Crypto Options Analytics, Feb. 5th, 2023

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Tuesday 11am - NY FED Inflation Expectations

Friday 10am - UMich Inflation Expectations & Consumer Sentiment

THE BIG PICTURE THEMES:

Last week we had two big market-moving events.

A +25bps rate hike from the Fed, followed by a press conference with Powell.

However, the massive market moving event of last week was the NFP release.

Unemployment continued to drop, marking the lowest level in 53 years (3.4%) as jobs increased +517k in January vs an expectation of +187k.

This sent GOLD prices, along with other precious metals and bonds, plunging lower.

It’s important to keep these charts in mind for BTC and ETH spot prices.

A lot of the downside in risk-assets last year was due to rising US yields as the Fed combats potentially entrenched inflation expectations.

This strong jobs report enables the Fed more wiggle room when raising rates.

Should the economy remain hot, worker wages could spiral higher, leading to a sticky inflation catalyst.

However, the market for crypto and equities remained very resilient this week, so price action doesn’t currently support these fears.

BTC: $22,863 -3.49%

ETH :$1,619 -1.15%

SOL: $23.34 -10.80%

TERM STRUCTURE

(Feb. 5th, 2023 - BTC Term Structure - Deribit)

The BTC term structure has flipped back into Contango as spot prices stalled in their rally.

It’s interesting to notice that all maturities, except 7-day implied vol, have been extremely well anchored since about January 15th.

Not only is the backend anchored, it is also clustered together.

Should a Contango shape persist, we’d likely see the 30-day and 60-day IV drop a lot lower as the current Contango would need to steepen.

SKEWS

(Feb. 5th, 2023 - BTC RR SKEW (C-P) ∆25 - Deribit)

Option markets are now beginning to bleed out the enthusiasm around a sustained spot price rally.

Short-term options are now the most negative RR-Skew, implying that there’s a little higher probably for BTC to “quickly” give back its recent gains, from a negative spot/vol. shock.

This actually makes sense, given the recent GOLD spot price reaction this week.

If GOLD and other risk-assets didn’t quickly drop this week, I wouldn’t have found the current short-term RR-Skew sensical.

Another reading of the current 7-day RR-Skew is that the option market believes the explosive BTC upside we’ve seen in Jan. 2023 is likely behind us.

Long term RR-Skew remains the MOST convincing “fade” (bet lower) in my opinion, however.

Given the strong spot/vol. trends seen in 2022 and the high BTC/Stonks correlation, these RR-Skews should trade in negative territory.

VOLATILITY PREMIUM

(Feb. 5th, 2023 - BTC IV-RV)

VRP is now very steady.

There’s a slight VRP being priced currently, but all-in-all options seem fair/cheap to buy.

Realized volatility still has the potential to keep moving and, historically speaking, current RV levels are merely around long term averages.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @Gravity5ucks

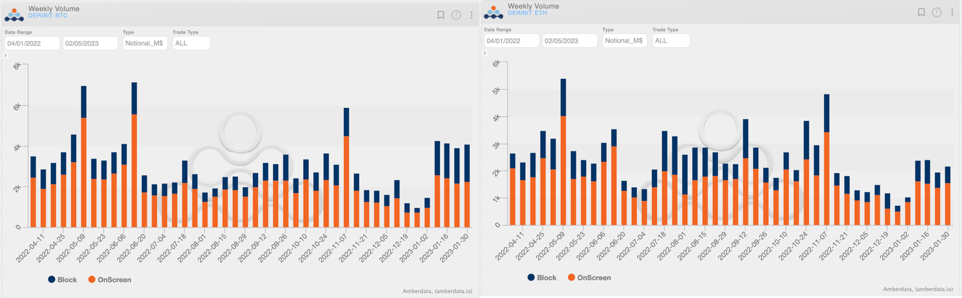

Another strong week for Bitcoin volumes. It’s really impressive to see block trades at historical highs both on number of contracts and notional.

(BTC Weekly BLOCK Volumes Contracts/Notional - Options Deribit Historical Section)

Ethereum keep struggling to keep pace: notionals BTC $4B vs ETH $2.1B.

(BTC vs ETH Weekly Volumes Notional - Options Deribit Historical Section)

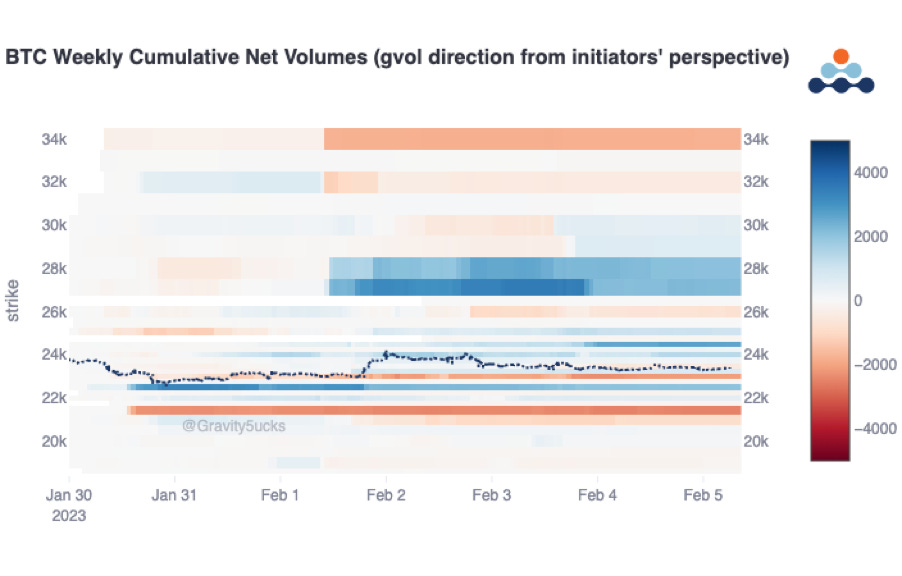

Earlier in the week, with the spot price slipping and in view of the FOMC meeting, traders built protection on the 3FEB23 with a tight call spread $22.5k/$21.5k. Then also replicated on-screen.

Mid week, instead, two call spreads dominated the flow: March ($27k/$32k) and April ($28k/$34k) for a net premium total of $1.7M. Huge.

(BTC AD Direction tables with uni_trade - Options Scanner section)

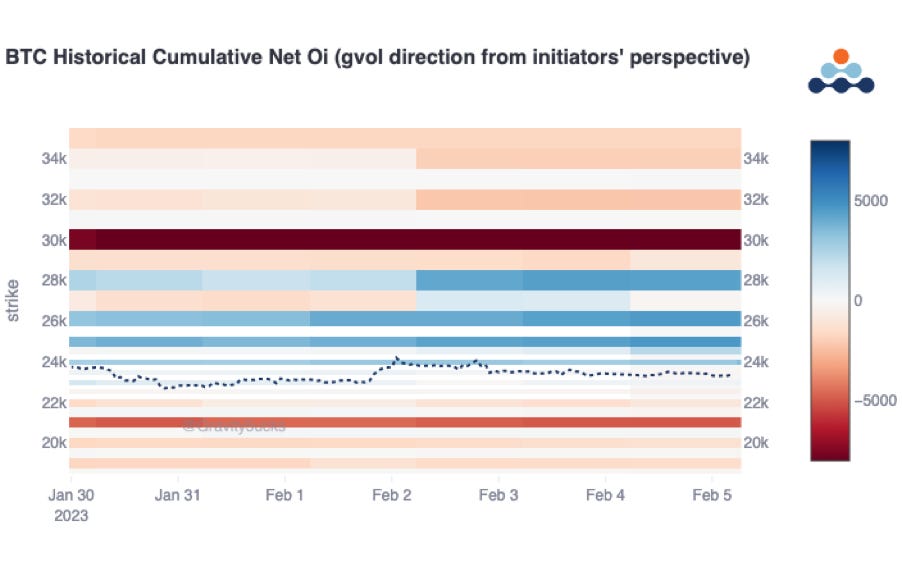

The net positioning of traders calculated with our proprietary system, highlights a support area at $21k and strong resistance at $30k (where dealers are gamma long).

Positive exposures instead in the $24k-$28k range (dealers are gamma short).

Paradigm Block Insights (30Jan - 5Feb)

Busy week for Crypto options! Flows were quite event-driven as the market digested multiple macro data prints. Spot round tripped to ~flat on the week. Takers bought more topside.

BTC -3%% / ETH unch. / NDX +4.5%

25d skew snapshot from Jan 30, notice the front end (3Feb) topside bid, with calls trading 3 vols over:

Notable Mon/Tues flows:

2338x 3-Feb-23 22500/21500 Put Spread bot

1100x 3-Feb-23 24500/26000 Call Spread bot

734x 3-Feb-23 23250/24500 Call Spread bot

FOMC hikes 25bps, full Fed day recap below.

As we have noted in the past, takers have been positioned to be long front-end topside. Risk assets rally following the print. Takers chased:

500x 31-Mar-23 32000 Call bot

400x 10-Feb-23 28000 Call bot

300x 31-Mar-23 25000/30000 CSpd bot

Commentary TG link: https://t.me/Paradigm_Market_Commentary

Friday 🌊 part 1

Busy session revolving around US NFP and unemployment data.

Large topside flows were blocked, wings got bid via rolling strikes up:

500x 31-Mar-23 24000 / 30-Jun-23 29000 Call Calendar bot

500x 31-Mar-23 24000 Call sold

445x 29-Dec-23 30000/50000 Call Spread bot

Friday 🌊 part 2

Large front-end term structure calendar trades lifted in BTC and ETH:

950x Call 10-Feb 24500 / Call 17-Feb 27000

300x Call 10-Feb 24000 / Call 17-Feb 27000

200x Call 10-Feb 24000 / Call 17-Feb 26000

6500x Call 10-Feb 1750 / Call 31-Mar 3000

Additional notable topside flows 🌊

1000x 24-Feb-23 26000 / 30-Jun-23 40000 1x1.5x CCal bot

1000x 31-Mar-23 30000 Call bot

10000x 10-Feb-23 1750 Call bot

🔊 The Big Picture

Amberdata put out a BTC vol regime report last week.

We discussed it with the authors on our latest TBP filmed this week!.

Report and TBP link below. 🙏

https://go.amberdata.io/dissecting-volatility-trends-research-paper?utm_campaign=2023-Q1-Dissecting-Volatility-Research-Report&utm_source=PR&utm_content=Volatility-Report

🎀 Another Friday, another successful @ribbonfinance auction complete on @tradeparadigm 🥳

🎉 Average beats to screen of 8% spicing those vault yields 🔥🔥🔥

Winners: 🏆

🥇 @QCPCapital

🥇 @MoonvaultCap

🥇 Various ANON🤫

Same time next week, friends 🏆

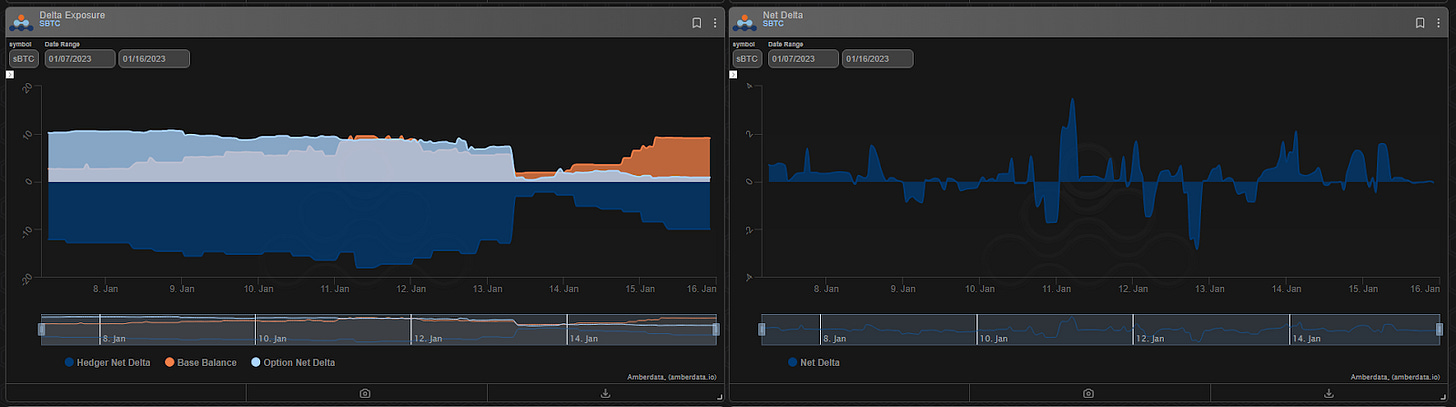

BTC

ETH

The Squeecosystem Report (1/29/23 - 2/04/23)

With most of the major headline risk out of the way for the short term, the market has been left to a decision. Some broader market shifting under the hood is setting up for what could be an interesting week. ETH ended the week +3.5% and oSQTH ended the week +6.31%.

Volatility

Squeeth IV had some decent range on the week, starting in the mid-60s, peaking in the mid-80s and round-tripping back to the 60s to end the week. This created great opportunities for active vol traders and Crab depositors.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $4.07m. February 1st saw the highest volume, with a daily total of $1.27m traded. An additional $563.65k traded via OTC auctions this week.

Crab Strategy

Crab had an incredible week, returning 2.23% for depositors in USDC terms.

Zen-Bull Strategy

Zen-Bull also benefited from the slow upward move in the market this week, stacking 1.13% more ETH for depositors.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

Lyra Weekly Review

Volatility

Current ATM IV is ~60% in ETH, normalizing as upside momentum has stalled. Downside puts are catching a bid as the fear to the downside is returning.

Trading

Lyra is now live for trading on Arbitrum! The Newport release allows for lower fees for traders and greater profitability for liquidity providers.

This week has seen a renewed interest in puts; put traders made up for ~63% of all volume.

ETH Market-Making Vault

The ETH MMV has returned +5.51% since its inception (June 28th, 2022) representing a weekly change of -0.08. Annualized performance since inception is +8.84%

Depositors earn an additional 19.43% rewards APY, boosted up to 38.85% for LYRA Stakers on Optimism or 55.4% boosted up to 110.7% for LYRA Stakers on Arbitrum (new).

Net MMV Exposure:

Both ETH vaults are short gamma as it seems that option buyers have returned, and short selling vaults have been less active.

Optimism

Arbitrum

BTC Volatility

BTC Market-Making Vault

Lyra’s BTC MMV has returned +1.28% since its inception (August 16th, 2022). This represents a weekly change of -.22%. Annualized performance since inception is +2.68%

Depositors earn an additional 24.2% rewards APY (boosted up to 48.4% for LYRA Stakers)

Net BTC MMV Exposure:

Learn more about Lyra in this GVOL explainer video!

Trade: app.lyra.finance

Twitter: https://twitter.com/lyrafinance

Discord://discord.gg/Lyra

Watch @itseneff and @GenesisVol talk options here