Crypto Options Analytics, Jan. 24th, 2021

HEADLINE THEME: "If you missed out last week, don't worry, IV can drop further"

Visit gvol.io

Disclaimer: Nothing here is trading advise or solicitation. This is for educational purposes only.

For a Chinese translation visit our partner: TokenInsight

To trade, visit our exchange partners: Deribit, Bit.com, Okex, Delta.Exchange

For best execution, with multiple counter-parties and anonymity visit: Paradigm

For Crypto Options Podcast content, check out: The Crypto Rundown

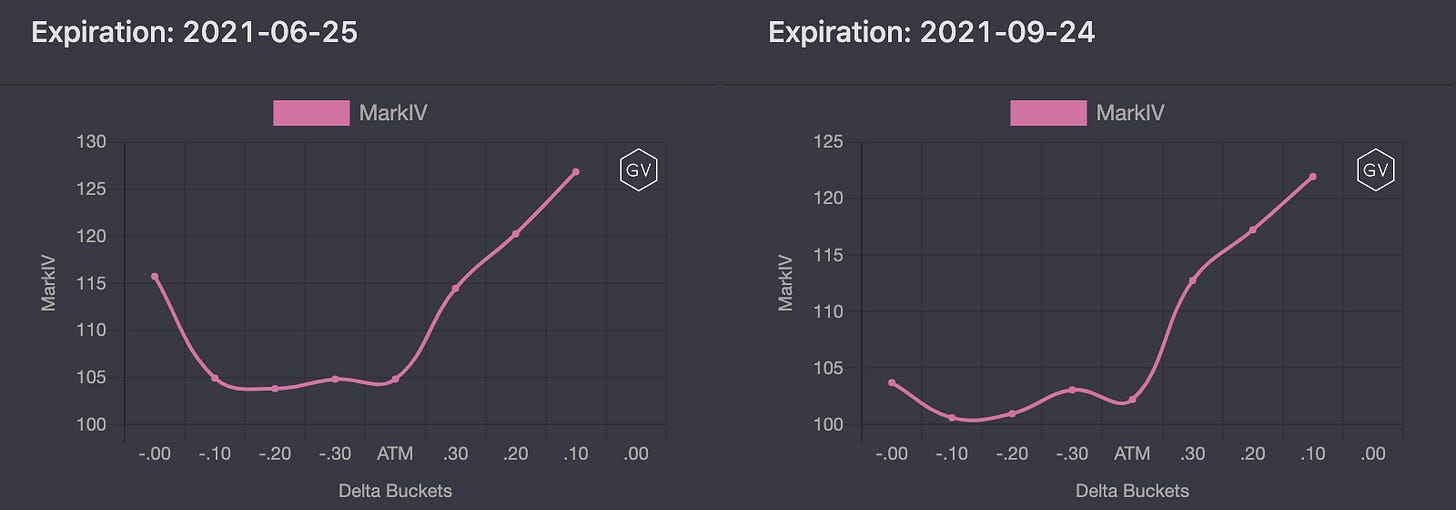

SKEWS

(Jan. 24th, 2021 - Short-term and Medium Term BTC Skews - Deribit)

Bitcoin volatility skews are now in mixed territory. We no longer have decidedly positive BTC skews for short-dated and medium term options.

This is for two reasons:

1) Bitcoin spot price collapse has increased demand for protective puts.

2) Bitcoin spot prices have broken the strong uptrend, reducing the FOMO call demand.

Longer dated options are still pricing positive skews (below), but this merely reflects the traditional crypto skew structure.

(Jan. 24th, 2021 - Long Dated BTC Skews - Deribit)

Skew trade structures are less interesting in this balanced environment.

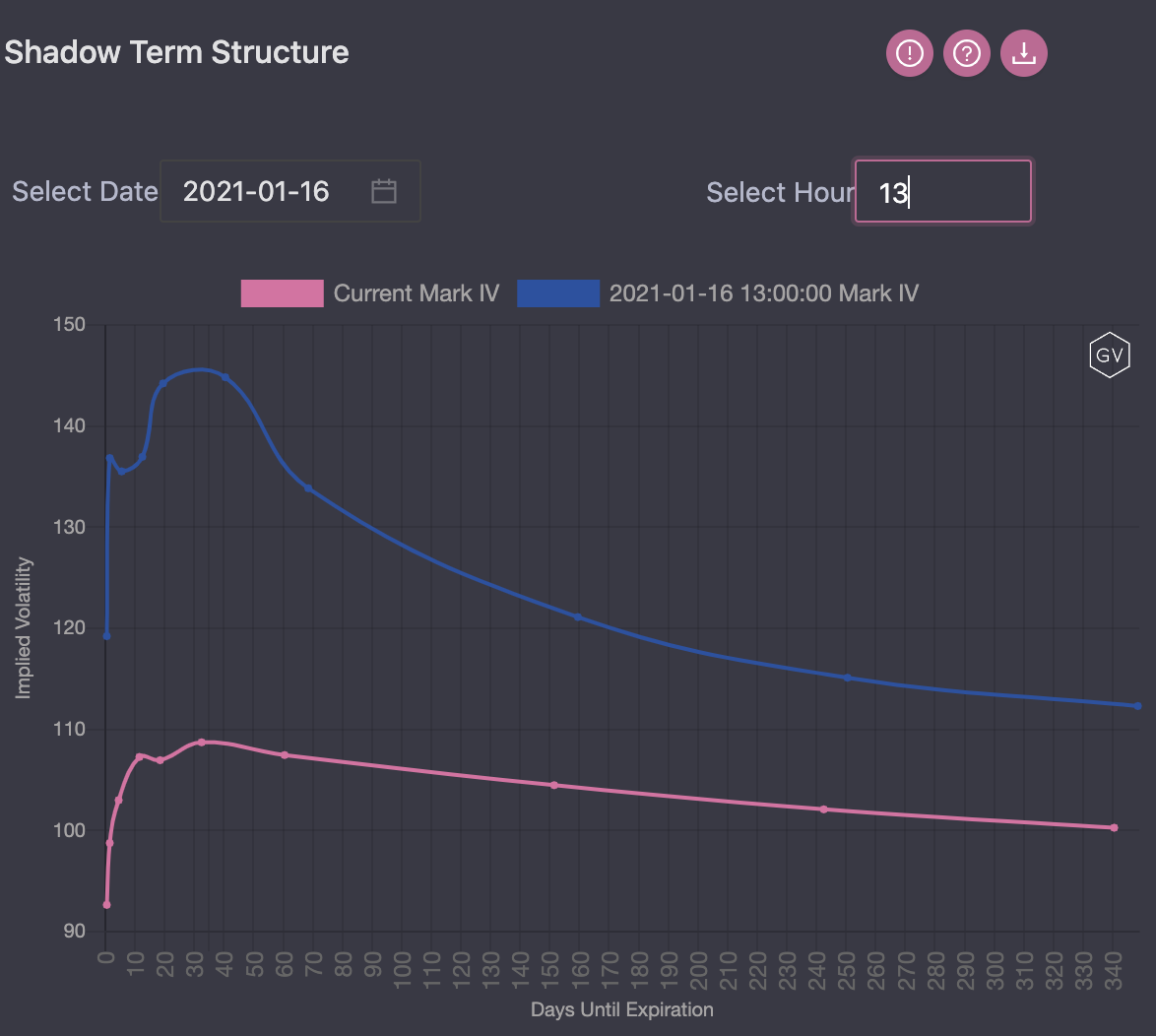

TERM STRUCTURE

(Jan. 24th, 2021 - BTC Term Structure - Deribit)

(Jan. 24th, 2021 vs Jan. 16th, 2021 - BTC “Shadow” Term Structure - Deribit)

Despite the big drop in overall implied volatility levels, the term structure continues to be Backward, yet the short-term options are in a Contango.

We believe that overall IV levels have much more room to drop lower.

We also believe the term structure will be fully Contango if we see lower IV levels.

This BTC spot price correction will likely need to consolidate and experience side-ways “price discovery” before finding a leg higher.

This is the PERFECT scenario to send vol. levels even lower.

ATM/SKEW

(Jan. 24th, 2021 - BTC ATM & Skews for options 10-60days out - Deribit)

Last week we noted that both IV and Skew levels were extremely stretched. We recommended taking advantage of the skews by using collars and risk-reversals.

Now we’ve witnessed a fantastic reversal of the skew levels seen last week.

We’ve also seen a dip in IV levels but we maintain the opinion that there is much more room to fall.

VOLUME

(Jan. 24th, 2021 - BTC Premium Traded - Deribit)

(Jan. 24th, 2021 - BTC Contracts Traded - Deribit)

Volume levels have come down significantly, both in terms of premiums traded and contracts traded.

This is congruent with our lower IV thesis.

We continue to monitor volume levels for congruency.

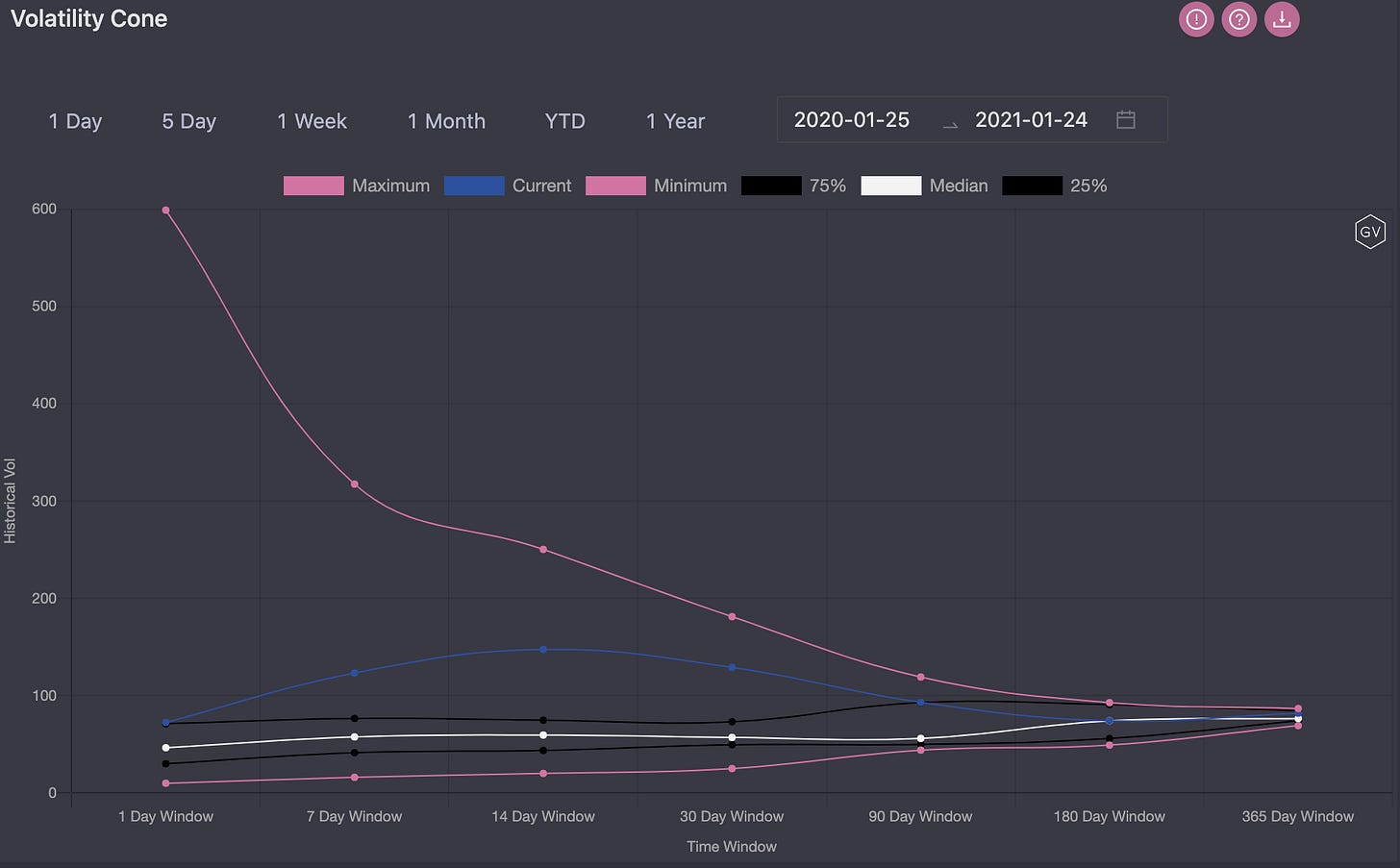

VOLATILITY CONE

(Jan. 24th, 2021 - BTC Volatility Cone)

Realized volatility has headed lower along with IV.

Although RV is indeed lower, it is very high historically speaking.

We think this volatility cone supports our thesis regarding lower volatility.

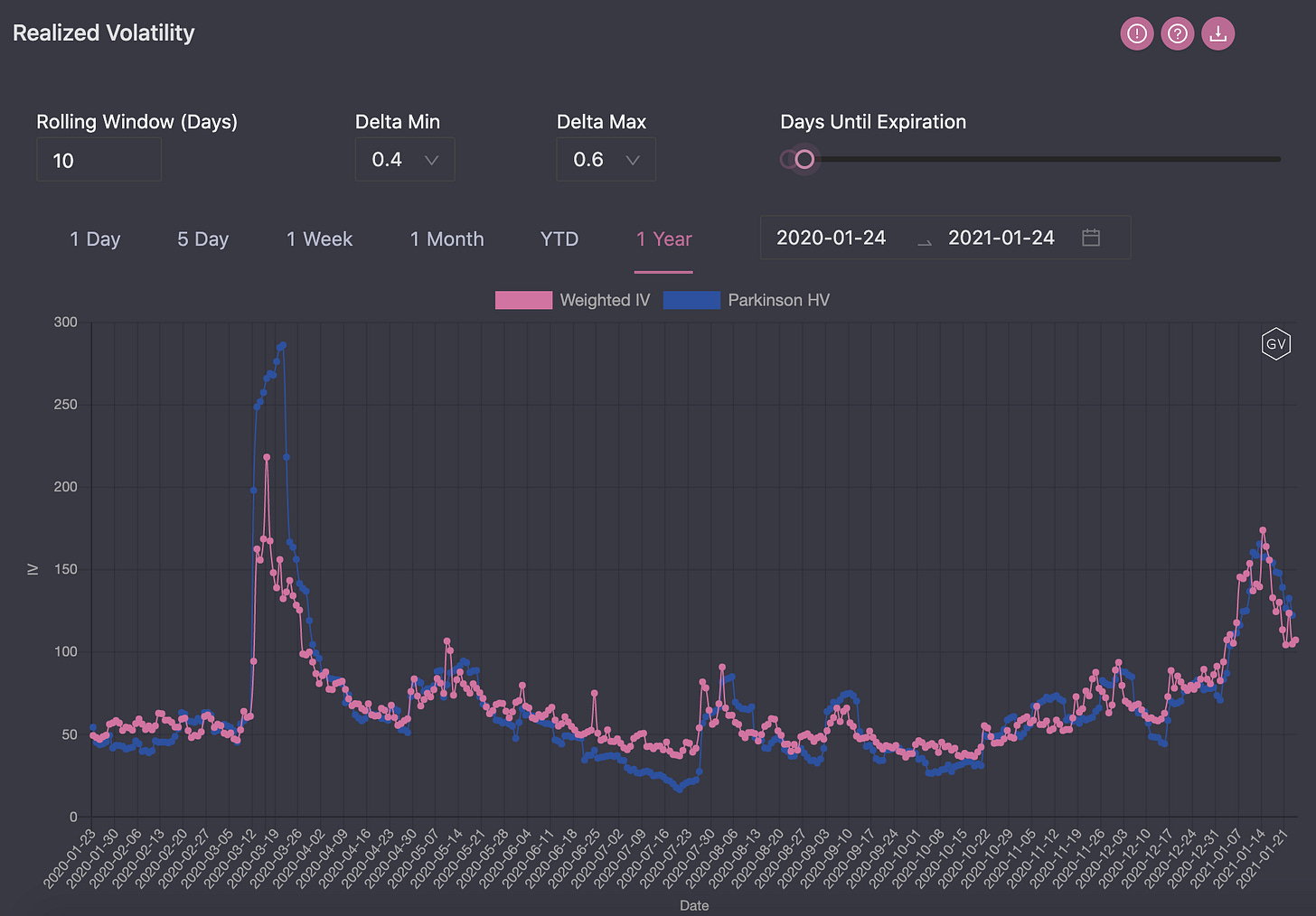

REALIZED & IMPLIED

(Jan. 24th, 2021 - BTC 10-day Realized and Trade Weighted Implied Vol - Deribit)

ATM IV (.4-.6 delta range) for options with 0-31 days until expiration displays the relationship between RV and IV.

Notice the IV (pink) is slightly discounting RV (blue). Although there is a small discount, we believe it isn’t large enough to discourage us from favoring short IV positions.

SKEWS

(Jan. 24th, 2021 - ETH Skews - Deribit)

Although ETH and BTC are two highly correlated assets, their skew profiles are currently slightly independent.

ETH skews are much more positive than the same dated BTC skews.

We believe this indicates a more resilient bullish asymmetry for ETH spot prices given the lower ETH market cap.

(Jan. 24th, 2021 - ETH Skews - Deribit)

TERM STRUCTURE

(Jan. 24th, 2021 - ETH Term Structure - Deribit)

The ETH term structure is similar to BTC, yet shifted up to reflect an overall higher IV complex.

We do think ETH IV has room to drop but we are much more cautious shorting ETH IV than BTC IV… There are still reasons for ETH’s lower market cap to “catch-up” to BTC.

ATM/SKEW

(Jan. 24th, 2021 - ETH ATM & Skews for options 10-60days out - Deribit)

Looking at the ATM implied volatility, for options with 10-60days to expiration, we witnessed a decent retracing lower last week.

Skews also dropped significantly last week.

Surprisingly, ETH spot prices have held up nicely versus last week.

Most of the action was purely in the vol. complex.

VOLUME

(Jan. 24th, 2021 - ETH Premium Traded - Deribit)

(Jan. 24th, 2021 - ETH Contracts Traded - Deribit)

Compared to BTC, ETH option volumes were a bit more firm.

We view ETH option volumes to be more balanced.

We also saw our partner, Bit.com, launch their ETH option offering. This data is now supported on gvol.io

VOLATILITY CONE

(Jan. 24th, 2021 - ETH Volatility Cone)

Current realized volatility is extremely high and nearly on the maximum.

This context bodes well for vol. sellers.

REALIZED & IMPLIED

(Jan. 24th, 2021 - ETH 10-day Realized and Trade Weighted Implied Vol - Deribit)

ETH ATM IV, .4-.6 delta range for options with 0-31 days until expiration, is now showing a slight IV discount to RV.

To reiterate, although ETH vol. levels are very high overall, we do think ETH vol. is a “Cautious” short.

We also view volatility to be positively correlated with spot prices, meaning carrying a positive delta, short vega position makes the most sense.