Crypto Options Analytics, Feb 4th, 2024

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

All Week: Various Fed Speakers

Friday 8:30am- CPI Seasonal Revisions

Last week concluded with an impressive performance in the NFP employment report, surpassing expectations by almost double.

In January, employment saw a significant increase of +355k, far exceeding the expected +185k. Additionally, there was a notable uptick in wages by +4.5%, although a substantial part of this increase can be attributed to a reduced hourly workweek.

The FOMC rates remained unchanged, leaning slightly towards a "dovish" stance. Powell mentioned his anticipation of rate cuts in 2024, though not to the extent that the market currently predicts. Powell also emphasized his lack of confidence in fully controlling inflation.

Currently, we are observing a mixture of data. Recent PCE data indicates a softening in inflation, with 3-month and 6-month PCE trends falling below the 2% inflation target. However, on the other hand, strong employment and rising wages could potentially act as catalysts for a resurgence in inflation.

(WSJ.com Wages and CPI)

In the upcoming week, there is a scarcity of economic data releases, but it will be busy with various appearances and speeches by Fed board members. These events are expected to assist in processing the recent assortment of mixed economic data.

Treasuries have experienced volatility, with bond prices surging due to resurfacing concerns about regional banks in one instance, but then dropping once more as robust employment figures were reported.

(Bond Futures Price Chart /ZB)

In general, the rise in risk-free yields could pose a challenge for non-interest-bearing cryptocurrencies like Bitcoin. However, I maintain the belief that macroeconomic yields play a relatively minor role in the current price movements of Bitcoin.

The primary driving force behind Bitcoin's recent headlines is the demand for spot ETFs.

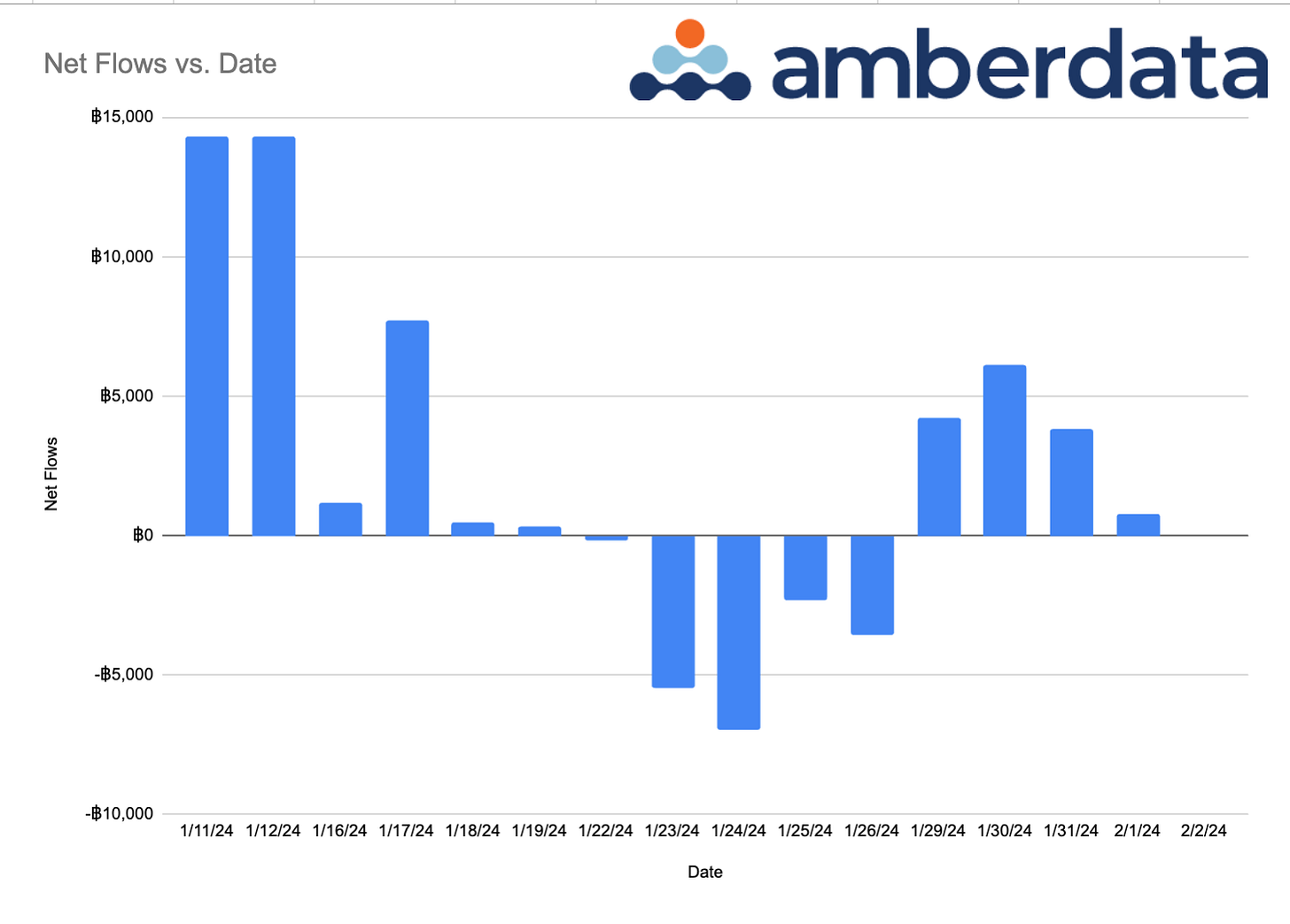

(ETF Bitcoin Net Flows )

(ETF Bitcoin Flows by Symbol)

It's evident that ETF Bitcoin flows have returned to positive territory, with a significant decrease in outflows from GBTC and increased inflows into other ETF symbols surpassing GBTC.

These flow trends are favorable for Bitcoin's recent rally, and the reduced outflows from GBTC indicate a stabilizing market.

The decreasing volatility in these flows is likely to contribute to a reduction in Bitcoin spot market volatility as well.

BTC: $42,687 (+2.4% / 7-day)

ETH :$2,278 (+1.7% / 7-day)

SOL :$96.38 (+1.6% / 7-day)

(BTC 1-yr Realized Volatility Cone)

Looking at the BTC volatility cone, we can see that short-term RV measurements are headed lower towards the minimum line, while longer-term measurement windows remain above the +75% percentile.

As the market trades post-ETF decision and ETF flows begin to subdue, I expect RV to continue to drop in the medium-term.

(BTC Normalized Gamma TimeSeries 2024 YTD)

We can see that dealer gamma has marched higher back to even. There is no longer a clear demand for optionality from the street. Mid-Jan saw peak demand for options, the most negative dealer inventory. Sentiment has turned neutral for optionality here.

ETH

(ETH Normalized Gamma 18-month chart)

Although BTC volatility going lower is my bias, ETH implied volatility is starting to look interesting in my eyes. We can see that the street is max-short ETH optionality. The dealer gamma has never been this LONG in ETH.

(ETH Term Structure with RV measures)

If we look at the current term structure, the March 29th expirations look especially attractive. This is the longest maturity before the leg higher in April.

The Red horizontal line is 30-day RV which is substantially above the current 30-day implied.

10-day RV is below all IV measurements, but only by a slight amount and given positioning in the market, any tick higher in Vol will likely cause a “buy2close” scramble.

(4yrs ATM IV)

To contextualize a bit more, the current ATM IV for ETH is near all-time lows.

(ETH 7-day VRP)

And making sure this low IV isn’t expensive relative to RV, we can see the VRP for short-term options (the best reflection of recent reality) is nearly zero.

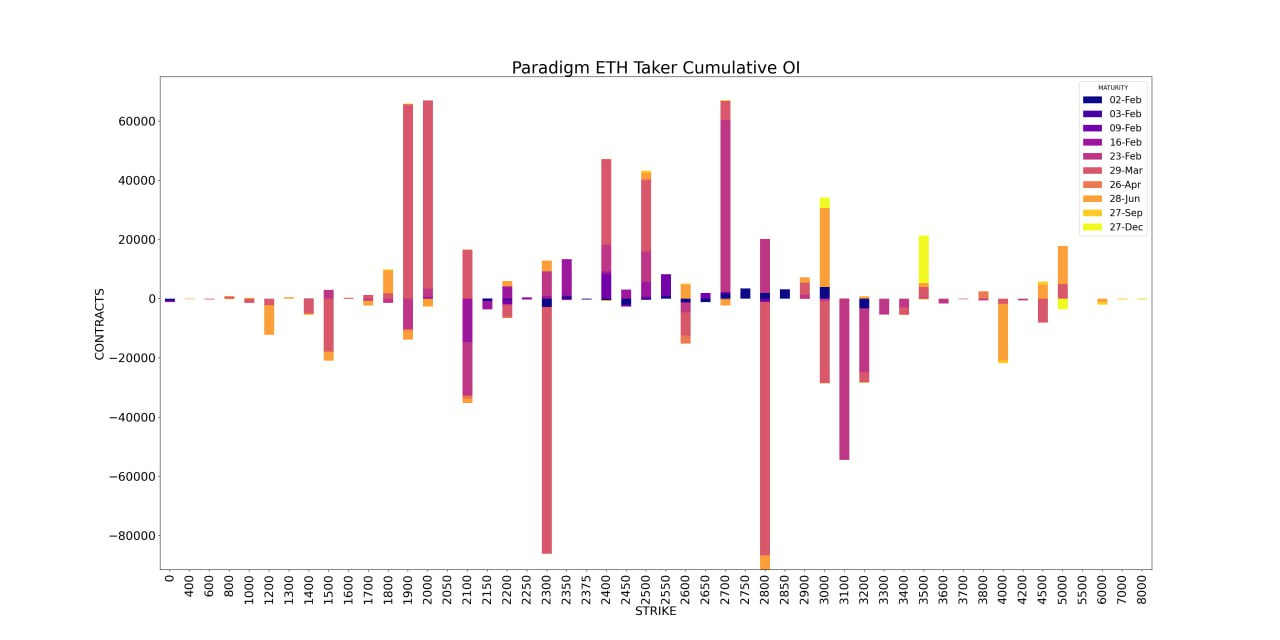

Last week we saw massive demand for 30-day 2500-C in ETH. About 52k contracts were bought via 12 separate block trades. This is an interesting purchase and given market positioning across the board, I like this trade. Although, I’d prefer the March 29th expiration.

Paradigm's Week In Review

BTC +3.3% / ETH 1.5% / NDX 0.9%

Paradigm Top Trades this Week 👇

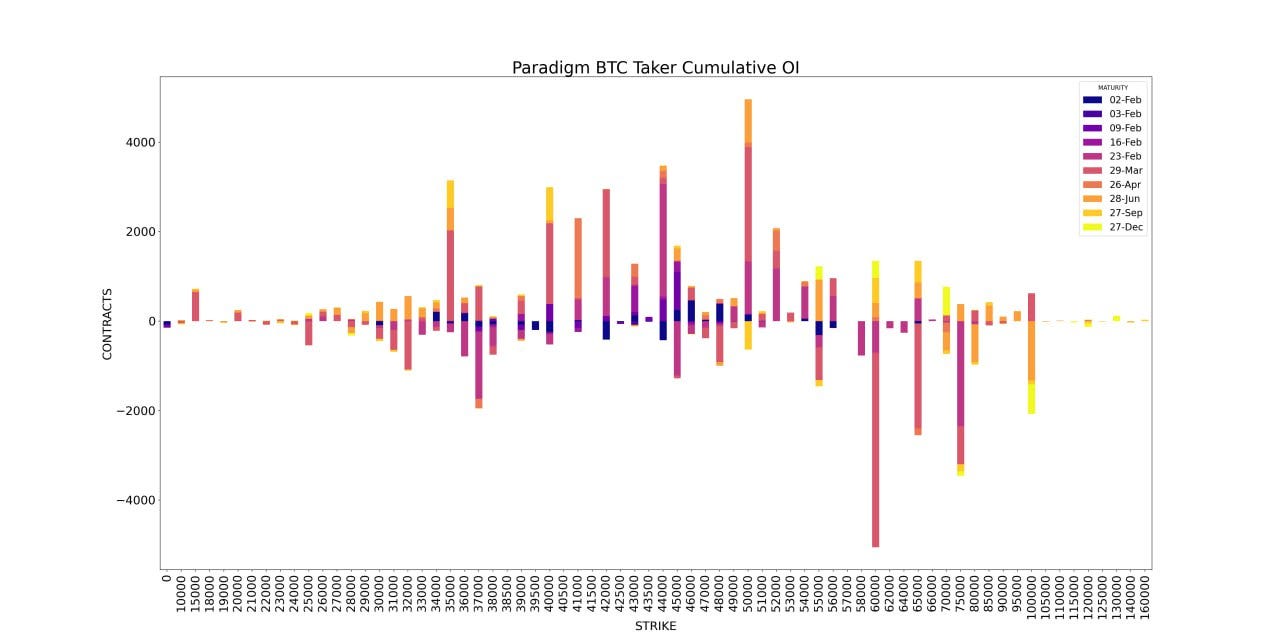

Weekly BTC Cumulative Taker Flow 🌊

Weekly ETH Cumulative Taker Flow 🌊

BTC Cumulative OI

ETH Cumulative OI

As always you can hit us up from the below

Hit us up on Telegram! 🙏

Paradigm Edge: Daily Commentary✍️ http://pdgm.co/edge

24/7 Support: http://pdgm.co/tgsupport

Sign up now! 👉 https://pdgm.co/3BLEw1Y

BTC

ETH

The Squeethcosystem Report

Crypto markets had a relatively quiet week. ETH ended the week -0.75%, oSQTH ended the week -1.19%.

Volatility

oSQTH IV remained active this week, trading in the 80s before settling back in the 60s .

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $235k

Feburary 2nd saw the most volume, with a daily total of $70.23k traded.

Crab Strategy

Crab saw gains ending the week +1.95% in USDC terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.