Crypto Options Analytics, Jan 16th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

DeFi Options

DOVs

One of the recent themes in the crypto options market is structural short volatility flow via “DOVs” (DeFi Option Vaults).

Protocols such as Friktion, Atomic.finance and Thetanuts allow crypto holders to allocate holdings to structured products that perpetually use the capital to sell covered calls and cash secured puts on Solana, Bitcoin and EVM chains respectively.

Top Trades this week include:

Frik - (135,594 X) SOL $180 1/21 Calls, sold for 1,111 SOL Premium = $20m (Notional)

Frik - (63,977 X) LUNA $94 1/21 Calls, sold for 704 LUNA Premium = $5.4m (Notional)

Frik - (16,839 X) ETH $3.8k 1/21 Calls, sold for 26 ETH Premium = $54m (Notional)

Tnuts - (7,500 X) WETH $3.8k 1/21 Calls = $24m (Notional)

$43,051

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

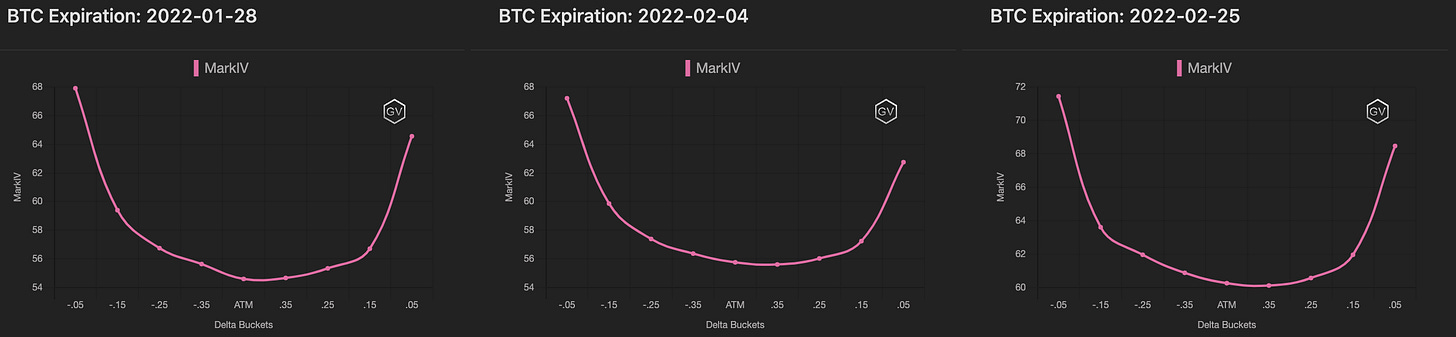

(Jan. 16th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

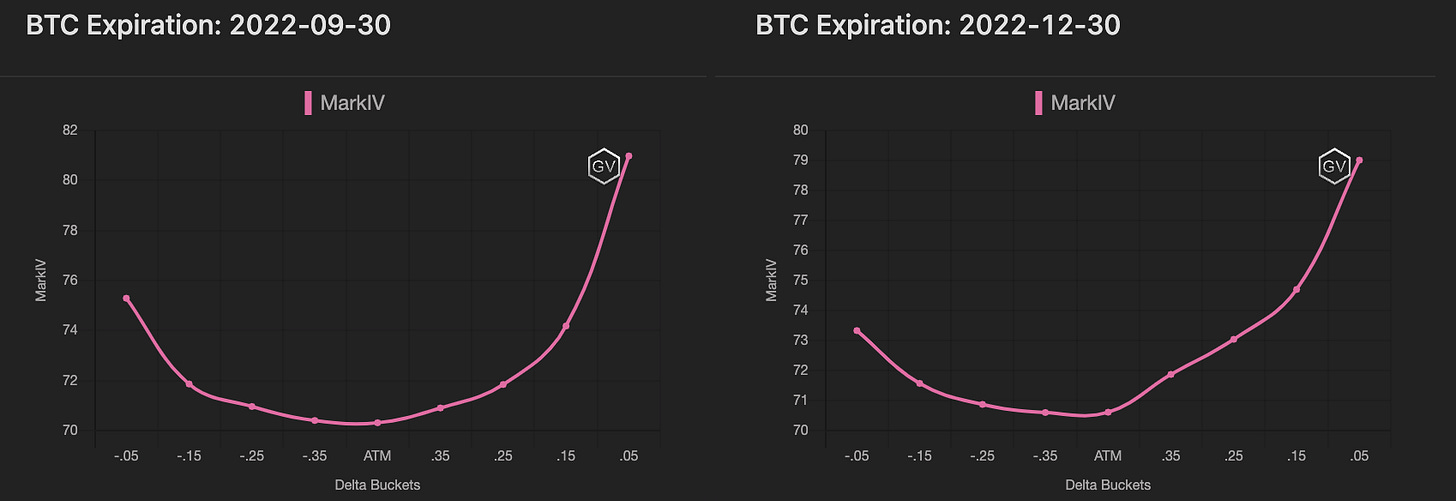

This week we saw a continuation of themes seen in our last newsletter.

First, a persistent parallel vol. selling.

Second, an option skew that mimics underlying spot prices.

The modest relief rally seen this week has enabled BTC option skew to rally +6pts for the short-term expirations and a +3pts rally for long-term options.

Without predicting spot activity, this type of skew and IV compression, once again, provides fantastic opportunity for 2022 Fed rate hike hedging.

JPM predicts +6 hikes in 2022?!?!

If that materializes to be true, risk assets would need to drop.

At the very least, this type of headwind “likely” prevents upside vol. path from exceeding downside vol. path, a layup for collars or delta-neutral skew trades.

(Jan. 16th, 2022 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Jan. 16th, 2022 - BTC’s Term Structure - Deribit)

We’re seeing an absolute decoupling of short-term options versus the rest of the expiration curve.

We’re entering a new world of structural volatility sellers from new DeFi Option Vaults (DOV).

Projects like Friktion and Thetanuts allow regular long crypto holders to become “Volatility sellers” by parking their holdings into Automated Covered Call or Cash Secured Put Selling structured products.

Most of these flows are targeted to the short-end of the expiration curve, causing a steepening in term structure.

ATM/SKEW

(Jan. 16th, 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) displays a relentless selling of option volatility with little indication of buyers willing to halt the drop.

SKEW (right) is following spot activity very closely and providing great back-&-forth trading opportunities.

Open Interest - @fb_gravitysucks

BTC

After the last spike of contracts, this weekly expiration comes back to the average with around 16k open positions.

Spot prices at delivery were mainly unchanged compared to the opening bell on Monday and outstanding premium has been balanced between calls and puts. Around 85% of options have expired worthless.

(Jan 14th , 2022 – BTC Open interest – Deribit)

(Jan 14th , 2022 – BTC Dollar premium – Deribit)

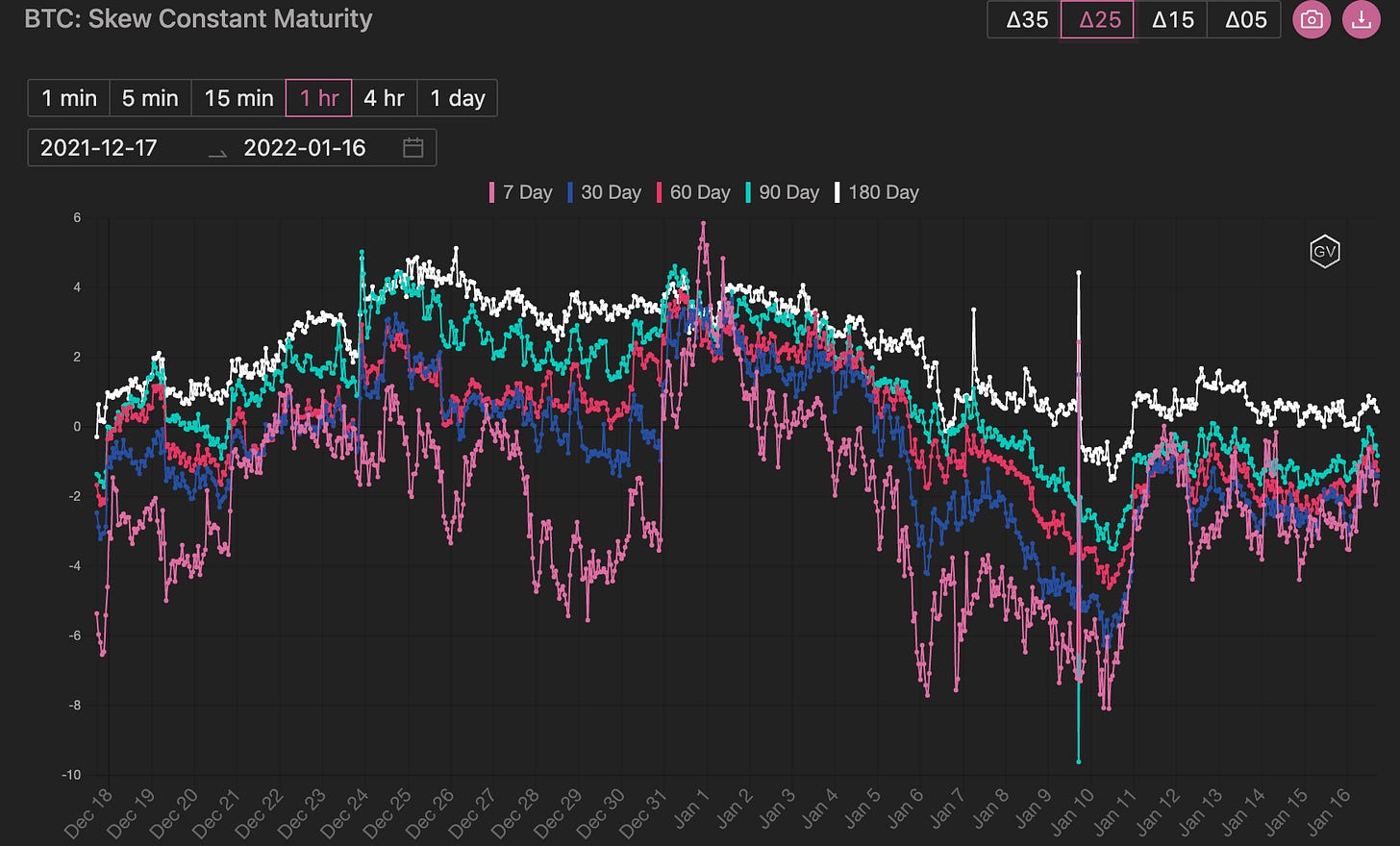

TOP TRADES:

1. Big short term call strips (43-44k-46k-48k) have been bought in advance of Powell’s speech. Buyer(s) dropped their new positions on the 12th after the rally didn’t materialize, being Theta savvy. Well played!

2. On the 12th, some sophisticated trader went short Feb strangles to long March wings. Ratio of 1-3.

The main scenario is to try to monetize violent movement (unbiased direction) in the next 2/3 weeks. Interesting Vega/Gamma profile.

3. Over $8Mil net premium paid for two separate Jun22 long call spreads. The biggest trade of the week!

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Jan. 16th, 2022 - BTC Premium Traded - Deribit)

(Jan. 16th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Jan 10 to Jan 16) - Patrick Chu

With the market continuing to consolidate off of the key 40k support, the term structures of both BTC and ETH were pushed lower & steeper as the relentless selling of vols related to hedging flows from the DOVs and the lackluster realized vols continued to hammer the front end of the curve lower.

We continued to see two-way interest, with some participants taking advantage of the low vols to put on directional topside bets, while others continued to sell vols via strangles.

(Jan 10 to Jan 16 - Volume Profile - Deribit & Paradigm)

In BTC, we saw aggressive buying of topside in the form of outrights for 28Jan 44k, 46k & 48k calls in three big clips on Jan 11th, as well as steady buying of 24Jun 40k/60k & 50k/70k call spreads.

Elsewhere, we saw strong interest to sell 30k/60k 25Mar strangles, and put calendars the 25Feb / 25Mar 30k rolls.

(Jan 10 to Jan 16 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Jan. 16th, 2022 - BTC’s Volatility Cone)

Just like IV, RV is seeing a relentless drop lower.

Nearly all measurement windows are hugging annual lows and providing justification for lower IV.

We think using this opportunity to find smart long vol. plays and hedges is a gift.

Rarely do we get to buy cheap vol. in crypto.

REALIZED & IMPLIED

(Jan. 16th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Notice that IV and RV are finally moving in tandem.

The last 6-months was characterized by a persistent IV “anchor” and wandering RV.

Today we see RV “dragging” IV lower and one of the lowest IV pricing profiles in recent history.

$3,337

DVOL: Deribit’s volatility index

(1 month, hourly)

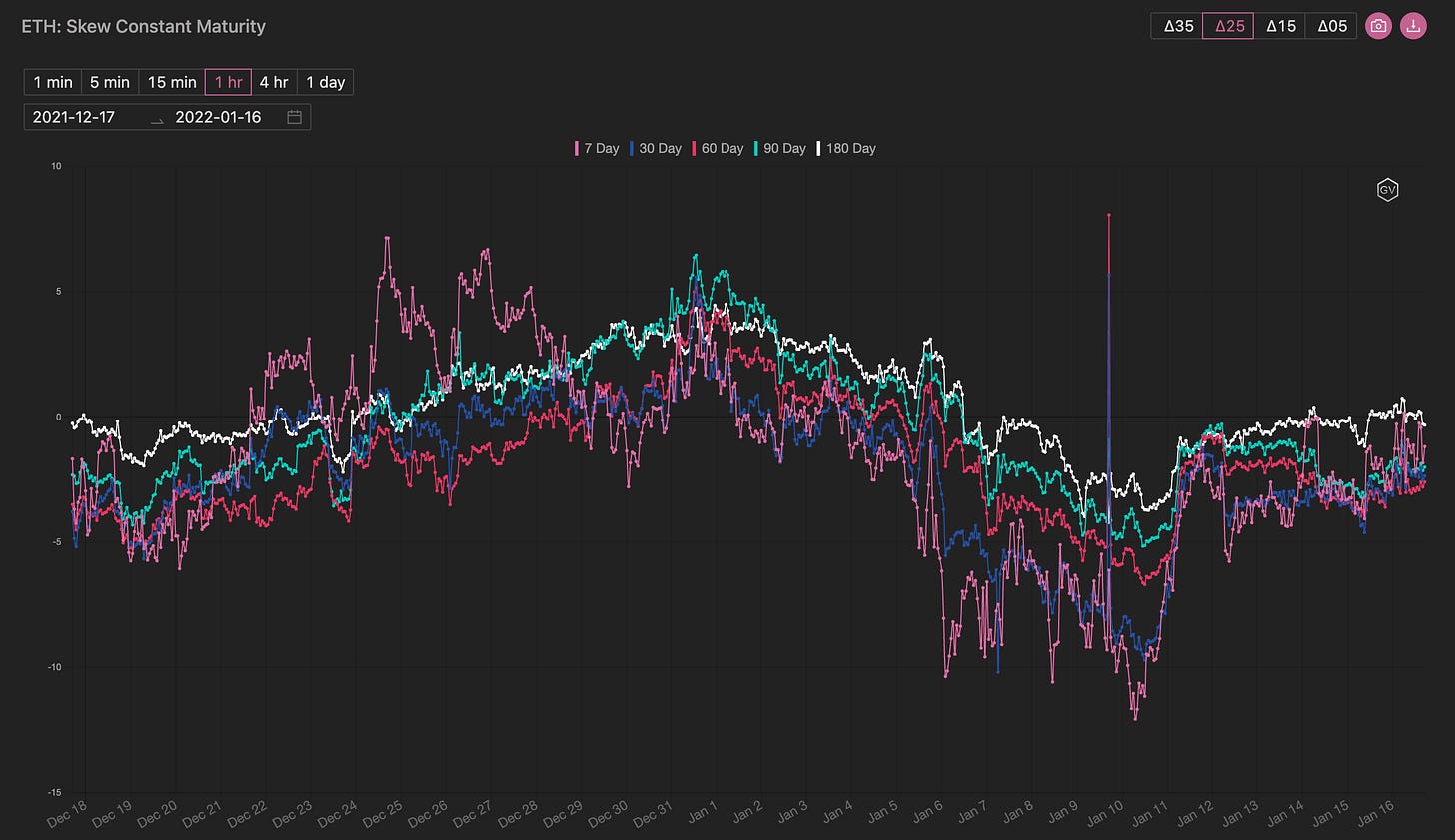

SKEWS

(Jan. 16th, 2022 - ETH’s Skews - Deribit)

Last week we noted that ETH skew seemed a little too negative given the ETH/BTC trend.

This week we’ve seen a massive rise in ETH skew as spot prices found some stability and a relief bounce.

That said, all expirations remain below par for ETH skew.

(Jan. 16th, 2022 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Jan. 16th, 2022 - ETH’s Term Structure - Deribit)

The ETH term structure is also quite steep as IV continues to drop lower.

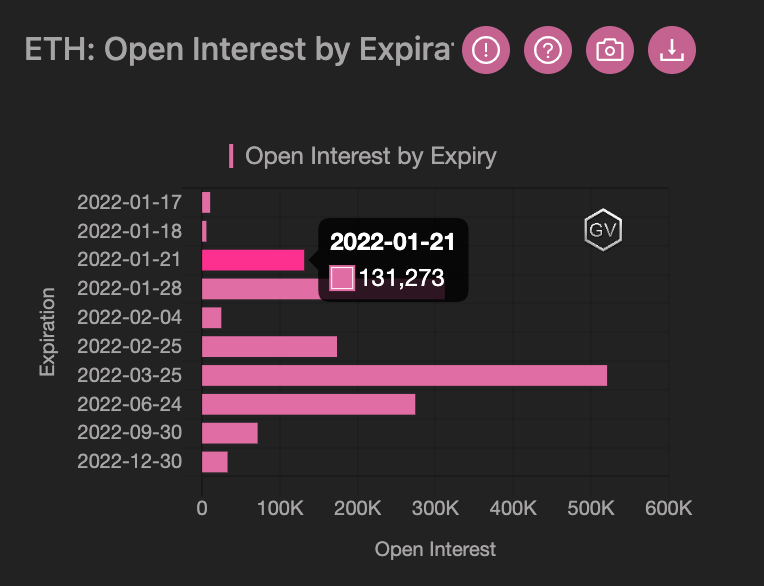

Remember we’ve noted about 25,000 contracts of weekly vol. traded on-chain Friday via DOVs… decent size considering total 1/21 OI is 131K contracts on Deribit.

We’re seeing short-term options lead implied volatility lower and massive narrowing of BTC IV versus ETH IV gap….

(BTC 30-day IV (vs) ETH 30-day IV)

(BTC 7-day IV (vs) ETH 7-day IV)

ATM/SKEW

(Jan. 16th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is showing a fast and relentless drop.

Skew (right) shows a rather large recovery in ETH skew.

Early in the week, ETH calls provided interesting opportunity as vols and skew provided cheap entry. That trade is likely still an interesting structure component for delta neutral skew trades or outright exposure.

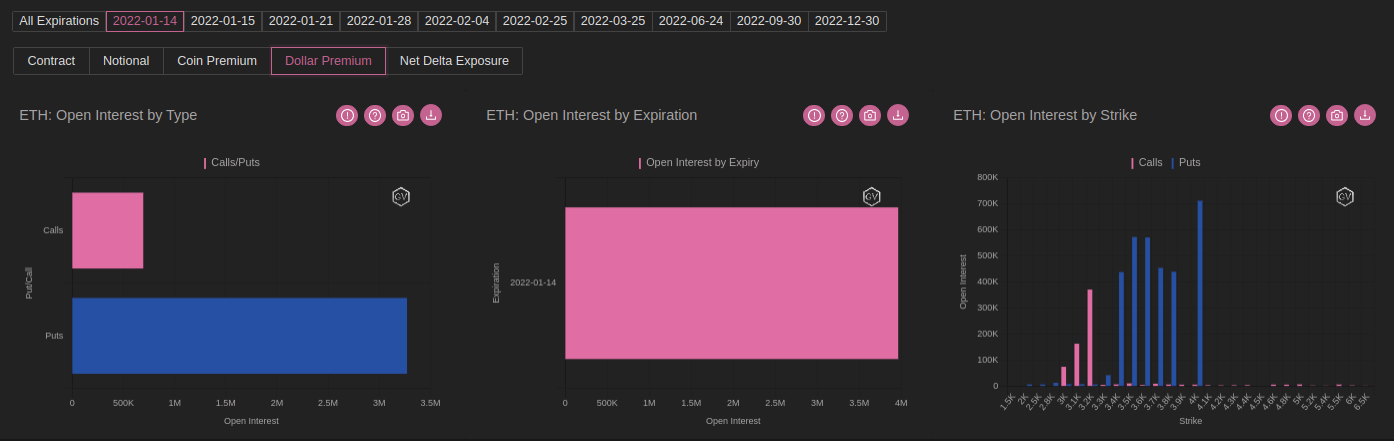

Open Interest - @fb_gravitysucks

ETH

Participants have showed a lot of interest for this weekly expiration, with almost 170k contracts going into delivery.

88% of options have expired worthless and premiums have been concentrated on the put side.

(Jan 14th , 2022 – ETH Open interest– Deribit)

(Jan 14th , 2022 – ETH Dollar premium – Deribit)

TOP TRADES:

An internal account transfer of big funds alarmed options-flow-readers with bullish delusion. Puts sold not taken in consideration.

The volume has been subdued all week for Ethereum. Continuation of little interest for big speculative trades.

Interesting to mention: the copycat of short Feb strangle long March wings we’ve seen in Bitcoin.

The 1 x 3 ratio also maintained.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

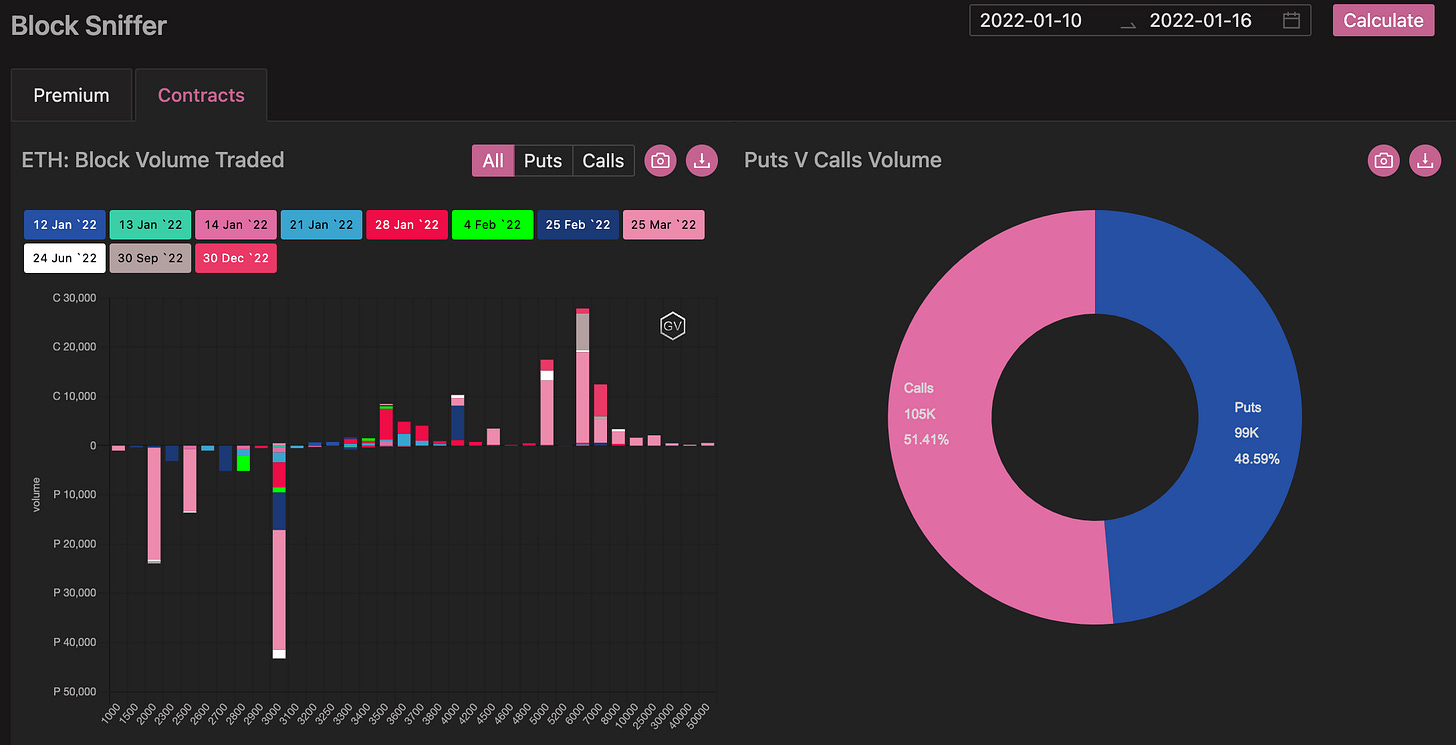

VOLUME

(Jan. 16th, 2022 - ETH’s Premium Traded - Deribit)

(Jan. 16th, 2022 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

Paradigm Block Insights (Jan 10 to Jan 16) - Patrick Chu

In ETH, we saw strong interest for selling downside protection, in particular on the 25Mar 2000 & 2500 & 3000 strikes.

We also saw good interest on the 25Mar 2000/6000 strangles and an interesting 1/1.5x/1 structure for 25Mar 5000C/30Sep 6000C/30Dec 7000C.

(Jan 10 to Jan 16 - Volume Profile - Deribit & Paradigm)

(Jan 10 to Jan 16 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

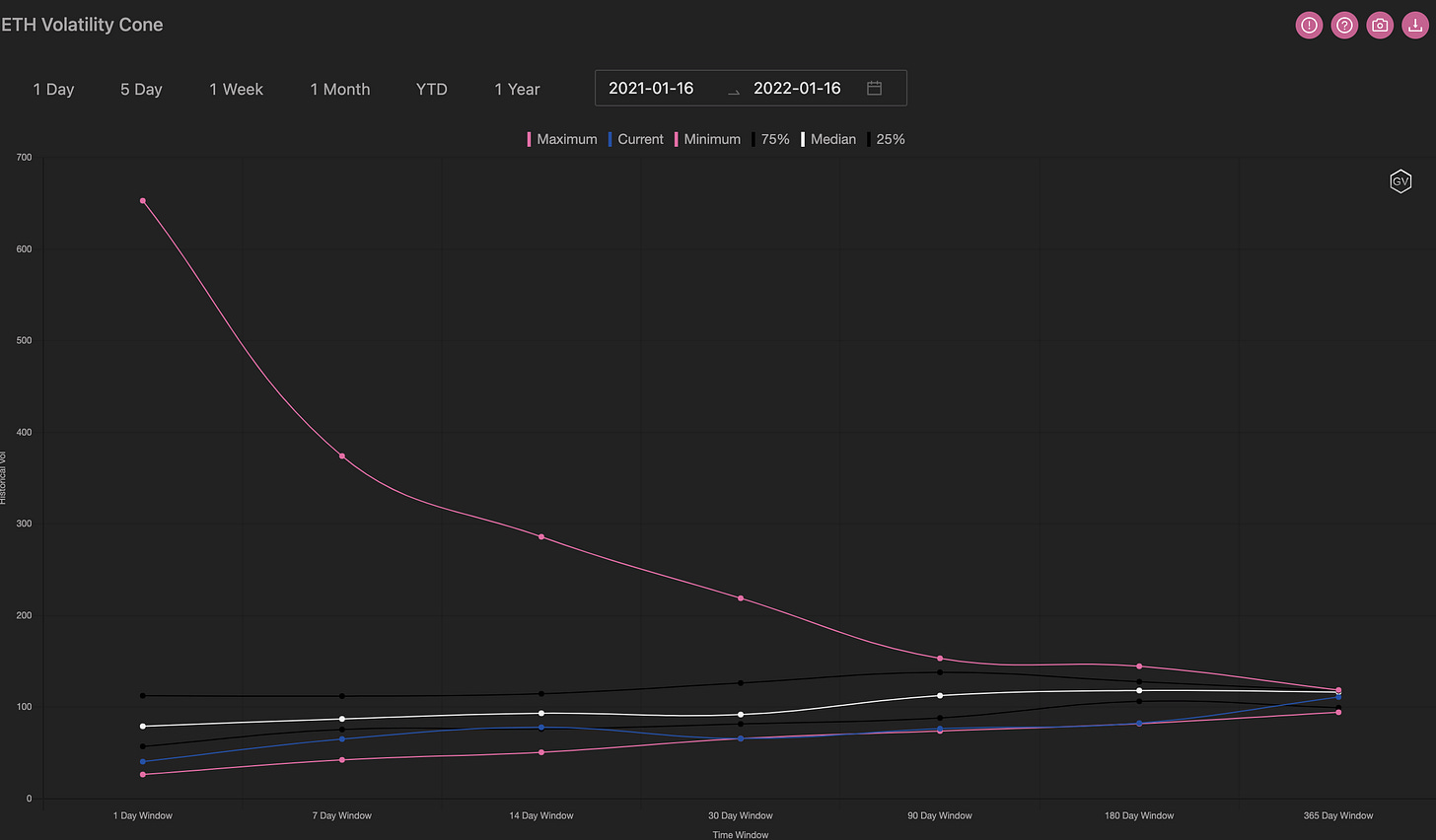

VOLATILITY CONE

(Jan. 16th, 2022 - ETH’s Volatility Cone)

ETH RV is low but remains higher on the volatility cone versus BTC.

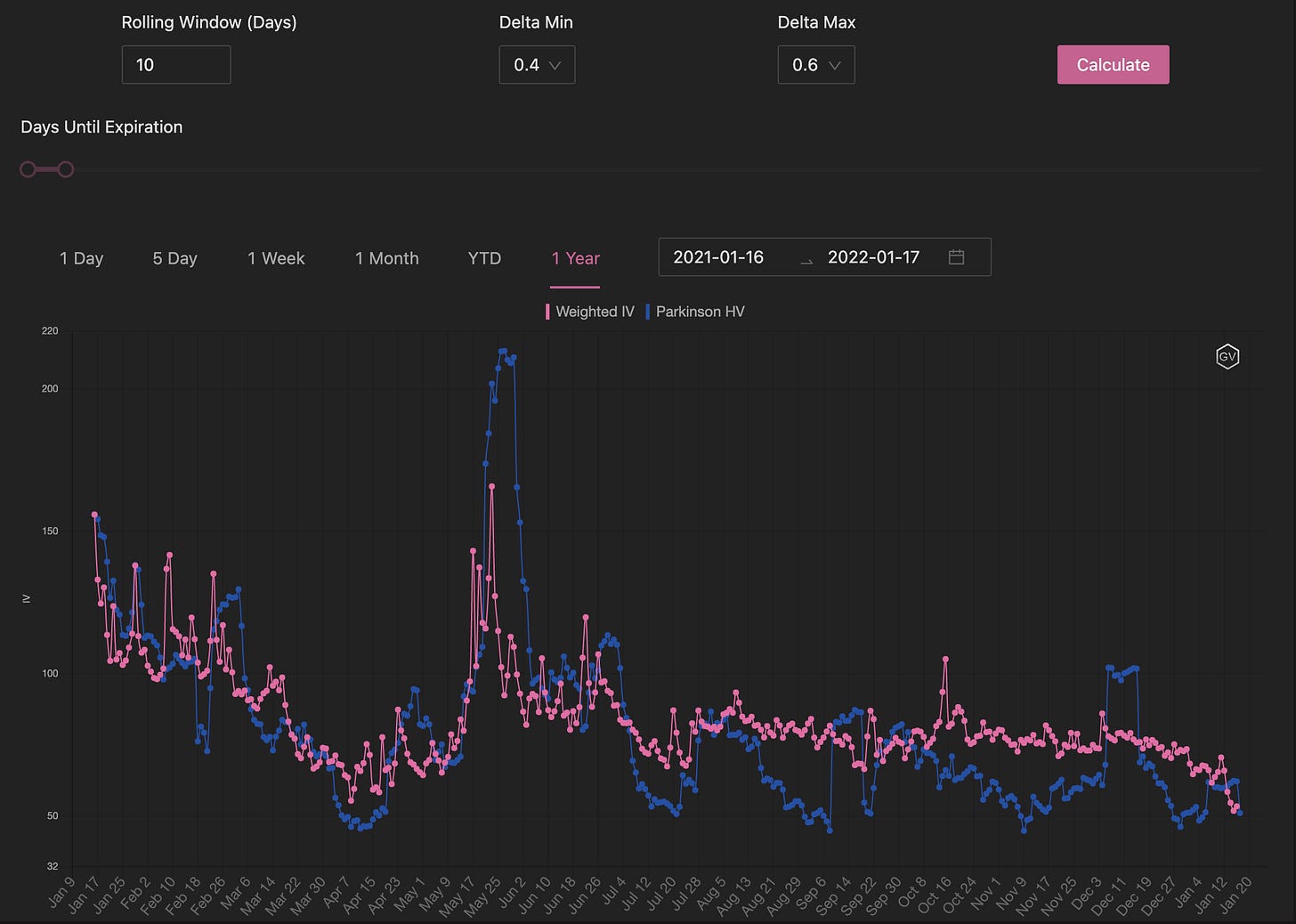

REALIZED & IMPLIED

(Jan. 16th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

We’re actually seeing RV above IV.

This is an interesting context given that ETH IV is dropping faster than BTC IV (narrowing IV gap) and ETH skew is more bearish than BTC skew.

There’s good vol. plays lining up!