Crypto Options Analytics, Jan 2nd, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$47,359

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Jan. 2nd, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Bitcoin options saw a substantial drop in IV and an increase in option skews over the holiday period.

As IV dropped, so did put-demand relative to calls, causing all option maturities to see a steady move higher in ∆25 skew.

Weekly options saw the sharpest rise in skew as skew began the month around -10pts and rose to +5pts near New Year’s.

Long dated skews currently hold the highest positive reading, sitting around +3pts.

(Jan. 2nd, 2022 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Jan. 2nd, 2022 - BTC’s Term Structure - Deribit)

Notice the massive drop in IV across the term structure.

The parallel shift lower has caused the term structure Contango shape to remain nearly identical.

Long-dated options saw a drop lower nearly as significant as short-dated options.

ATM/SKEW

(Jan. 2nd, 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

The simple average charts depicted above highlight these two trends clearly.

The combined effects of lower IV and higher option skew is providing a good entry for 2022 macro hedges, in case the US Fed rate hikes affect the market negatively.

VOLUME

(Jan. 2nd, 2022 - BTC Premium Traded - Deribit)

(Jan. 2nd, 2022 - BTC’s Contracts Traded - Deribit)

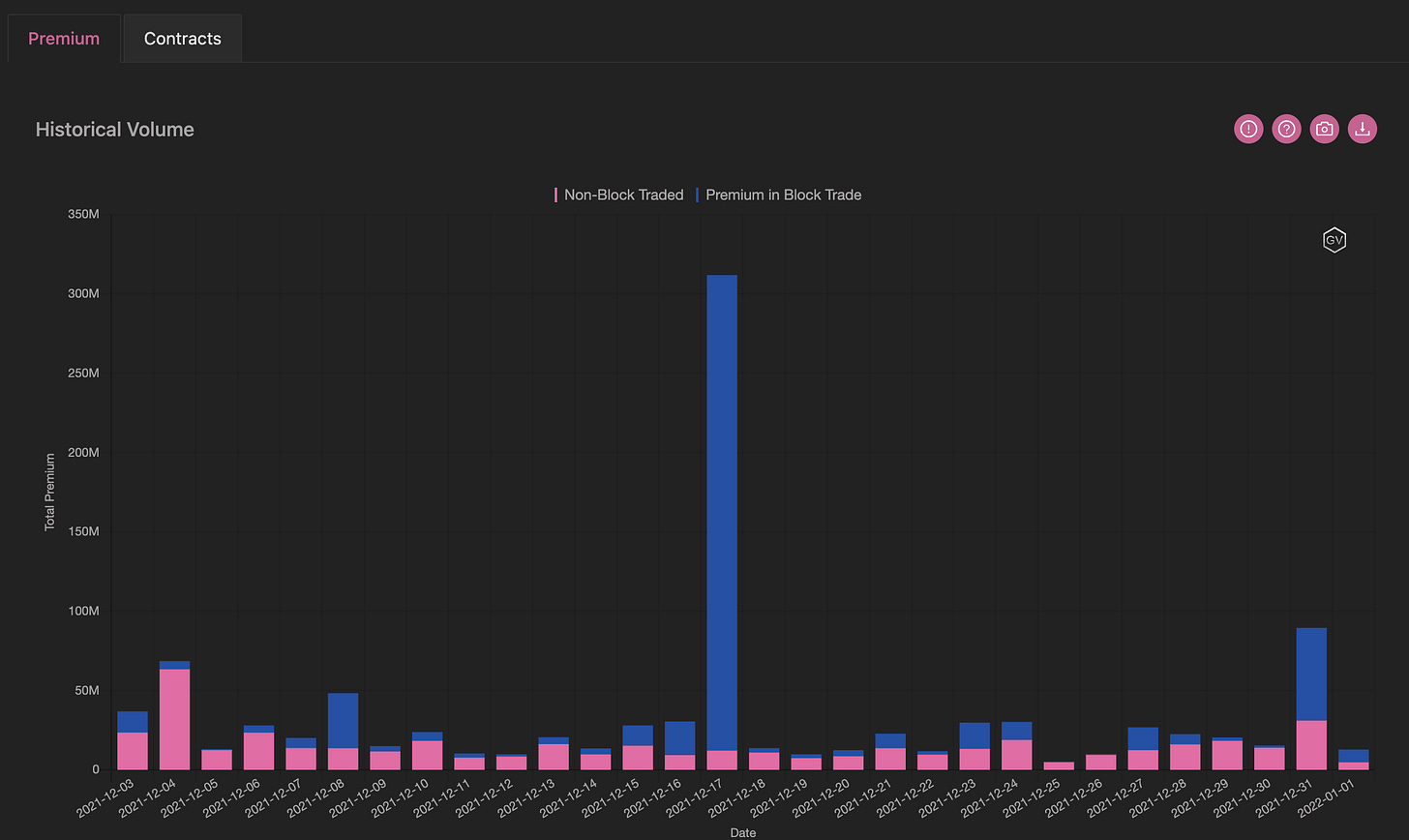

Paradigm Block Insights (27 Dec - 02 Jan)

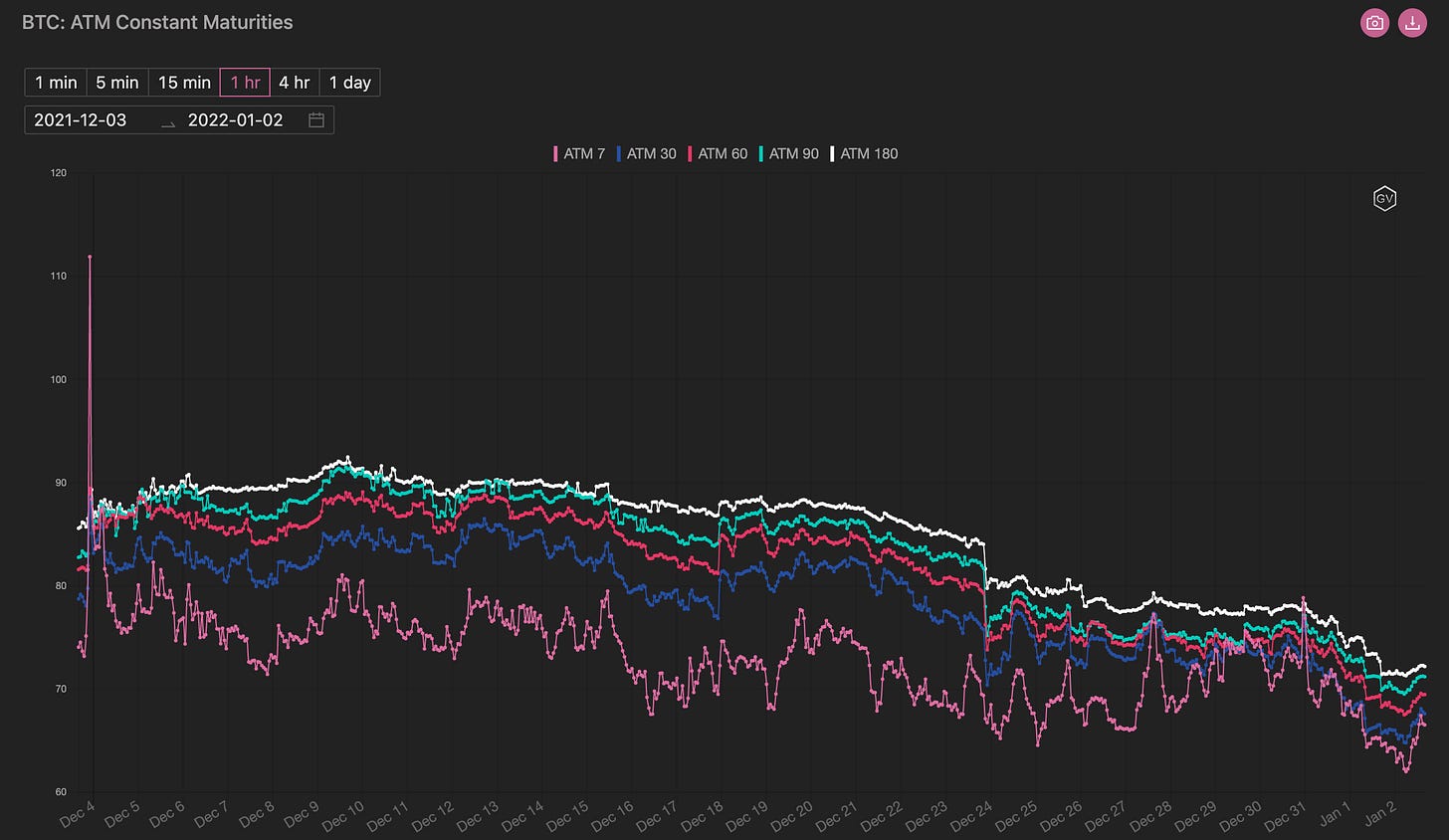

Crypto welcomed us into 2022 with peacefulness and bliss. Markets were focused on the large 31Dec options expiry (~6bn in BTC, ~3bn in ETH), but the week has passed rather uneventfully with IVs grinding lower.

(27 Dec - 02 Jan - Volume Profile - Deribit & Paradigm)

DVOL traded lower, from 77 IV to 70 IV this week. Interest for BTC options resembled a bell-curve, with an average strike around 53k (64% of volume were calls). Highest volume traded on BTC was the 7Jan’22 50k (1030x) vs 53k (1430x) - mainly traded as a call spread.

(27 Dec - 02 Jan - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

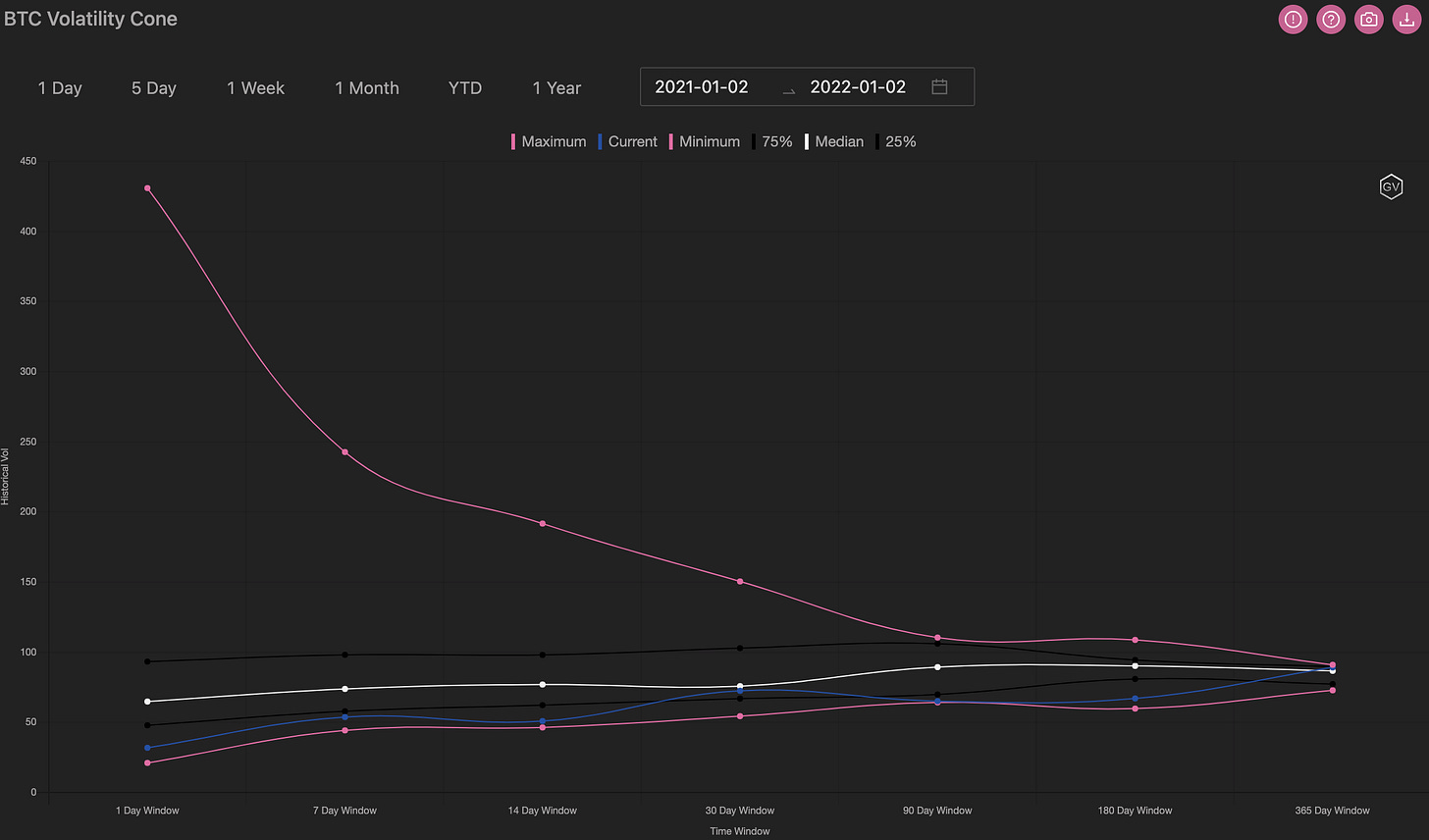

VOLATILITY CONE

(Jan. 2nd, 2022 - BTC’s Volatility Cone)

IV was led lower by the dismal RV picture.

Notice the RV profile is near annual lows for most measurement windows, justifying the lower IV action seen these past two weeks.

REALIZED & IMPLIED

(Jan. 2nd, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

A rather large IV/RV gap is reappearing as RV leads drastically lower, sitting at annual lows.

$3,822

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Jan. 2nd, 2022 - ETH’s Skews - Deribit)

Over the past two weeks, Christmas to New Year’s, Ethereum options saw two big trends.

First: implied volatility, along with realized volatility, came down significantly.

Second: Ethereum option skew became much more positive as put demand fell, call demand returned, and Deribit launched a new Dec. 2022 option as Dec. 31st 2021 option expired quietly.

Short-term weekly skew moved from -10pts in mid-December to +8 pts on Christmas.

Short-term skews currently sit around +1pts.

90-day skew - although less erratic than weekly skew - also moved higher, climbing from -4pts to +2pts now.

Overall, this is a positive development as traders seem to think the potential for volatile drops lower has diminished.

Given the Fed macro backdrop of rate hikes into 2022, the option space is now providing cheaper downside hedges.

(Jan. 2nd, 2022 - ETH’s Skews - Deribit)

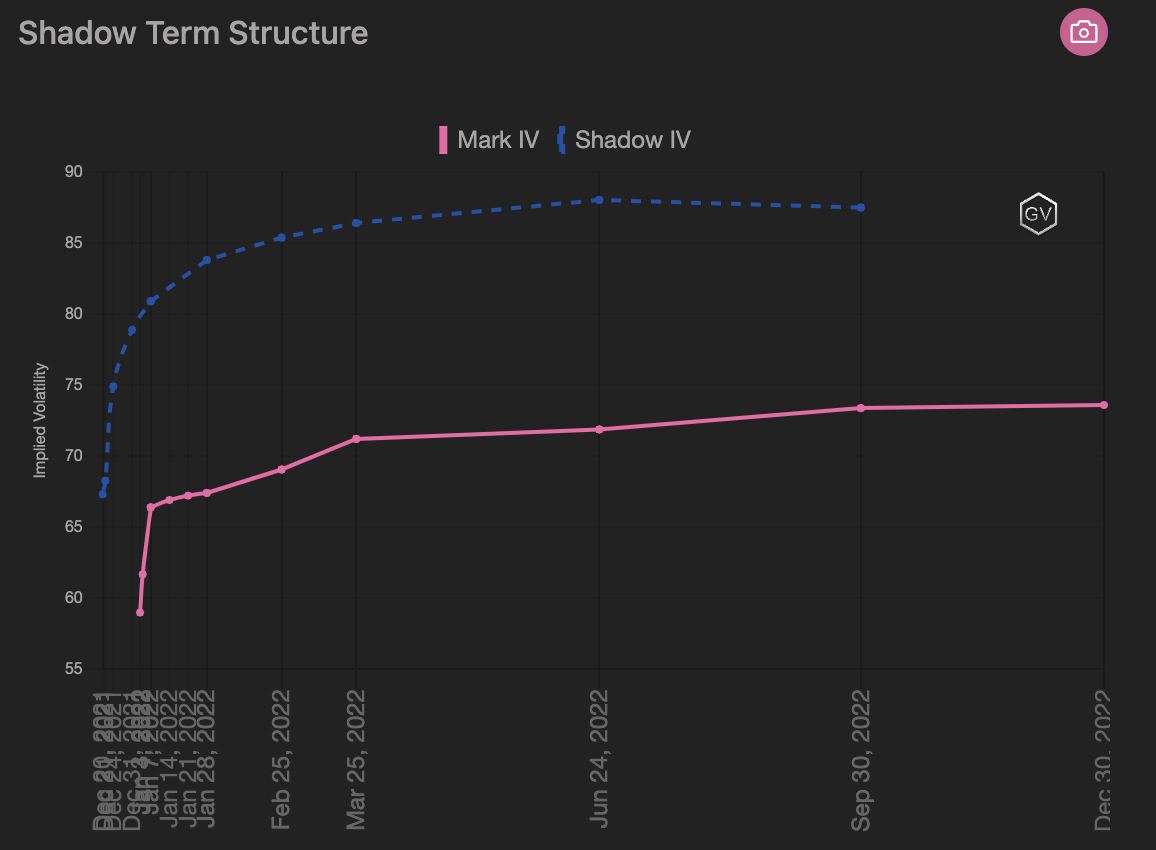

TERM STRUCTURE

(Jan. 2nd, 2022 - ETH’s Term Structure - Deribit)

The 2-week shadow term structure (time lapse) is displaying a significant drop in IV.

This is great news for anyone looking to hedge their books.

Notice that all maturities dropped lower in parallel, causing the term structure shape to remain nearly identical despite the rather large drop in overall IV.

ATM/SKEW

(Jan. 2nd, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

The model free, simple average charts above, highlight these two trends concisely.

For expirations between 10-60 days, ATM IV has dropped nearly -25pts, while option skew had a +14pt rally from peak to trough.

VOLUME

(Jan. 2nd, 2022 - ETH’s Premium Traded - Deribit)

(Jan. 2nd, 2022 - ETH’s Contracts Traded - Deribit)

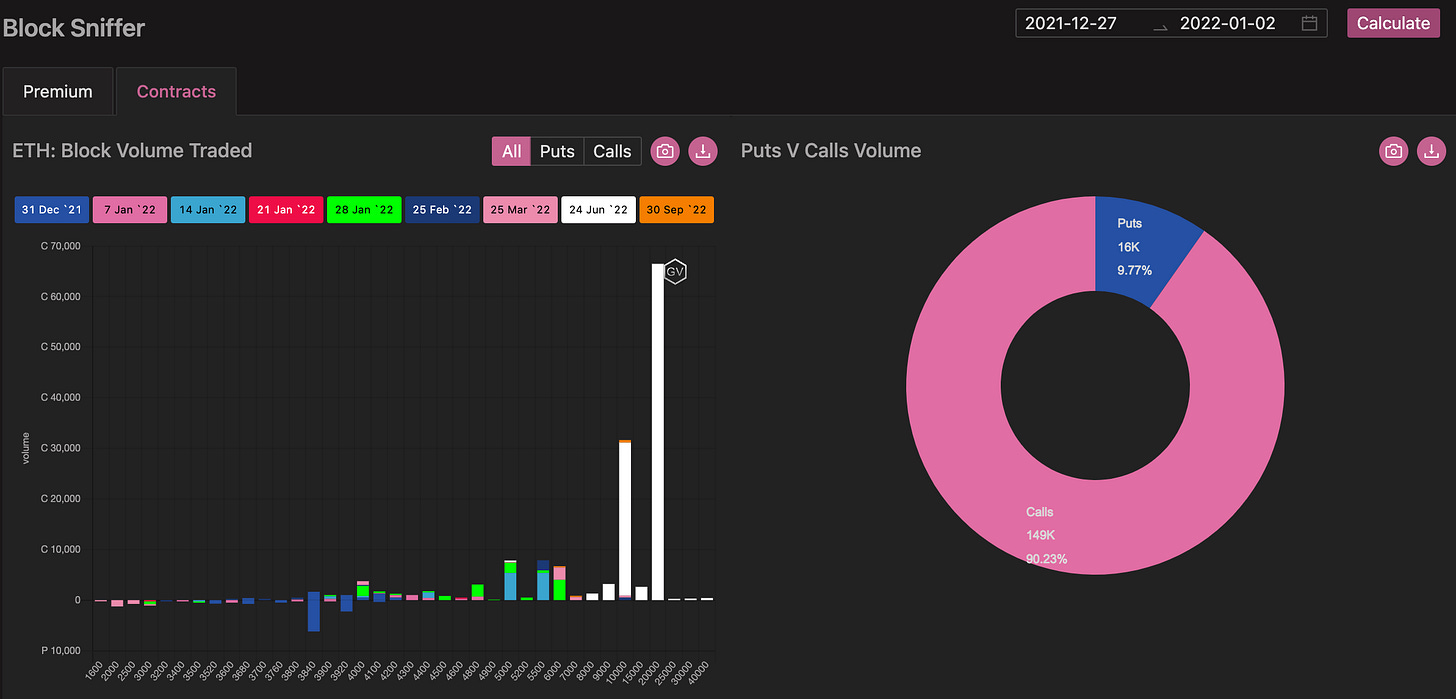

Paradigm Block Insights (27 Dec - 02 Jan)

ETH options was our outperformer on 30 Dec (Thursday) with $328m traded, representing 46.8% of exchange volume! 🔥🔥

(27 Dec - 02 Jan - Volume Profile - Deribit & Paradigm)

There was particular interest in the ETH 24Jun‘22 10k vs 20k in 1x2 call ratio spread, with a total of 30,250x traded on the 10k strike and 66,500x on the 20k strike. This drove our proportion of ETH call volume to 90%.

(27 Dec - 02 Jan - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

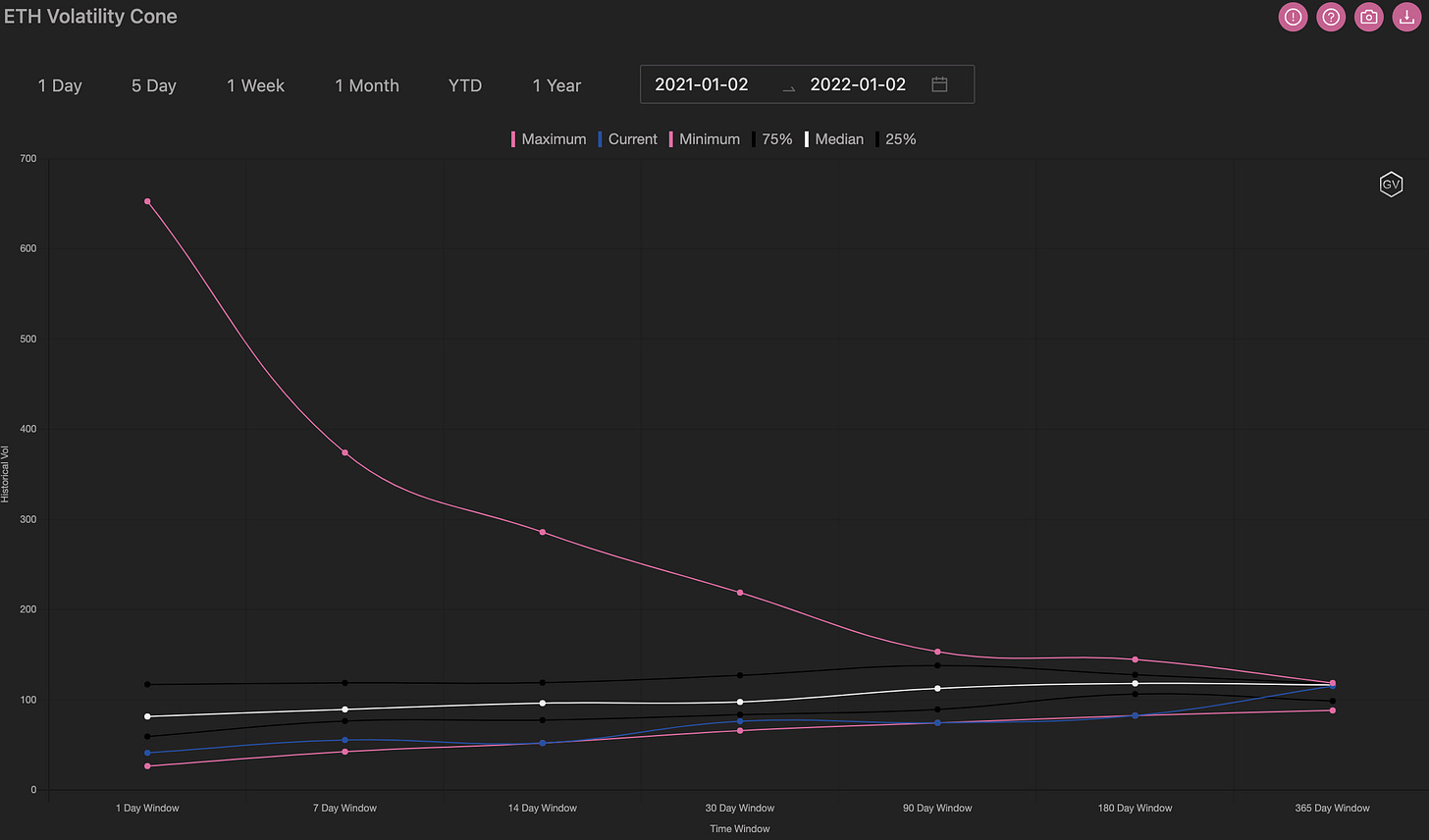

VOLATILITY CONE

(Jan. 2nd, 2022 - ETH’s Volatility Cone)

Implied volatility did not move on its own over the holiday season.

We saw realized volatility hug the lows from the year for nearly every measurement window.

Vol. sellers rejoiced as a whole lot of nothing occurred.

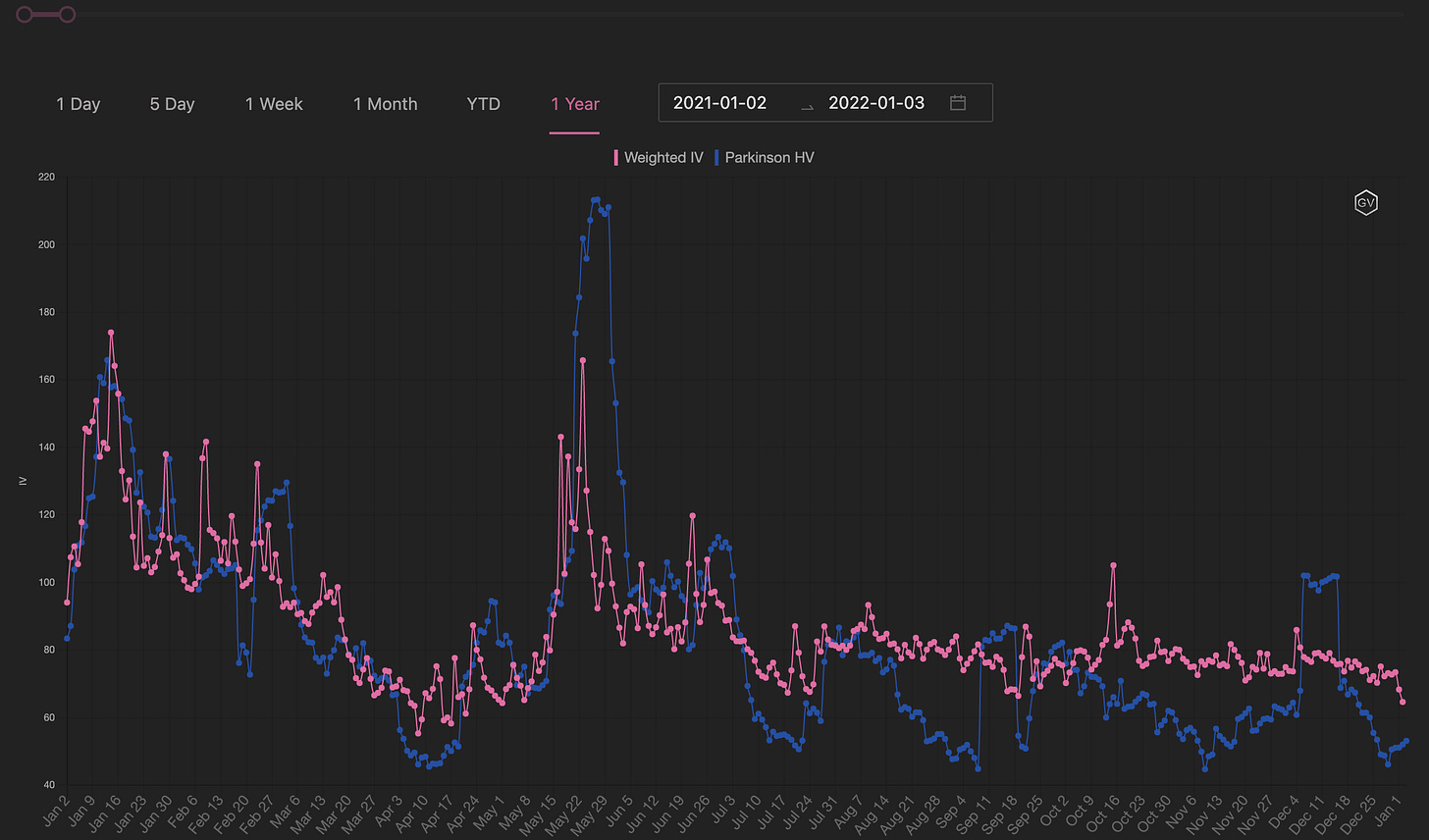

REALIZED & IMPLIED

(Jan. 2nd, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The RV vs traded ATM IV, displays the drop lower was lead by RV.

Again, the combo of positive skew and lower overall IV is providing an opportunity for decent option hedges going into an uncertain 2022 macro environment.