Crypto Options Analytics, Jan 30th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

DeFi Options

DOVs

One of the recent themes in the crypto options market is structural short volatility flow via “DOVs” (DeFi Option Vaults).

Protocols such as Ribbon, Friktion, Atomic.finance and Thetanuts allow crypto holders to allocate holdings to structured products that perpetually use the capital to sell covered calls and cash secured puts on Solana, Bitcoin and EVM chains respectively.

Top Trades this week include:

Frik - SOL $115 2/4 C = ~ $15.4m (Notional)

Frik - BTC $42k 2/4 C = ~ $13.5m (Notional)

Frik - SOL $65 2/4 P = ~$13.8m (Notional)

Thetanuts - Luna/WBTC/Talgo/WETH = ~ $28m (Notional)

$37,721

DVOL: Deribit’s volatility index

(1 month, hourly)

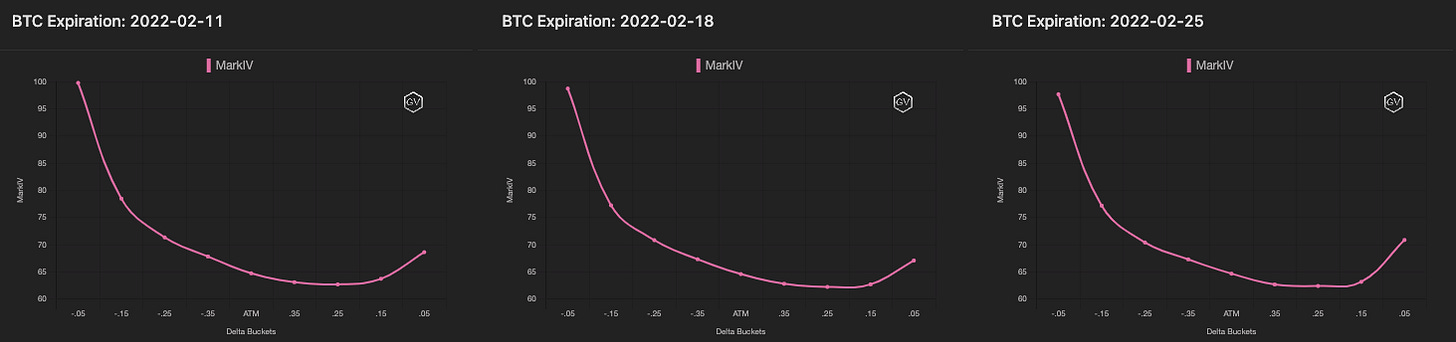

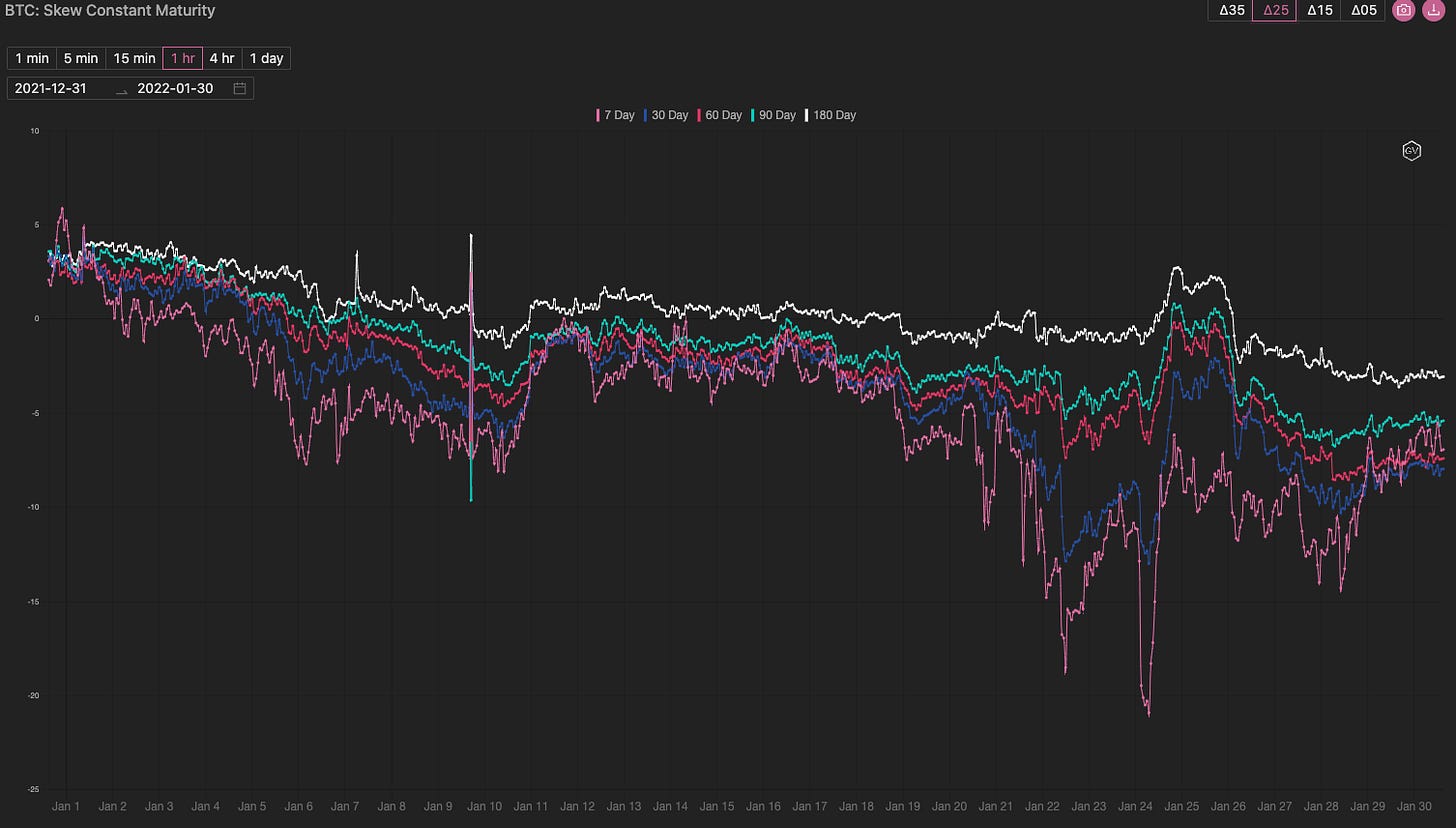

SKEWS

(Jan. 30th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

This week, spot prices saw a pause in selling. There was also a slight “relief rally”.

Spot price action enabled option skew to recover slightly and converge to about -7pts for short-term and medium-term options.

Long-dated skew remained steady throughout the week at -2pts.

We continue to believe that any relief in skew and drop in implied volatility provide great opportunity to pick up volatility and hedge lower prices.

Macro forces were the initial catalyst behind the 2022 weakness, but we’re now witnessing potential executive regulatory action for cryptocurrencies here in the US.

(Jan. 30th, 2022 - Long-Dated BTC Skews - Deribit)

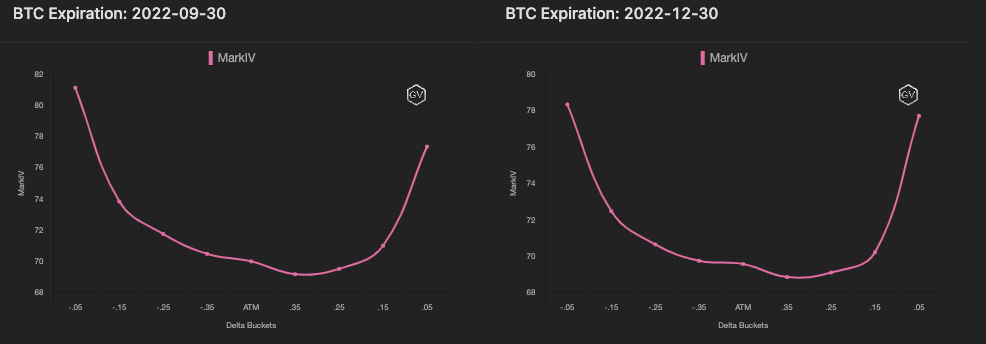

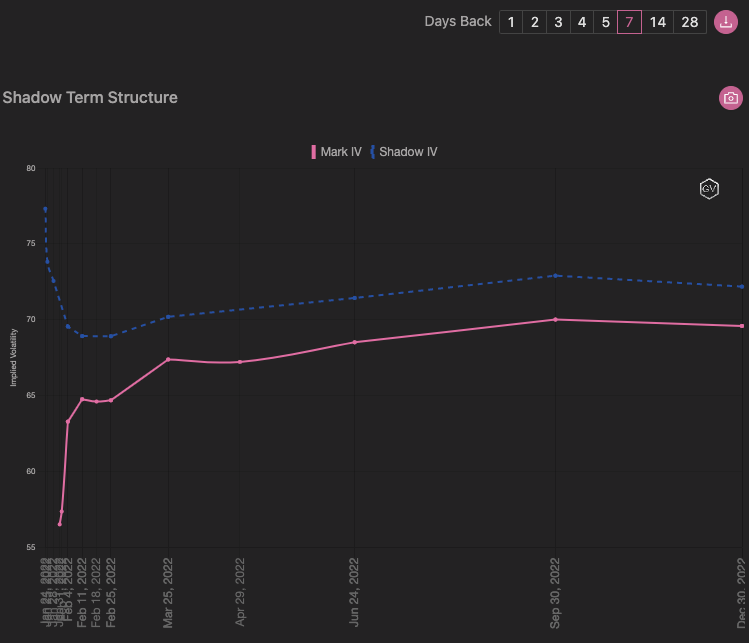

TERM STRUCTURE

(Jan. 30th, 2022 - BTC’s Term Structure - Deribit)

Week over week, implied volatility saw a term structure shape change, flipping from Backwardation to Contango.

Long-dated expirations saw about a -5pts parallel shift lower.

Let’s also keep in mind that macro equity volatility is rather high now too, while crypto volatility remains below Q3 & Q4 levels.

ATM/SKEW

(Jan. 30th, 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) saw a slight retracing after making monthly highs last week.

SKEW (right) saw a brief rally higher, but that enthusiasm has quickly faded back lower. The downward trend in BTC option skew seems quite strong.

Open Interest - @fb_gravitysucks

BTC

This week had a monthly contract expiration.

With almost 60k contracts of open interest, traders expected some sort of a regime change in both price action and volatility. These expectations were deluded.

What we’ve been seeing during these last few weeks is still in play: caution on the downside and calls being sold aggressively.

(Jan 28th , 2022 – BTC Open interest – Deribit)

(Jan 28th , 2022 – BTC Dollar premium – Deribit)

BIG TRADES IN THE FLOW

No big action this week as participants wait for a clear sign of direction.

Generally speaking, puts have been bought in shorter tenures but a trader put some heavy chips on the $40k call strikes for June/September.

Almost $10M in premium this week for this strike.

It’s difficult to assess the “bullishness” of this trade but the execution seen (a lot of clips of 50 contracts in two days) is something worth noting.

(Jan 29th , 2022 – BTC Options scanner 7 days – Deribit)

(Jan 29th , 2022 – BTC Change in OI 7 days – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Jan. 30th, 2022 - BTC Premium Traded - Deribit)

(Jan. 30th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Jan 24 to Jan 30)

Spot prices consolidated after the sell-off last week and DVOL retraced from 88-IV to 73-IV. However, we saw more option buyers this week, possibly taking advantage of the higher realized vol and macro risks. Vol premium (IV-HV) tightened from 20% to 12% this week.

In BTC, call options remained a larger proportion with 63% of options traded.

24Jun 40k vs 60k call spreads were the most dominant options with about 1300x traded.

BTC skew remains in favor of puts, but the 1w 25delta risk eased off from -13 to -5, along with spot rebounding. In the shorter tenors, we saw more downside interest in 28Jan and 4Feb contracts via buying of put spreads 35k vs 34-30k, and saw buyers in 40k outrights.

(Jan 24 to Jan 30 - Volume Profile - Deribit & Paradigm)

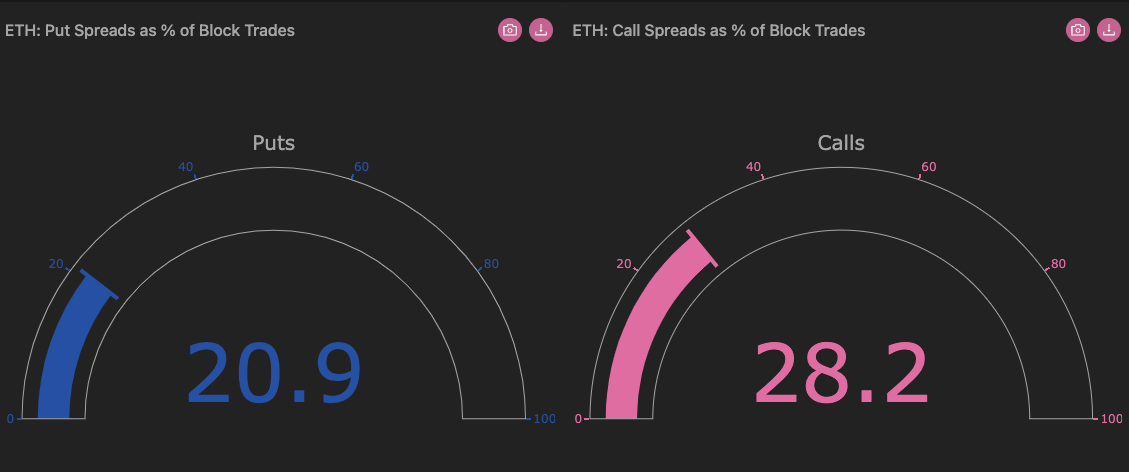

(Jan 24 to Jan 30 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Jan. 30th, 2022 - BTC’s Volatility Cone)

Realized volatility is sustaining higher levels… essentially a “bleed through” into longer term measurement windows.

REALIZED & IMPLIED

(Jan. 30th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Implied volatility is trading at a discount to 10-day realized.

Combine this pricing with regulatory headlines and macro assets also seeing a higher volatility regime.

This is the time to buy volatility.

Various structures seem interesting… ex: Long-term call volatility, combined with futures short-positions, can provide a long volatility position while:

Capturing positive basis yield

Encompassing the negative long-term option skew (rarely seen in crypto).

$2,559

DVOL: Deribit’s volatility index

(1 month, hourly)

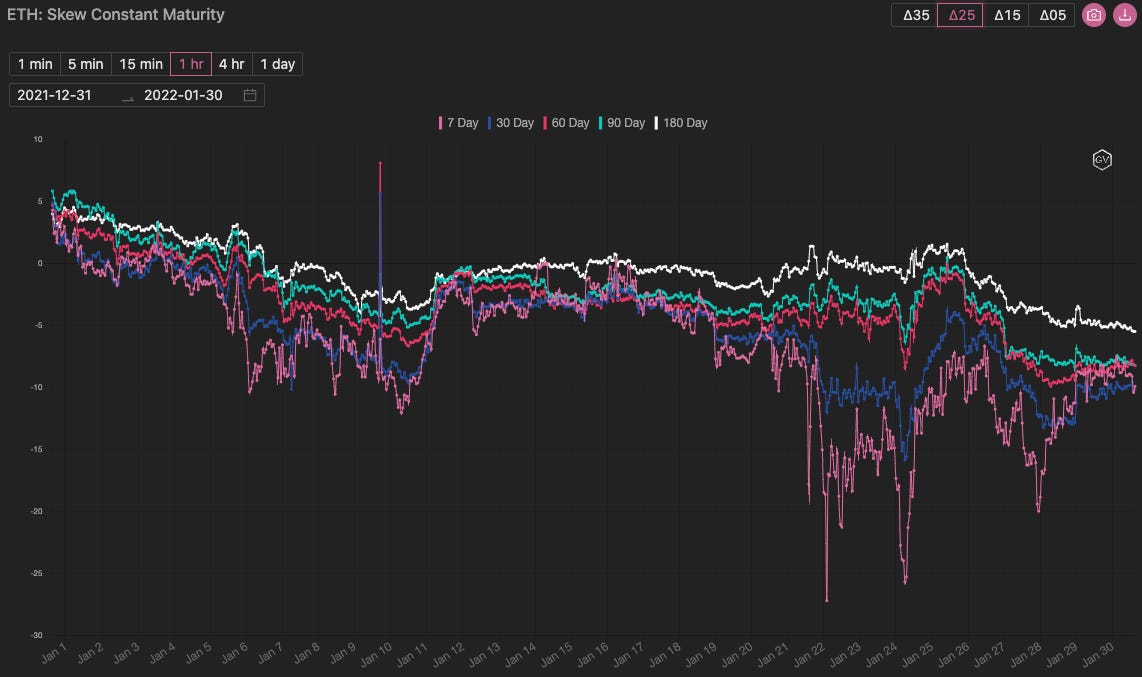

SKEWS

(Jan. 30th, 2022 - ETH’s Skews - Deribit)

ETH option skew saw a decent rebound in short-term and medium-term expirations, currently residing around -10pts.

Long-term option skew, on the other hand, saw a steady grind lower… with no spot driven relief, currently residing around -5pts.

Skew is unable to “shake” the bearish volatility pricing, while overall implied volatility levels are tame by comparison.

(Jan. 30th, 2022 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Jan. 30th, 2022 - ETH’s Term Structure - Deribit)

Week over week, the term structure drops significantly for Ethereum.

Long-dated volatility dropped about -10pts while short-term options saw a -25pts drop as the shape flipped into Contango.

Like BTC, ETH implied volatility is providing interesting long vol opportunity here.

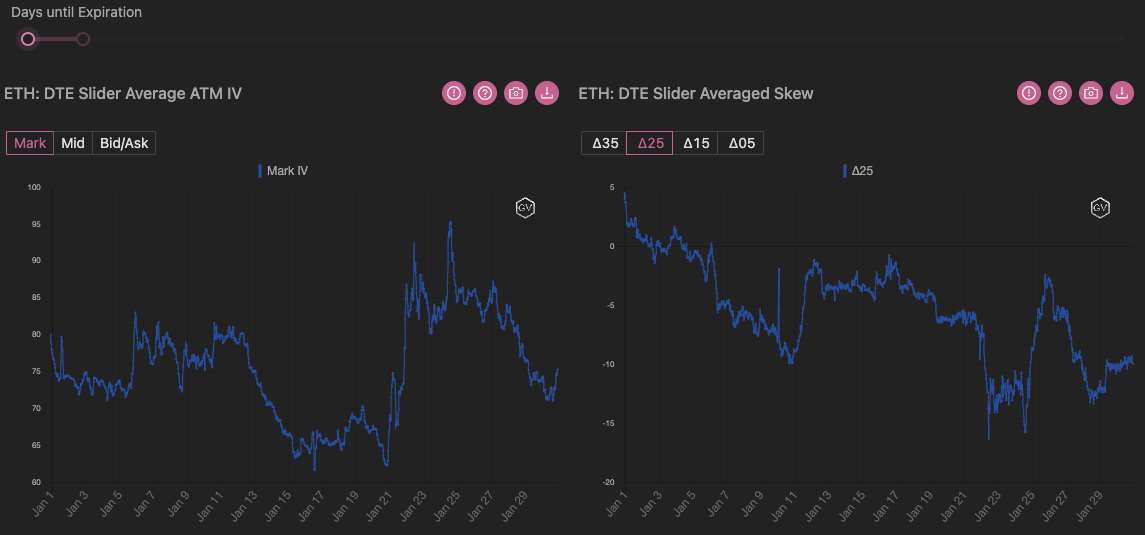

ATM/SKEW

(Jan. 30th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) retraced nearly the entire move higher.

Skew (right) is unable to hold higher and quickly lost ground made towards par.

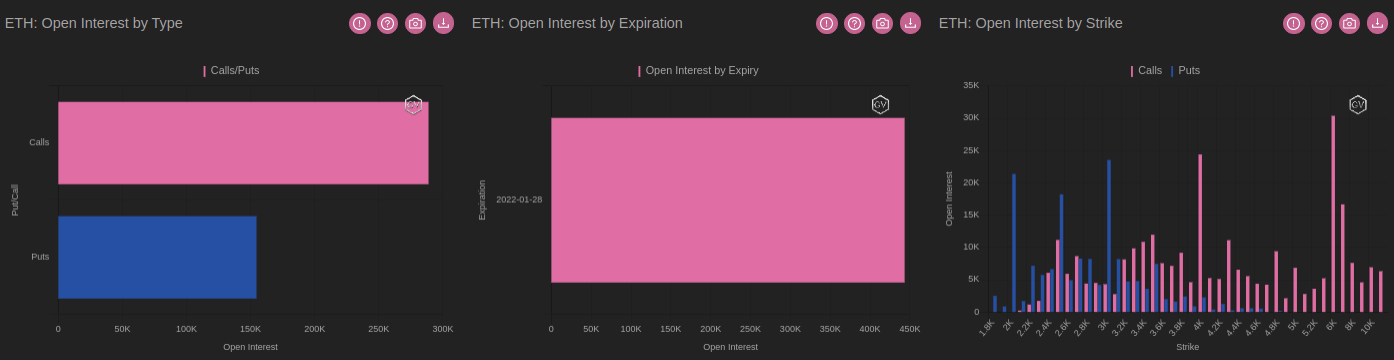

Open Interest - @fb_gravitysucks

ETH

Expiration this week saw a decent amount of contracts in go, even if not quite the average for typical monthly contract expirations.

It’s interesting to see oi put/call ratio, which has been increasing during January (also a similar trend for Bitcoin option oi); this is not a bearish indicator but certainly something worth looking into in the next few weeks.

(Jan 28th , 2022 – ETH Open interest– Deribit)

(Jan 28th , 2022 – ETH Dollar premium – Deribit)

(ETH Top / BTC Bottom – Put Call Ratio - Deribit)

Some caution was seen in Ethereum with short-term puts generally bought until mid-week. Afterwards, trader sentiment saw a shift, discounting the idea of further spot price drawdown and instead increased bets for a bounce. Active traders accumulated call spreads in $3k-$5k range and outright calls for $2.8k-$3k strike.

June/September were the most active expiries.

(Jan 29th , 2022 – ETH Options scanner 7 days – Deribit)

(Jan 29th , 2022 – ETH Change in OI 7 days – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

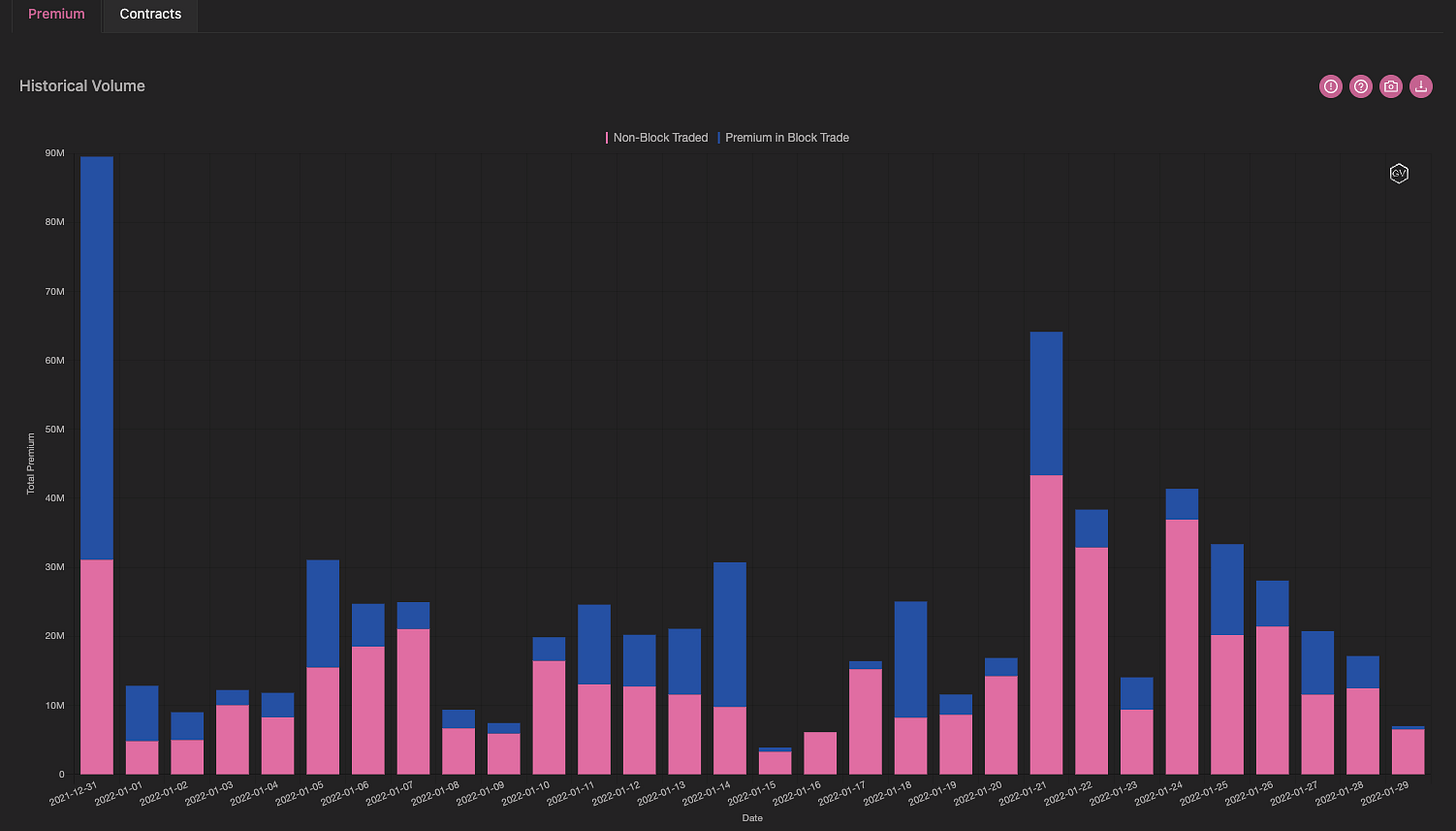

VOLUME

(Jan. 30th, 2022 - ETH’s Premium Traded - Deribit)

(Jan. 30th, 2022 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

Paradigm Block Insights (Jan 24 to Jan 30)

Interest in ETH was more evenly distributed amongst strikes, except for the 2k strike with 39,245x traded: here we saw strong buying interest.

In general, market participants were buying wings (via 1.5k,2k puts, 4k, 5k, 7k calls) and selling near-the-money 2300, 2500, and 3500 strikes.

(Jan 24 to Jan 30 - Volume Profile - Deribit & Paradigm)

(Jan 24 to Jan 30 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Jan. 30th, 2022 - ETH’s Volatility Cone)

ETH RV is also expanding into larger measurement windows.

The realized vol space will likely continue to expand should spot prices test recent lows.

REALIZED & IMPLIED

(Jan. 30th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Like BTC, the ETH IV/RV relationship bodes well for vol. buyers.

Finding long Vol. opportunities remains our bias for both BTC and ETH.