Crypto Options Analytics, Feb. 7th, 2021

Headline theme: "ETH IV likely drops significantly after CME ETH futures see a week of trading activity"

Visit gvol.io

Disclaimer: Nothing here is trading advise or solicitation. This is for educational purposes only.

To trade: Deribit, Bit.com, Okex, Delta.Exchange, Hegic, Opyn

For a Chinese translation visit our partner: TokenInsight

For best execution, with multiple counter-parties and anonymity visit: Paradigm

For crypto options podcast content, check out: The Crypto Rundown

SKEWS

(Feb. 7th, 2021 - Short-term and Medium Term BTC Skews - Deribit)

This week we saw an extension of the crypto rally for altcoins and a recovery for BTC.

Although BTC approached its recent ATH during the week, the weekend gave way to a pullback.

Short-term and medium-term option implied volatilities have shifted negative for the .10-.00 delta bucket.

Longer dated expirations have also seen a relative increase for IV in the .10-00 delta bucket.

For the exception of these “tails” skews do remain positively skewed by a small margin.

(Feb. 7th, 2021 - Long Dated BTC Skews - Deribit)

TERM STRUCTURE

(Feb. 7th, 2021 - BTC Term Structure - Deribit)

The BTC term structure continues to hold its shape and IV has come down further, albeit slowly.

Without a new ATH spot price, expect IV to drop.

Even with BTC spot prices trading in the $40k-$50k range, we expect IV to drop as BTC ranges in these prices.

$40k-$45k-$50k butterfly positions would be logical in such an environment.

Above +$55, BTC would be in a different price paradigm and we could see vol. reach insane heights.

ATM/SKEW

(Feb. 7th, 2021 - BTC ATM & Skews for options 10-60days out - Deribit)

Skew seem to have found stability.

We expect skew to remain around these levels unless spot prices break below $30k or above $50k.

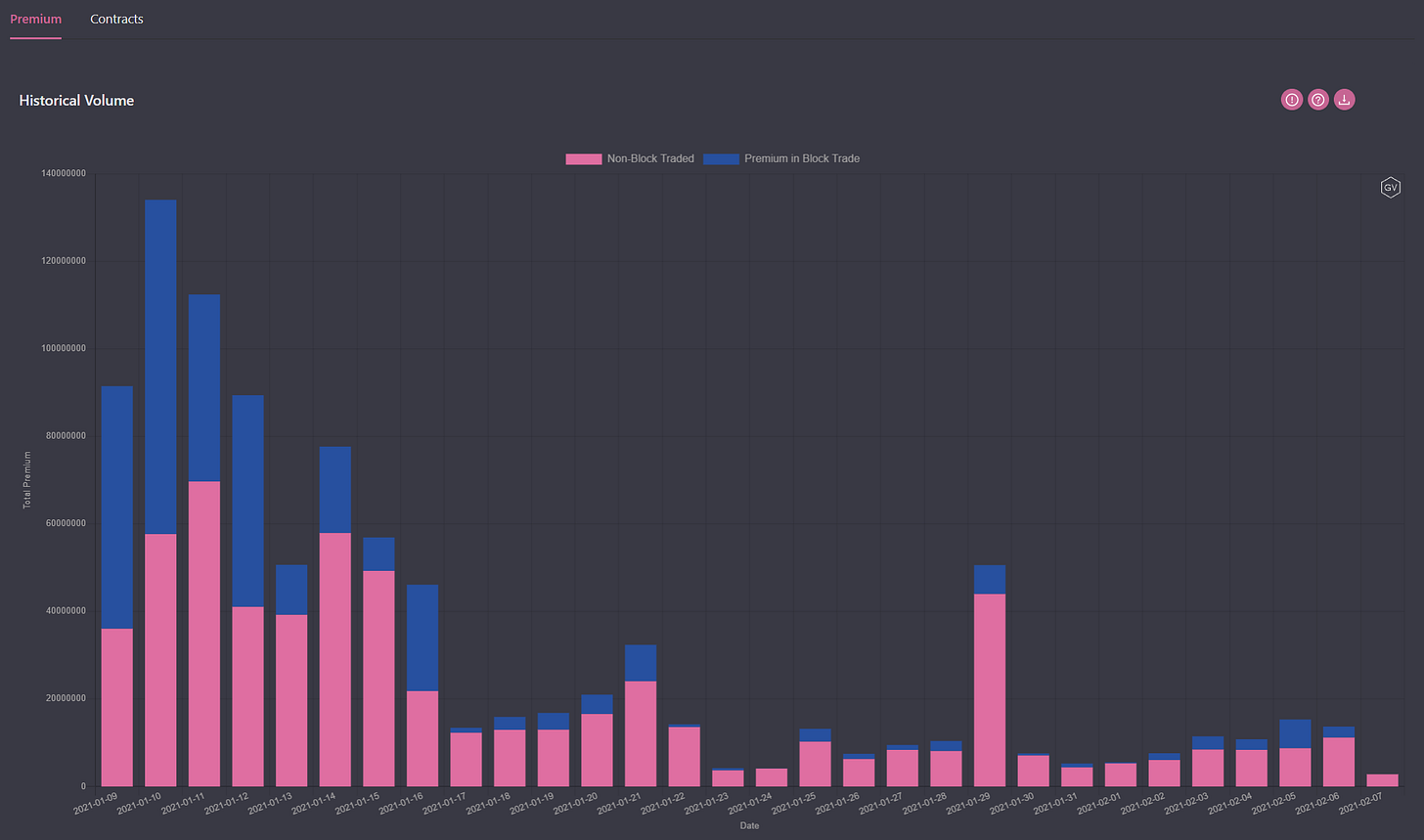

VOLUME

(Feb. 7th, 2021 - BTC Premium Traded - Deribit)

(Feb. 7th, 2021 - BTC Contracts Traded - Deribit)

Volume levels are currently calm.

This type of volume activity is consistent with spot consolidation and lower IV levels going forward.

VOLATILITY CONE

(Feb. 7th, 2021 - BTC Volatility Cone)

Notice realized volatility has now finally begun to back away from the extreme highs we’ve seen recently.

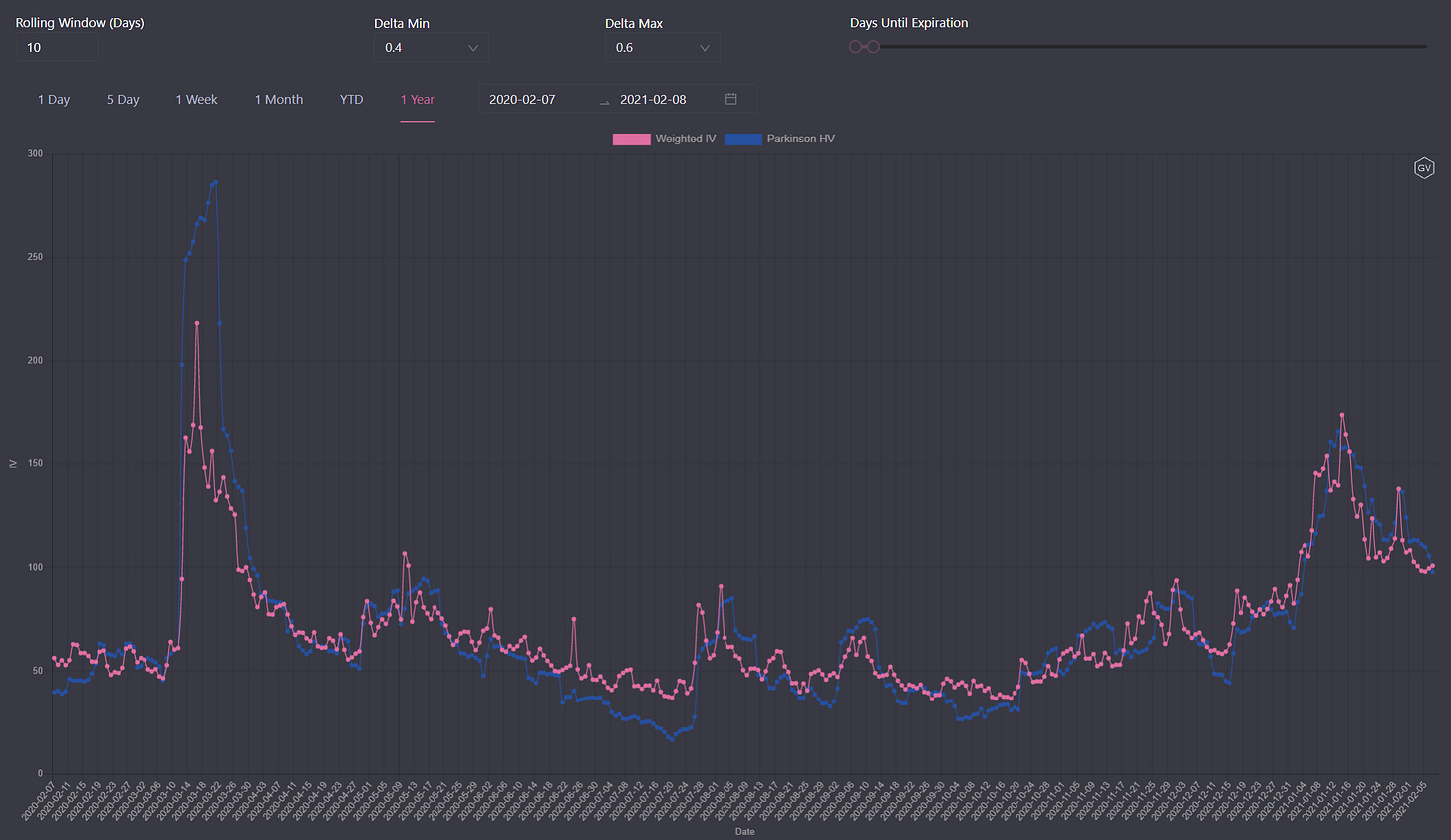

REALIZED & IMPLIED

(Feb. 7th, 2021 - BTC 10-day Realized and Trade Weighted Implied Vol - Deribit)

Realized and implied vols. have converged, but during the week IVs led the way lower, trading at a discount to realized.

SKEWS

(Feb. 7th, 2021 - ETH Skews - Deribit)

ETH is achieving a major milestone tomorrow with the introduction of CME ETH futures.

This week, skews are showing a similar dynamic to BTC skews.

For short-term and medium-term options the .10-.00 “tails” are being bid to the put side, while the skews around the tails remain positive.

(Feb. 7th, 2021 - ETH Skews - Deribit)

TERM STRUCTURE

(Feb. 7th, 2021 - ETH Term Structure - Deribit)

The ETH term structure is similar to last week.

Like BTC, the shape is similar to the previous week, but overall IV levels have only dropped 3-5 points versus last week, this is likely due to the CME futures “event”

After the first week of CME ETH futures trading, the vol. market will likely soften dramatically for ETH, unless ETH breaks significant spot price trading levels… Think $1k or $2.3k price levels.

ATM/SKEW

(Feb. 7th, 2021 - ETH ATM & Skews for options 10-60days out - Deribit)

Notice the trend ATM vol. is displaying… With CME’s event risk gone this trend will likely continue and make up for lost time.

The skew is stable here and without significant price breaks we have little opinion to add.

VOLUME

(Feb. 7th, 2021 - ETH Premium Traded - Deribit)

(Feb. 7th, 2021 - ETH Contracts Traded - Deribit)

ETH volumes are more resilient than BTC volumes, relatively speaking.

This does make sense given ETH made new ATHs this week, while BTC did not.

For us right now, there’s no clear indications between ETH option volumes and ETH IV here.

VOLATILITY CONE

(Feb. 7th, 2021 - ETH Volatility Cone)

Current realized volatility has softened versus last week but all RV windows remain in the very elevated +75% range.

REALIZED & IMPLIED

(Feb. 7th, 2021 - ETH 10-day Realized and Trade Weighted Implied Vol - Deribit)

ETH ATM IV, .4-.6 delta range for options with 0-31 days until expiration, is pricing a premium to 10-day realized vol.

This premium is likely related to CME futures trading this week.