Crypto Options Analytics, Jan. 16th, 2021

HEADLINE THEME: "Short IV, until spot price makes new highs"

Visit gvol.io

Disclaimer: Nothing here is trading advise or solicitation. This is for educational purposes only.

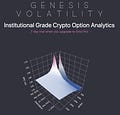

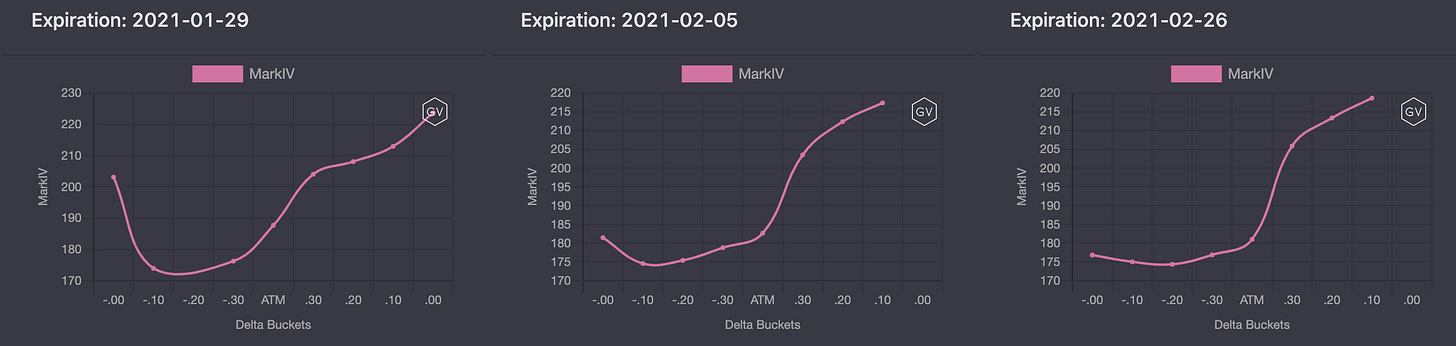

SKEWS

(Jan. 16th, 2021 - Short-term and Medium Term BTC Skews)

Bitcoin volatility skews are showing positive profiles once again. After the recent spot price correction, traders are anticipating more volatility to be seen on the upside moves.

Short-term and medium term option expirations are now fully positively skewed (above) while longer dated options are pricing in extreme upside skews (below).

(Jan. 16th, 2021 - Long Dated BTC Skews)

Risk-reversals and collar positions are ideal trade structures to capture edge with respect to skews.

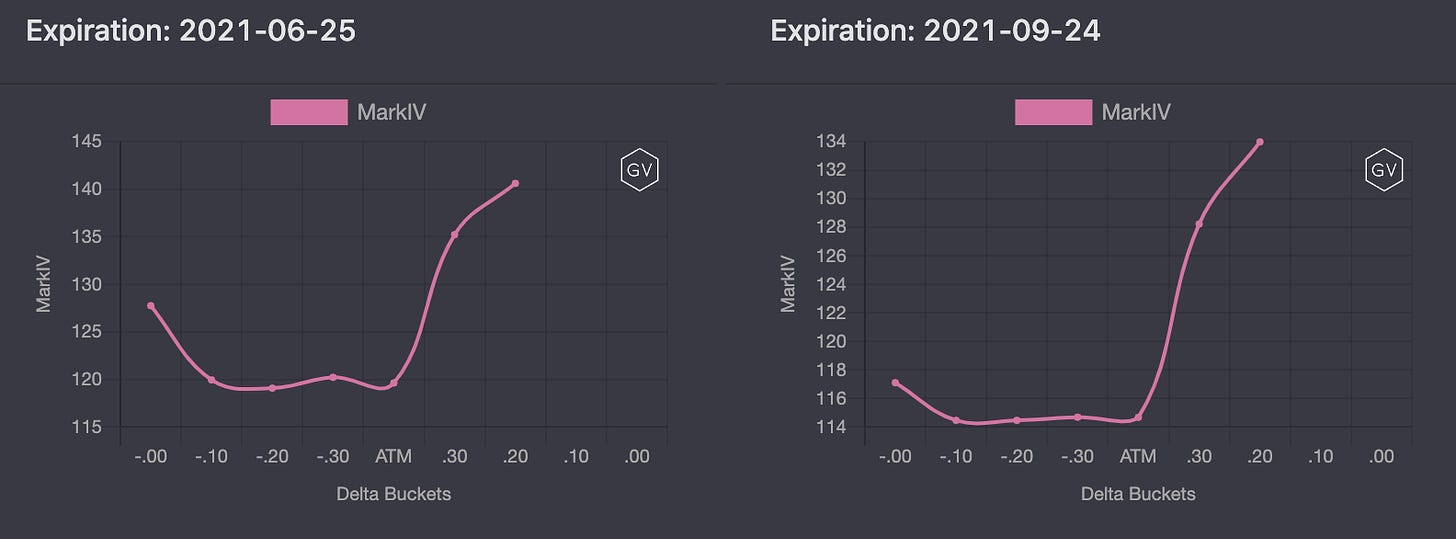

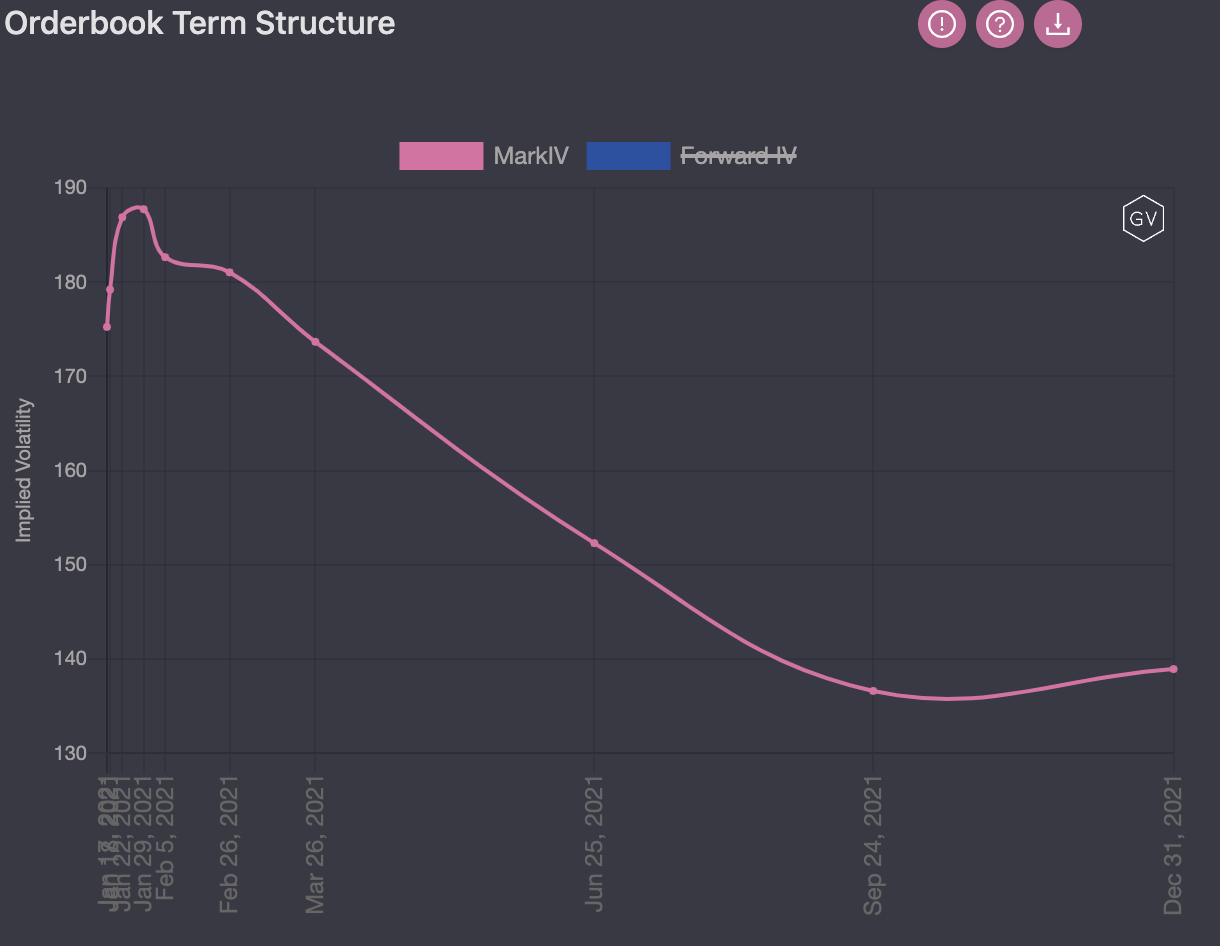

TERM STRUCTURE

(Jan. 16th, 2021 - BTC Term Structure)

The term structure continues to display Backwardation, yet the short-term options are in a Contango.

Overall implied volatility levels are some of the highest seen since the inception of BTC options.

Even one year options are pricing 110+ IV, realized volatility has rarely seen these levels.

ATM/SKEW

(Jan. 16th, 2021 - BTC ATM & Skews for options 10-60days out)

Looking at the ATM implied volatility, for options with 10-60days to expiration, we can see the high ATM IV has been able to hold.

The skew profile is extremely high here as well. This is one of the most extended skew profiles in recent memory.

There is FOMO in this market. Whether that FOMO is justified remains to be seen.

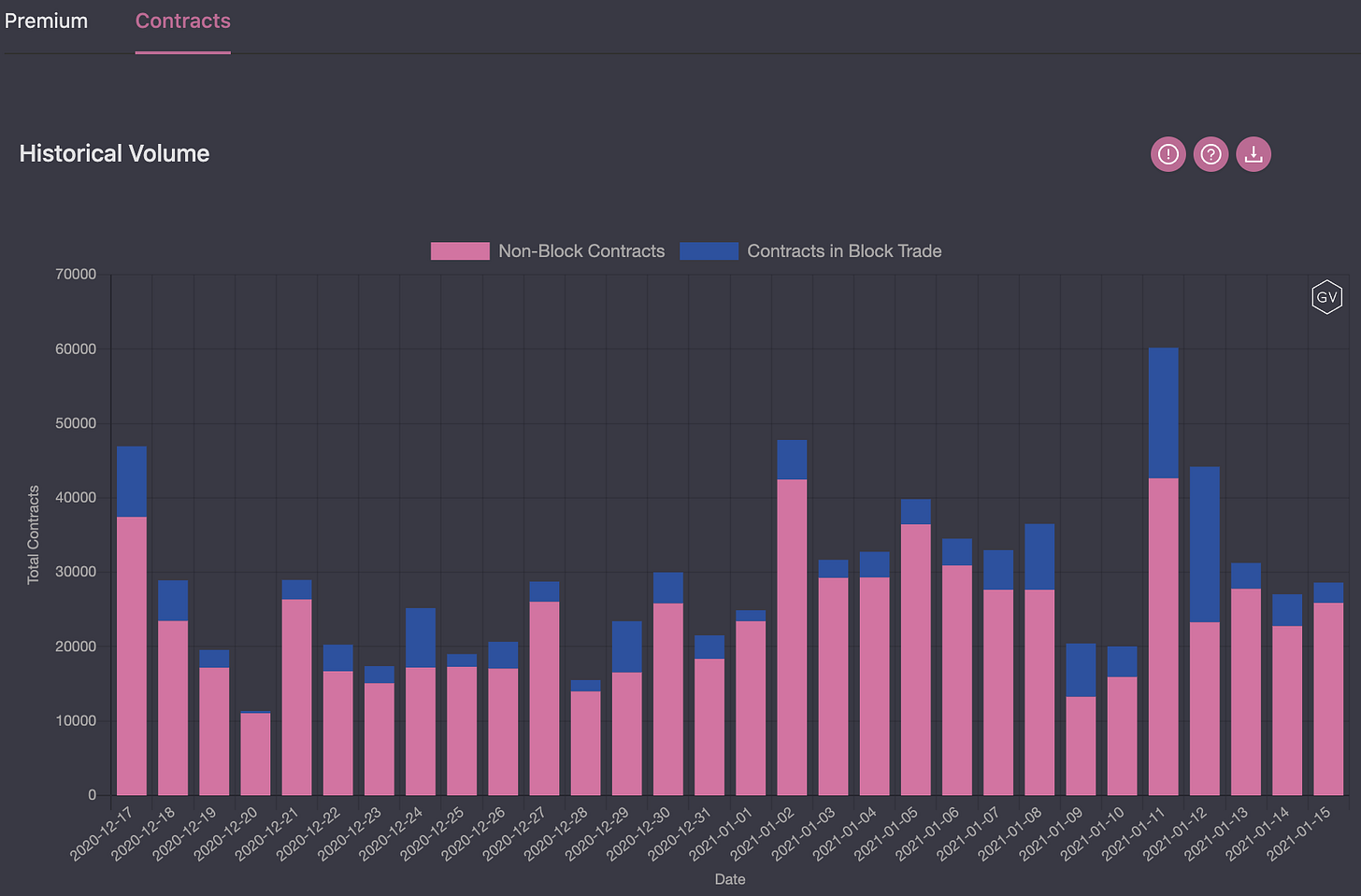

VOLUME

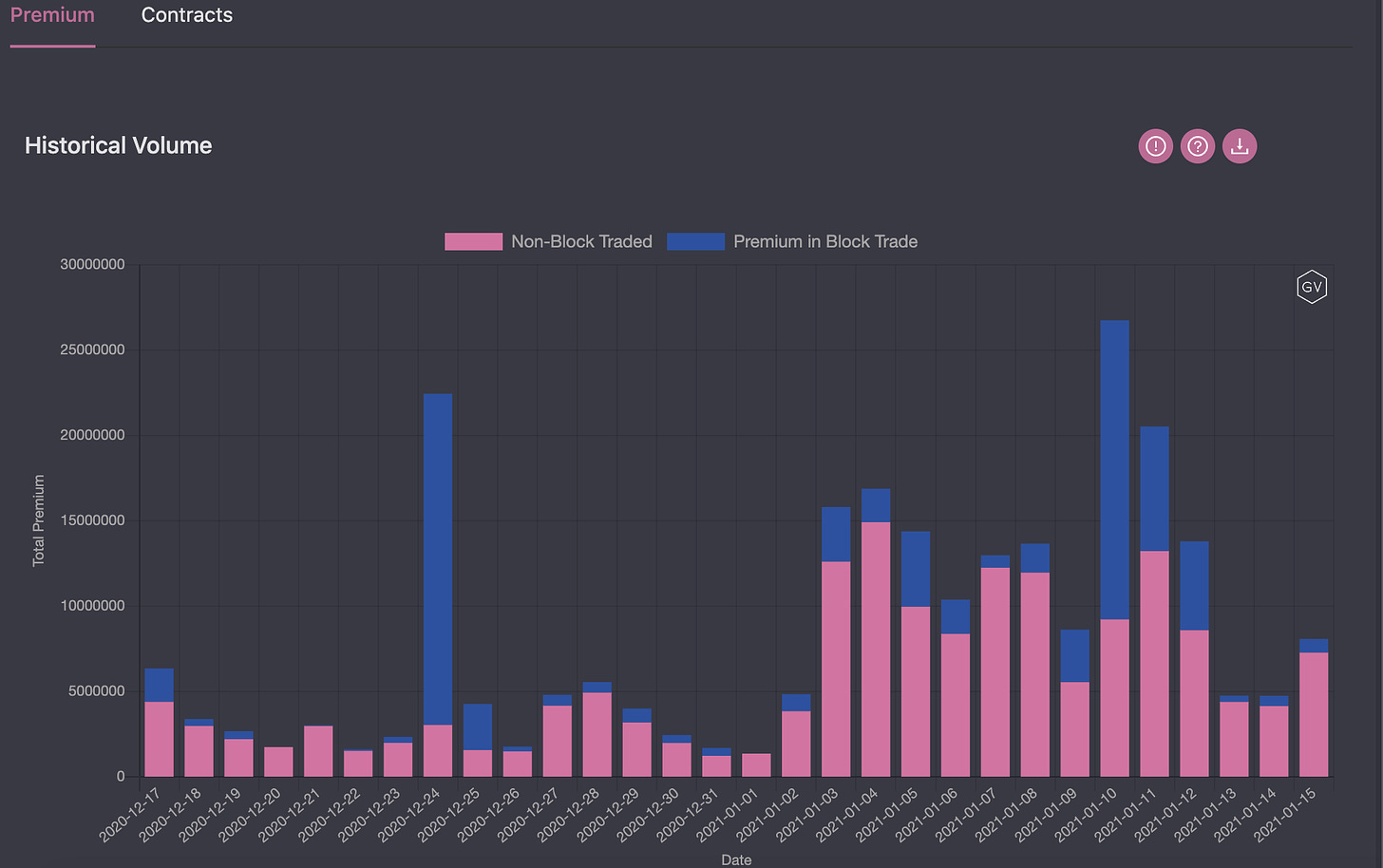

(Jan. 16th, 2021 - BTC Premium Traded)

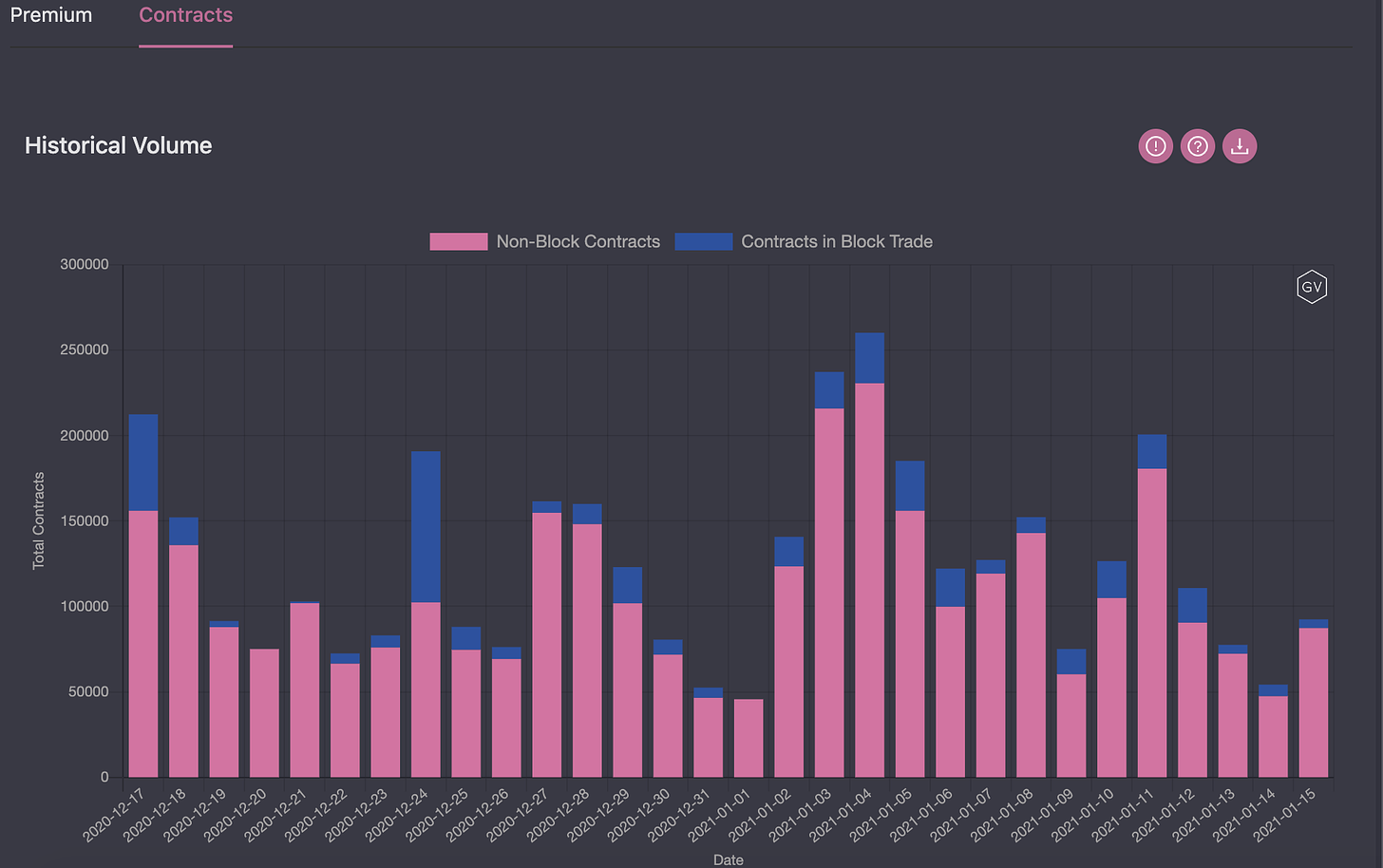

(Jan. 16th, 2021 - BTC Contracts Traded)

Volume levels are still very high, but they are subdued compared to last week.

Seeing volume activity “slightly relax” is congruent with lower realized volatility in the spot market.

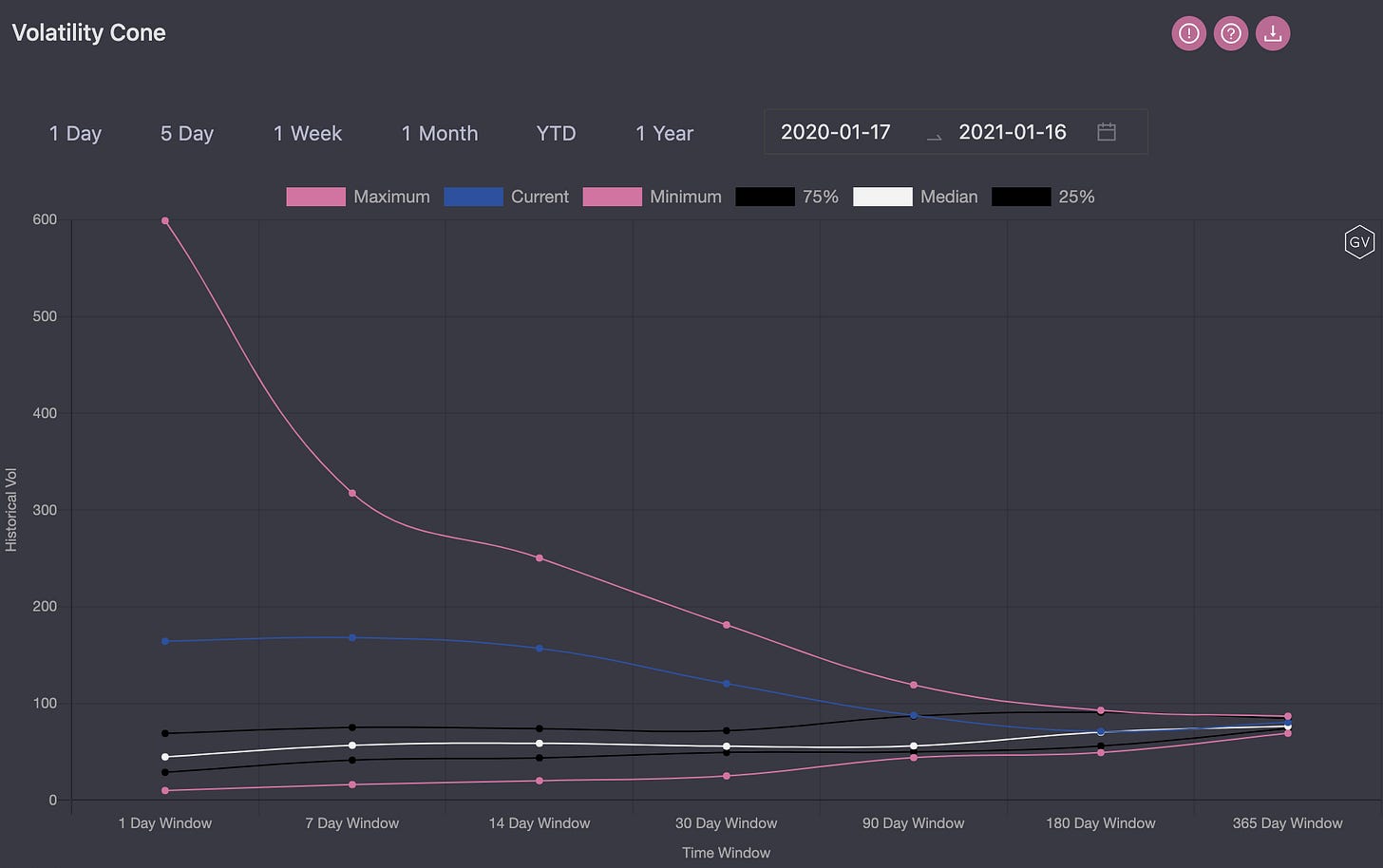

VOLATILITY CONE

(Jan. 16th, 2021 - BTC Volatility Cone)

Realized volatility continues to exceed the 75th percentile for most rolling windows.

We can see that RV is likely bounded… If history is a guide forward, there isn’t much vol “pain” left if sellers are wrong here.

REALIZED & IMPLIED

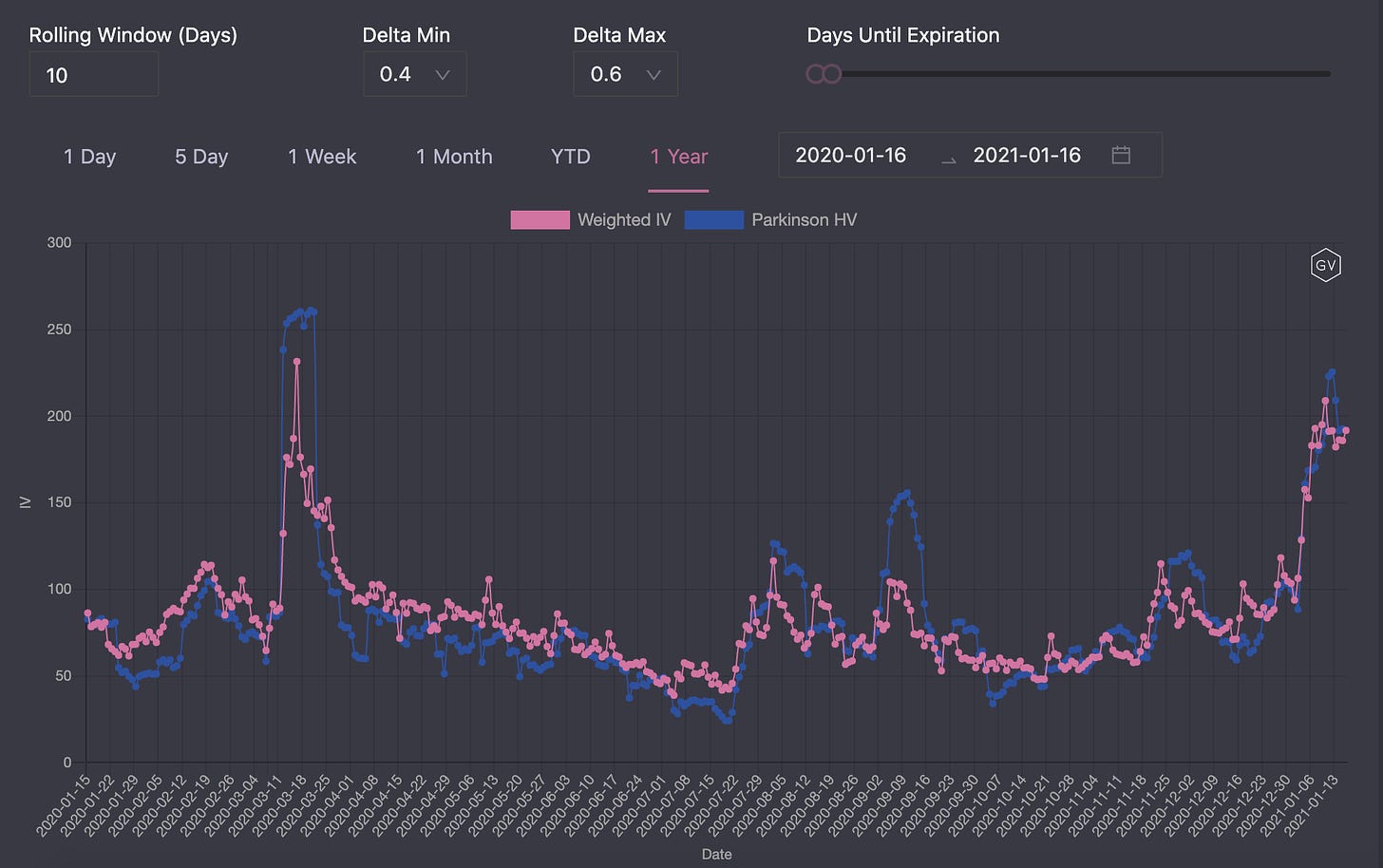

(Jan. 16th, 2021 - BTC 10-day Realized and Trade Weighted Implied Vol)

ATM IV (.4-.6 delta range) for options with 0-31 days until expiration hasn’t discounted RV yet. They are both tightly bound despite the very high RV levels which are likely to mean revert lower into the future.

SKEWS

(Jan. 16th, 2021 - ETH Skews)

ETH volatility skews are showing classic profiles. All options remain positively skewed.

Option traders are willing to pay up much more for ETH upside option exposure than they are for downside exposure.

ETH holders are also unwilling to sell covered calls… There is a lack of call seller supply.

The positive skew is even higher in ETH than it is in BTC.

(Jan. 16th, 2021 - ETH Skews)

TERM STRUCTURE

(Jan. 16th, 2021 - ETH Term Structure)

The term structure continues to display backwardation.

Overall, ETH IV levels are higher than BTC.

We do believe there is more upside “Risk” in ETH spot price than BTC spot for two reasons:

1) The ETH market cap. is much smaller than the BTC market cap., meaning less money is needed to move the spot price.

2) The ETH/BTC ratio has been depressed compared to 2017. With CME’s new ETH futures product, an institutional avenue is now opening up… This is a catalyst for fresh money flow into ETH potentially increasing the ETH/BTC ratio.

That being said, ETH IV is already accounting for a lot of this.

ATM/SKEW

(Jan. 16th, 2021 - ETH ATM & Skews for options 10-60days out)

Looking at the ATM implied volatility, for options with 10-60days to expiration, we can see that IV levels have held their highs.

ETH skew remains more elevated. There are “price bullish” option structures traders can use to capture skew edge while maintaining an upward price bias.

Long call butterflies make sense for that bias.

VOLUME

(Jan. 16th, 2021 - ETH Premium Traded)

(Jan. 16th, 2021 - ETH Contracts Traded)

Like BTC, ETH volume has subdued.

This volume activity does suggest that ETH IV is very high here and will likely revert lower.

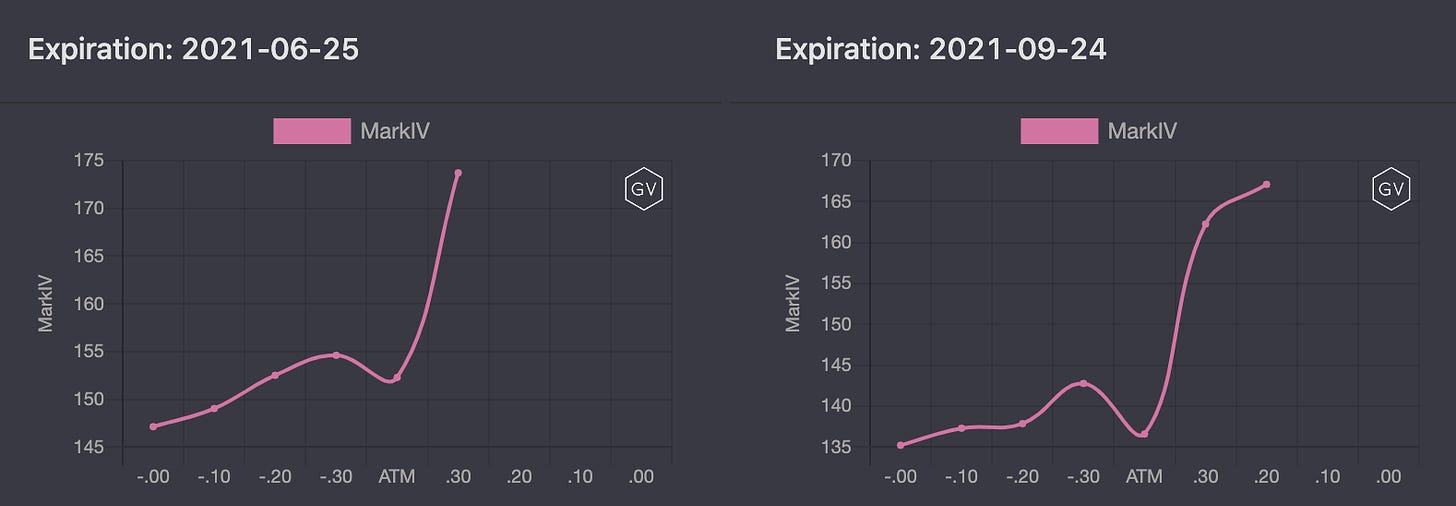

VOLATILITY CONE

(Jan. 16th, 2021 - ETH Volatility Cone)

Current realized volatility is extremely high and nearly on the maximum.

This context bodes well for vol. sellers.

Again, new spot price highs would be a good “Stop”.

REALIZED & IMPLIED

(Jan. 16th, 2021 - ETH 10-day Realized and Trade Weighted Implied Vol)

ETH ATM IV, .4-.6 delta range for options with 0-31 days until expiration, is now showing a slight IV discount to RV.

This is consistent with mean reversion beginning to be priced in.