Crypto Options Analytics, Feb. 27th, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$37,709

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Feb. 27th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Current events have become unpredictable.

Not only are global events unfolding in a very chaotic fashion but subsequent implications of various scenarios are nearly impossible to predict.

Let’s think about the SWIFT banking sanctions on Russia.

These sanctions can become very bullish for crypto currencies as citizens and rival governments look for alternatives to USD fiat systems.

Although foreign governments may now begin to accumulate BTC en masse, western governments may simultaneous stigmatize crypto currencies and crypto market participants as “sympathizers” of foreign aggression.

A surprising de-escalation of aggression may materialize, easing tensions and altering demand.

That said, crypto currencies arguably should be pricing 0% skew, in our opinion… as vol. path can materialize in either direction.

Current option skew is slightly negative for long-term and medium-term options, while short-dated options are pricing -8 pts after nearly touching nearly negative -20pts during initial Russian aggression headlines.

(Feb. 27th, 2022 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Feb. 27th, 2022 - BTC’s Term Structure - Deribit)

The IV term structure has reacted strongly to events this week.

We are currently in deep Backwardation as markets swing about wildly, with the term structure itself being very unstable.

This week, the term structure has shifted from Backwardation to Contango three times.

Think of this environment as a high “vol of vol”.

ATM/SKEW

(Feb. 27th , 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV has swung about wildly.

Overall, a 75pts volatility for BTC is meager at best.

Crypto can easily hit 200+ vol and has many times in the past.

Skew had a nasty panic crash this week on the back of war headlines but has now managed to stabilize.

Open Interest - @fb_gravitysucks

BTC

The monthly closure was very interesting in several aspects.

A notional expiration of $1.6B, spot prices between $34k and $46K, and the contextual macroeconomic scenarios, gave both bulls and bears an opportunity to express their views with conviction.

In a few cases there was an informative open interest profile within the $40k and $50k strikes that described well the positions taken over the past few weeks.

In the end, the bears won and were rewarded with a good prize.

(Feb 25th, 2022 - BTC Notional - Deribit)

(Feb 25th, 2022 - BTC Dollar premium - Deribit)

BIG TRADES IN THE FLOW

A very active and dynamic week, which saw some very refined trades hit the tape.

The week started with a diagonal between March 40k and June 50k.

With prices well above $38k, a short-term bullish view expressed by $40k calls.

With the spot losing all supports and panic spreading across the markets, a seraphic trader took a good profit on a put spread, with remaining exposure partially rolled down.

Starting on the evening of the 24th, prices recovered all the lost ground, causing an intense upward option flow, with concentration around outright calls in March 40k and May 50k.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

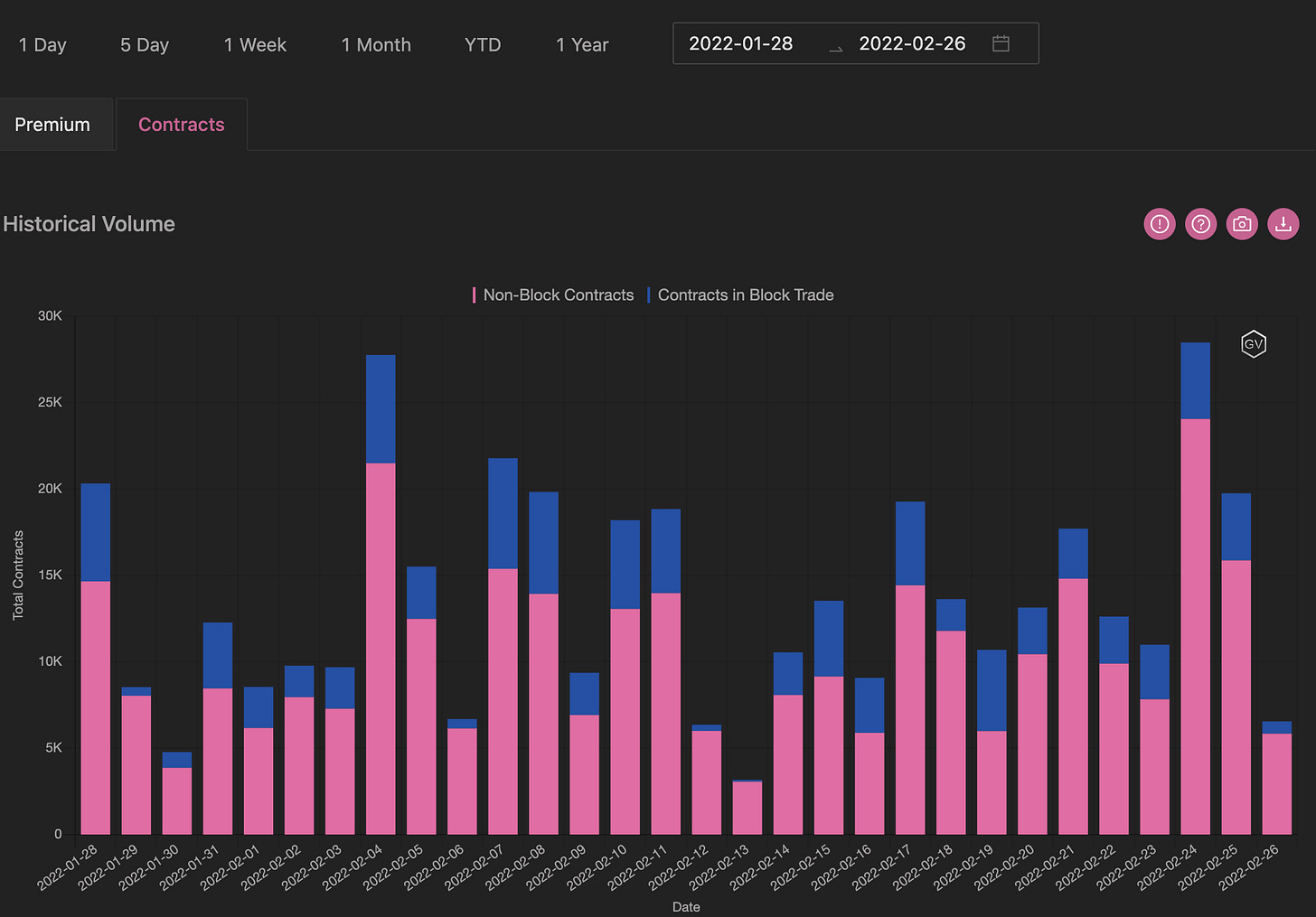

VOLUME

(Feb. 27th, 2022 - BTC Premium Traded - Deribit)

(Feb. 27th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Feb 21 to Feb 27)

Markets remain risk-off due to inflation and geopolitical risks. BTC reached a trough of 34500 and ETH touched 2300 when the Russo-Ukrainian war was declared, before rebounding into the weekend.

Realized volatility remains elevated amidst market uncertainty and IV has failed to climb higher. There has been limited gamma selling opportunities since the year-turn, as RV has been outperforming IV. RV is 17vols above IV in BTC and 22vols above IV in ETH at their peaks.

Skew nosedived on the day war was declared (24Feb) with 7-day 25d RR reaching a low of -19 in both BTC and ETH, before recovering to -5. Short dates remain well below long term’s, and skew remains negative across tenors.

(Feb 21 to Feb 27 - Volume Profile - Deribit & Paradigm)

In BTC, we saw more sellers in the most frequently traded strikes of 35k (2300x traded) and 40k (1600x traded), while buying the ATMs between 36-39k strikes. Puts accounted for 45% of the trading volume.

(Feb 21 to Feb 27 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

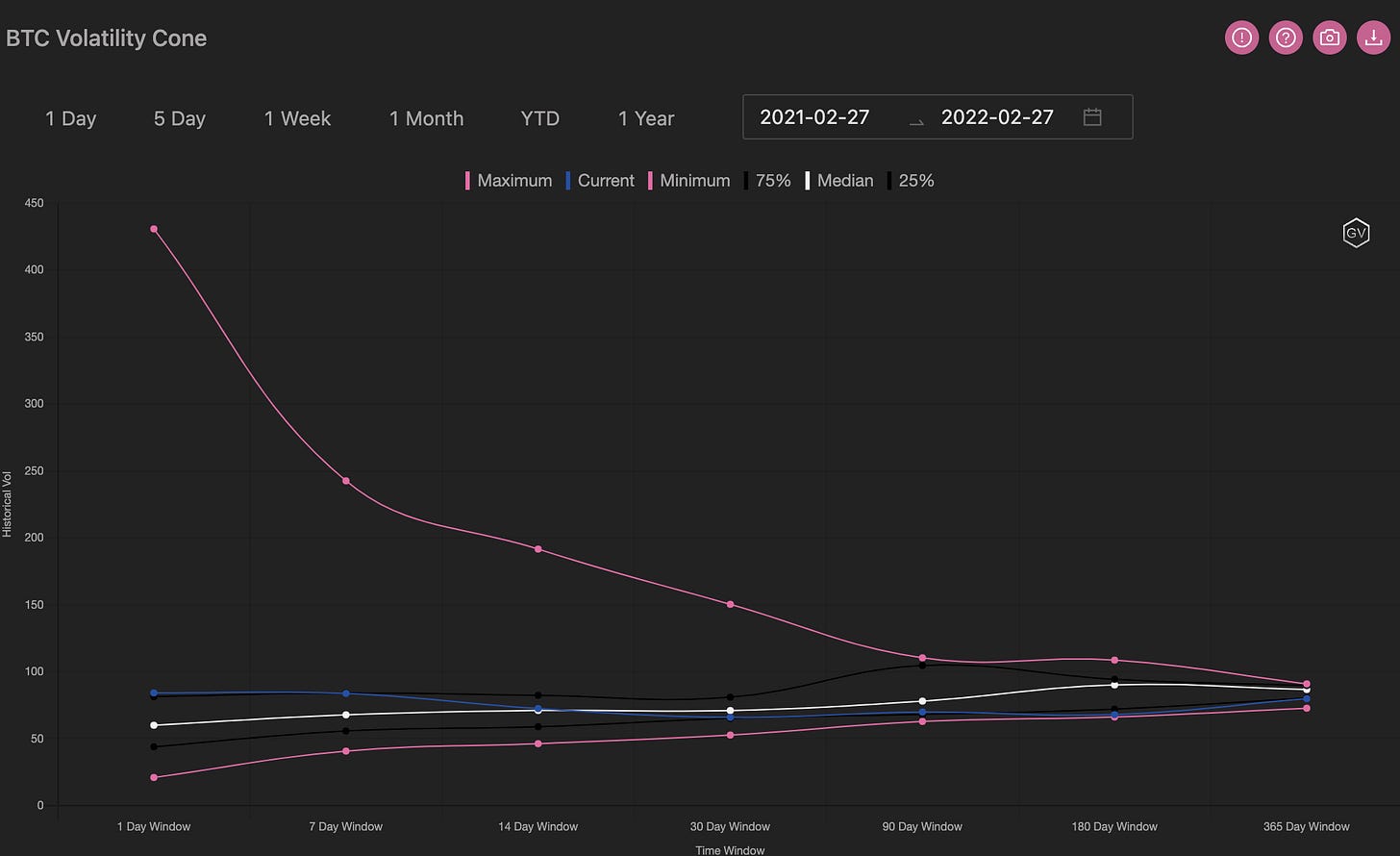

VOLATILITY CONE

(Feb. 27th, 2022 - BTC’s Volatility Cone)

Realized Volatility is seeing lift off.

Flirting with the upper 75th percentile, this week has been a payoff for vol. buyers.

We believe there’s no reason to think the volatility episode has concluded, although there may be lulls in between now and the next volatility spike.

REALIZED & IMPLIED

(Feb. 27th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV and RV have converged and are both trending higher.

We continue to lean towards buying volatility, especially in the longer maturities where negative skew is currently underestimating the potential for a massive +20k green candle, as BTC emerges as a viable alternative to traditional fiat systems.

$2,623

DVOL: Deribit’s volatility index

(1 month, hourly)

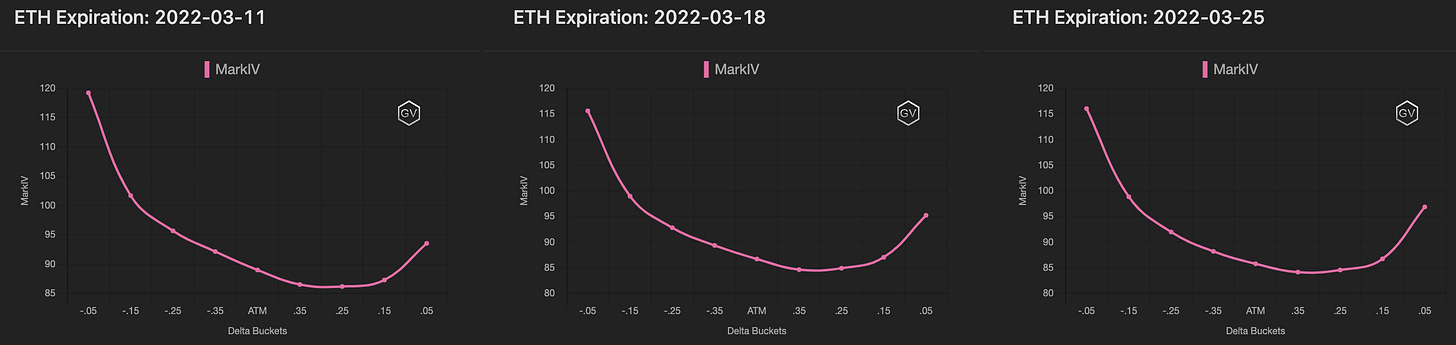

SKEWS

(Feb. 27th, 2022 - ETH’s Skews - Deribit)

ETH has a similar skew profile to BTC although slightly more negative in absolute terms.

Short-term skew has seen erratic moves this week and continues to remain the most negative maturity for ETH.

(Feb. 27th, 2022 - ETH’s Skews - Deribit)

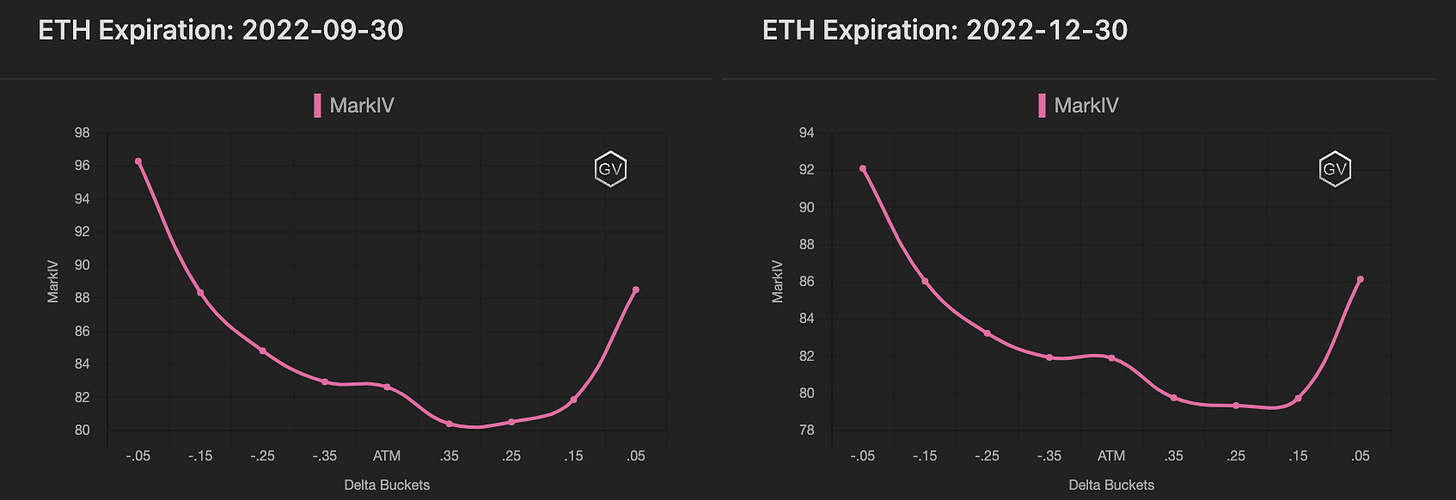

TERM STRUCTURE

(Feb. 27th, 2022 - ETH’s Term Structure - Deribit)

The term structure is currently in deep Backwardation and has seen three shifts between Contango and Backwardation this week alone.

Still, we continue to think IV is cheap in the medium to long-term maturities…

Short-term options can provide good short-volatility plays, as term structure reversals appear to be frequent.

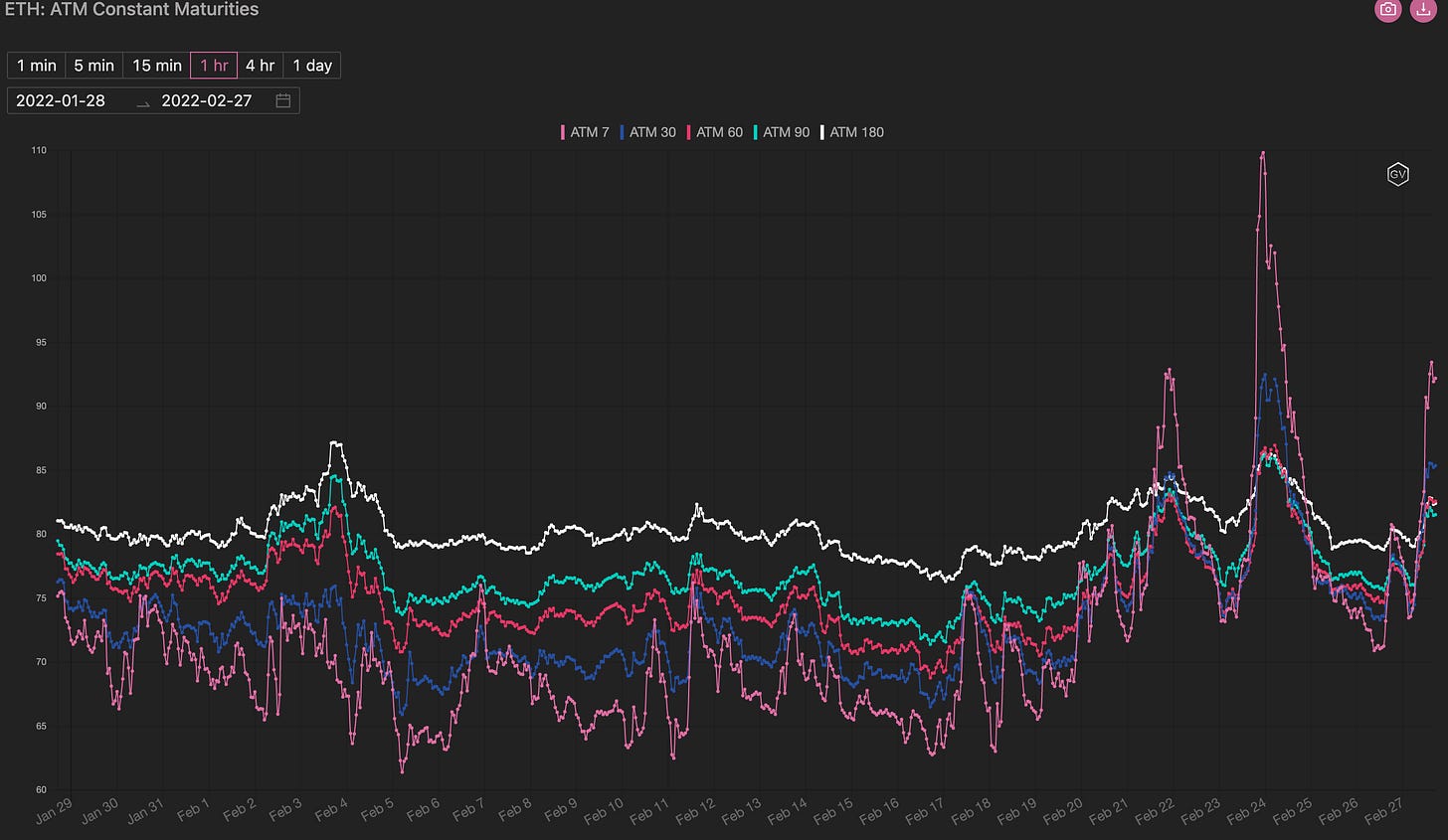

ATM/SKEW

(Feb. 27th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV of 87pts for ETH isn’t abnormally rich, historically speaking.

As volatility shifts up and down, we can expect an overall trend higher.

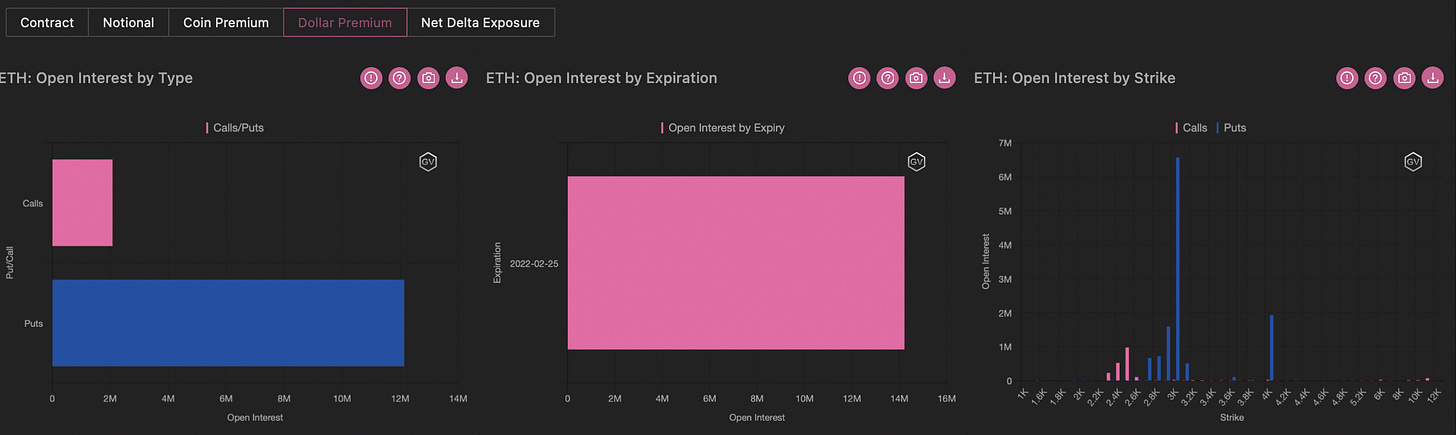

Open Interest - @fb_gravitysucks

ETH

The same context seen for Bitcoin also applies to the Ethereum expiration, with an absolute exposure of $1.1B notional.

The fluctuation in the monthly spot prices between 2.3k and 3.3k polarized the attention of traders around the 4k and 3k strikes, with the latter level having a two-way flow.

In the end, put holders won- with an impressive dollar premium at the 3k strike.

(Feb 25th, 2022 - ETH Notional - Deribit)

(Feb 25th, 2022 - ETH Dollar premium - Deribit)

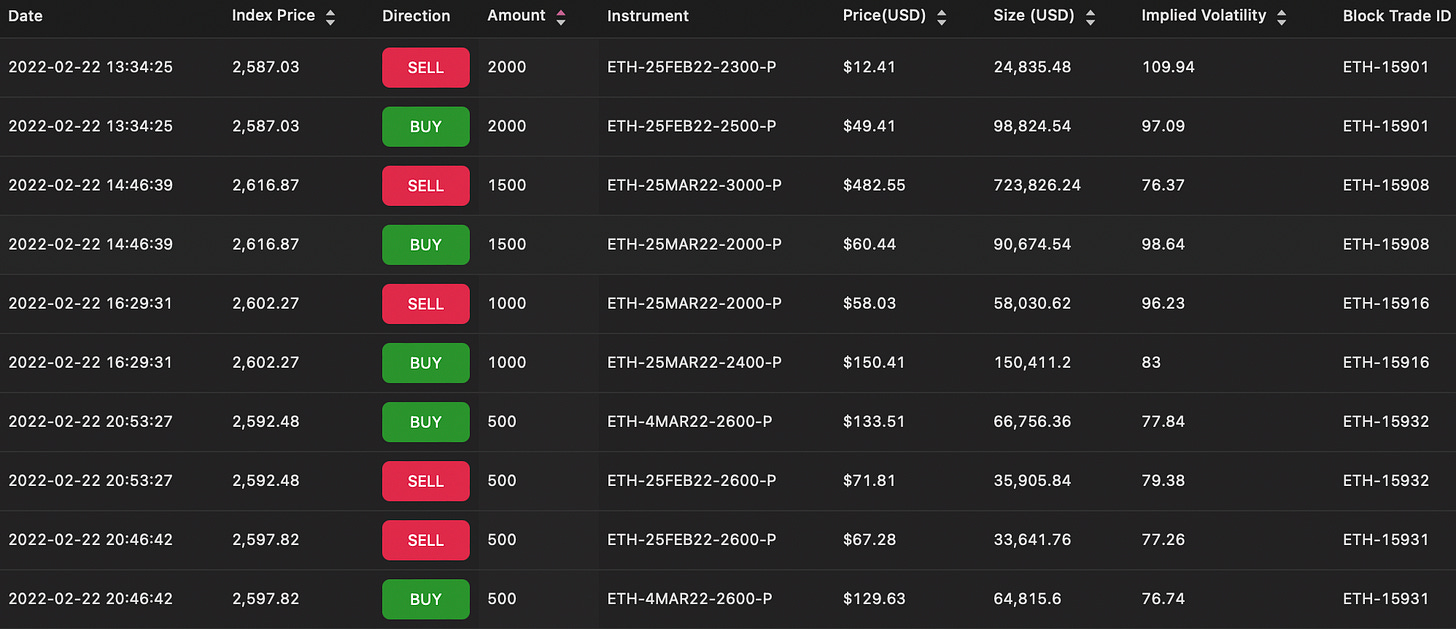

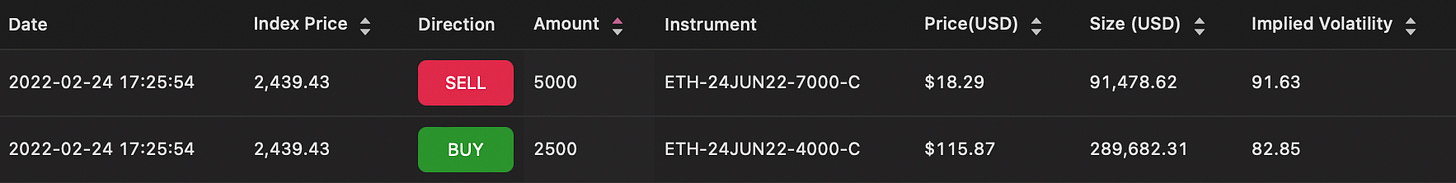

BIG TRADES IN THE FLOW

The week in Ethereum started with strong interest in puts with renewed positions in the lower strikes, spreads in March, and expiring positions rolled forward.

On the 24th, with exceptional timing, a daring trader bought TFD.

Apparently, when spot was below the security levels, there were no profit taking on opened protections. An interesting dynamic that perhaps suggests a more speculative spirit in the Ethereum flow compared to Bitcoin.

At the end of the day, with the index back in green territory, there was an unloading of puts and some newsworthy bullish positions such as this call 1x2 ratio, ideal after a volatility spike.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Feb. 27th, 2022 - ETH’s Premium Traded - Deribit)

(Feb. 27th, 2022 - ETH’s Contracts Traded - Deribit)

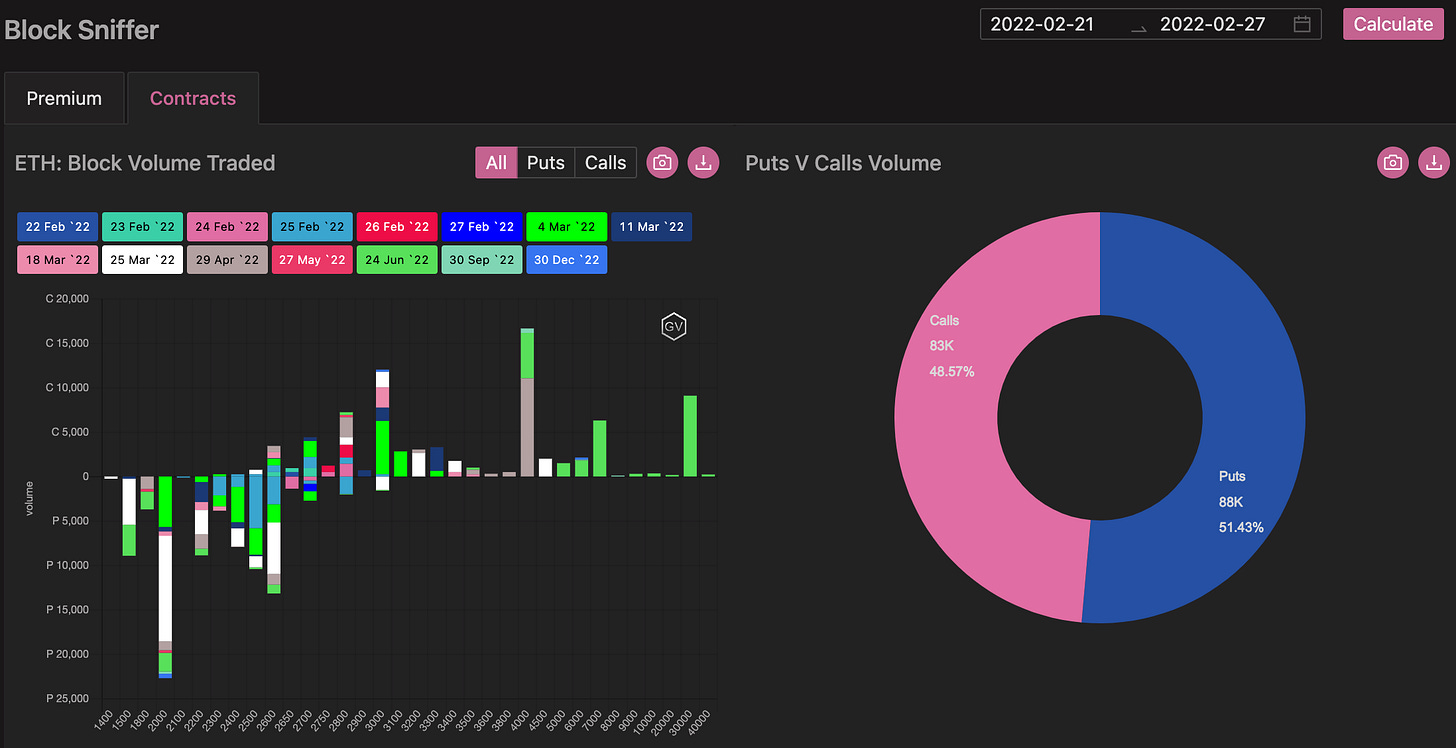

Paradigm Block Insights (Feb 21 to Feb 27)

In ETH, we saw more buying in the 2k-3k region, and the highest volume strike was 2100P at 23,000x. Puts were more heavily traded in ETH, accounting for 51.5% of the total volume traded.

(Feb 21 to Feb 27 - Volume Profile - Deribit & Paradigm)

(Feb 21 to Feb 27 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Feb. 27th, 2022 - ETH’s Volatility Cone)

ETH RV is starting to test the upper 75th percentile and could easily reach consistent +100pts levels, should current events remain chaotic, though we believe the “Alternative to fiat” thesis is better suited to BTC than to ETH.

REALIZED & IMPLIED

(Feb. 27th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Both RV and IV have been trending higher this week, but RV remains above IV.