Crypto Options Analytics, Feb. 6th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$41,599

DVOL: Deribit’s volatility index

(1 month, hourly)

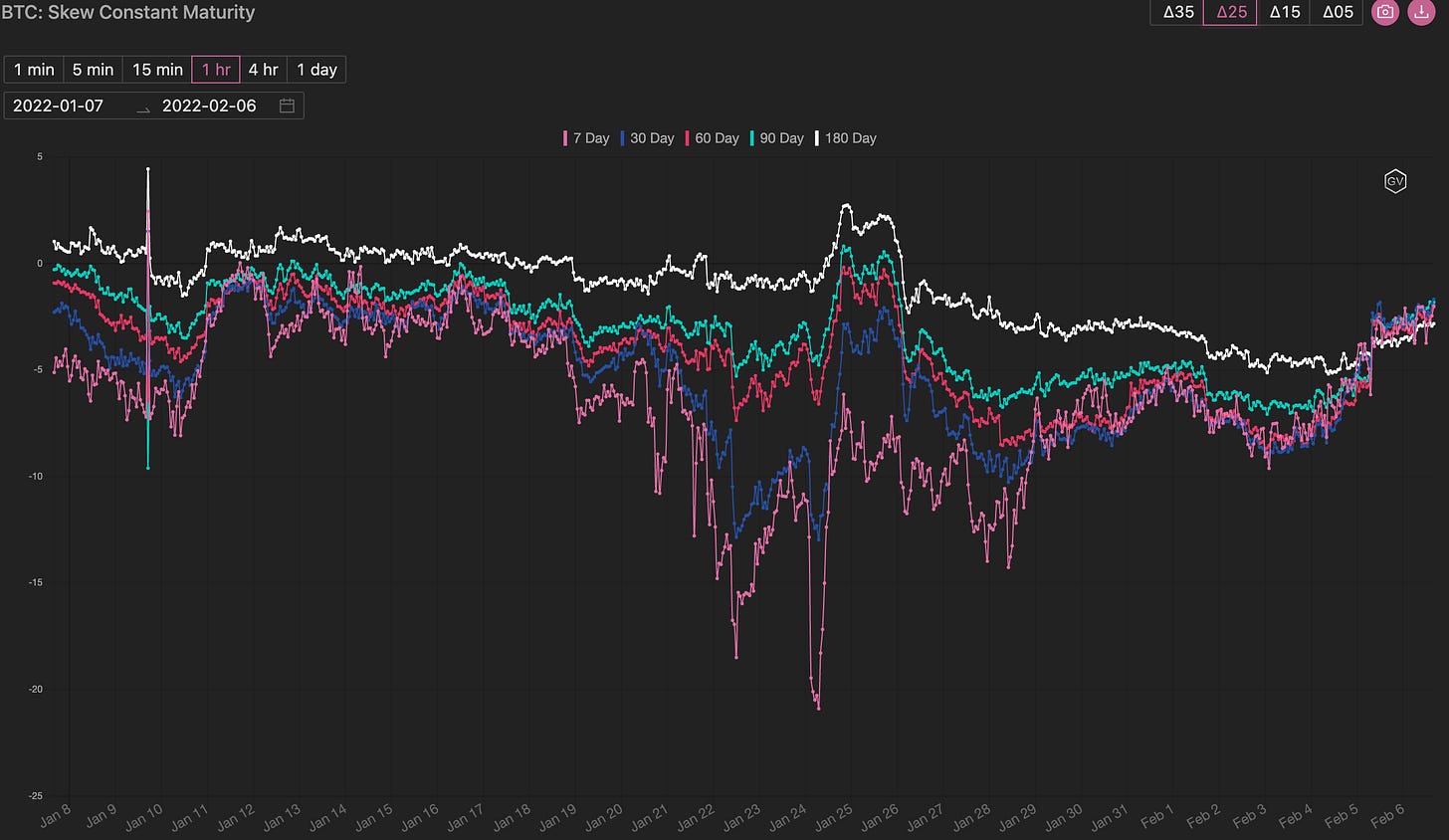

SKEWS

(Feb. 6th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Markets all around loved the broad based relief rally seen this past week.

Bitcoin options reacted strongly by reversing the negative skew (put-led demand) and converging higher around -3pts for all fixed expirations.

(Feb. 6th, 2022 - Long-Dated BTC Skews - Deribit)

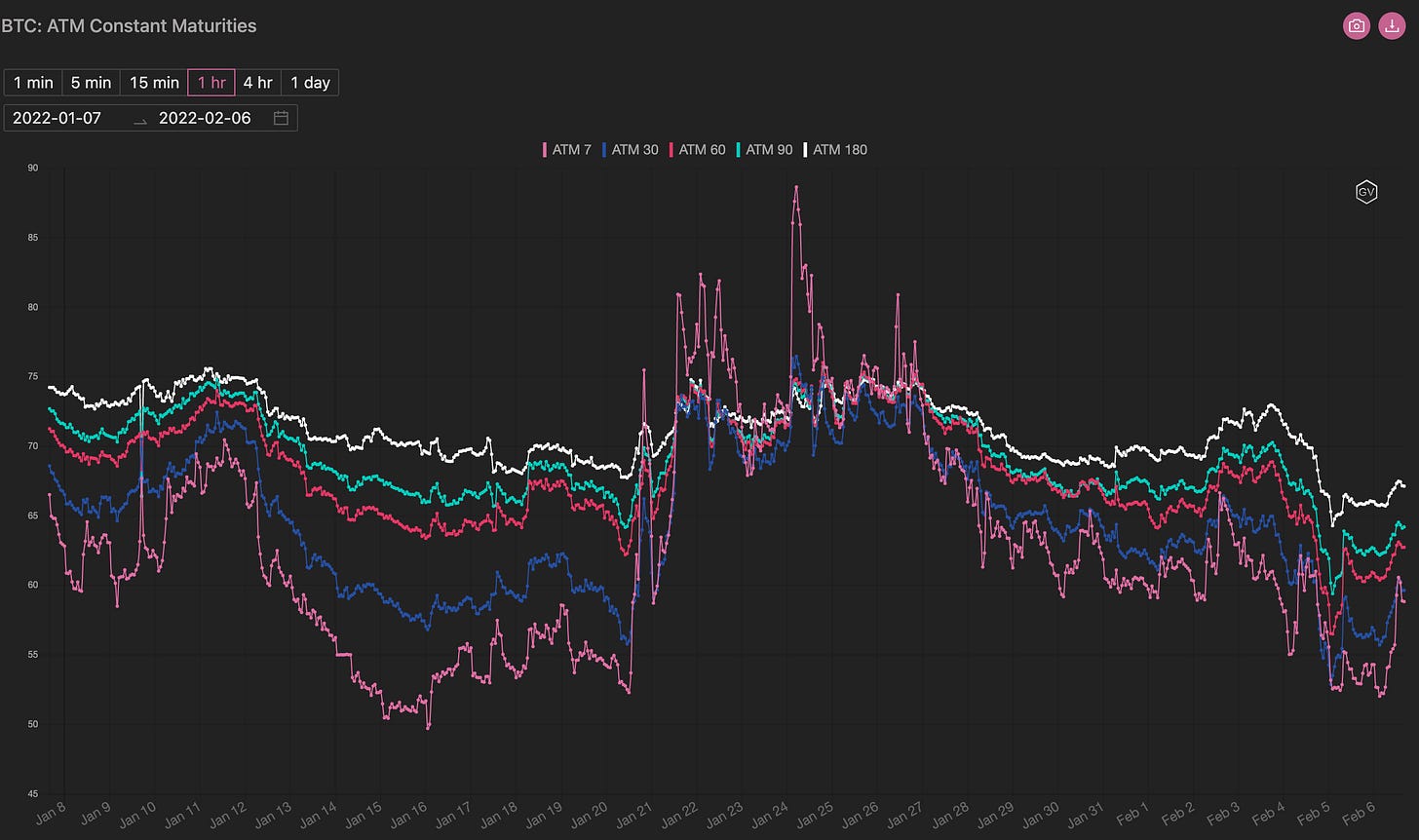

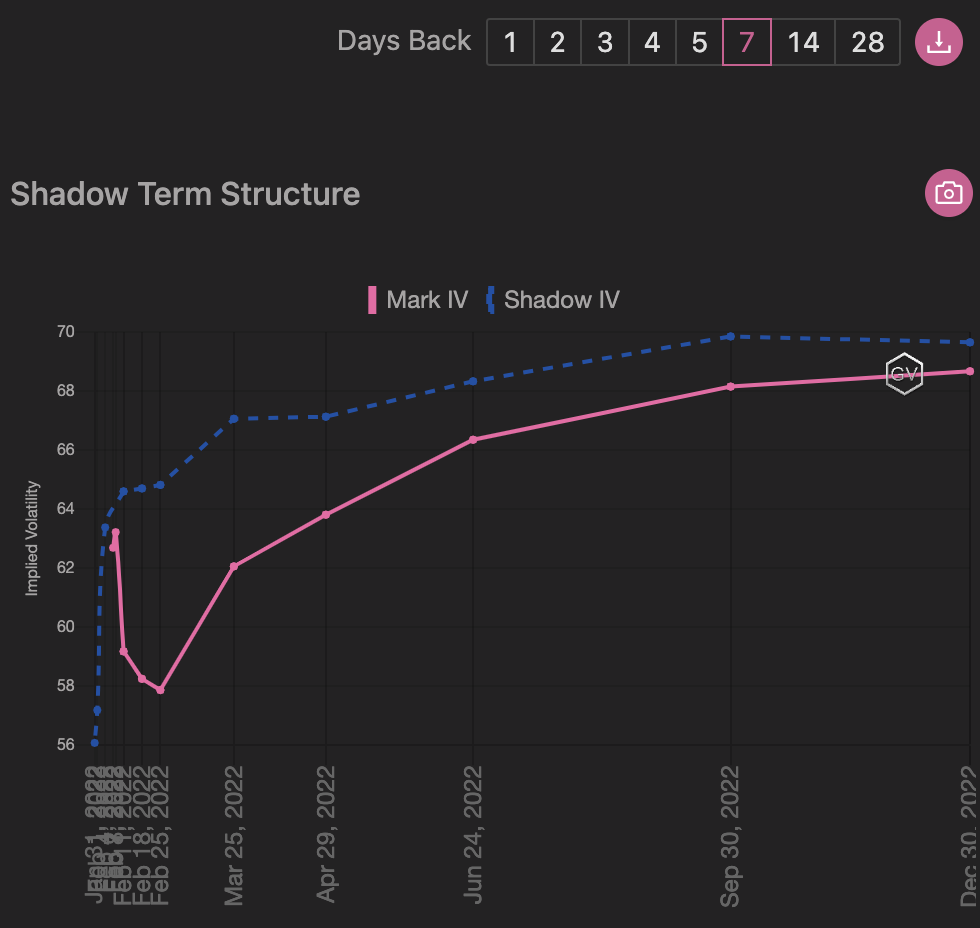

TERM STRUCTURE

(Feb. 6th, 2022 - BTC’s Term Structure - Deribit)

Week over week the ATM term structure saw a shift lower.

Interestingly, IV moved higher around Feb. 3rd via a parallel shift higher, only to be quickly faded as spot prices continued to rally into the weekend.

ATM/SKEW

(Feb. 6th , 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is right back towards monthly lows for select expiration and skew near monthly highs.

There is opportunity fading both of these trends. There still remains a ton of uncertainty in global affairs, central bank liquidity, and additional “regulatory” uncertainty in crypto assets.

Again, these hedging opportunities should be viewed graciously.

Open Interest - @fb_gravitysucks

BTC

This week’s “weekly option” expiration, with more than 18k contracts, 84% of which have expired worthless, has been negatively affected by compressed realized volatility. The slightly higher settlement price has given some relief to call holders compared to previous “weekly option” expirations. A disappointing tenor overall.

(Feb 4th , 2022 – BTC Open interest – Deribit)

( Feb 4th , 2022 – BTC Dollar premium – Deribit)

BIG TRADES IN THE FLOW

This has been a two-phase week. During the first part of the week, prices fluctuated in the 37k-38k range; the greatest interest was noticed on the put side with trades around 35k strikes being rolled further down.

(Feb 6th , 2022 – BTC Options scanner 7 days – Deribit)

After the Friday evening rally, by contrast, we’ve seen an unusual flow on the Asian session with outright calls on 25Feb 44k, 25Mar 45k and 24 Jun 50k being aggressively sold. These trades being executed during the low volume weekend have caused a tangible impact on IV.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Feb. 6th, 2022 - BTC Premium Traded - Deribit)

(Feb. 6th, 2022 - BTC’s Contracts Traded - Deribit)

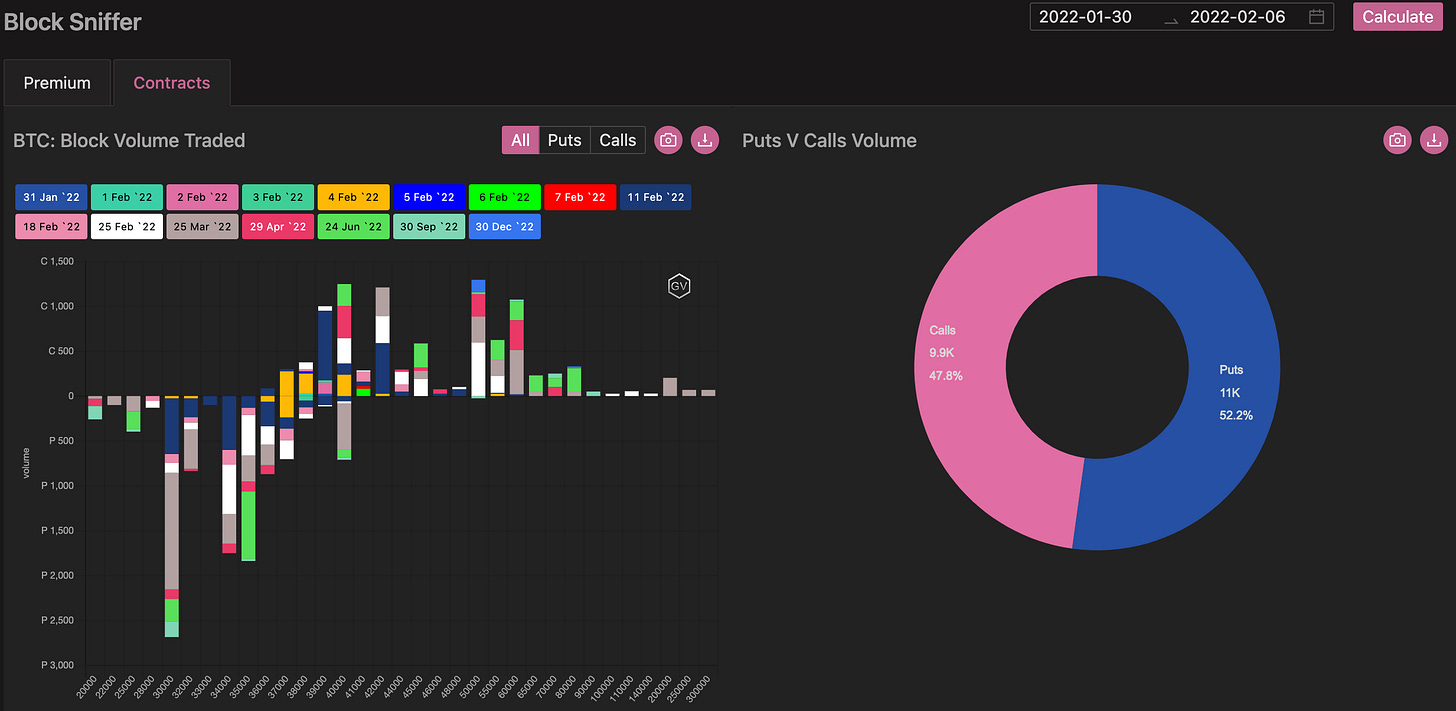

Paradigm Block Insights (Jan 30 to Feb 6)

As the market posted bullish engulfing bars in both BTC & ETH on Feb 4th, skew recovered to -2 in BTC & -4 in ETH and IV tumbled towards the lows of January as fears of a sharp spot move lower dissipated.

The return to calmness in crypto happened despite significant volatility in tech stocks, with the largest firms in the world such as Apple & Amazon trading like an alt-coin this past week, suggesting an interim bottom may be in.

In BTC, there was particularly high demand for the 30k puts, which was the most traded strike of the week, printing 2660 times. The 11Feb & 25Mar expiries accounted for the highest volumes. The strike was featured in put spreads as the far leg, in flies as the mid leg, and in risk reversals as puts accounted for 54% of overall volumes.

Of interest, vols in the entire front end to the end of Feb continued to slip lower as the implied - realized spread disappeared, suggesting value in picking up some gamma across the short dates, especially with large moves like those seen on Feb 4th becoming more frequent.

(Jan 30 to Feb 6 - Volume Profile - Deribit & Paradigm)

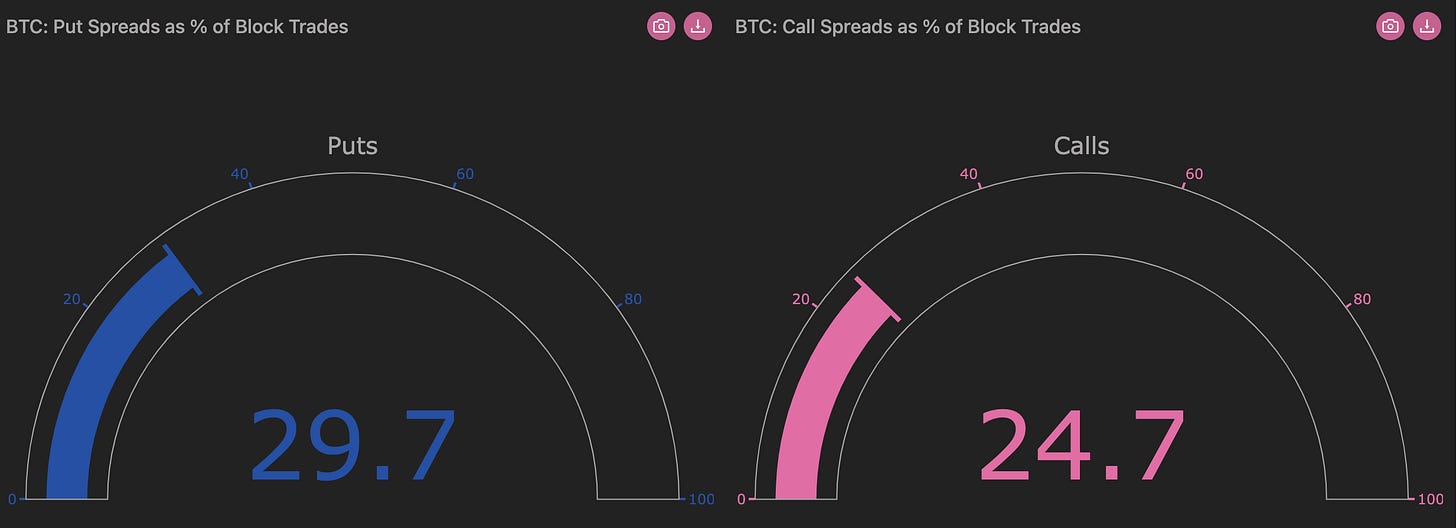

(Jan 30 to Feb 6 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Feb. 6th, 2022 - BTC’s Volatility Cone)

Realized volatility is priced at the median for medium measurement windows and lower 25th percentile for longer-term windows.

REALIZED & IMPLIED

(Feb. 6th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Although realized volatility has dropped week-over-week, there remains a slight elevation of RV to IV.

Our bias this week remains the same… Uncertainty is abundant and buying vol.- given these lower levels- seems logical.

$2,990

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Feb. 6th, 2022 - ETH’s Skews - Deribit)

ETH spot prices recovered strongly this week, along with macro risk assets.

Option skew traded in line with spot prices: trending higher, pulling-back lower and bouncing strongly into the weekend.

Nearly all fixed option maturities are hovering around the -5pt mark.

Long-dated skew was the least volatile, holding around -5pts without much variation.

This persistent negative skew (puts leading demand) has been persistent since the beginning of 2022.

Short-dated skews are more volatile but have been unable to trade above longer maturities… instead only being a leader to the downside.

(Feb. 6th, 2022 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Feb. 6th, 2022 - ETH’s Term Structure - Deribit)

Overall, ATM implied volatility levels remain tightly bound to levels seen last week.

The term structure continues to hold a similar contango shape.

On Feb. 3rd, as spot prices “pulled-back” from their trend higher, implied vol. levels saw a spike higher, but this spike higher was only in the longer-term options… This divergence is interesting…

Implied vol. levels continue to react to spot downside and overall ATM levels remain relatively low and attractive.

ATM/SKEW

(Feb. 6th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is right back towards monthly lows for the select maturities.

Skew (right) for select maturities is looking attractive to fade. Any spot downside could drop skew -8pts, even if the spot drop is very “shallow”.

The market is “touchy” and skew has consistently reacted logically as of late.

Open Interest - @fb_gravitysucks

ETH

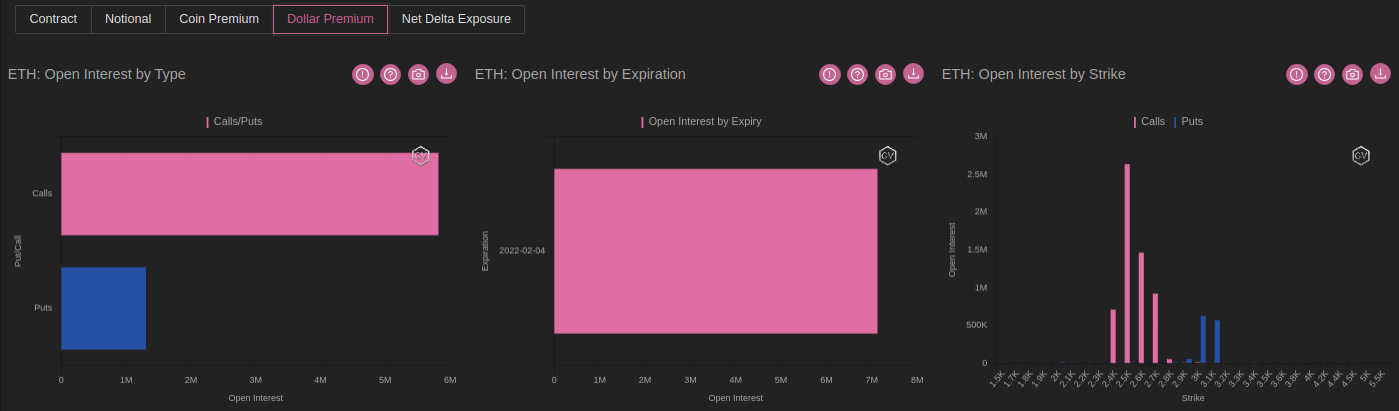

This week’s Ethereum activity was a completely different story compared to BTC. Almost 190k contracts expired. The settlement was above the previous weekly by +18% and “only” 69% expired worthless.

When looking in the dollar premium, it is clear to see that those rewarded were call holders.

(Feb 4th , 2022 – ETH Open interest– Deribit)

(Feb 4th , 2022 – ETH Dollar premium – Deribit)

This chart gives a good view about relative (ETH vs BTC) realized volatility of the week.

(Jan 28th - Feb 4th, 2022 – Relative realized volatility – ETH in red, BTC in blue)

BIG TRADES IN THE FLOW

The week started in similar fashion for ETH compared to Bitcoin. Protection was extended by buying June 2.5k puts financed by closing positions in March 3.0k.

Later in the week -and more broadly speaking- the flows seen were more bullish, with call being very active.

(Jan 29th , 2022 – ETH Options scanner 7 days – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Feb. 6th, 2022 - ETH’s Premium Traded - Deribit)

(Feb. 6th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (Jan 30 to Feb 6)

In ETH, the 3000 strike calls were the most traded contract of the week and were prominently featured in call spreads (30 Sep 3000/6000), risk reversals (4 Feb 2400P/3000C), and outrights (25Mar 3000C).

(Jan 30 To Feb 6 - Volume Profile - Deribit & Paradigm)

(Jan 30 To Feb 6 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Feb. 6th, 2022 - ETH’s Volatility Cone)

ETH RV is around the median for mid-range measurement windows.

This is merely typically RV and leaves room for upside.

REALIZED & IMPLIED

(Feb. 6th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The combination of median RV with discounted IV/RV, continues to lean our bias towards buying volatility.

The other interesting item this week was the sharp “backend vol” spike around Feb. 3rd, which steepened the term structure.