Crypto Options Analytics, Feb. 14th, 2021

Headline theme: "The option market is feeling cautious. Despite the massive spot price rally, skews did not rally and became more negative."

Visit gvol.io

Disclaimer: Nothing here is trading advise or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

To trade visit: Deribit, Bit.com, Okex, Delta.Exchange, Hegic, Opyn, Primitive

For a Chinese translation visit our partner: TokenInsight

For best execution with multiple counter-parties and anonymity visit: Paradigm

For crypto options podcast content visit: The Crypto Rundown

Bitcoin is flirting with the big $50k level, we’ve rallied hard and fast up to this point!

The big question on everyone’s mind… “When do we get a market correction” ?

Do we breach $50k and go straight up to $100k?

Or do prices breach $50k only to “Bart Simpson” back down?

Let’s look at how the option market is positioned.

SKEWS

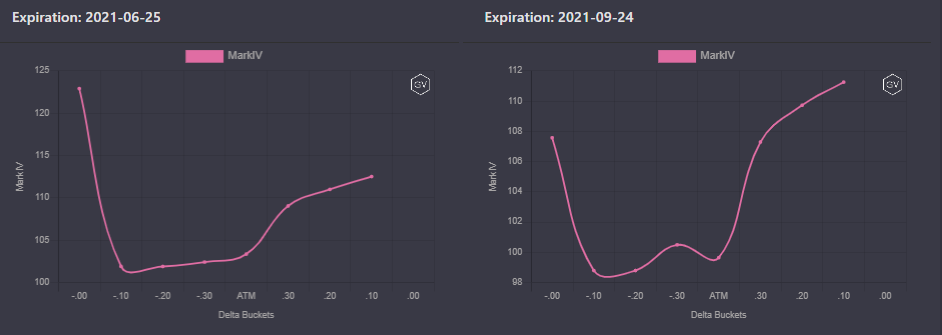

(Feb. 14th, 2021 - Short-term and Medium Term BTC Skews - Deribit)

This Monday we saw Elon Musk announce that Tesla would be buying $1.5B of Bitcoin and accepting Bitcoin as payment.

This sent BTC spot and BTC vol. shooting up!

Yet, we see options displaying a more negative skew than we’re used to. This is unusual given the trend for the past 4 months has been; spot up, vol. up, skew up.

(Feb. 14th, 2021 - Long Dated BTC Skews - Deribit)

Longer term expirations are also seeing an elevation in the “tail” put vol.

TERM STRUCTURE

(Feb. 14th, 2021 - BTC Term Structure - Deribit)

The BTC term structure continues to be in backwardation. Signaling a high vol. environment. No surprise here.

Given the awesome Musk surprise, our call for a volatility drop was foiled. BTC IV has gained about +5 points since this time last week.

ATM/SKEW

(Feb. 14th, 2021 - BTC ATM & Skews for options 10-60days out - Deribit)

Note that IV was quickly faded back down after Elon Musk’s twitter action.

More surprising is how the volatility skew reacted to the news. Traders seem to have used the price rally as an opportunity to buy put protection.

VOLUME

(Feb. 14th, 2021 - BTC Premium Traded - Deribit)

(Feb. 14th, 2021 - BTC Contracts Traded - Deribit)

Feb. 8th saw a spike in volume for both premium and contracts traded on Deribit, but on Feb 11th, we saw HUGE spikes in premium being block-traded on Paradigm.

We noted this flow on twitter. Large JUN-DEC futures spreads being traded synthetically.

VOLATILITY CONE

(Feb. 14th, 2021 - BTC Volatility Cone)

7-day and 14-day realized volatility saw a spike higher due to this week’s action.

Most of the realized volatility continues to hold steady otherwise.

REALIZED & IMPLIED

(Feb. 14th, 2021 - BTC 10-day Realized and Trade Weighted Implied Vol - Deribit)

Notice the large divergent spikes between the realized volatility and where the IV traded.

This displays the short-lived nature of the implied vol. enthusiasm seen this week.

SKEWS

(Feb. 14th, 2021 - ETH Skews - Deribit)

Although our BTC implied volatility bias was foiled last week, our ETH call was a little better.

Implied Vol. dropped about 10 pts last week with the passage of CME’s ETH futures product launch. We’re extremely happy to see Ethereum gain new adoption.

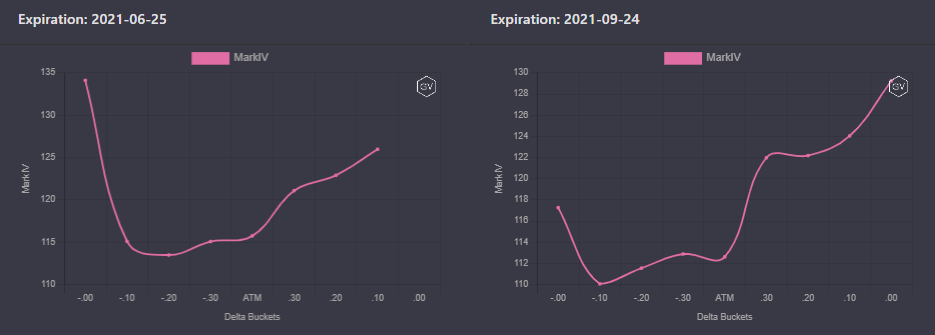

All options saw a more negative skew this week.

(Feb. 14th, 2021 - ETH Skews - Deribit)

The June 25th expiration notably stands out for the increased bid found on the put “tail”.

TERM STRUCTURE

(Feb. 14th, 2021 - ETH Term Structure - Deribit)

Except for a shift down in IV, the term structure looks nearly identical to last week.

It’s important to note this backwardation DOES signal the potential for large moves in ETH over the next few months.

Although we feel that ETH vol. could drop 25pts… that would still be 100% IV. This is an extremely high volatility level compared to almost ANY other asset.

ATM/SKEW

(Feb. 14th, 2021 - ETH ATM & Skews for options 10-60days out - Deribit)

Notice that the BTC/Tesla announcement had almost no impact on Ethereum volatility.

Like BTC, ETH skew is now near negative territory.

VOLUME

(Feb. 14th, 2021 - ETH Premium Traded - Deribit)

(Feb. 14th, 2021 - ETH Contracts Traded - Deribit)

ETH option volumes had no significant deviations last week.

VOLATILITY CONE

(Feb. 14th, 2021 - ETH Volatility Cone)

Although realized volatility remains above the 75th percentile across the board, we did see a softening of RV compared to last weeks reading.

REALIZED & IMPLIED

(Feb. 14th, 2021 - ETH 10-day Realized and Trade Weighted Implied Vol - Deribit)

Both ETH implied vol. and realized vol. are seeing a grind lower. IV is also currently trading a premium to RV.