Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$38,678

DVOL: Deribit’s volatility index

(1 month, hourly)

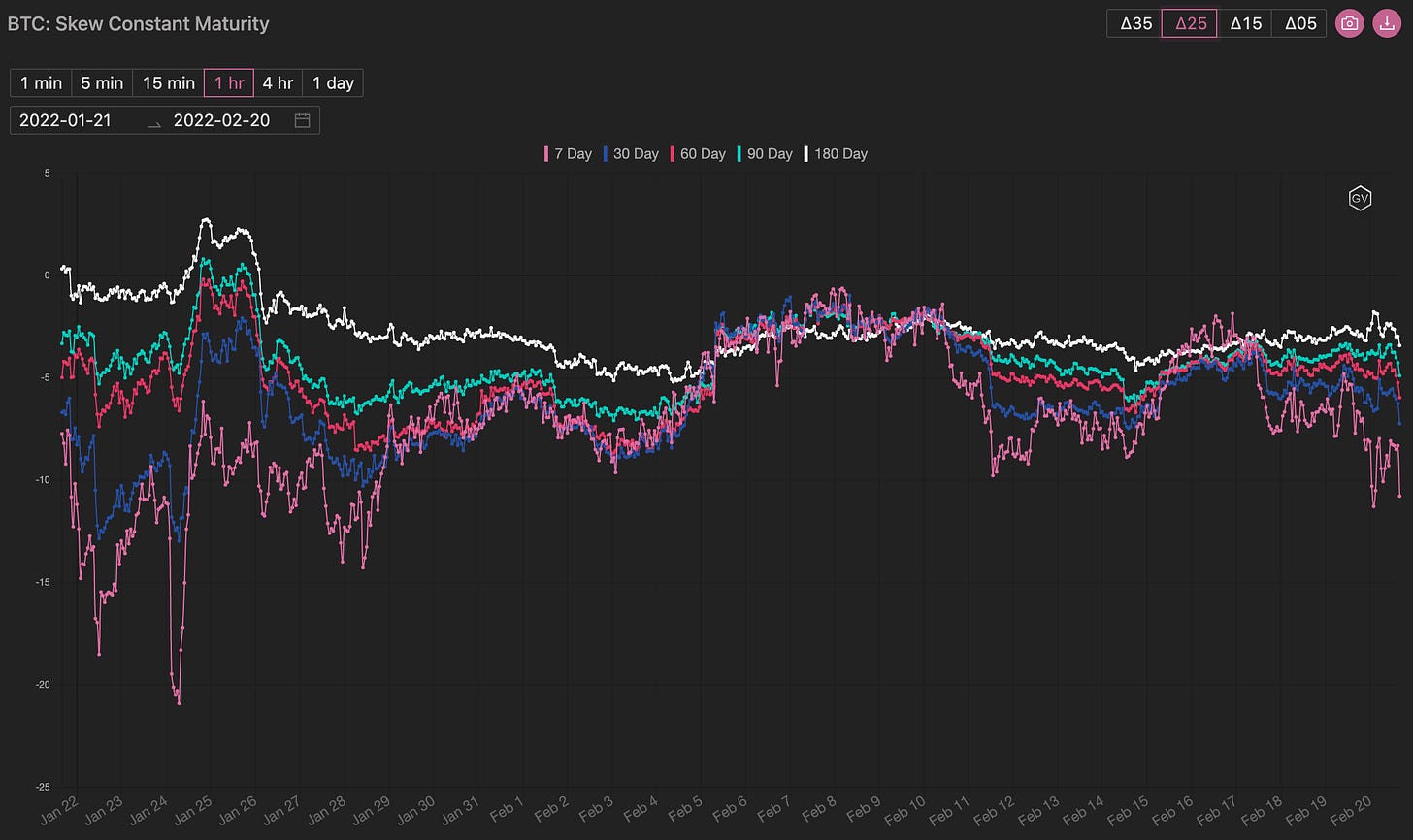

SKEWS

(Feb. 20th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Things continue to be extremely shaky in the world and crypto can move in either direction.

Our bias is that prices could spike lower in the short-term but rally significantly higher in the longer term.

Here’s some of our thinking:

Canada is freezing bank accounts and extending this into crypto on/off ramps. Combine this with potentially negative executive actions from the US White House. Bearish.

Decentralization is built EXACTLY for this reason and owning “self-custody” BTC becomes even more attractive in these situations… That said, the market needs time to “realize” this conclusion.

Bullish.

War:

Should war break out in Eastern Europe or South-East Asia, risk assets will suffer and the dollar will likely go bid (along with other historical “safe havens”). Bearish.

Beyond the panic of war, the longer-term truth is that wars are extremely expensive and inflationary… especially with ALREADY indebted countries and existing fiat systems. Crypto THEN becomes a very portable preservation of wealth… Bullish.

Inflation:

The Fed raises rates, IN ORDER to crash risk assets and halt “wealth gap" increasing” asset prices. Bearish.

If prices recover and then continue to rally, does the fed really have the wherewithal to KEEP hiking? Think “Volcker Style”. I think not. Very Bullish.

These three scenarios present interesting vol opportunities.

Short-term option maturities are leading the way lower for skew, as puts become bid, although we are still above January lows.

Long-term skew is also very negative - actually some of the most negative levels seen on record.

Long-term skew seems to be the most attractive, especially considering that overall implied volatility levels are cheaper than anytime during Q4 2021.

(Feb. 20th, 2022 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Feb. 20th, 2022 - BTC’s Term Structure - Deribit)

The front-end of the term structure is starting to see “lift-off”.

Although, overall, the term structure is almost unchanged week-over-week and IV remains rather low compared to the previous 5 months.

Short-term vol. bets remain tough to trade as gamma will likely have a binary “pay-off”… timing the event headlines will be hard on a week-to-week basis, but the next 90-days are likely to contain a market moving event (in our opinion).

ATM/SKEW

(Feb. 20th , 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

Medium-term volatility is testing February highs but remain near mid-range for the month.

Skew is also “waiting to see” as we hover in the mid-range.

Betting on lower skew for medium-term options seems like a decent probability play, as the events we previously highlighted might impact crypto in the medium-term.

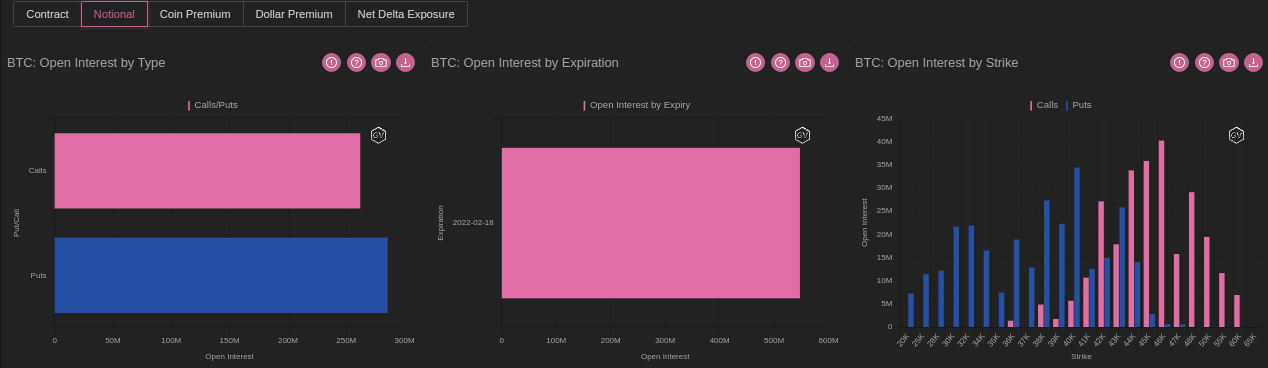

Open Interest - @fb_gravitysucks

BTC

A truly disappointing expiry on Friday. With around 13k open contracts, it was the worst weekly in over a year. Spot prices had no distinct direction and the macro correlation with risk-off scenarios have not enticed traders looking for short-term speculation.

(Feb 18th , 2022 – BTC Notional – Deribit)

(Feb 18th , 2022 – BTC Dollar premium – Deribit)

BIG TRADES IN THE FLOW

The options scanner clearly highlights market sentiment of traders seeking protection at the $40k key level; however, there is no significant flow - think big positions - to underline the prevailing uncertainty.

(BTC Options scanner – Deribit)

Earlier in the week, with the index well above $43k, there were some interesting short-term calendars with an upside bias expressed through exposure above $50k.

Late Thursday evening, a shrewd trader took a position by betting on the usual Friday effect of DOVs. This trade gained over 8 volatility points over the next few hours.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

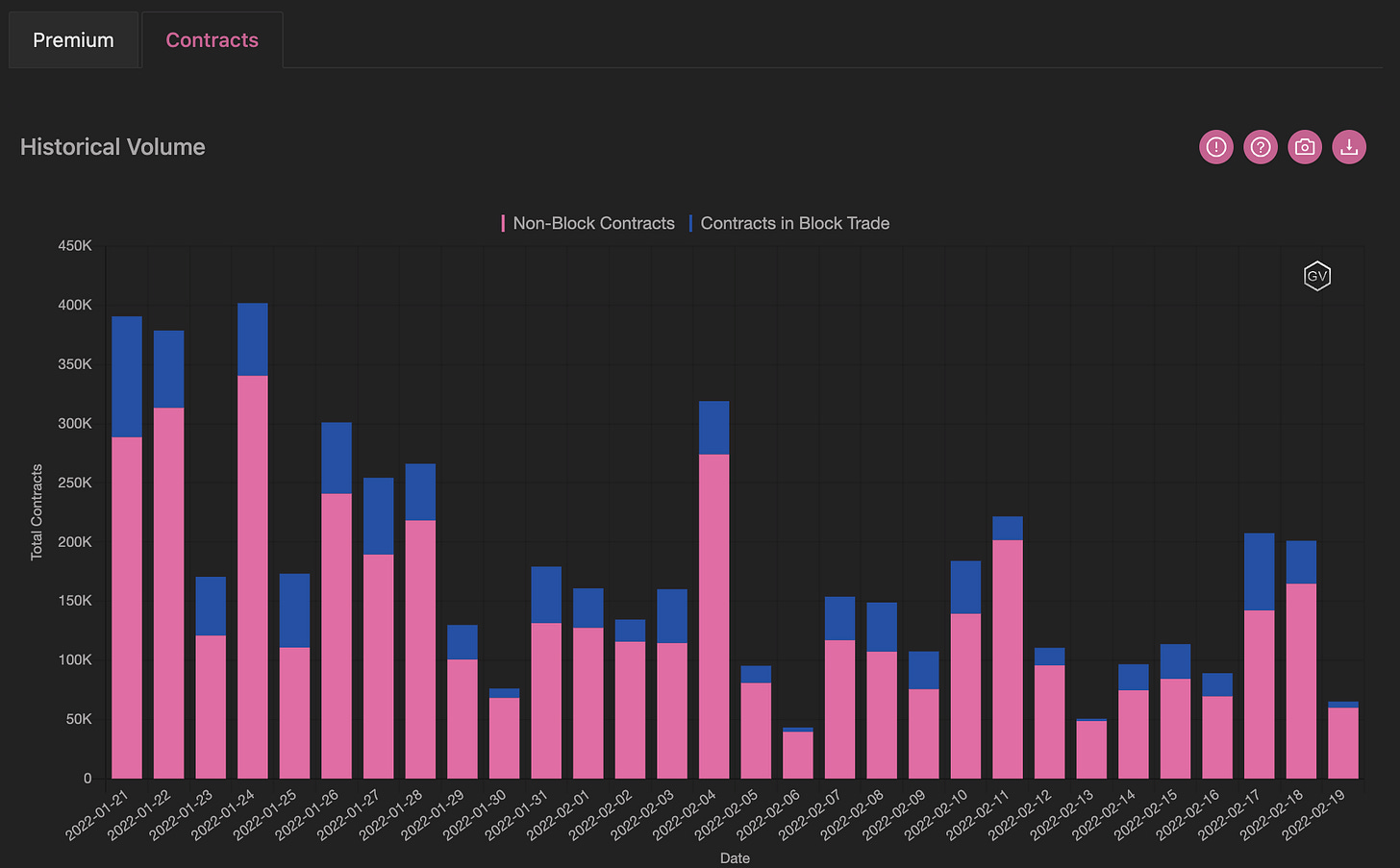

VOLUME

(Feb. 20th, 2022 - BTC Premium Traded - Deribit)

(Feb. 20th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Feb 14 to Feb 20)

Spot drifted lower in both BTC & ETH into the weekend as the macro backdrop remained weak, and geopolitical risk remained elevated as things turned for the worse on 17 Feb.

IV once again remained calm, with BTC & ETH trapped around 65 / 75 while skew continued to move in favor of puts across both BTC & ETH. BTC skew recovered to as high as -3 before closing the week closer to -8 and ETH followed suit posting a -4 to -9 range.

In BTC, the most popular strike of the week was 40k where we - on a net basis - saw outright selling of Feb-March puts, 25Feb straddles, call spreads (40k/42k) and put spreads (40k/38k). Both call & put spreads remained popular, making up 61% of overall volumes.

We took down particularly high amounts of flow on Feb 16 & 19 where we were 35% of the overall market and 40% of BTC, respectively.

(Feb 14 to Feb 20 - Volume Profile - Deribit & Paradigm)

(Feb 14 to Feb 20 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Feb. 20th, 2022 - BTC’s Volatility Cone)

Realized volatility is currently in “wait and see” mode, as we test the lower 25th percentile band.

This is important when comparing with the IV/RV relationship below.

REALIZED & IMPLIED

(Feb. 20th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

We still think IV is attractive to buy in the medium- to long-term.

With RV near the lower 25th percentile band, we’d expect IV to remain higher than RV as volatility is “mean reverting”… Yet, we currently see a tight relationship between the two.

The chaotic world is not in the “lower 25th percentile” of situational risk…Implied volatility in other asset classes is pricing in risk that crypto is not. Hence the opportunity.

$2,647

DVOL: Deribit’s volatility index

(1 month, hourly)

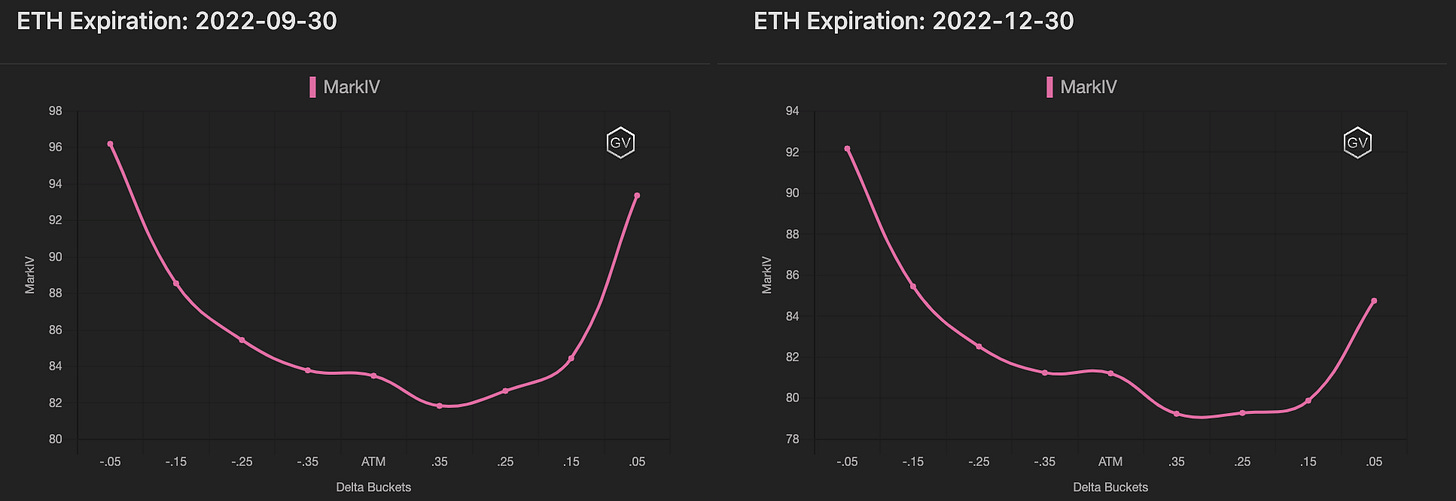

SKEWS

(Feb. 20th, 2022 - ETH’s Skews - Deribit)

ETH is actually getting a head start repricing volatility higher and skew lower.

We can see the ETH DVol index moving higher this weekend along with option skew becoming much more negative for short-term options.

However, long-term skew is holding its line and refusing to dip lower.

(Feb. 20th, 2022 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Feb. 20th, 2022 - ETH’s Term Structure - Deribit)

Week-over-week, the term structure has moved higher across all expirations.

We’re also seeing convergences between maturities as the term structure finds a flattening shape.

Options prices are starting to price and reflect risk.

ATM/SKEW

(Feb. 20th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Notice that ATM vol for medium-term options is now breaking above the February high, while option skew heads back towards monthly lows.

Traders are buying puts and reshaping the volatility surface.

Open Interest - @fb_gravitysucks

ETH

Unlike BTC, this was a really interesting weekly expiration for ETH. ETH oi was over 190k contracts and had a notional exposure greater than bitcoin. This signal is worth paying attention to, since in the past it happened near the historical highs for the ETH/BTC pair and right before spot price corrections.

(Feb 18th , 2022 – ETH Notional – Deribit)

(Feb 18th , 2022 – ETH Dollar premium – Deribit)

BIG TRADES IN THE FLOW

In bitcoin, we saw the need for hedging; but here in Ethereum, we see a desire for speculation. That is usually never a good thing when accompanied by a lateral-descending phase in price.

The June call spread of $7k- $10k dominated the tape; however, it seems that market-makers have reduced inventory for the higher strike. This dynamic leaves some uncertainty on the trade, which could in fact merely be a “roll-down” of a previous position.

(ETH Options scanner – Deribit)

(Feb 17th , 2022 – ETH Time and Sales – Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Feb. 20th, 2022 - ETH’s Premium Traded - Deribit)

(Feb. 20th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (Feb 14 to Feb 20)

In ETH, volume was dominated by the June 7k/10k call spreads, where strong buying interest was seen & we traded almost 13k contracts per leg.

Lastly, we also saw significant interest in rolling risk via diagonal spreads from Feb out to March & April, with a shift towards wingier strikes in both calls and puts.

(Feb 14 to Feb 20 - Volume Profile - Deribit & Paradigm)

(Feb 14 to Feb 20 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Feb. 20th, 2022 - ETH’s Volatility Cone)

ETH RV is relatively higher along the volatility cone than BTC.

Currently, readings hover near the median, as opposed to the lower 25th percentile band.

REALIZED & IMPLIED

(Feb. 20th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The RV/IV relationship remains interesting for volatility buyers.

Despite RV being around the median (actually slightly below) IV is priced lower than RV.

This relationship, given the RV volatility cone context and the potential fundamental volatility catalysts, creates a continued long vol. bias.