Crypto Options Analytics, Jan. 31st, 2021

Headline theme: "IV holds steady. Big potential for retail flows. Neutral overall IV, with a preference for options structures around volatility skews"

Visit gvol.io

Disclaimer: Nothing here is trading advise or solicitation. This is for educational purposes only.

To trade: Deribit, Bit.com, Okex, Delta.Exchange, Hegic, Opyn

For a Chinese translation visit our partner: TokenInsight

For best execution, with multiple counter-parties and anonymity visit: Paradigm

For crypto options podcast content, check out: The Crypto Rundown

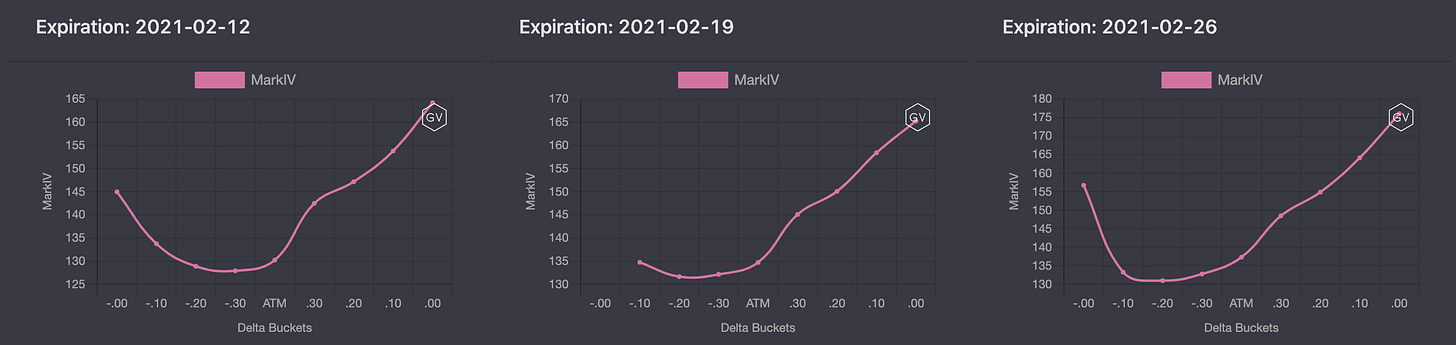

SKEWS

(Jan. 31st, 2021 - Short-term and Medium Term BTC Skews - Deribit)

After the brief Elon Musk driven BTC rally, skews have shifted to positive territory once again.

Volatility continues to be positively correlated to spot prices.

Option market participants are reflecting higher upside gamma risk by demanding more vol. premium in order to entice call sellers.

Short-term and medium term skews are similar, reflecting positive skew for .40-.10 delta buckets, while trading near symmetry in the .10-.00 delta “tails”.

Longer term options are the most positively skewed options.

If traders view crypto spot prices as having a positive asymmetry, long-term options on cryptos most definitely capture asymmetrical distributions.

(Jan. 31st, 2021 - Long Dated BTC Skews - Deribit)

TERM STRUCTURE

(Jan. 31st, 2021 - BTC Term Structure - Deribit)

Compared to last week, the term structure for BTC options is nearly identical.

We’ve seen IV hold steady versus this time last week.

The term structure continues to hold a Backwardation shape, while the front-end IV is displaying a Contango.

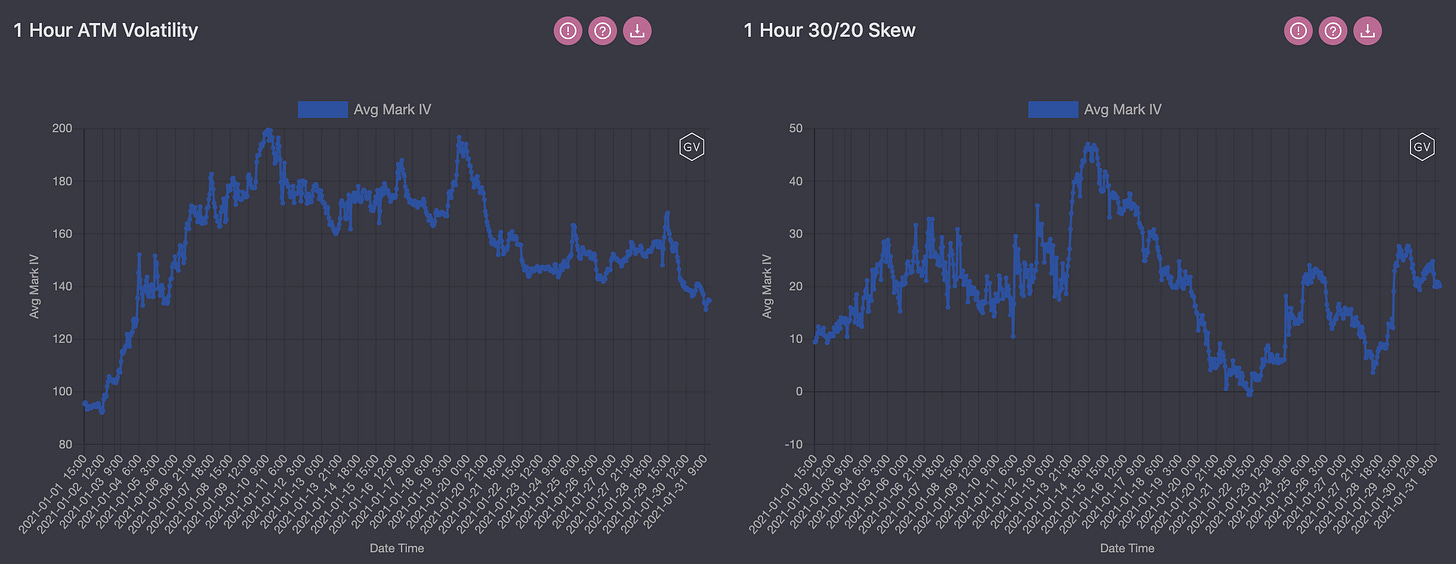

ATM/SKEW

(Jan. 31st, 2021 - BTC ATM & Skews for options 10-60days out - Deribit)

This week we saw a lot of action in retail stock trading and bad responses by Robinhhood and other retail brokers attempting to restrict trading in GME, AMC and other names.

Elon Musk then began tweeting about BTC, which sent both spot prices and IV higher.

Although, the Elon driven rally was short lived causing IV to float back down, there remains a lot of potential for more crypto upside spikes due to retail flows.

This upside asymmetry requires positive skews.

We are more neutral on the prospect of overall IV.

110% ATM IV is high.

This level of vol. implies 1 standard deviation is equal to a daily swing of +/- $2,000.

Outright volatility buying is therefore potentially expensive, we prefer trade structures that neutralize vega exposure and instead isolate bets on the positive correlation between vega & spot.

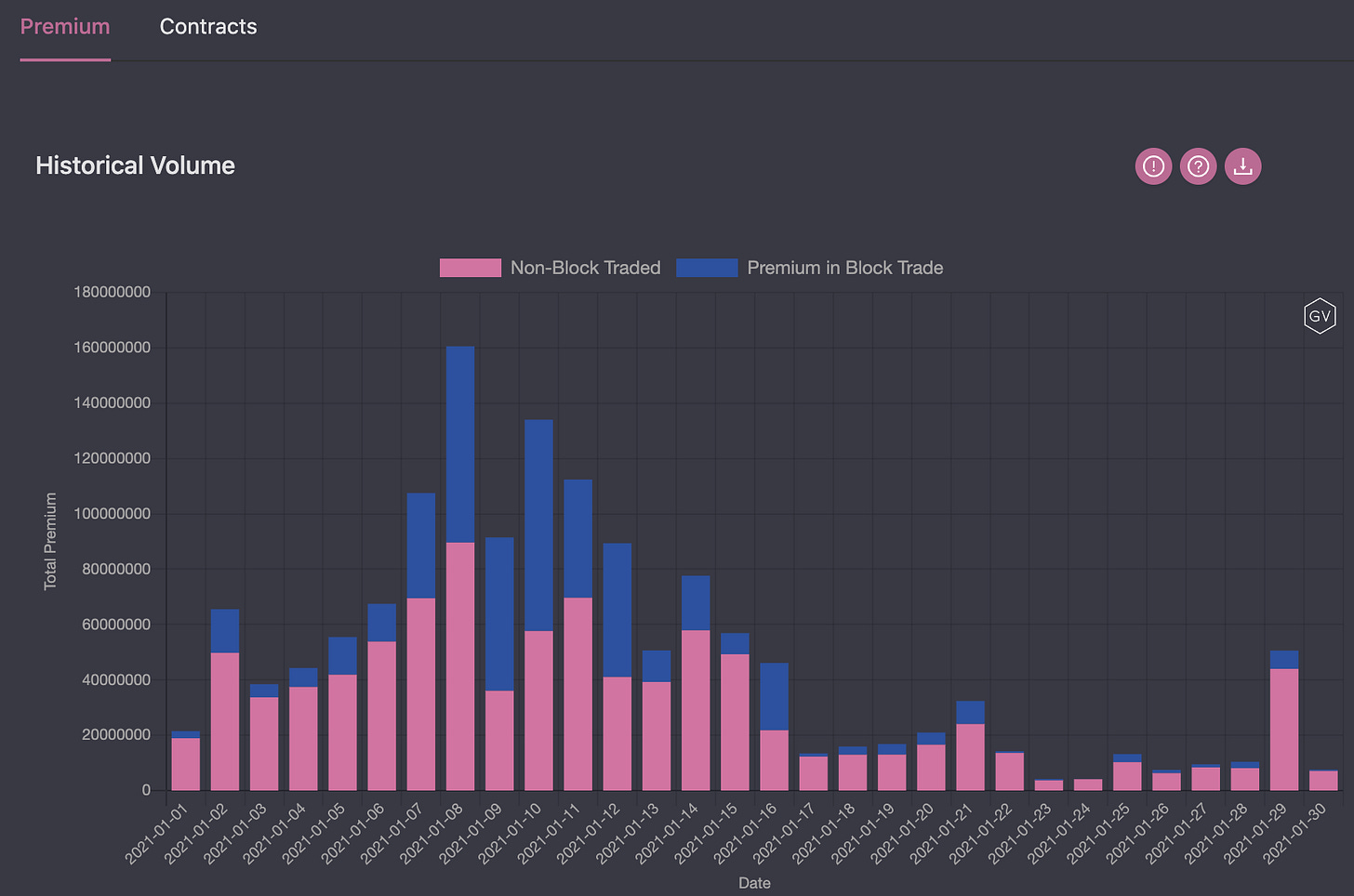

VOLUME

(Jan. 31st, 2021 - BTC Premium Traded - Deribit)

(Jan. 31st, 2021 - BTC Contracts Traded - Deribit)

Volume levels are still in the relatively lower range, with the exception for Elon Musk’s BTC twitter activity on January 29th.

This is option volume activity is consistent with a sharp vol. rally which was then quickly faded.

We continue to conclude there is valuable insights into volatility from option volume data.

VOLATILITY CONE

(Jan. 31st, 2021 - BTC Volatility Cone)

Realized volatility continues to hold the high-end of the 12 month range.

We recommend our paid subscribers adjust the realized volatility cone to analyze 2017 data.

REALIZED & IMPLIED

(Jan. 31st, 2021 - BTC 10-day Realized and Trade Weighted Implied Vol - Deribit)

ATM IV (.4-.6 delta range) for options with 0-31 days until expiration displays a slight IV discount to 10-day RV.

This makes sense given the short-lived Elon Musk BTC rally.

SKEWS

(Jan. 31st, 2021 - ETH Skews - Deribit)

ETH skew profiles continue to be more positive than BTC skews.

Over the past week ETH skews have become even more pronounced in their positivity across the board.

We believe this is due to 1) the lower ETH market capitalization 2) CME ETH futures coming online February 8th.

(Jan. 31st, 2021 - ETH Skews - Deribit)

TERM STRUCTURE

(Jan. 31st, 2021 - ETH Term Structure - Deribit)

The ETH term structure has dropped a modest 5-8 points over the past week.

The ETH term structure is similar to BTC, with a profile of mostly Backwardation and a display of Contango for the front-end.

ATM/SKEW

(Jan. 31st, 2021 - ETH ATM & Skews for options 10-60days out - Deribit)

Looking at the ATM implied volatility, for options with 10-60days to expiration, we see that ATM vol. has continued to drop over the past week.

ETH skew has had the chance to leg higher.

We do believe higher ETH skews are justified here.

Like BTC, overall IV levels are high and we therefore prefer positions that neutralize outright vega exposure.

140% ATM IV implies 1 standard deviation is equal to a daily swing of +/- $95.

VOLUME

(Jan. 31st, 2021 - ETH Premium Traded - Deribit)

(Jan. 31st, 2021 - ETH Contracts Traded - Deribit)

ETH option volumes are more consistent compared to BTC option volumes.

There is a sustained interest in ETH options trading.

We view the volume consistent with “brewing” interest in ETH spot price. Something like a consolidation or coiling before another leg higher.

VOLATILITY CONE

(Jan. 31st, 2021 - ETH Volatility Cone)

Current realized volatility continues to be very high and near on the maximum on many windows.

REALIZED & IMPLIED

(Jan. 31st, 2021 - ETH 10-day Realized and Trade Weighted Implied Vol - Deribit)

ETH ATM IV, .4-.6 delta range for options with 0-31 days until expiration, is still showing a slight IV discount to RV.

We do think given the current retail environment in traditional markets bodes very well for crypto spot prices.

We expect another leg higher in ETH spot prices.