Crypto Options Analytics, Feb. 28th, 2021

Headline Theme: "Large IV/RV premiums gone as RV pumps! Did last week's option positioning foretell the spot price drop? "

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

To trade visit: Deribit, Bit.com, Okex, Delta.Exchange, Hegic, Opyn, Primitive

For Chinese visit our partner: TokenInsight

For best execution with multiple counter-parties and anonymity visit: Paradigm

For crypto options podcast content visit: The Crypto Rundown

Last week’s option positioning was a fantastic insight into this week’s price action.

This is why we look at the option markets.

Option volatility profiles give an insight into trader positioning and risk appetite in a way that futures open interest and funding rates alone cannot.

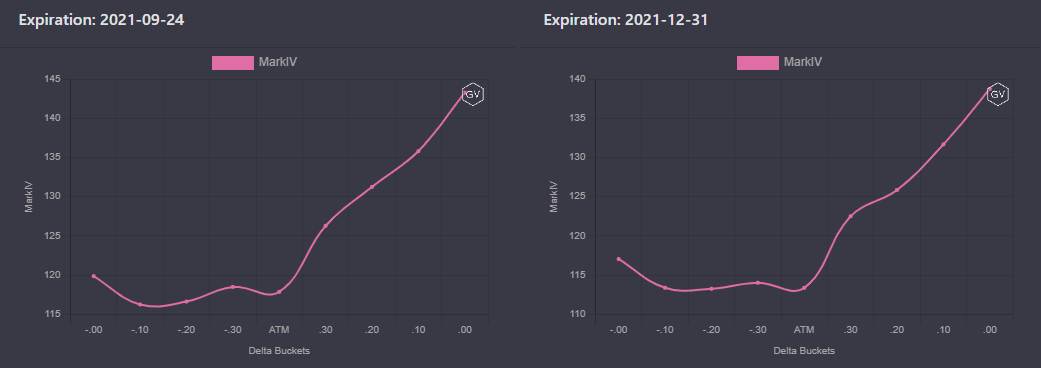

SKEWS

(Feb. 28, 2021 - Short-term and Medium Term BTC Skews - Deribit)

In last week’s newsletter we noted that traders were willing to pay extremely high IV for -.10 delta “tails”…, demonstrating an appetite for “just in case” insurance.

We also noted a breakdown in the FOMO trend of: Spot up, Vol. up, skew up.

Despite new ATH’s to $57k, skews were NOT showing the same call bid that we’d expect.

This week skews are decidedly negative.

Short-term and medium-term skews are negative in almost all delta buckets, not only the “tails”.

(Feb. 28, 2021 - Long Dated BTC Skews - Deribit)

Long-term skews are much more resilient to the natural call bid.

TERM STRUCTURE

(Feb. 28, 2021 - BTC Term Structure - Deribit)

Implied volatilities have increased for shorter-term options.

This has caused the term structure to go Backward.

Long-term option IV hasn’t moved at all.

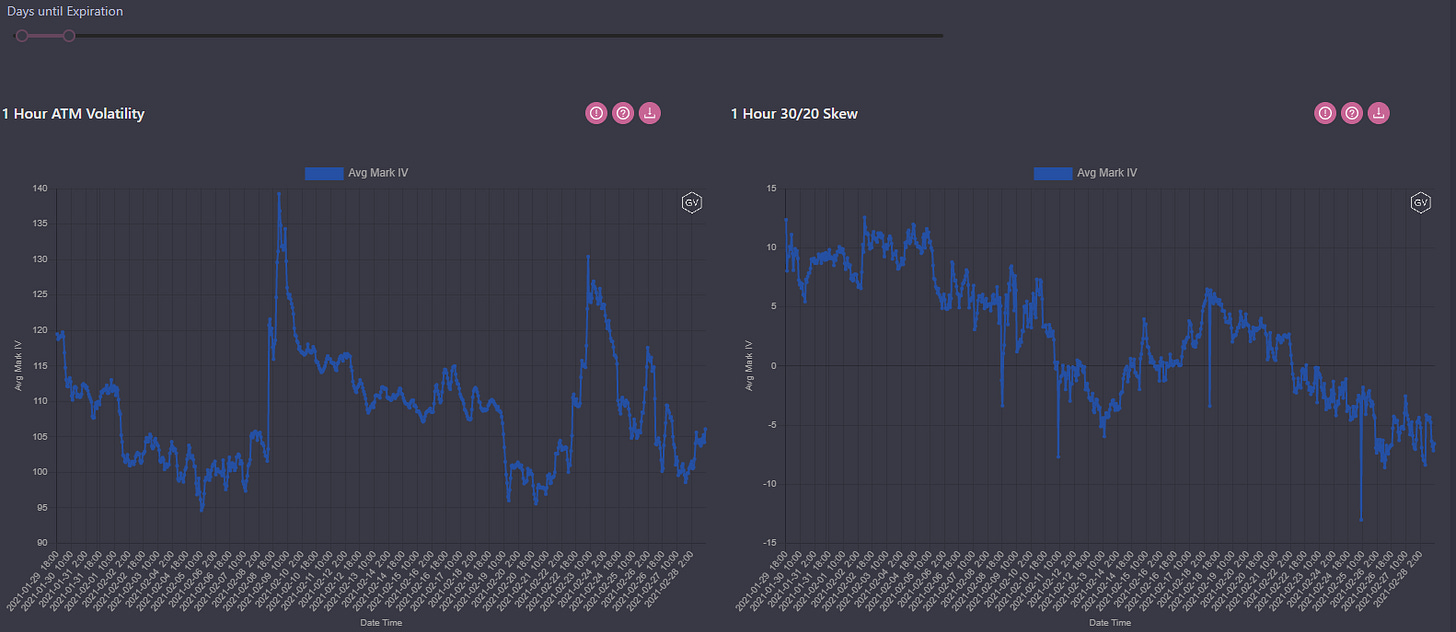

ATM/SKEW

(Feb. 28, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM volatility continued to trade in 95%-130% range, recently closing around the 105% level for selected maturities.

The bigger story is the skew profile. We are seeing a steady grind lower putting our skews into negative territory.

This type of put bid skew allows for interesting trade structures for traders attempting to “buy the dip”.

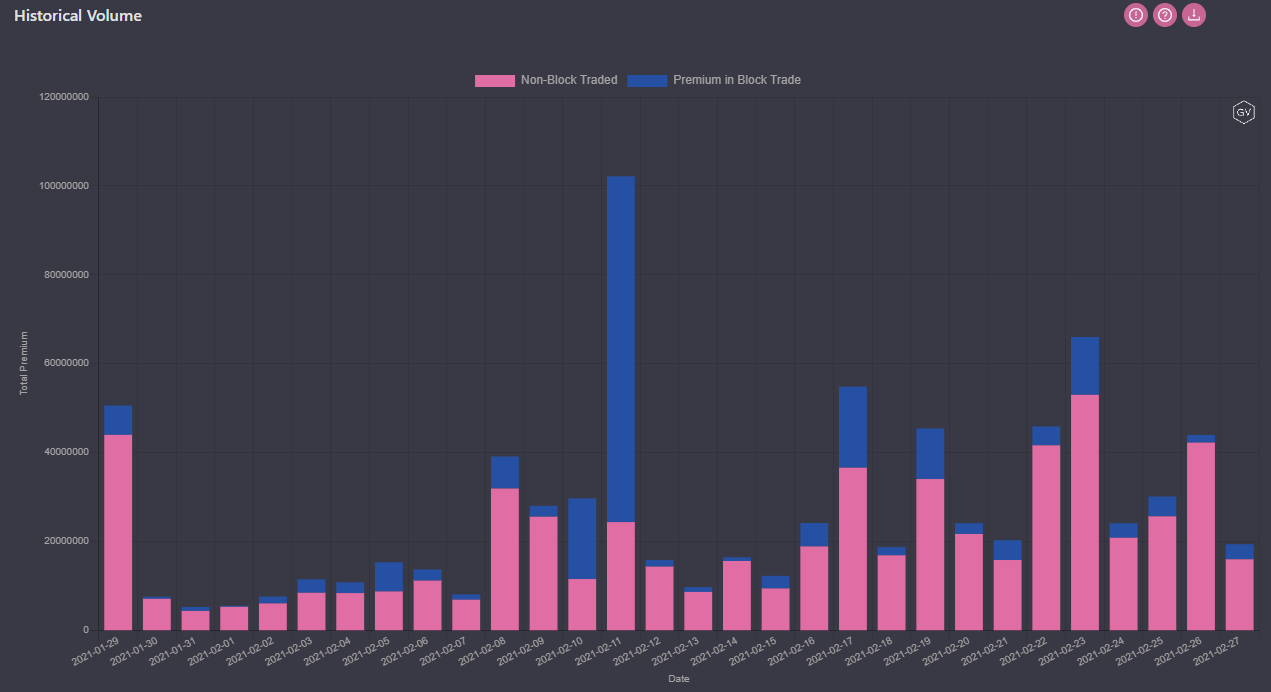

VOLUME

(Feb. 28, 2021 - BTC Premium Traded - Deribit)

(Feb. 28, 2021 - BTC Contracts Traded - Deribit)

Volumes are showing a pickup compared to those of early February, but there isn’t much outlier activity to be noted.

VOLATILITY CONE

(Feb. 28, 2021 - BTC Volatility Cone)

This week’s correction has lead to a nice pump in RV’s, especially around the 7-day and 14-day rolling windows.

We are still clearly in a high volatility range given RV’s exceeding the 75th percentile for nearly all measurement windows.

REALIZED & IMPLIED

(Feb. 28, 2021 - BTC 10-day Realized and Trade Weighted Implied Vol - Deribit)

Last week we were seeing a big RV discount compared to IV.

This week RV jumped high enough to completely reverse the RV/IV disconnect.

Now both are at near identical levels.

SKEWS

(Feb. 28, 2021 - ETH Skews - Deribit)

Last week, ETH skews had a undecided mixed picture.

We saw heavy NIKE “Swoosh” skew profiles… Which displayed an appetite for both put and call “tails” compared to ATM options.

This uncertainty could be read as an expectation of some volatility.

This week, short-term options are showing put bids while longer-term options are consistently big to the call side.

(Feb. 28, 2021 - ETH Skews - Deribit)

TERM STRUCTURE

(Feb. 28, 2021 - ETH Term Structure - Deribit)

Just like BTC, the ETH term structure saw a massive rally in short-dated IVs.

The term structure is now completely Backward.

We saw almost now change in long-dates IVs.

ATM/SKEW

(Feb. 28, 2021 - ETH ATM & Skews for options 10-60 days out - Deribit)

Notice the short-live rally in ATM implied vol.

ETH IV screamed higher jumping from 120% to 160% only to drop back around 130% by the end of the week.

The skew profile was much more consistent, steadily grinding lower as puts have become in demand for traders in these select expirations.

VOLUME

(Feb. 28, 2021 - ETH Premium Traded - Deribit)

(Feb. 28, 2021 - ETH Contracts Traded - Deribit)

ETH volumes saw a demand spike in both premium terms and contracts terms this week. This was likely due to just-in-time hedging demand.

VOLATILITY CONE

(Feb. 28, 2021 - ETH Volatility Cone)

Similar to BTC, 7-day and 14-day measurement windows saw a large spike in RV as ETH prices dropped lower.

REALIZED & IMPLIED

(Feb. 28, 2021 - ETH 10-day Realized and Trade Weighted Implied Vol - Deribit)

We also saw a massive correction this week of the IV/RV dislocation seen last week.