Crypto Options Analytics, Jan. 12th, 2021

Visit gvol.io to view options analytics and signup for gvol-pro!

SKEWS

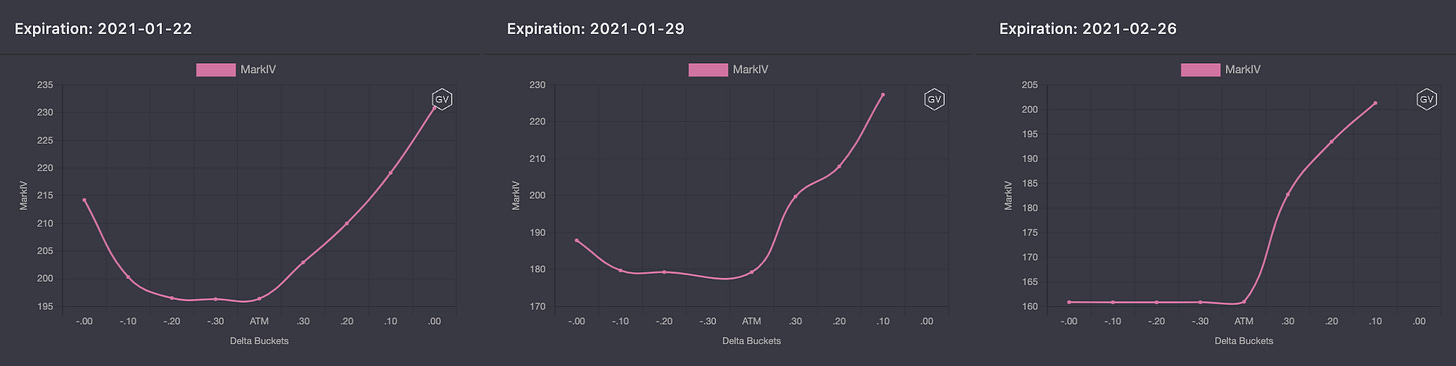

(Jan. 12th, 2021 - BTC Skews)

Bitcoin volatility skews are showing positive profiles but have changed drastically from 3 days ago.

Short-term and medium term option expirations are now fully positively skewed but on Jan. 9th, 2021 (pictured below) the options in the tails buckets (.10 and .00) were extremely skewed to the put side.

(Jan. 9th, 2021 - BTC Skews)

Traders were positioning for a sharp pull-back. Now that the pull-back has occurred, the tail risk protective puts are being unwound.

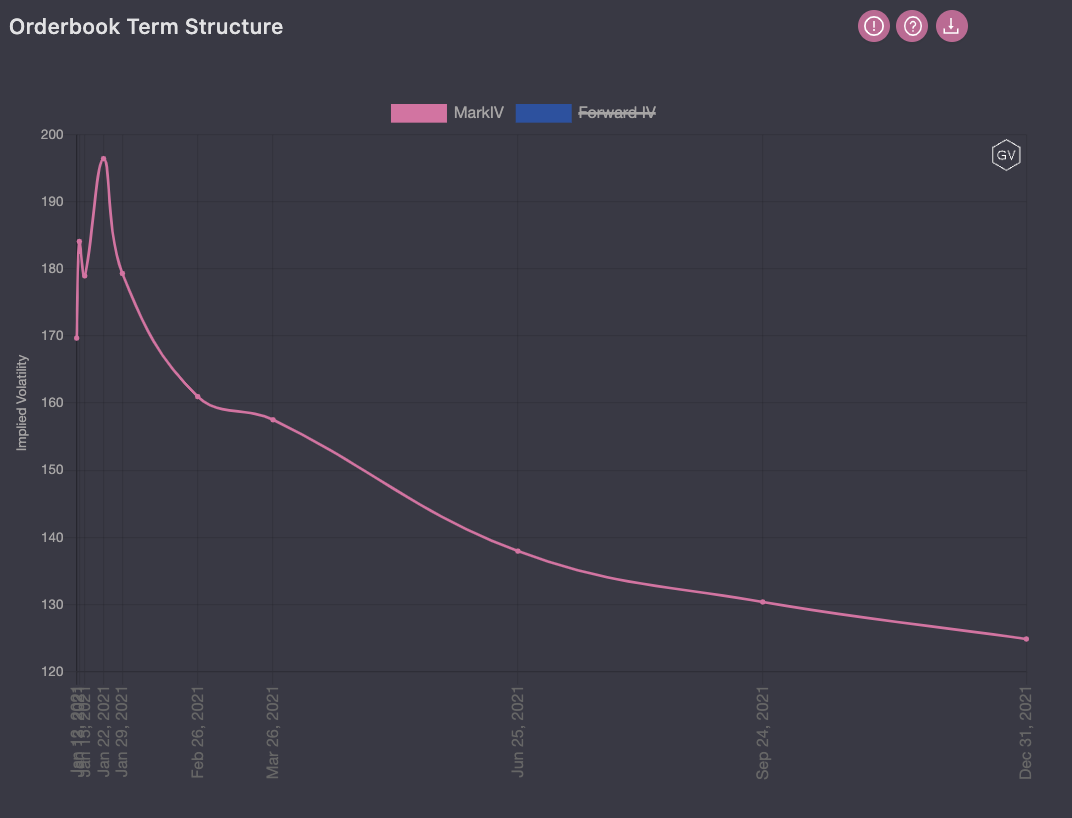

TERM STRUCTURE

(Jan. 12th, 2021 - BTC Term Structure)

The term structure continues to display backwardation.

This reflects that the high volatility environment is expected to be subdued in the future.

Despite the backwardation, long dated options still reflect very high implied volatility levels.

ATM/SKEW

(Jan. 12th, 2021 - BTC ATM & Skews for options 10-60days out)

Looking at the ATM implied volatility, for options with 10-60days to expiration, we can see the relentless move higher.

The skew profile is no longer as steady. In the past few newsletters we’ve noted that skew moved higher along with BTC spot price and ATM IV, we are now seeing skew break this correlation.

This break in skew correlations reflects the increased put appetite that traders using to hedge a potentially sharp spot price correction.

Now that the price pull-back has occurred, skew is seen rallying.

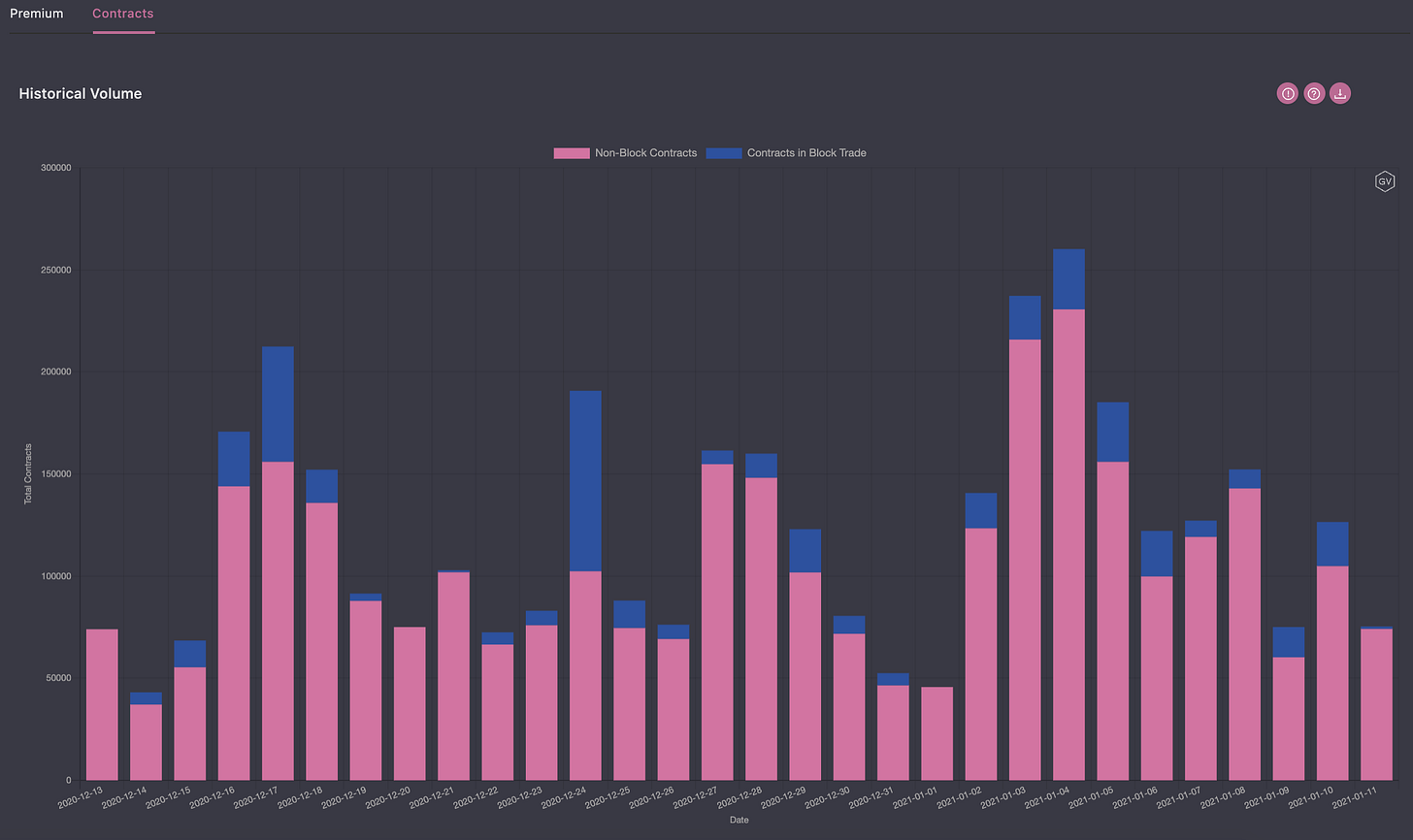

VOLUME

(Jan. 12th, 2021 - BTC Premium Traded)

(Jan. 12th, 2021 - BTC Contracts Traded)

Although volume in terms of contracts traded seems to have been holding steady, volume in terms of premium traded (not notional) tells us that more dollars continues to pour into BTC options.

Block trades on Paradigm have been an exceptional large part of the story. This appetite for options from professional firms continues to be encouraging.

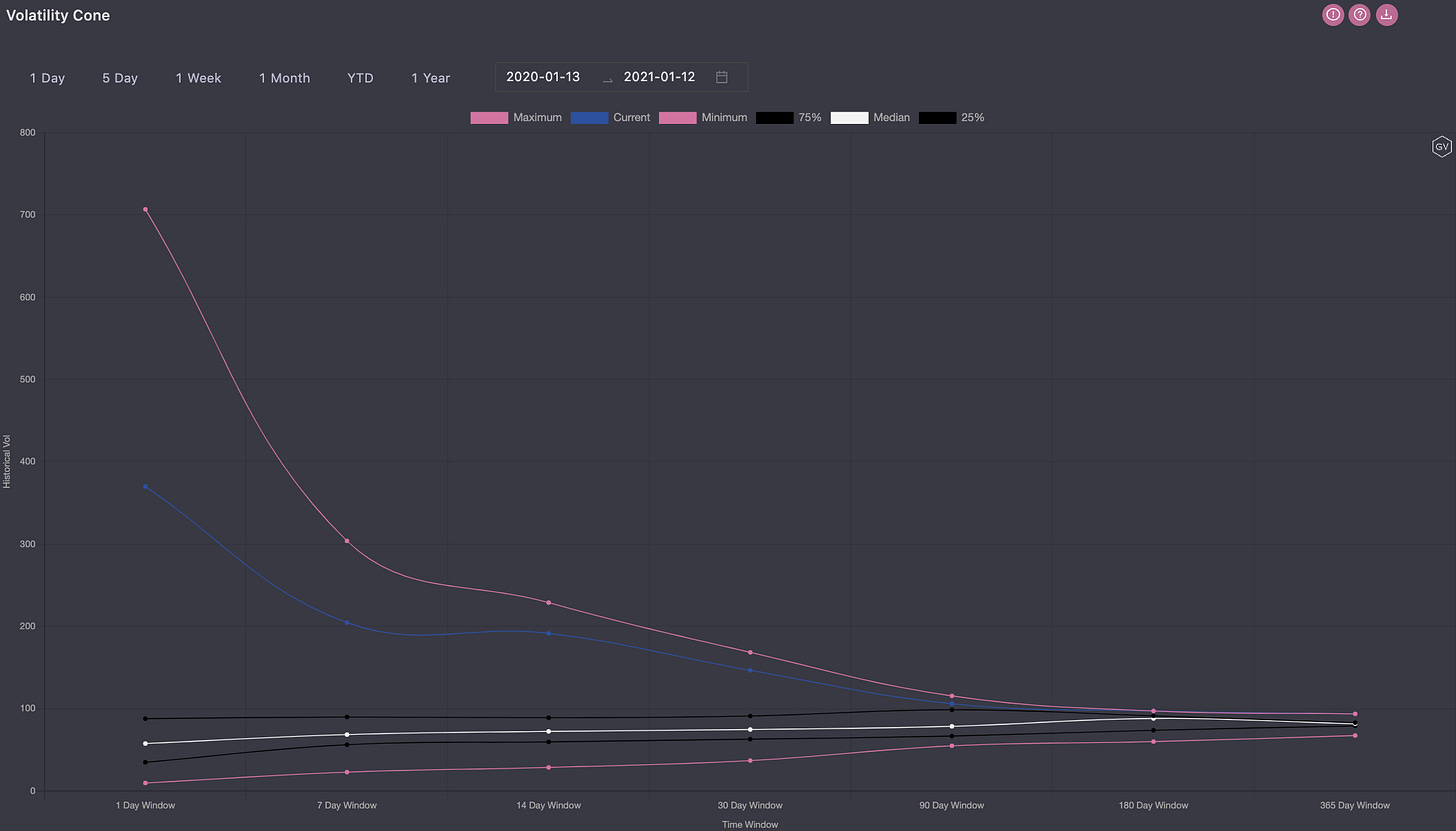

VOLATILITY CONE

(Jan. 12th, 2021 - BTC Volatility Cone)

It’s no surprise that realized volatility continues to exceed the 75th percentile.

This volatility environment is notably the highest bull-run environment seen since 2017. Modeling realized volatility with a 2017 context makes sense.

Remember, the 2017 bull-run was peppered with sharp pull-backs.

REALIZED & IMPLIED

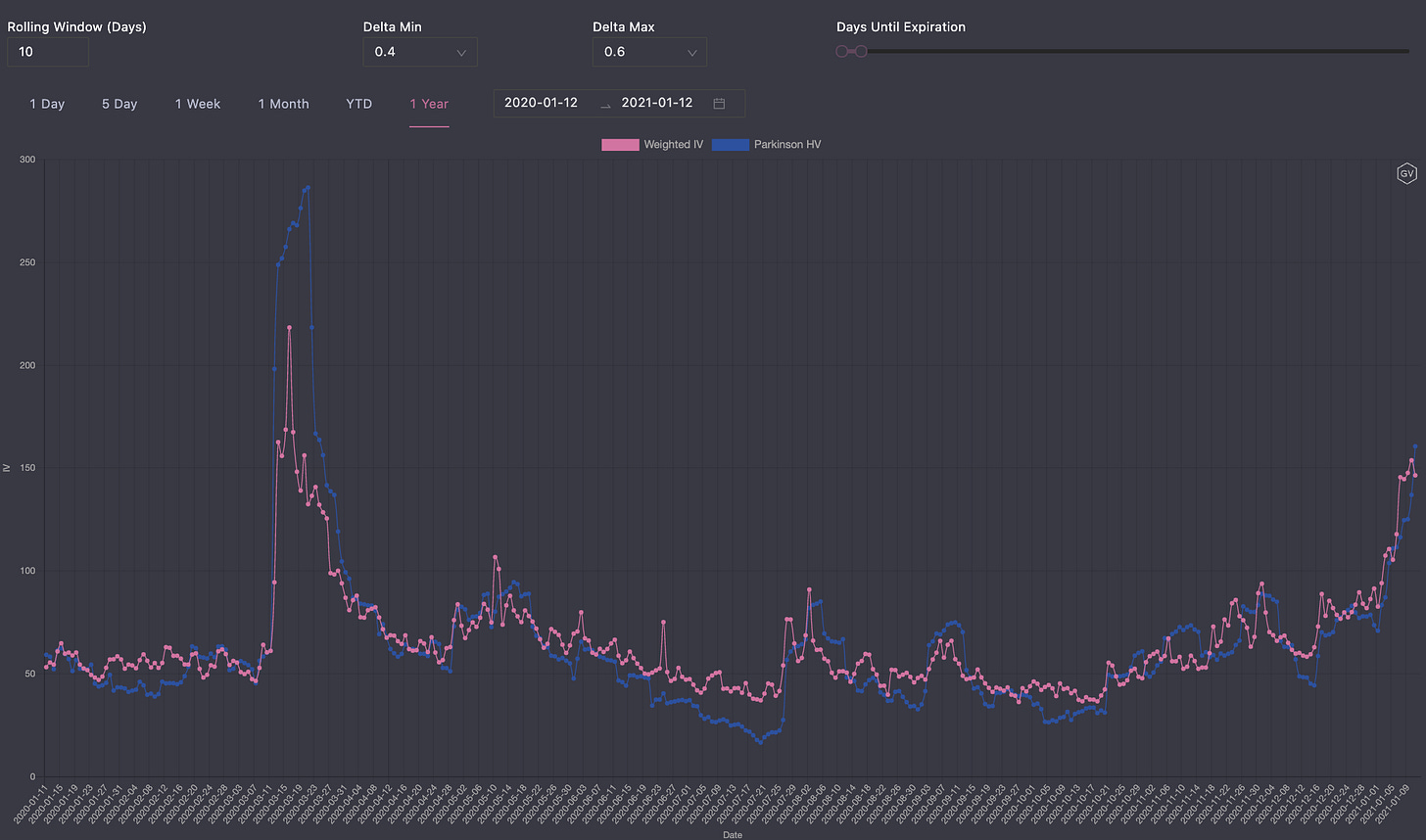

(Jan. 12th, 2021 - BTC 10-day Realized and Trade Weighted Implied Vol)

It’s important to note that ATM IV (.4-.6 delta range) for options with 0-31 days until expiration has had not problem walking higher along with realized volatility.

Normally sharp increases in realized volatility will exceed implied volatility levels, as seen in March 2020. This is due to IV discounting future RV as vol. is mean reverting.

Today’s relationship informs us that option traders believe there may be more fireworks ahead.

SKEWS

(Jan. 12th, 2021 - ETH Skews)

ETH volatility skews are showing classic profiles. All options remain positively skewed.

Option traders are willing to pay up much more for ETH upside option exposure than they are for downside exposure.

This activity indicates traders see an asymmetry in price action volatility, A.K.A. “Crash UP risk” and FOMO sentiment.

TERM STRUCTURE

(Jan. 12th, 2021 - ETH Term Structure)

(Jan. 12th, 2021 VS Jan. 3rd, 2021 - ETH Shadow Term Structure)

The term structure continues to display backwardation. This reflects that the high volatility environment is expected to be subdued in the future.

Despite the backwardation, long dated options still reflect very high implied volatility levels. This is exactly like BTC but with IV turned up even higher.

Notice the “Shadow Term Structure” displays a large increase in IV versus last week.

ATM/SKEW

(Jan. 12th, 2021 - ETH ATM & Skews for options 10-60days out)

Looking at the ATM implied volatility, for options with 10-60days to expiration, we can see the relentless move higher.

Unlike BTC, ETH skew remains more elevated. Although the spot price, IV and skew relationship isn’t as positively correlated as it once was the skew didn’t seem ready to leg lower.

VOLUME

(Jan. 12th, 2021 - ETH Premium Traded)

(Jan. 12th, 2021 - ETH Contracts Traded)

Like BTC, volume in terms of contracts traded continues to be nearly constant, but in terms of premiums traded we can clearly see a cluster of new option activity since ETH spot price broke above $1,000.

Huge block volume, executed of Paradigm, was seen on Jan. 10th, 2021!

VOLATILITY CONE

(Jan. 12th, 2021 - ETH Volatility Cone)

Currently realized volatility is extremely high and likely heads much lower from here.

As with BTC, this volatility environment is notably the highest bull-run environment seen since 2017.

REALIZED & IMPLIED

(Jan. 12th, 2021 - ETH 10-day Realized and Trade Weighted Implied Vol)

Like BTC, ETH ATM IV, .4-.6 delta range for options with 0-31 days until expiration, has had not problem walking higher along with realized volatility.

IV is also not trading below RV for ETH, despite high overall RV levels.