Crypto Options Analytics, Jan 9th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$41,895

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Jan. 9th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

We went into this week with skews that were bid to the calls and lower overall IV levels.

Tuesday, everything shifted as the US Fed hawkishness proved itself to definitely be in play.

Now option skews have reversed severely and puts are bid beyond levels seen in mid-December.

Weekly skew is the most bearish and provides some opportunity for a trader’s betting on a “Snap-Back” rally. Medium-term options are slightly negative, while the longer-dated skew remains buoyant enough to be above par.

(Jan. 9th, 2022 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Jan. 9th, 2022 - BTC’s Term Structure - Deribit)

Despite the harsh spot-selling seen this week, the IV term-structure is nearly identical to last week.

The overall trend of lower IV seen this month has continued despite a brief flattening rally which was quickly faded.

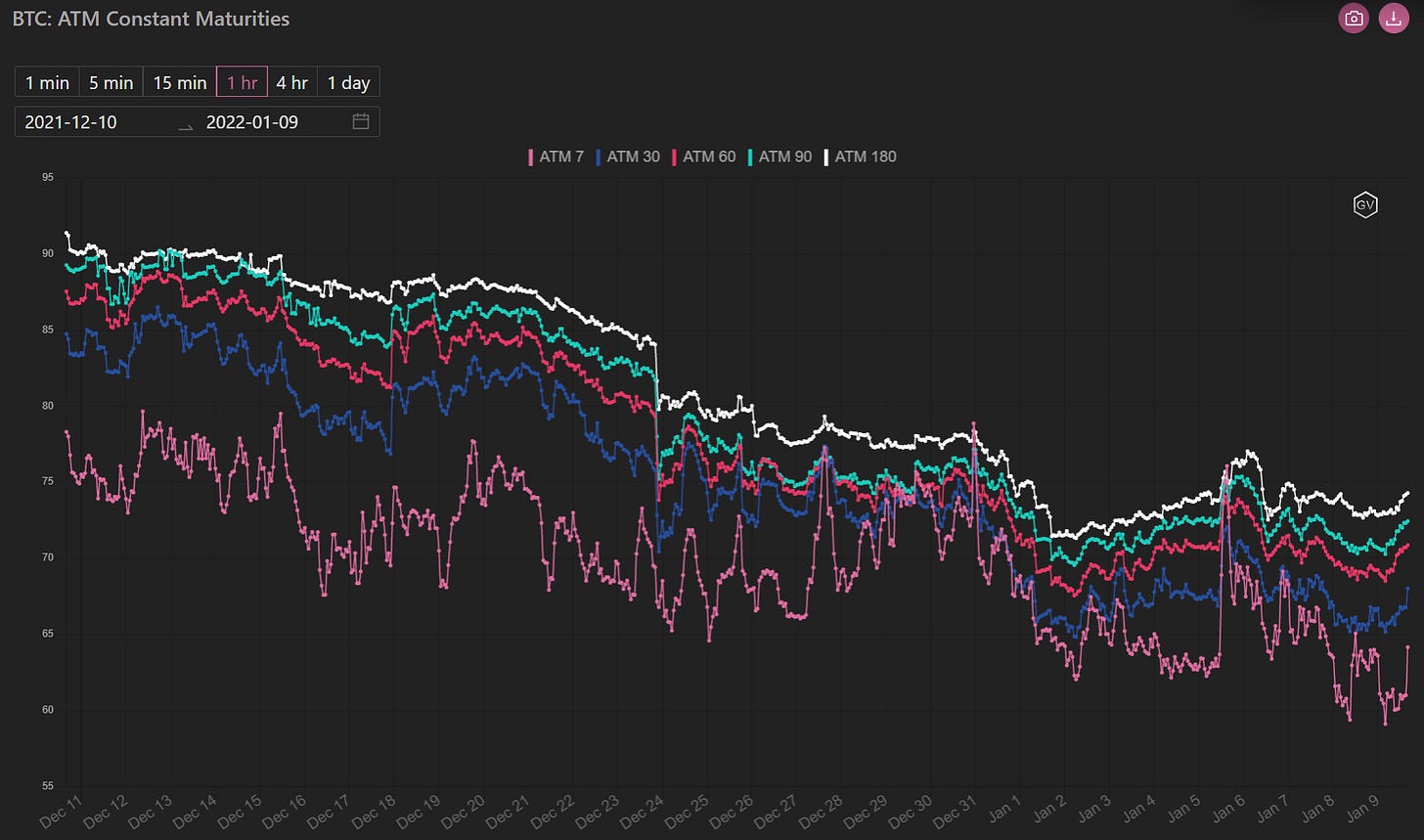

ATM/SKEW

(Jan. 9th, 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) barely managed to tick higher. Overall, this activity is surprising as a continuation in spot-price selling could birth much higher RV, like we’ve seen many times before in crypto.

SKEW (right) continues to be quick to react to the markets, more so than overall IV. We can see that skew had a large range this past month and this week’s reaction is logical.

Open Interest - @fb_gravitysucks

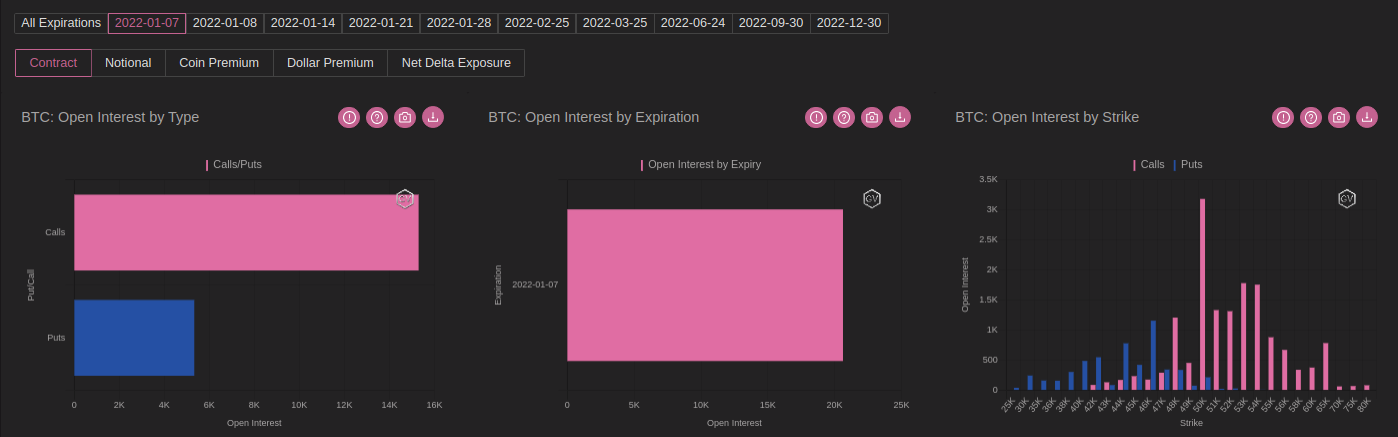

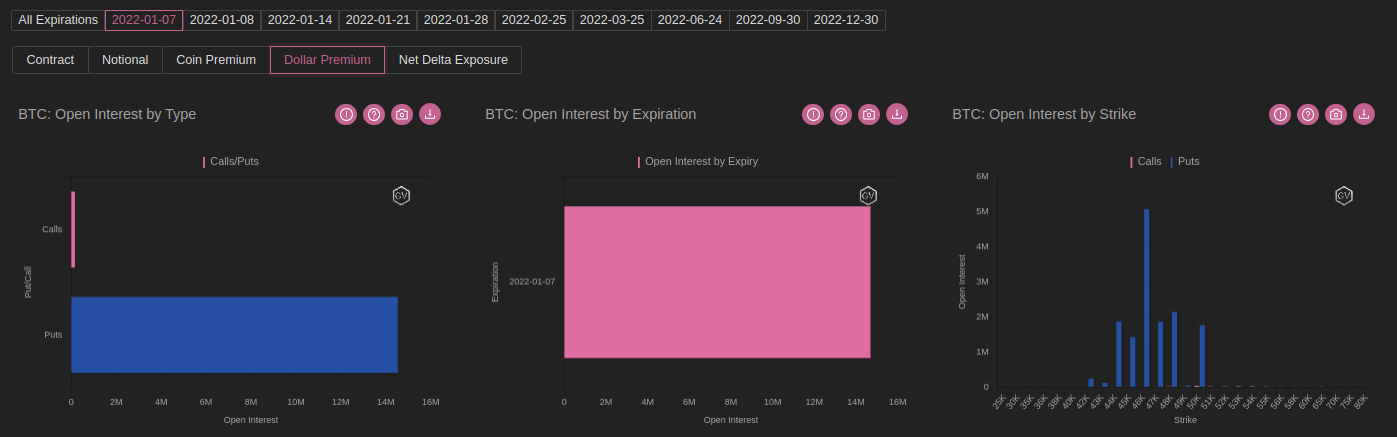

BTC

This was the first expiry of the new year and open interest was greater than 20k contracts. This has been one of the most traded “weekly contract” expirations in the last three months. Most traders were positioned for a move higher by being long gamma; spot pointed in the other direction and premium was paid only to put holders.

(Jan 7th , 2022 – BTC Open interest – Deribit)

(Jan7th , 2022 – BTC Dollar premium – Deribit)

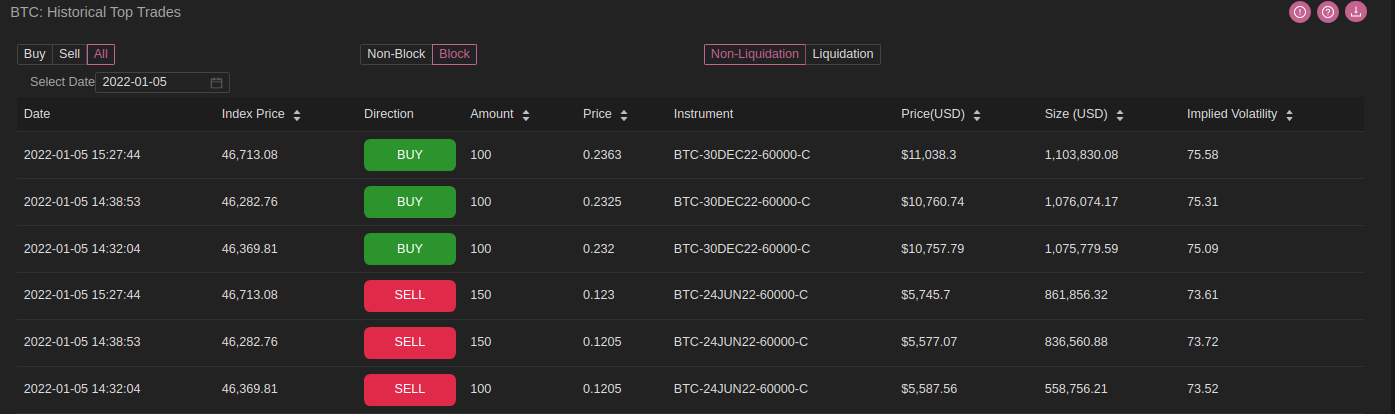

On 5th January 60k strike took a lot of attention: difficult to say with certainty if this is a bullish forward-trade or some more sophisticated volatility one.

With spot prices around $45k, an active player hedged/speculated buying 14JAN 44k puts. Terrific timing. Positions have been closed (took profit) on Saturday 8th: good sign for a bottom in place.

(3rd Jan – 9th Jan, 2022 – Options scanner - BTC)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Jan. 9th, 2022 - BTC Premium Traded - Deribit)

(Jan. 9th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Jan 3 to Jan 9) - Patrick Chu

Risk sentiment soured upon the release of FOMC meeting minutes, which flagged chances of faster rate hikes and balance sheet shrinkage. Prices fell across the board.

We saw a greater share of BTC volume pre-FOMC minutes release, before ETH printed more than twice the volume of BTC after release.

(Jan 3 to Jan 9 - Volume Profile - Deribit & Paradigm)

BTC DVOL saw a blip higher from 71 IV to 78 IV on 05 Jan after the minutes, but traded back down on the days after.

Put/Call ratio in BTC this week was more even at 0.90 (52.6% were calls) driven by protection buying.

(Jan 3 to Jan 9 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Jan. 9th, 2022 - BTC’s Volatility Cone)

Interesting to note, the current selling seen this week wasn’t erratic enough to even get weekly RV back above the median.

On a gut level, this is surprising RV profile compared to PnL returns.

REALIZED & IMPLIED

(Jan. 9th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

In order for IV and RV to meet this week, IV had to actually drop while RV rallied higher.

This vol. activity displays how much of persistent premium IV displayed going back to the second half of 2021. RV rarely traded above IV, which would normally make up for the common IV premiums.

$3,157

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Jan. 9th, 2022 - ETH’s Skews - Deribit)

ETH skews had a more erratic drop than BTC skews and the damage is actually deeper.

The skew profile is negative for maturities all the way through 180-days.

Weekly skew is the most negative but 30-day skew is sitting at nearly identical levels.

The “Snap-back rally” risk-reversal play could be executed with 30-day options here. A trade that becomes even more interesting given the strong ETH/BTC context.

(Jan. 9th, 2022 - ETH’s Skews - Deribit)

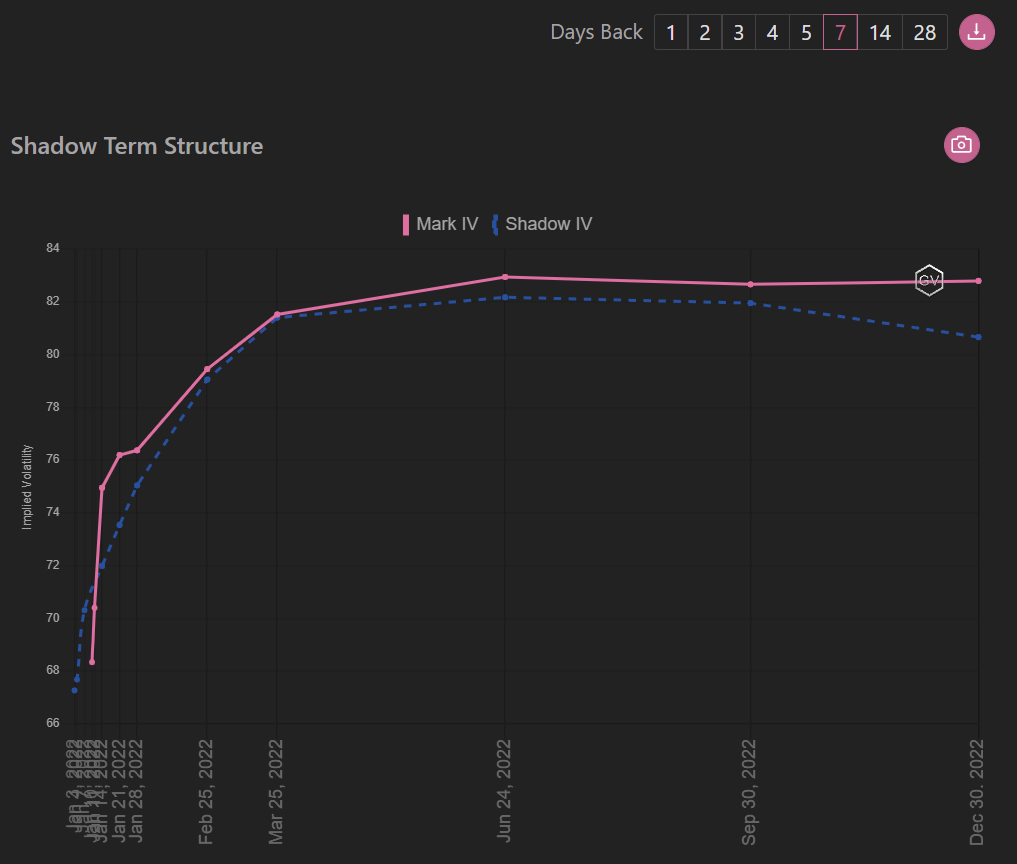

TERM STRUCTURE

(Jan. 9th, 2022 - ETH’s Term Structure - Deribit)

Similarly, the ETH term structure is nearly identical this week compared to last week, with a small exception of flattening for the very short-dated options.

Medium-term and long-term IV barely reacted to this week’s activity.

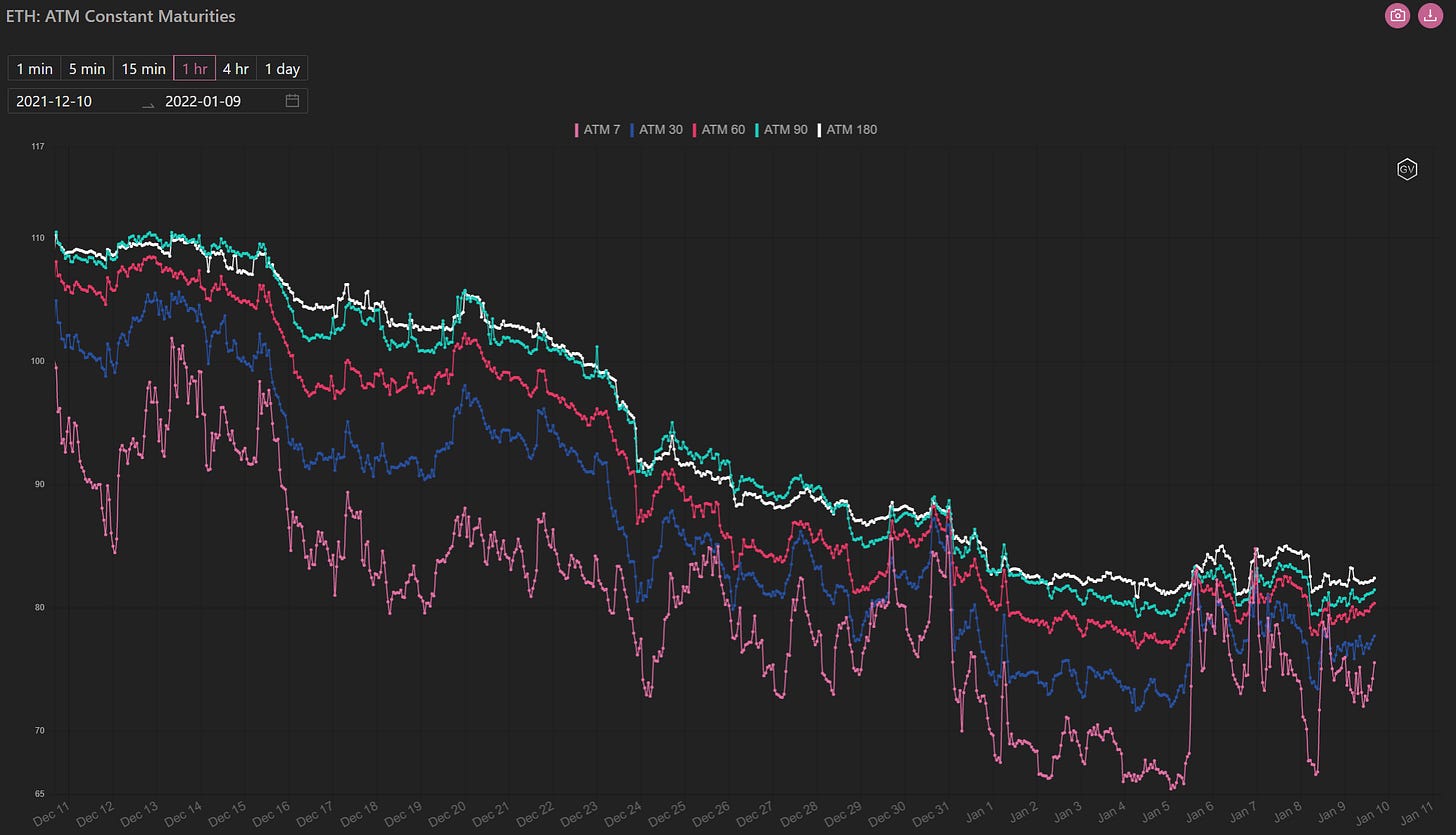

ATM/SKEW

(Jan. 9th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is below holiday season IV (when nothing happened). Interesting to see that option appetite only materialized in skew but not in overall IV.

Skew (right) reacted very logically and persistently sold-off. We are right back at monthly lows.

Open Interest - @fb_gravitysucks

ETH

This was a disappointing first 2022 expiry. Only 115k contracts of open interest expired which has been on the lower-end for the past two months. Opposite compared to Bitcoin.

The open interest profile showed a more cautious tone with an higher put/call ratio. Sell-off was rewarded to puts holders.

(Jan 7th , 2022 – ETH Open interest– Deribit)

(Jan 7th , 2022 – ETH Dollar premium – Deribit)

Bearish flow in advance of the price drop: 25MAR risk/reversal 3k-6k and 14JAN puts.

ETH lost some confidence showed in the last months. With beta>1 and iIV almost at par with BTC, hedgers are eager to buy some cheap protections.

(3rd Jan – 9th Jan, 2022 – Options scanner - ETH)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

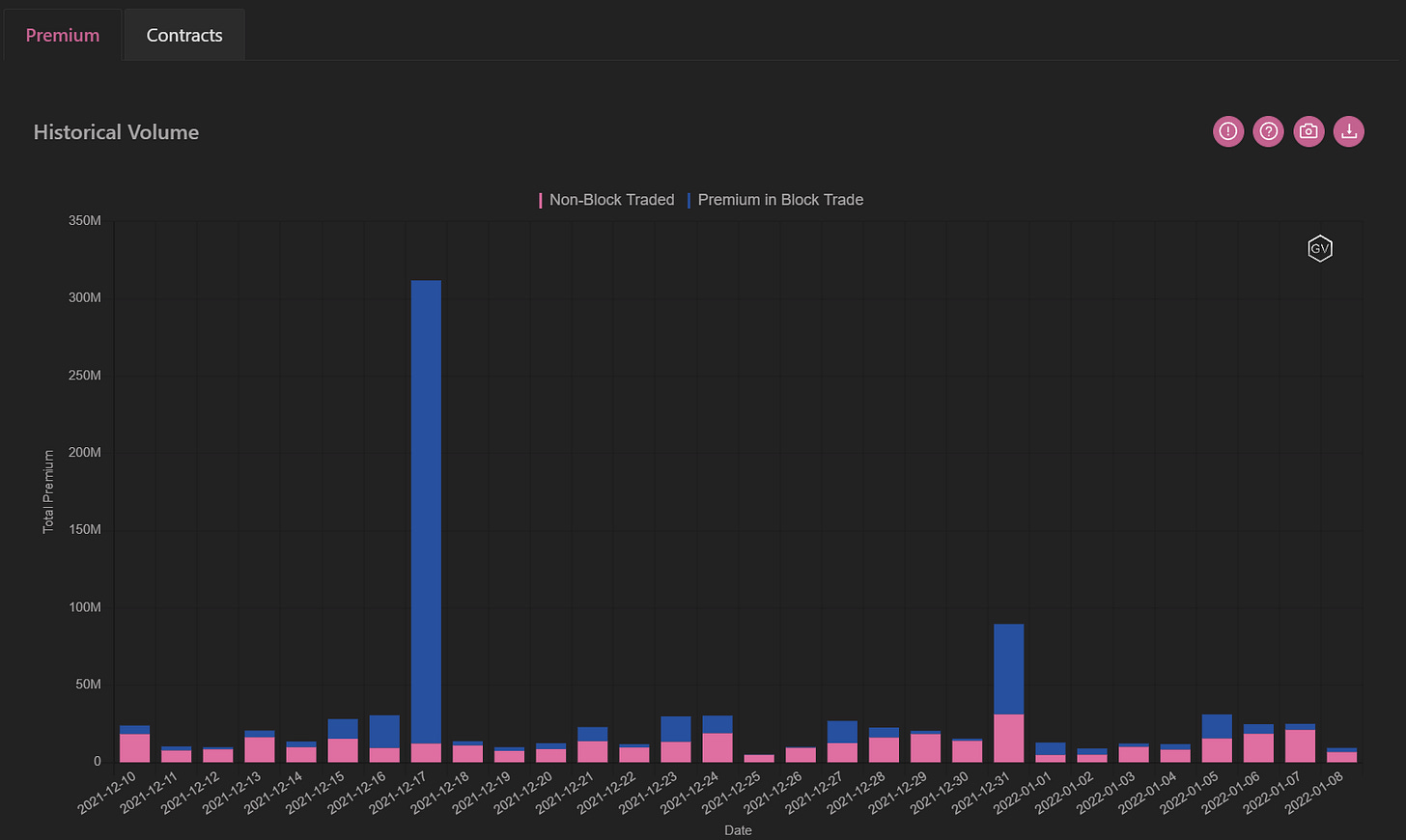

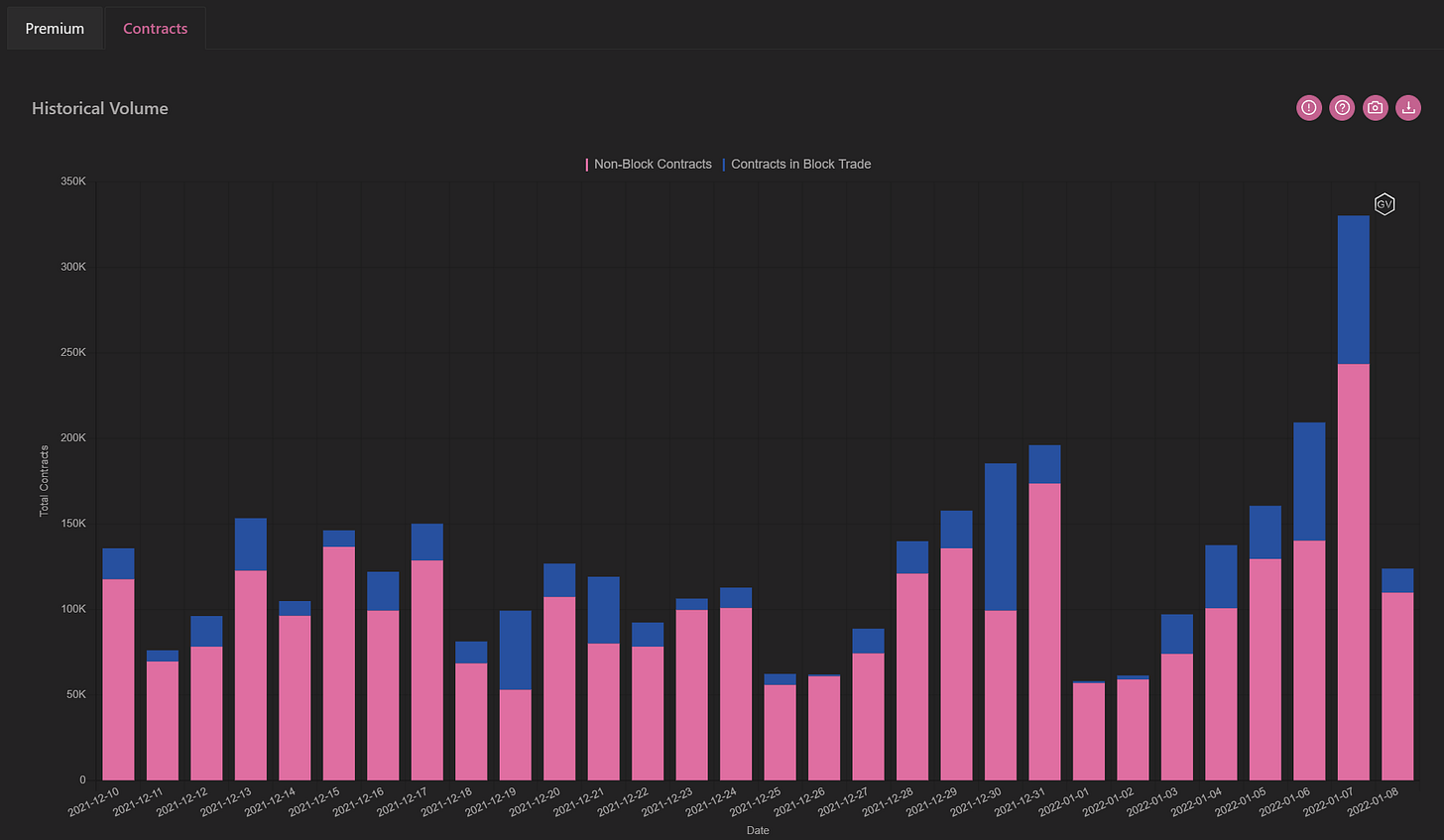

VOLUME

(Jan. 9th, 2022 - ETH’s Premium Traded - Deribit)

(Jan. 9th, 2022 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

Paradigm Block Insights (Jan 3 to Jan 9) - Patrick Chu

The dominant activity we saw in ETH this week was sellers of Skew via RR Puts and Call Spreads. We saw the greatest activity in 3000 (41,043x) and 4000 (38,428x) strikes across Jan-Jun tenors.

ETH volumes averaged 250MM on 6th & 7th Jan.

(Jan 3 to Jan 9 - Volume Profile - Deribit & Paradigm)

(Jan 3 to Jan 9 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Jan. 9th, 2022 - ETH’s Volatility Cone)

ETH RV was strong enough to get above the median, but longer measurement windows display meager readings with some sitting on annual lows.

REALIZED & IMPLIED

(Jan. 9th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

RV is peering above IV, closing the gap seen since the second half of December.