Crypto Options Analytics, Feb. 13th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$42,299

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Feb. 13th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Uncertainty has just increased this week.

Potential war brings a lot of unknown unknowns, but war aside, CPI inflation and the associated fed reaction is also creating the potential for a large move in either direction…

Should the fed under-react to inflation, BTC could begin to make sharp moves higher… Should the Fed aggressively combat inflation, the opposite spot move could be triggered.

Option skew retreated back into negative territory late last week, a move led by short-term expirations.

(Feb. 13th, 2022 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Feb. 13th, 2022 - BTC’s Term Structure - Deribit)

Despite the potential for large spot spikes materializing, implied volatility remains nearly unchanged week-over-week.

The term structure is also displaying a steep contango shape, with front-expiration to medium-expiration being about 12pts wide.

ATM/SKEW

(Feb. 13th , 2022 - BTC ATM & Skews for options 10-60 days out - Deribit)

Looking at average implied volatility for select maturities, we see a rather stubborn chart, which barely reacts to any of the events this week.

Select maturity skew continues to whip back-and-forth, providing interesting context, spot/vol dynamics, and sticky skew ratio measurements.

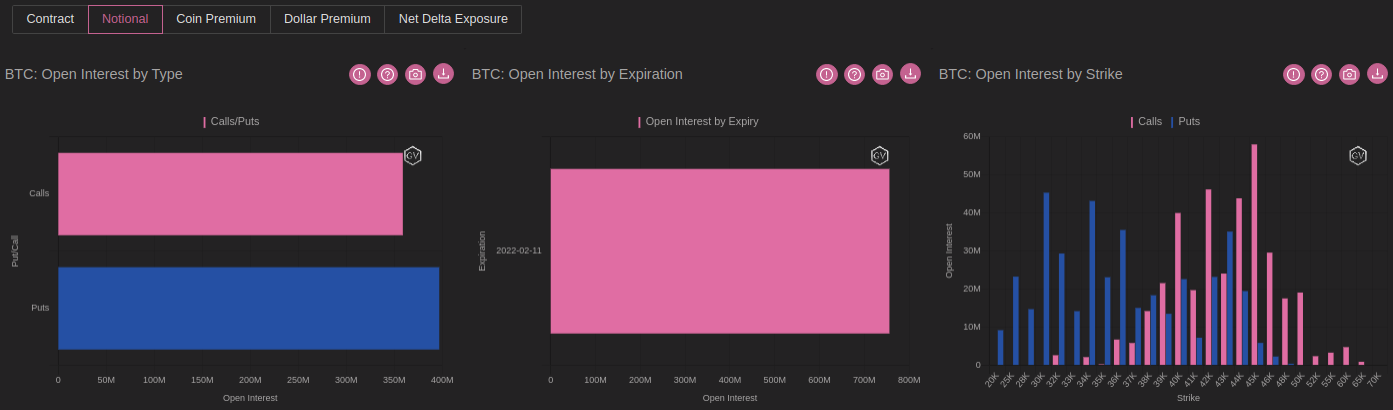

Open Interest - @fb_gravitysucks

BTC

In all of 2021, “weekly expiration” settlement prices have not been higher week-over-week more than 3%. This week, we have seen the first relevant expiration with an encouraging +15% week-over-week.

With around $750M of notional open interest, $12M dollars of premium has been distributed to call holders.

(Feb 11th , 2022 – BTC Notional – Deribit)

( Feb 11th , 2022 – BTC Dollar premium – Deribit)

BIG TRADES IN THE FLOW

This week, we saw very polarized flows with business-days in bullish mode and - as of Friday evening, because a “wind of war” has struct - some protective flows taking place.

Mid-week, we saw consecutive bull-call-spreads being bought in the June tenor. Notable trades include x250 40k-70k spreads and x600 45k-65k spreads.

Late Friday evening, when news about war in Ukraine hit the tape, a fast player bought short-term protection via bear-put-spreads with 41k-38k strikes. A pure gamma trade.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Feb. 13th, 2022 - BTC Premium Traded - Deribit)

(Feb. 13th, 2022 - BTC’s Contracts Traded - Deribit)

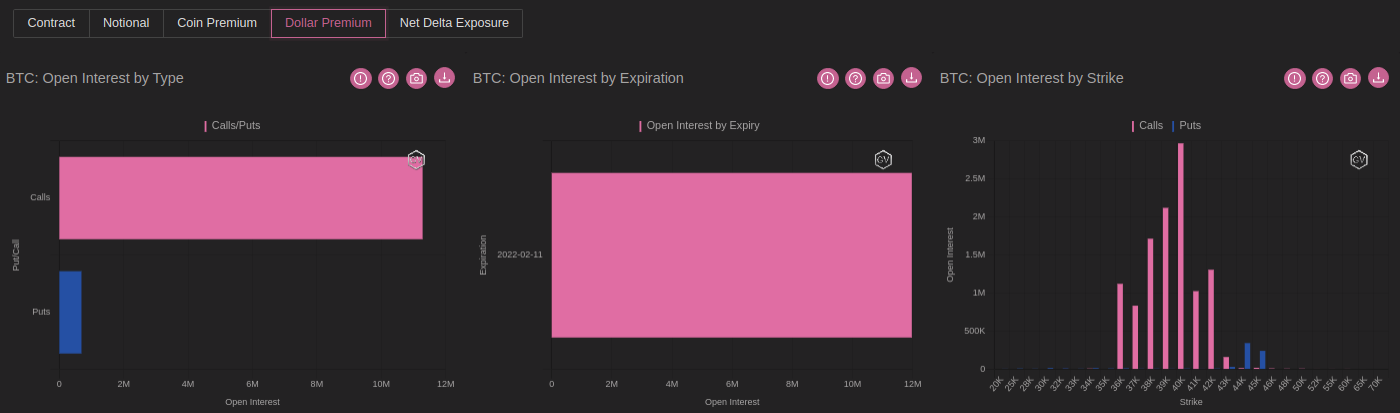

Paradigm Block Insights (Feb 7 to Feb 13)

BTC & ETH spent the majority of the week consolidating, as the bullish momentum from last week was countered by the raging US inflation print and geopolitical risk in Ukraine.

While IV remained calm at the lower end of the recent range, demand for puts outweighed calls as skew continued to move in favor of puts in both BTC (-2 to -5) & ETH (-4 to -8).

In BTC, volumes for calls & puts were even, with 13k contracts traded. Demand for protection was driven primarily by outright traders, put spreads, and general vol buying via straddles & strangles, with a focus on short-term dates and in particular the 40k & 38k strikes.

On the flip-side, we also saw heavy interest for calls on the 45k strike, with spreads against the 65k & 70k on the 24Jun expiry popular this week.

(Feb 7 to Feb 13 - Volume Profile - Deribit & Paradigm)

(Feb 7 to Feb 13 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Feb. 13th, 2022 - BTC’s Volatility Cone)

Realized volatility dropped week-over-week.

We now sit around the 25th percentile for medium measurement windows, although this time-series-analysis alone misses the outside context for a potentially explosive move.

REALIZED & IMPLIED

(Feb. 13th, 2022 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Realized volatility dropped this past week, but remains slightly above IV.

Compared to Q4 2021, volatility remains an interesting buying opportunity in our eyes.

$2,890

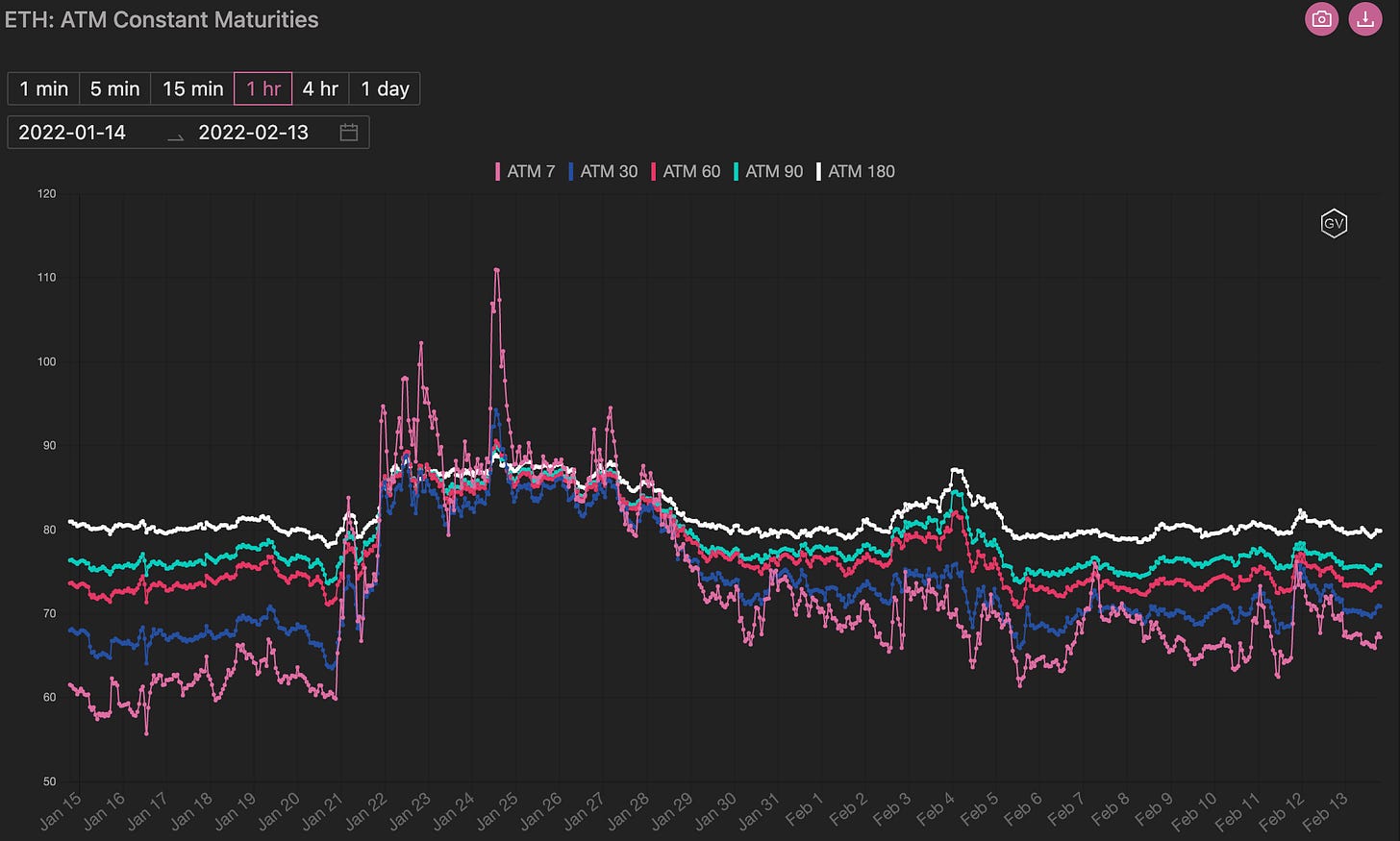

DVOL: Deribit’s volatility index

(1 month, hourly)

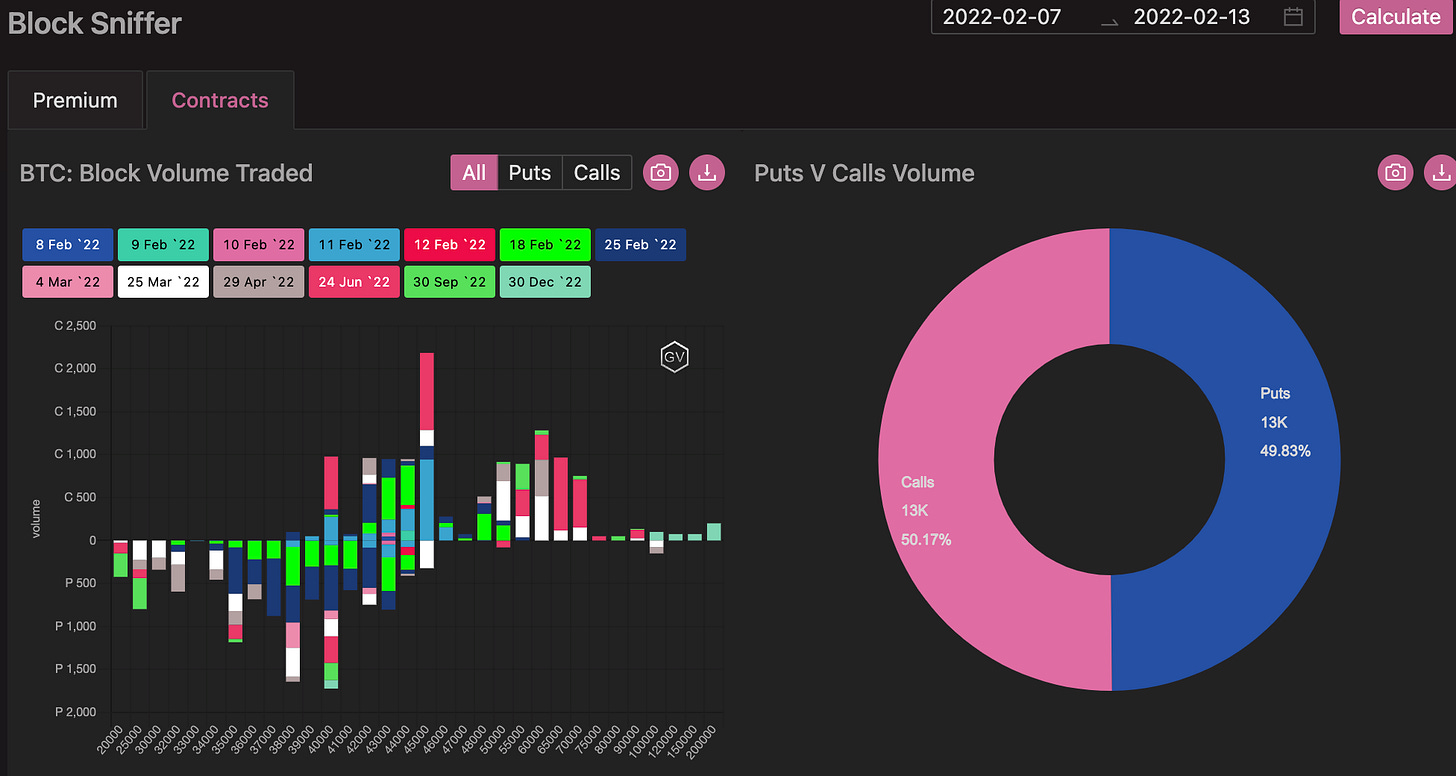

SKEWS

(Feb. 13th, 2022 - ETH’s Skews - Deribit)

Similar to Bitcoin, ETH skew was led lower by short-term expirations.

Although I’m regularly an “ETH maxi”, war and political uncertainty seems like a better environment for the faceless Bitcoin than the Ethereum Dapp/Defi community.

Should things get very dicey, ETH could underperform BTC.

Just an opinion.

(Feb. 13th, 2022 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Feb. 13th, 2022 - ETH’s Term Structure - Deribit)

Similarly for ETH, the implied volatility term structure remains nearly identical week-over-week.

We also continue to see a Contango term structure with about 16pts of difference between front expirations and medium expirations.

ATM/SKEW

(Feb. 13th, 2022 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Average implied volatility didn’t budge this week, but option skew reacted quickly this week.

A common theme for both BTC & ETH, but also a consistent theme over the past few months.

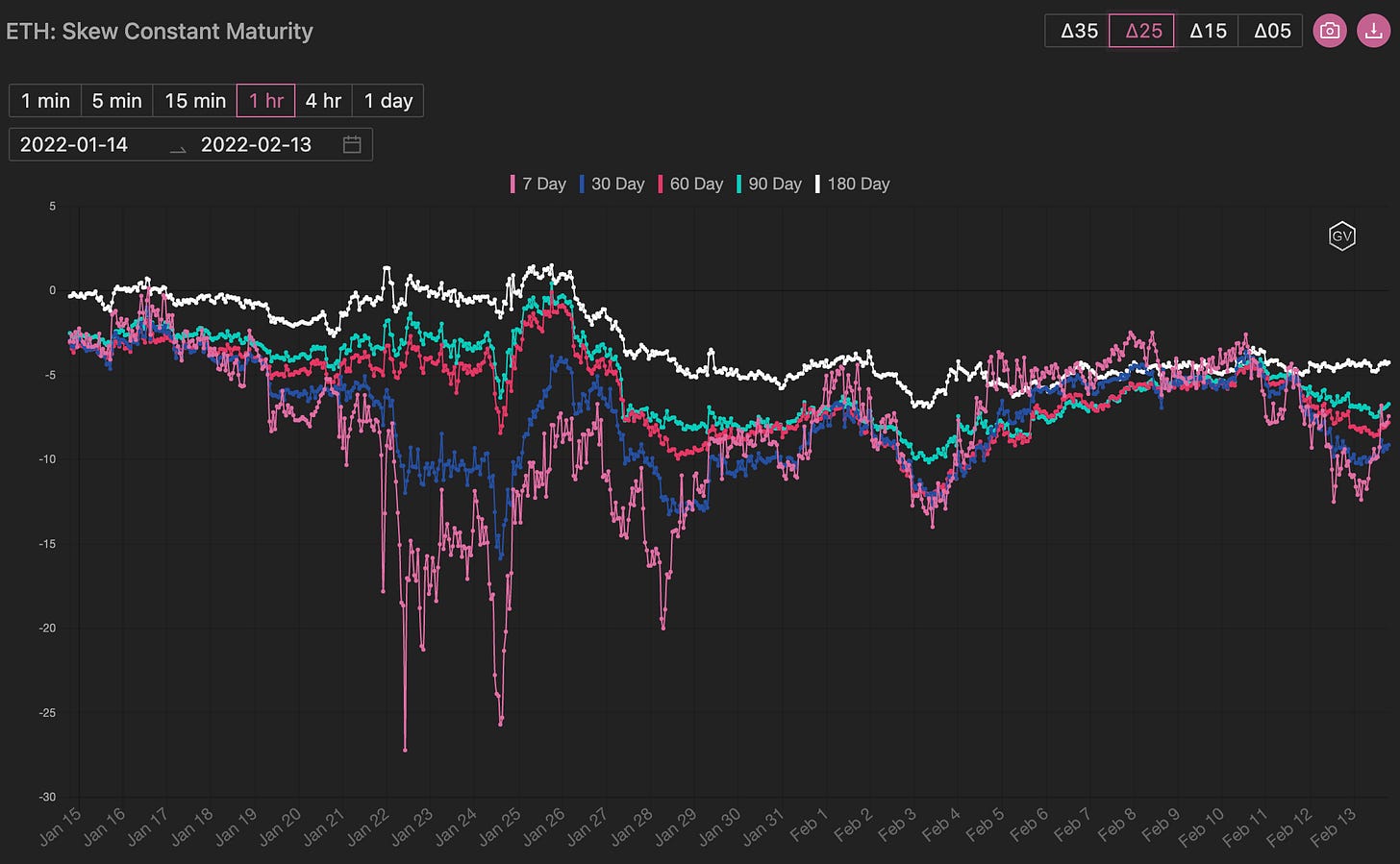

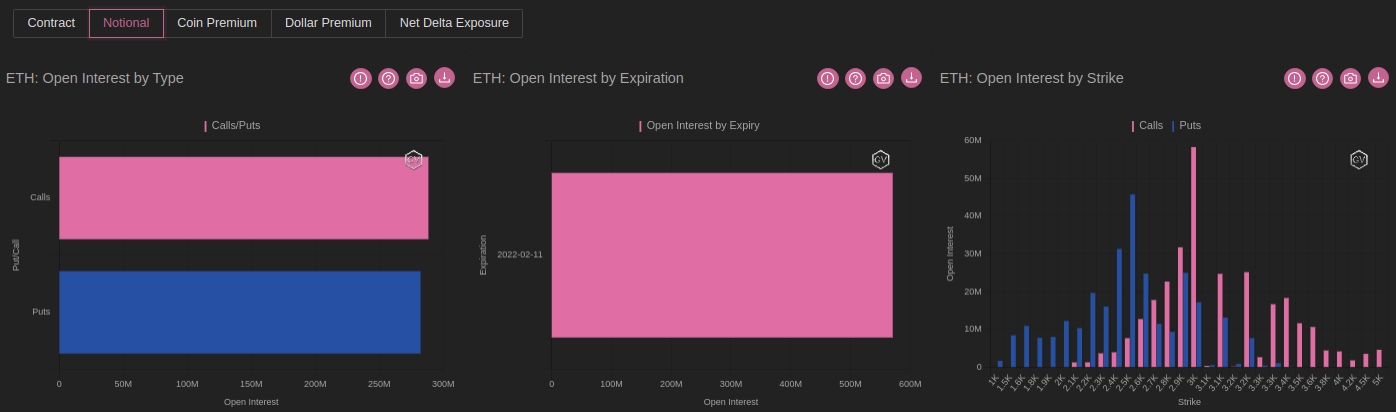

Open Interest - @fb_gravitysucks

ETH

This was the second “weekly expiration” in a row with a positive settlement, compared to the previous one. With a notional of almost $600M, more than $13M of dollar premium was rewarded to call holders. Some interesting divergent aspects to compare to Bitcoin: increasing open interest and volumes, a lower realized volatility, but a persistent >10% of vol spread. These conditions seem right for a big move.

(Feb 11th , 2022 – ETH Notional – Deribit)

(Feb 11th , 2022 – ETH Dollar premium – Deribit)

BIG TRADES IN THE FLOW

The week on Ethereum has started with x2000 bull-call-spread on June. Notice how this trade has been copied on Bitcoin the following days, as we wrote above.

The other big trade of the week has been a x7000 long straddles on 25Feb. As we said before, the recent low realized volatility and a “cheap” implied volatility are the perfect environment for this long vol trades.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Feb. 13th, 2022 - ETH’s Premium Traded - Deribit)

(Feb. 13th, 2022 - ETH’s Contracts Traded - Deribit)

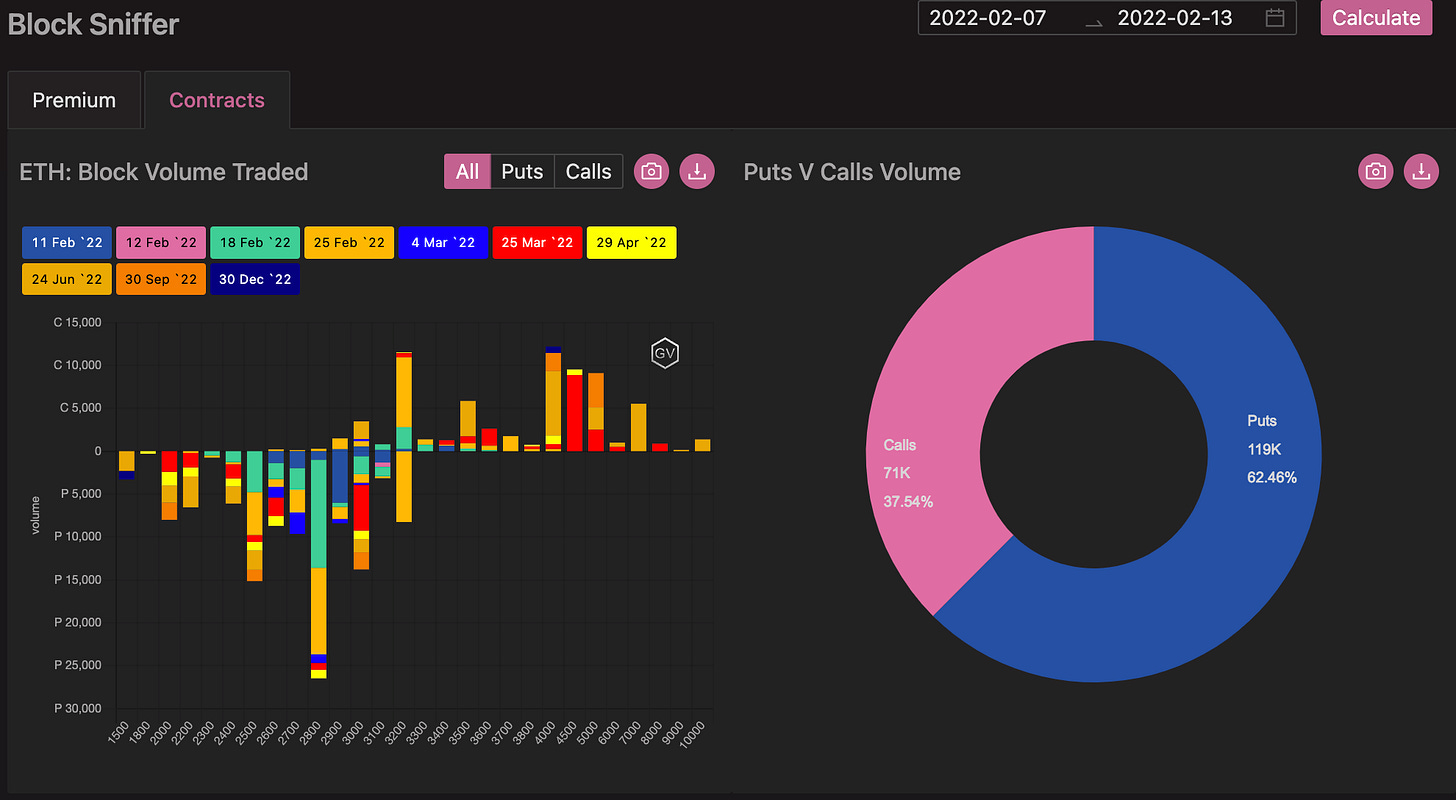

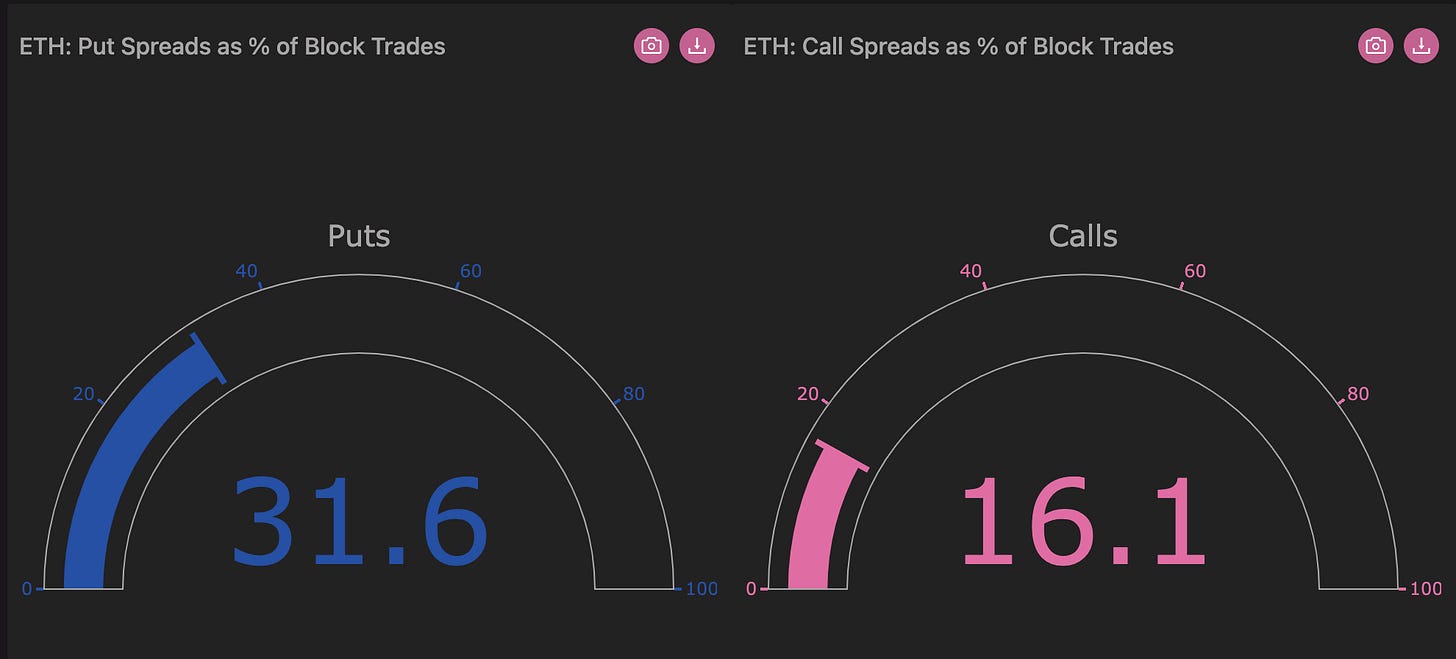

Paradigm Block Insights (Feb 7 to Feb 13)

In ETH, volume for puts dominated calls as puts accounted for 62% of our volume, easily the highest of the year thus far. We saw particularly strong interest on the 2800 strike, where 18 & 25 Feb expiry outrights, put spreads and calendar spreads dominated volumes.

Of note, put spreads accounted for 31.6% of our total volumes, as we saw heavy interest for 2800 vs 2500 put spreads for the 18 & 25 Feb expiries.

(Feb 7 to Feb 13 - Volume Profile - Deribit & Paradigm)

(Feb 7 to Feb 13 - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Feb. 13th, 2022 - ETH’s Volatility Cone)

ETH RV also dropped week-over-week, but don’t let this get you complacent… these headlines could go in any direction without warning, causing a huge jump in Vols.

We think of this environment as a high “vol of vol” atmosphere. Meaning the current RV & IV levels could drastically change.

REALIZED & IMPLIED

(Feb. 13th, 2022 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

If the atmosphere is indeed high in “vol of vol”, the current IV/RV discount is yet another reason we think finding long vol opportunities remains a good bias.