5k call

275x 22Jul 19.5k / 22k strangle

250x 8Jul 21k call

225x 15Jul 22k call

The 25k strike was the most active BTC strike on Paradigm last week with strong activity in outrights and call spreads.

Over 4k traded contracts in this strike! Very notable given that ATM strikes normally dominate BTC option volume.

2125x 29Jul 25k strike traded (two-way interest)

915x Dec 25k / 35k call spreads bot

300x 29Jul 25k / 28k call spread bot

250x Sep 25k calls bot

In ETH, strong activity in Sep/Dec options with 53.5k and 75k contracts trading, respectively. The most unique large print was two-way interest in OTM Sep 1x10 call spread.

3k Sep 3500 / 10000 1 x 10 call spread (33k cts. total)

Large Dec call spread buyer:

7.4k Dec 1300 / 2400 call spread bot

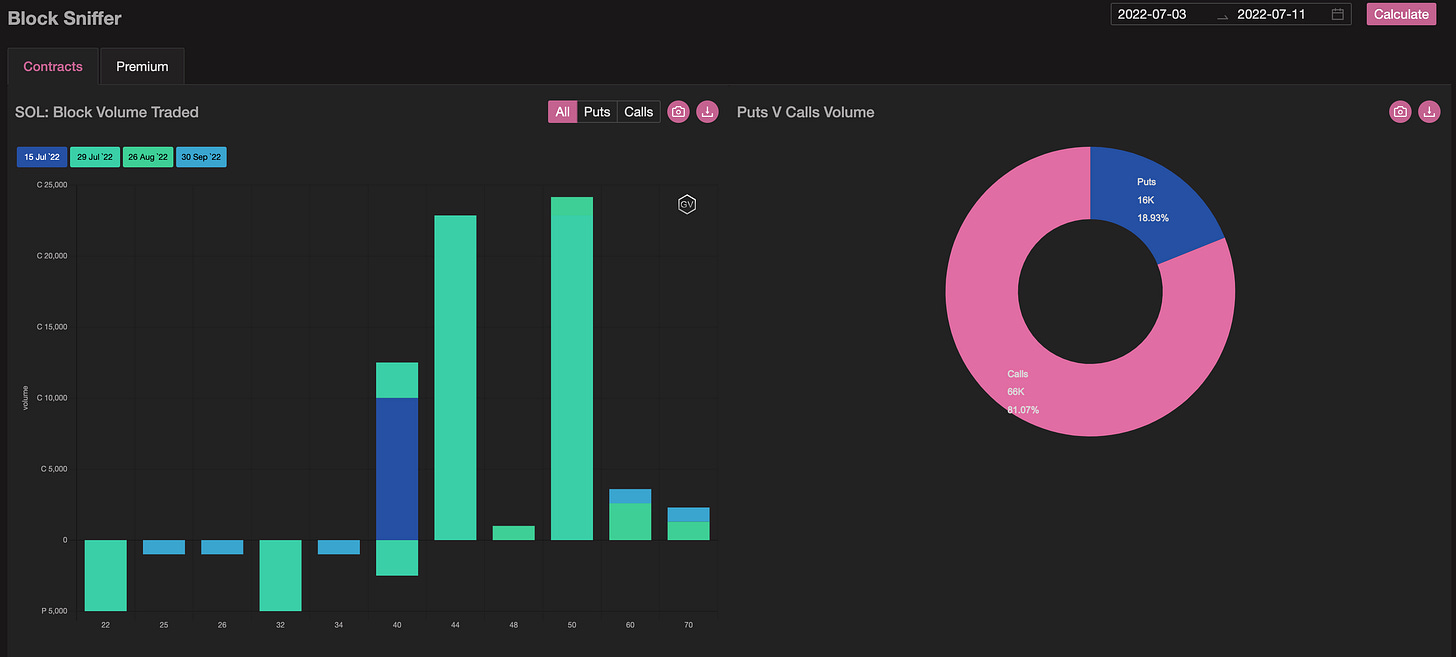

In SOL, 4:1 call/put ratio on Paradigm, with a large 23Jul call spread buyer. Multiple days last week where Paradigm earned over 40% of market share!

23k 23Jul 44/50 call spread bot

10k 15Jul 40 call bot

5k Jul 32 put sold

5k Jul 22 put sold

BTC

ETH

SOL

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(July 10th, 2022 - BTC’s Volatility Cone)

(July 10th, 2022 - BTC IV-RV)

VRP looks flat here, but if we used a weighted RV number we’d see it.

IV (like Skew) still has some residual demand… The recent blowups in Luna and 3AC continue to remain fresh in traders’ minds.

22.5C/25C/27.5C or 25C/27.5/30C flies could be great defined risk structure here.

Flies have dynamic greek profiles, but TL:DR, you want IV to be lower as spot prices reach your short-belly strikes.

On the riskier spectrum… you could trade 20P/18P/10P flies… something like that.

Squeeth: a Week in Review

Squeeth ended the week +16.2% vs. ETH +15.8% (as of 7/10/22 14:11 UTC). Here are a few things to note:

Volatility

Squeeth IV remains significantly under ETH DVOL, printing around 100% IV at highs and lows of near 70, while ETH DVOL poised to start the week slowly decreased from 115 - 96 (seen below).

Volume

Squeeth saw its most active volume days to end the week, on the back of Jobless Claims and NFP. Volume quickly tapered out to end the NYC trading session Friday.

Crab Strategy

Crab Strategy performed 7 hedges for a total of 648.842544 ETH.

With spot outsized positive returns for the week,traded ETH for oSQTH, reduced the amount of ETH held by depositors.

Hop in the discord: https://discord.gg/fe8YfUkUTr to learn more about Squeeth and for access in Crab V2!