Crypto Options Analytics: Feb. 16th, 2025

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

Monday - (Holiday) President’s Day

Wednesday 2pm - FOMC Fed Minutes

*Various Fed governors speak throughout the week*

MACRO

This upcoming week will start off slowly with a market holiday followed by the FOMC minutes on Wednesday. There’s likely going to be good insights around the impact of trade/tariff policy and government job cuts from DOGE, which means FOMC minutes (or “Fed Speak” during the week) could move certain markets.

Last week we had the CPI number come in at +0.50% for January versus +0.30% expected.

The January number is special since a lot of “forward year” price hikes occur in January, which makes it a hard month to predict.

This CPI “bad print” along with last Thursday’s PPI number will likely be talked about during the various “Fed speak” events this upcoming week.

Bond futures spiked down on the CPI print last week only to be lifted higher post PPI, closing the week nearly unchanged.

Rates could move during the week from Fed Speak and USD from Tariff speak, but equities look strong as VIX finally moves lower.

I continue to think crypto remains quiet for a bit.

The strong VIX futures Contango bodes well for equities as SPX is back to all-time-highs.

BTC: $96,906 (+0.67% / 7-day)

ETH :$2,675 (+1.3% / 7-day)

SOL :$188.48 (-5.92% / 7-day)

Crypto

Some bullish headlines hit for BTC last week but that didn’t materialize into any real spike higher for spot prices.

For example: 13F Filing shows $437m IBIT investment from Abu Dhabi

Combine this news with bearish memecoin market drag (a source of bearish headlines) such as the $Libra drop, pump-fun mania and growing supply of alts and I see this market in stand-still.

Together this reinforces my “sideways” market, lower volatility market thesis.

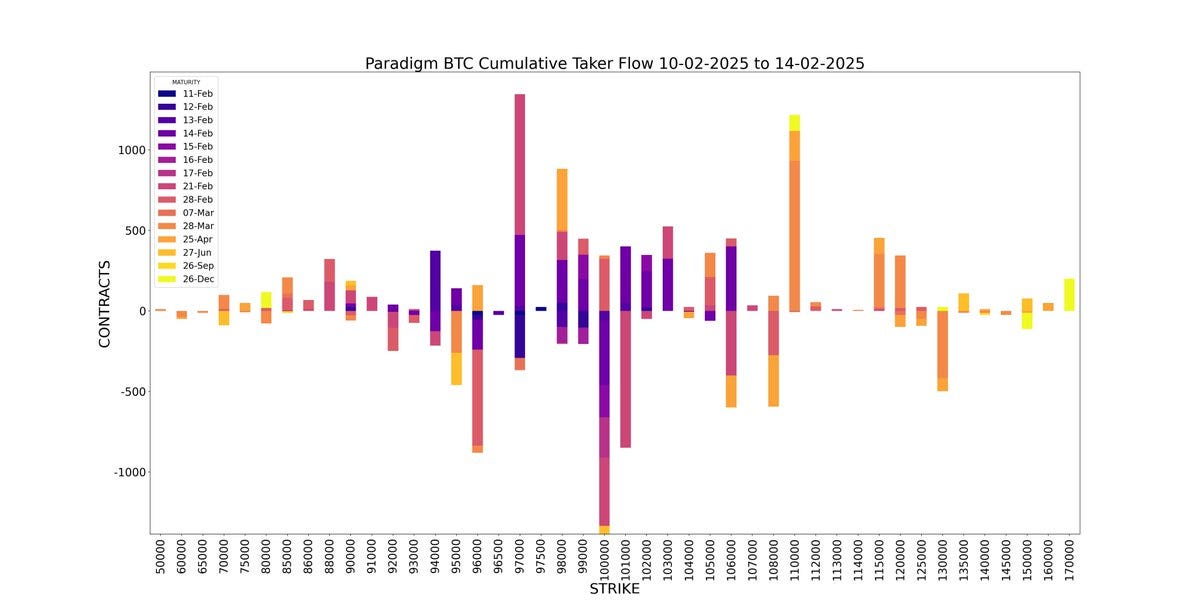

Looking at the month-to-date flows for on-screen traders… the buying of March $110k calls has been the most active trade. I can’t help but think vol buyers are going to get burned here.

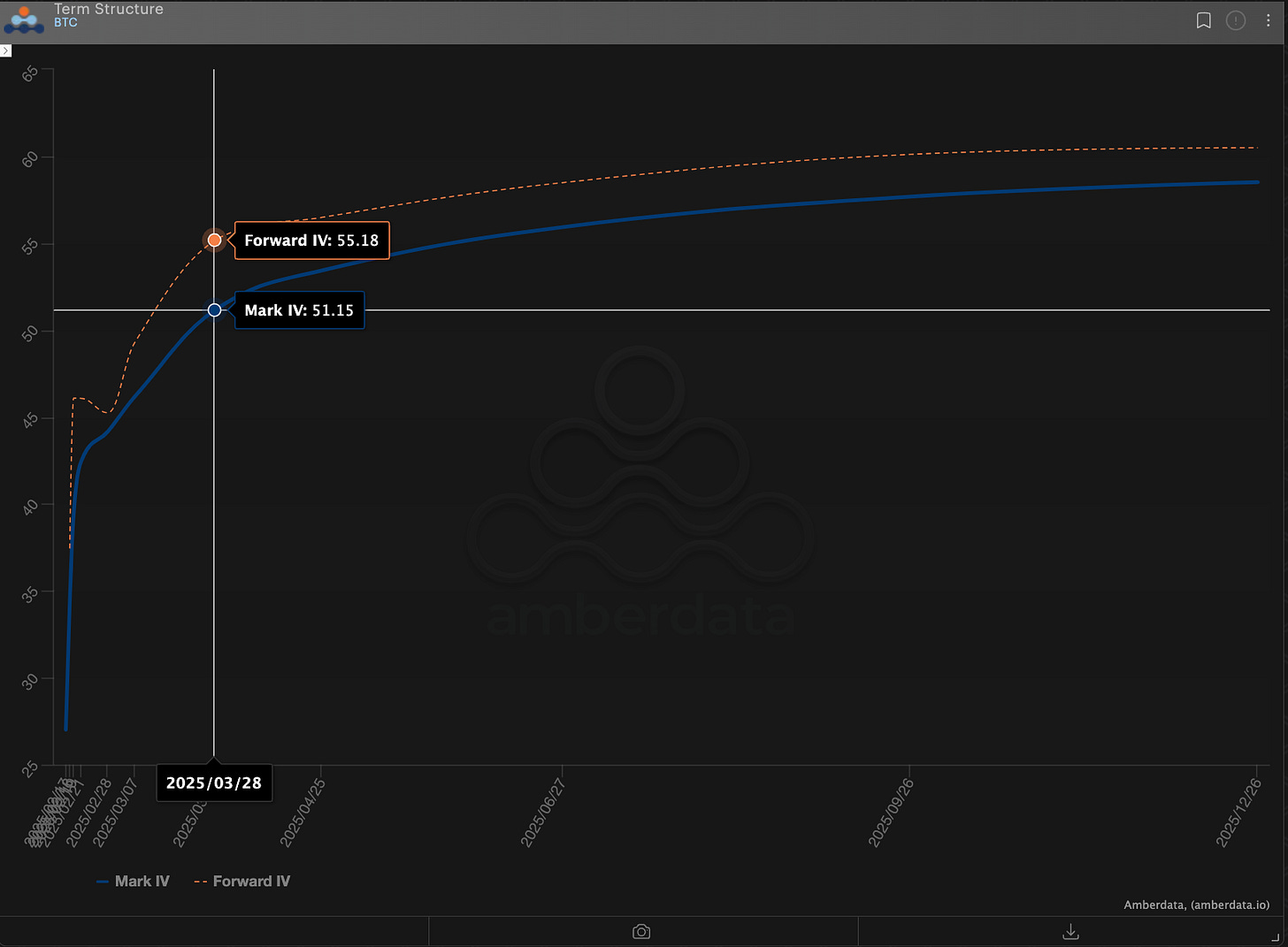

The march 28th expiration is the start of the Contango term structure “roll-down”.

If we contextualize this term structure Contango historically, we can see this as a pretty steep Contango. Meaning this Vega “drag” lower will quickly decay these options.

Combined with a low “vol-of-vol” and non-reactive news headlines, I see this as proof there’s stability in this volatility term structure shape.

Which suggests to me that realized will likely continue to underperform implied, as show above in the “realized VRP chart”.

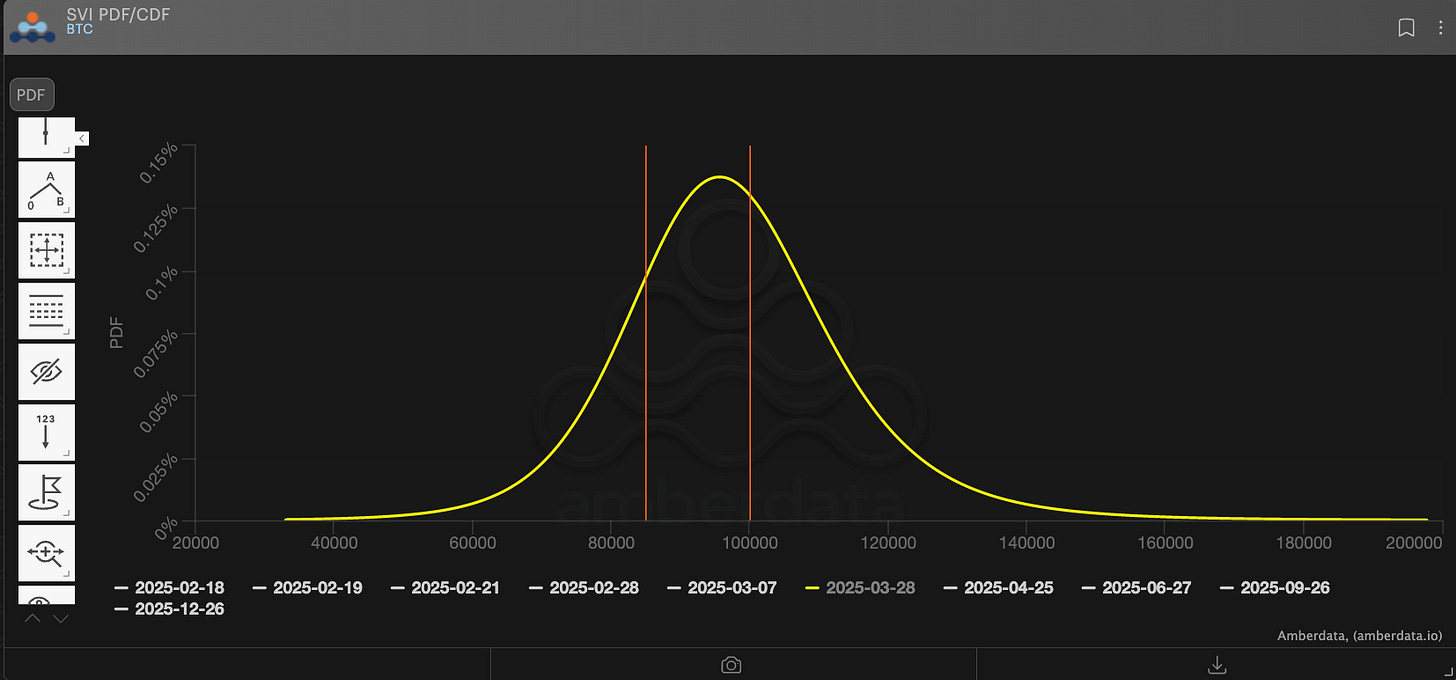

This makes the below March 28th probability range an interesting sell, imo.

TL-DR: The market continues to seem fatigued and consolidation (digestion) is the most likely outcome in my opinion. March 28th is the most interesting expiration to sell as on-screen traders continue to bid it.

There’s decent term structure “roll-down” to capture given VRP and stable vol-of-vol.

Paradigm's Week In Review

Paradigm Top Trades This Week

Weekly BTC Cumulative Taker Flow

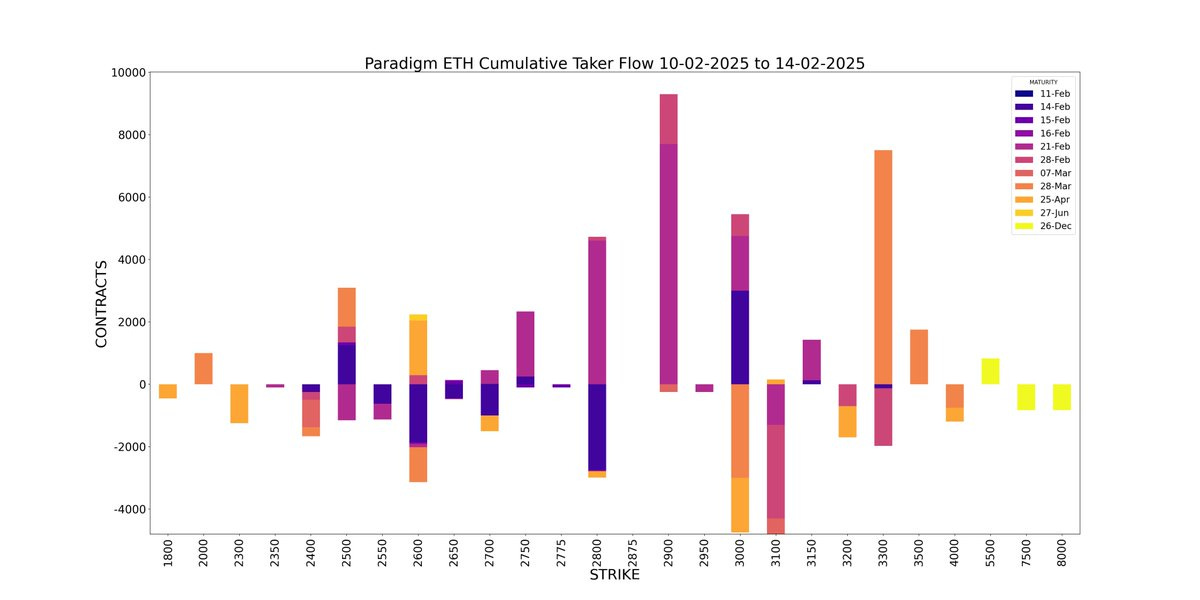

ETH Cumulative Taker Flow

BTC Cumulative OI

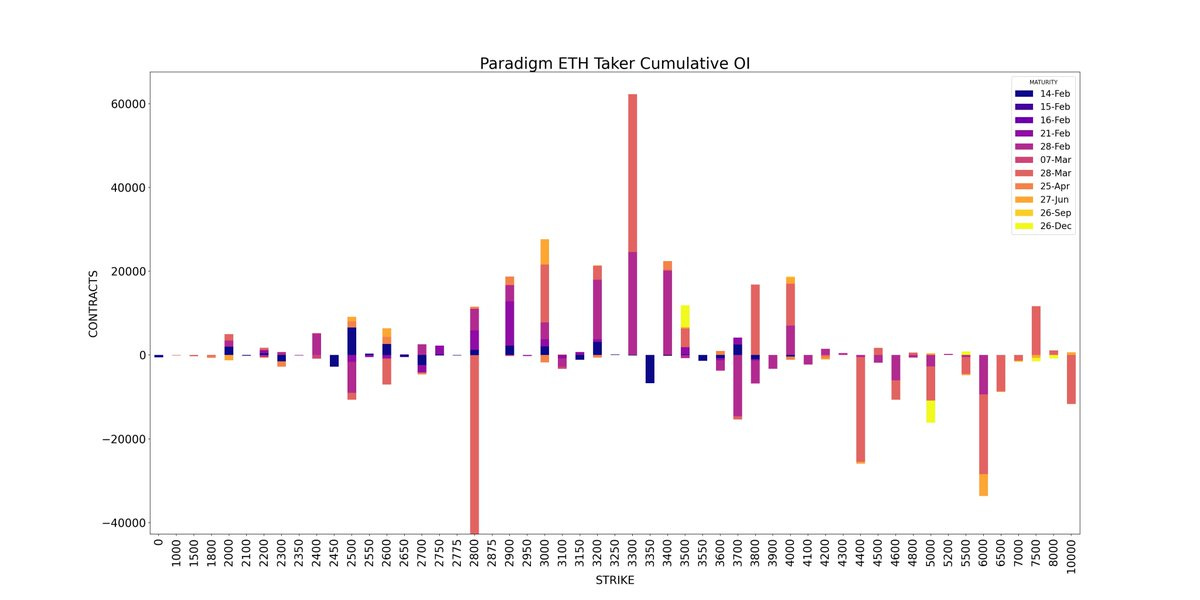

ETH Cumulative OI

BTC

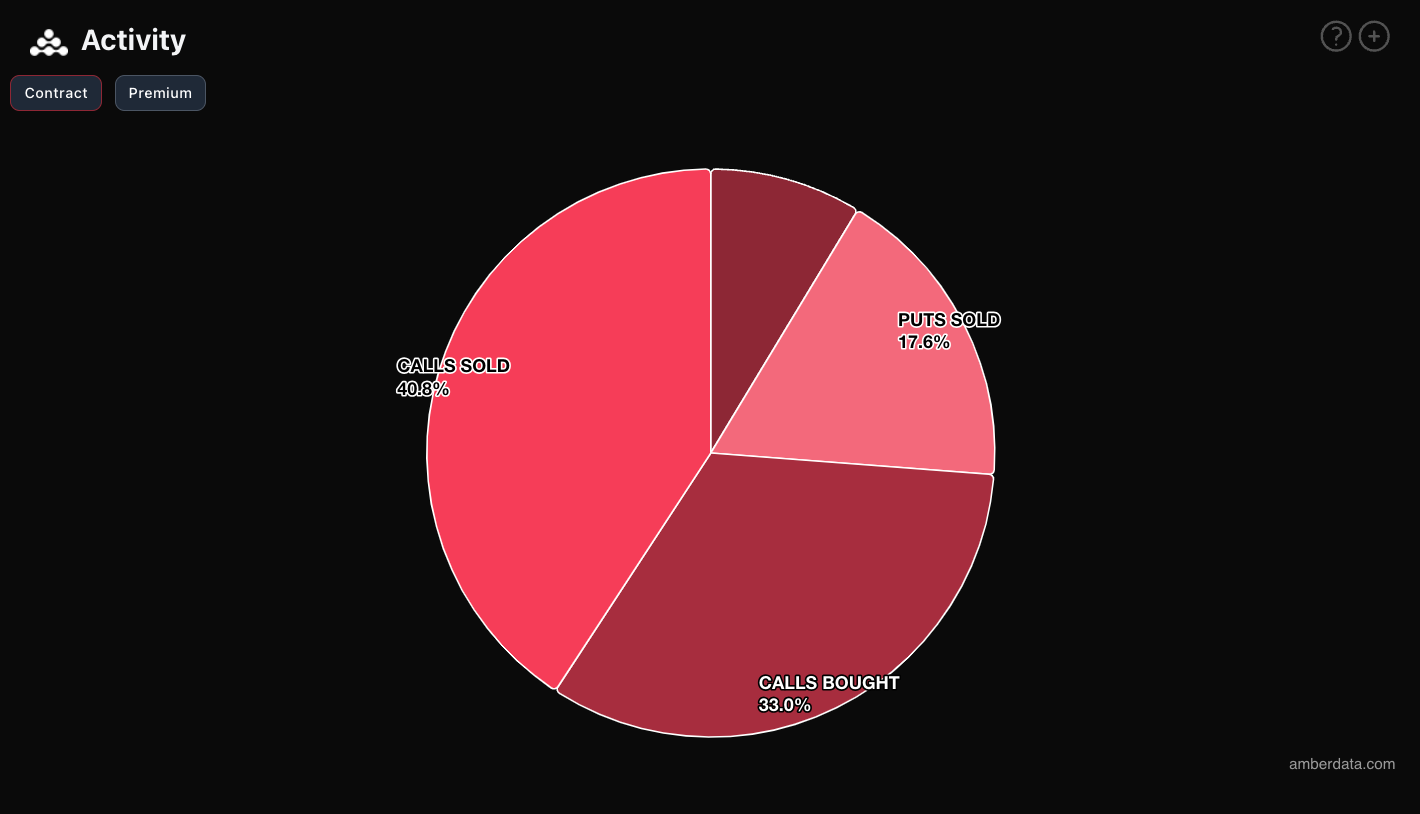

ETH

BTC Options

ETH Options

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.