Crypto Options Analytics, December 12th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$50,314

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

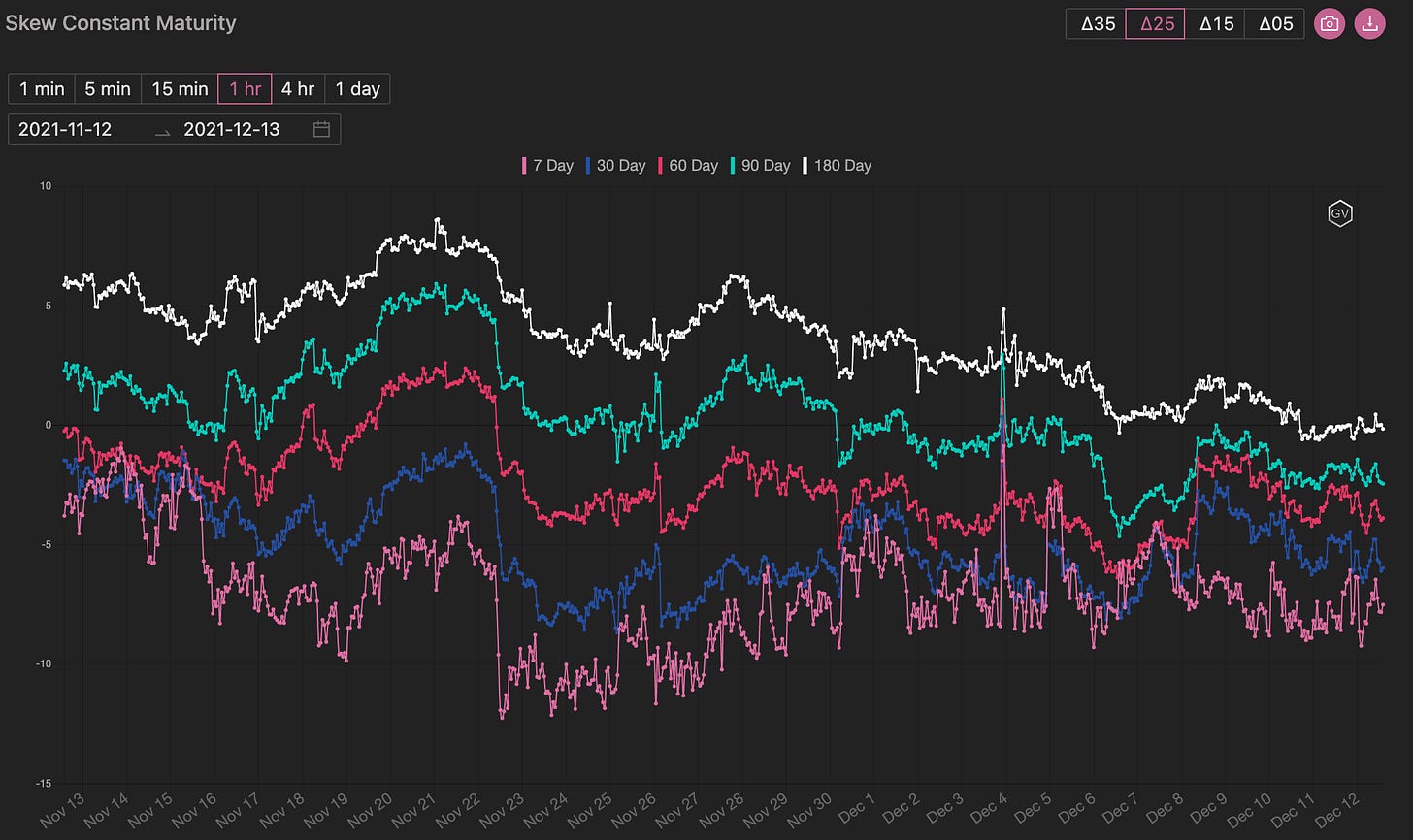

(Dec. 12th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

Spot prices have recovered nicely from last week bringing skews back towards par.

Despite leveraged longs being recently flushed out and the bullish seasonality of December, we believe 2022 could bring downside spot price vol. if the Fed has the intention to beginning a rate-hike cycle.

We continue to expect “vol. path” to bring lower vol on spot rallies.

The recovery in skew has brought some convergence around the different maturities, short-term weeklies saw the biggest increase rising +7pts and long term 180-day maturities rose about +2pt to reach par.

6-month skew trades (long to the puts) could prove to be great, given current vol. path behavior and the potential for Fed driven risk-off behavior in 2022.

(Dec. 12th, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Dec.12th, 2021 - BTC’s Term Structure - Deribit)

The term structure continues to display a steady Contango shape.

Nearly all expiration IV’s have moved sideways, keeping steady levels.

Daily’s are the exception, losing their bid as BTC proved to hold this week.

ATM/SKEW

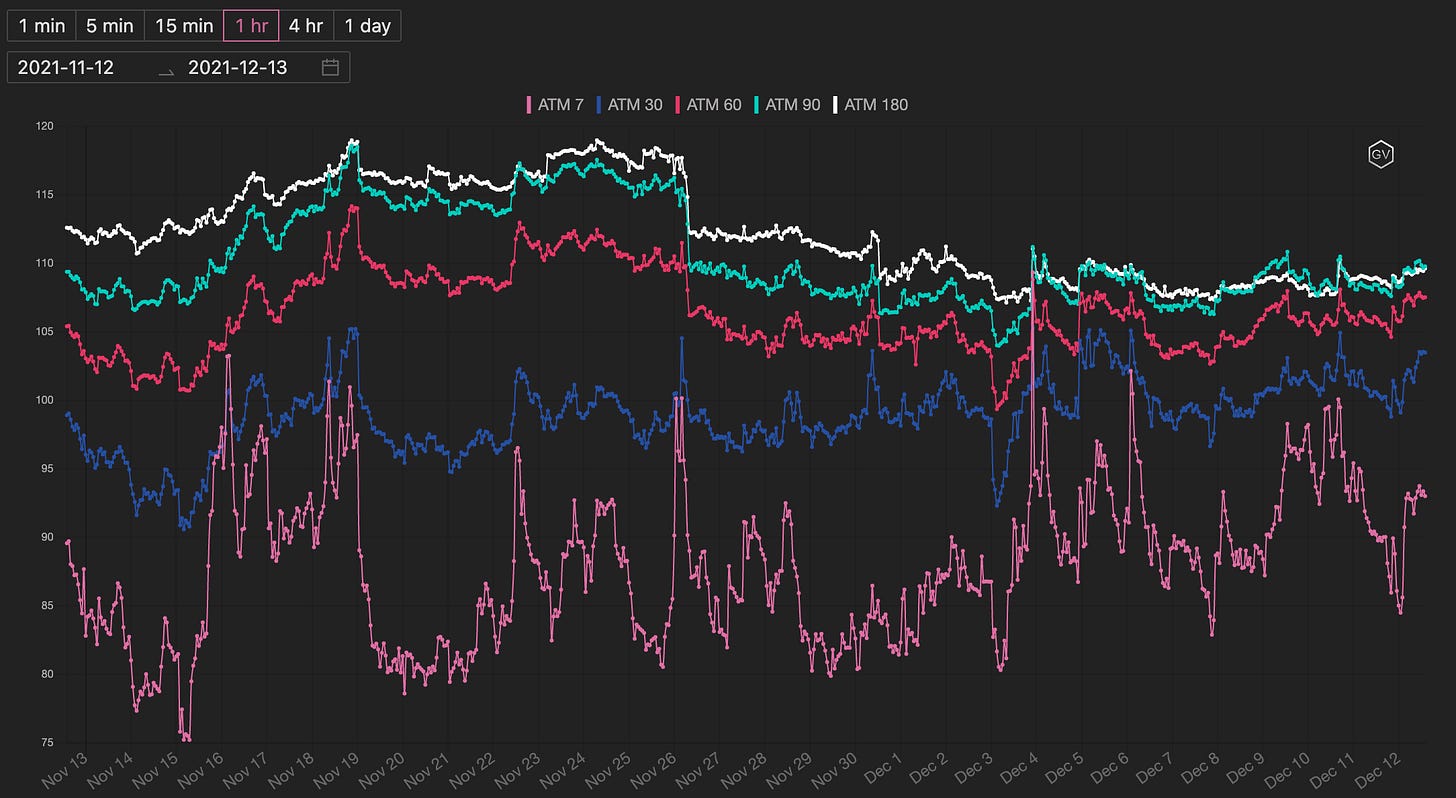

(Dec. 12th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left): IV is holding the top of the monthly range for select maturities.

SKEW (right): As mentioned before, skew greatly recovered this week providing interesting entries for hedges going into 2022.

Open Interest - @fb_gravitysucks

BTC

On Friday’s expiration there were no big surprises: with around 20k contracts expiring and price under recent resistance, 70% of options expired worthless.

Good premium was paid to the puts.

The recent trading activity has been concentrated on EOY expiration. Some trades started to be rolled further (closing December opening Jan/Mar 22). We will see more of this type of activities from now on.

(Dec 12th , 2021 – BTC Open interest – Deribit)

Despite a week without big trades, participants traded mostly around the two technical levels: $40k and $60k.

(Dec 6th – Dec 12th 2021 – BTC - Biggest open interest change - Deribit)

(Dec 6th – Dec 12th 2021 – BTC – Options scanner - Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

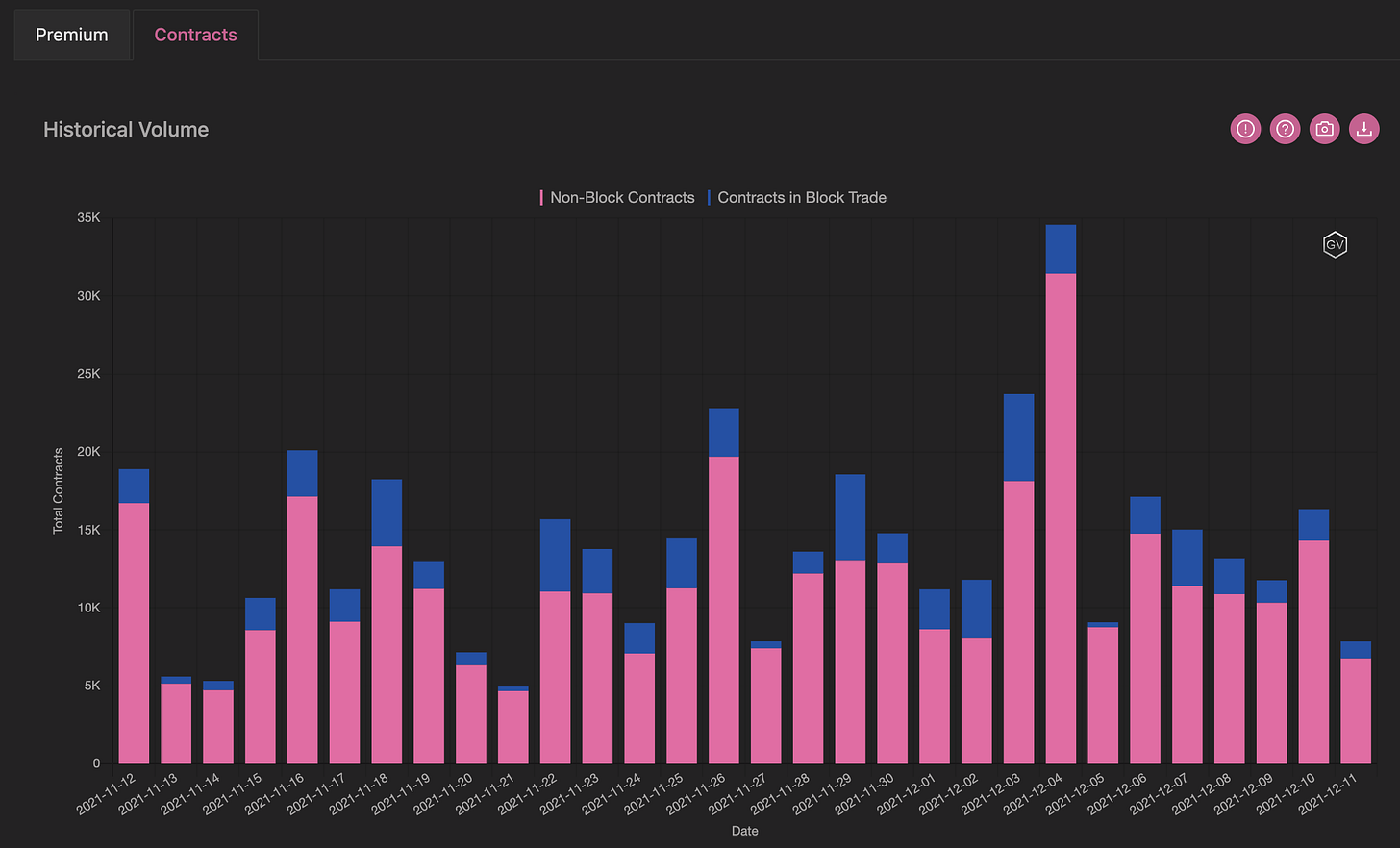

(Dec. 12th, 2021 - BTC Premium Traded - Deribit)

(Dec. 12th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (6 Dec. - 12 Dec.) - Patrick Chu

In BTC this week the market remained focused on the lower end of recent ranges between 46k & 52k as two distinct groups of conflicting activity were spotted (1) outright interest in calls vs (2) demand for puts via outrights, risk reversals, and put spreads.

(6 Dec. - 12 Dec. - Volume Profile - Deribit & Paradigm)

Popular structures included 31Dec 60000C, 25Mar 80000C, 24Jun 100000C, 42k/62k 31Dec & 35k/80k Mar risk reversals, and 31Dec 50k/46k put spreads

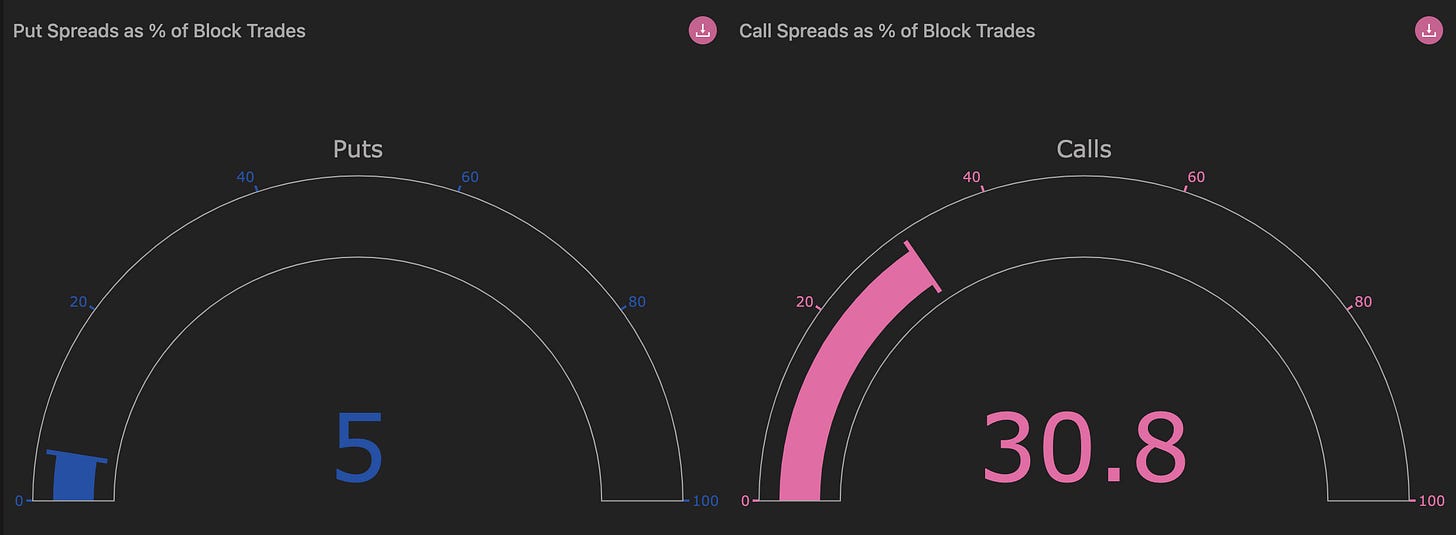

(6 Dec. - 12 Dec. - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Dec. 12th, 2021 - BTC’s Volatility Cone)

RV is within the inter-quartile range for nearly all measurement windows and directly sitting on the median for 30-day vol.

We’re back to typical vol for BTC.

REALIZED & IMPLIED

(Dec. 12th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Last week’s selling activity is still being plotted in the 10-day RV measurement, causing the reading to remain high.

More interesting is the continued resilience of IV holding steady levels.

$4,144

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Dec. 12th, 2021 - ETH’s Skews - Deribit)

While BTC skews climbed higher this past week, ETH skews ground lower.

We hoped that the relative enthusiasm for ETH would continue but last week’s theme didn’t hold up this week.

180-day skews currently reside at par, while all shorter maturities are negative.

Weekly maturities, the most negative, are currently reading -7pts.

(Dec. 12th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Dec. 12th, 2021 - ETH’s Term Structure - Deribit)

The term structure is in Contango as most maturities continue to hold similar levels to those seen last week.

Like BTC, the daily’s are down, bringing the whole term structure into a consistent Contango shape.

ATM/SKEW

(Dec. 12th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left): IV continues to hold a trendless time-series, although the range of values is tightening up compared to mid-November.

Skew (right): Skew held tight this week and continues to hold higher than the monthly lows by about 5pts.

Open Interest - @fb_gravitysucks

ETH

The weekly option cycle expired with around 150k contracts, 90% of which ended up worthless. Profile showed balance between puts and calls. Low realized penalized them both.

The chart below shows the current open interest profile. Mar22 still growing in open interest (highlighting the difference between ETH and BTC). Reading option flow, we see that directional traders keep buying upside exposure, while volatility traders short the curve.

(Dec 3rd , 2021 – ETH Open interest– Deribit)

Options flow showed a two-way interest between call and puts. In general, short-dated maturities have been more cautious with calls sold and puts bought; on the other hand, calls activity has been dominant in the longer expirations.

(Dec 6th – Dec 12th 2021 – ETH– Options scanner - Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Dec. 12th, 2021 - ETH’s Premium Traded - Deribit)

(Dec. 12th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

Paradigm Block Insights (6 Dec. - 12 Dec.) - Patrick Chu

In ETH this week, we continued to see good two-way action in calls, with several larger structures going through via outrights (28Jan22 8000C 3000x), call spreads (24Jun 9000/15000 2000x) & butterflies (17Dec 4700/5100/5500 2000x4000x2000).

We also continued to see demand for protection via outrights & risk reversals, in particular for 17Dec 4000P (2100x), 17Dec 3000P (2000x) & 31Dec RR with 3520/4600 trading in 2000 per leg.

(6 Dec. - 12 Dec. - Volume Profile - Deribit & Paradigm)

(6 Dec. - 12 Dec. - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Dec. 12th, 2021 - ETH’s Volatility Cone)

ETH RV is hugging the median closely.

ETH vol. is back to “business as usual”

REALIZED & IMPLIED

(Dec. 12th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

We can see a rather tight relationship between RV and IV.