Crypto Options Analytics, December 19th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$46,818

DVOL: Deribit’s volatility index

(1 month, hourly)

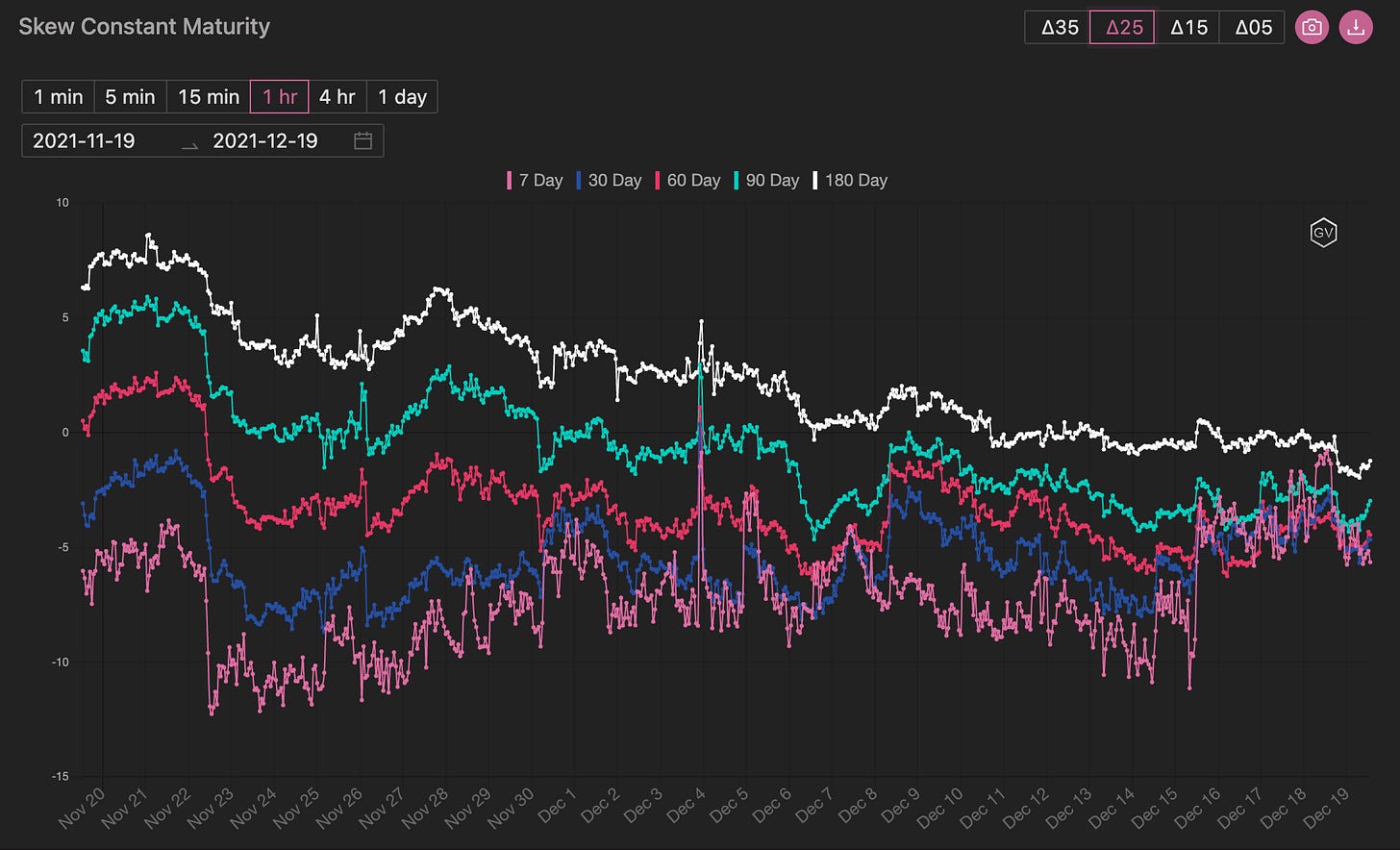

SKEWS

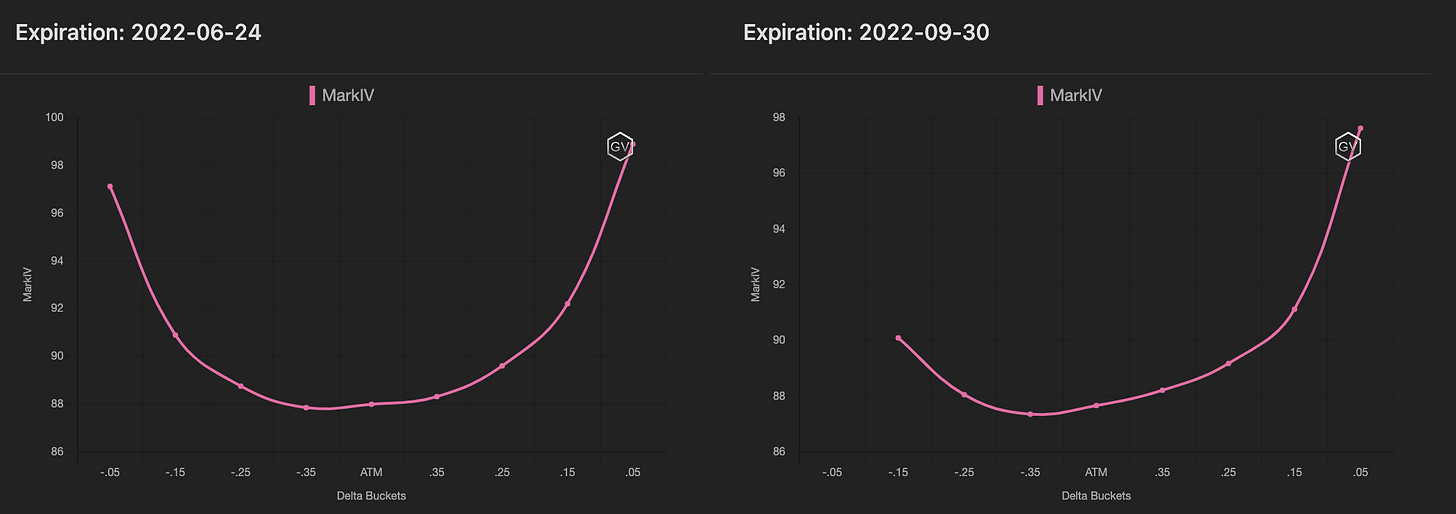

(Dec. 19th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

Bitcoin options held a bearish tilt this week going into FOMC.

Market participants hedged their books and the vol. space quickly reacted post FOMC by easing demand for puts relative to calls, skew rallied.

We were thrilled to see the pulse of crypto vol. being so reactive to the US macro environment. This bodes well for the evolution of the crypto vol. space.

QCP released an interview on Real Vision this week, highlighting the potential for a market correction by Q2 2022.

(Dec. 19th, 2021 - Long-Dated BTC Skews - Deribit)

The skew “relief rally” lines up an interesting opportunity for skew trades (long the puts).

TERM STRUCTURE

(Dec.19th, 2021 - BTC’s Term Structure - Deribit)

The term structure steepened versus last week with EOY options losing nearly -10pts.

The short-end will likely remain quiet throughout the holidays and traders have been quick to sell the Dec 31st. contract in anticipation.

ATM/SKEW

(Dec. 19th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

BTC vol. is now near the lower end of the past 30-day range, while skew is back near the monthly highs.

Again, we think this bodes well for bearish BTC protection and vol. plays. The potential for a sharply lower prices, given a macro catalyst remains real. We don’t expect bullish price action to exhibit the same vol. potential.

Open Interest - @fb_gravitysucks

BTC

The weekly expiration was mild with 14k contracts and a “sell calls, buy puts” activity bias in the days before expiration. A final delivery price of $47,030 caused 85% of options to expire worthless.

(Dec 17th , 2021 – BTC Open interest – Deribit)

(Dec 17th , 2021 – BTC Dollar premium – Deribit)

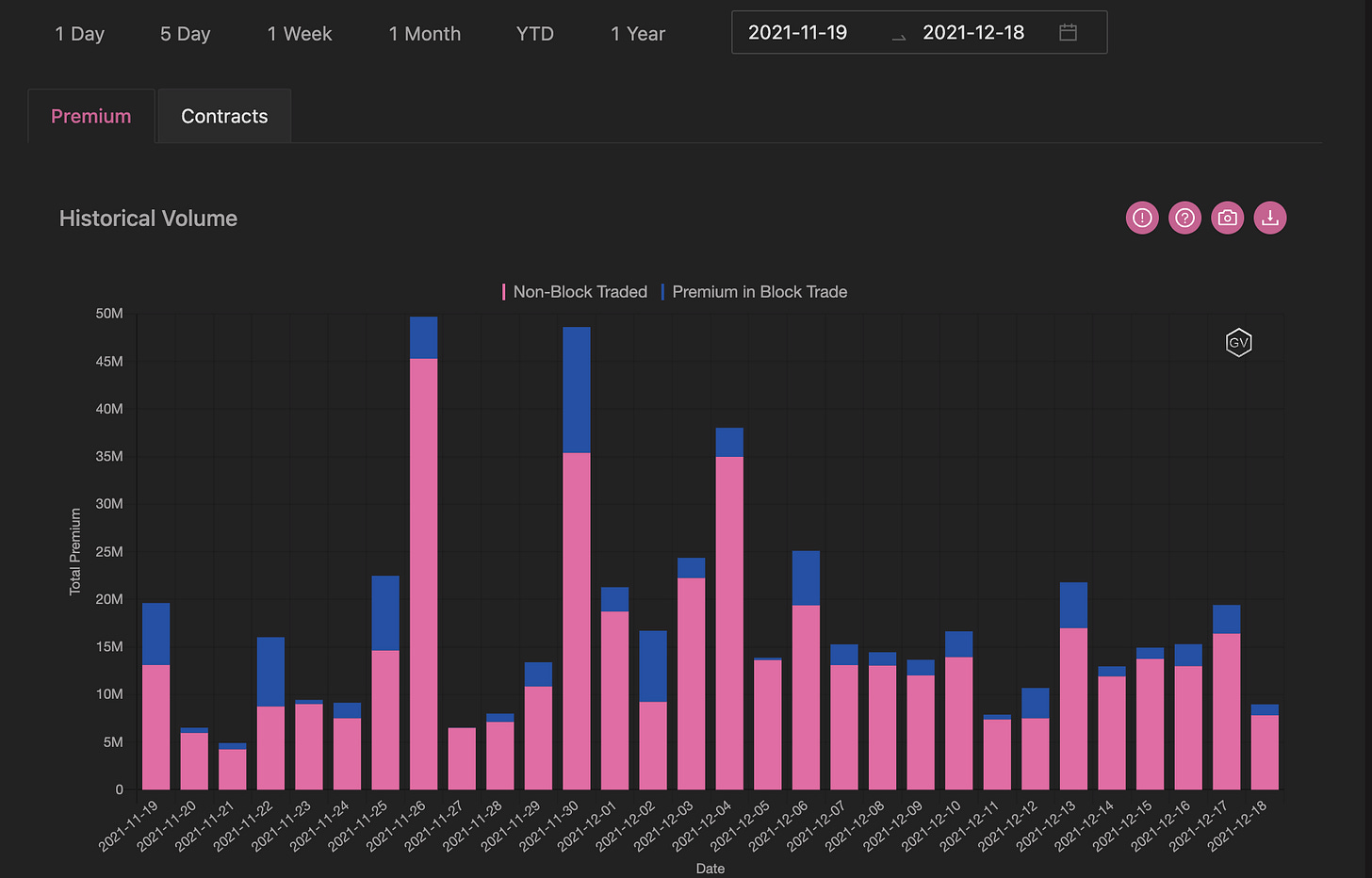

The choppy regime this week, prices drifting sideways/downward, caused subdued flows.

Nevertheless interesting trades were put on:

1. Short Mar22 50k calls and 50k straddles for 3.4M of premium sold. These trades are a pure volatility take: players are betting that future realized volatility will be less than 87% (iv sold).

2. Calendar: short 31Dec 50k calls, long 7Jan 50k. This trader played big with a x500 position.

3. Risk reversal. 24Dec short 52k calls/ long 45k puts. Spot around 48k. Good trade in advance of Friday’s downside.

4. Long 28Jan $55k call. Anomalous trade for execution: on screen on Saturday!

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

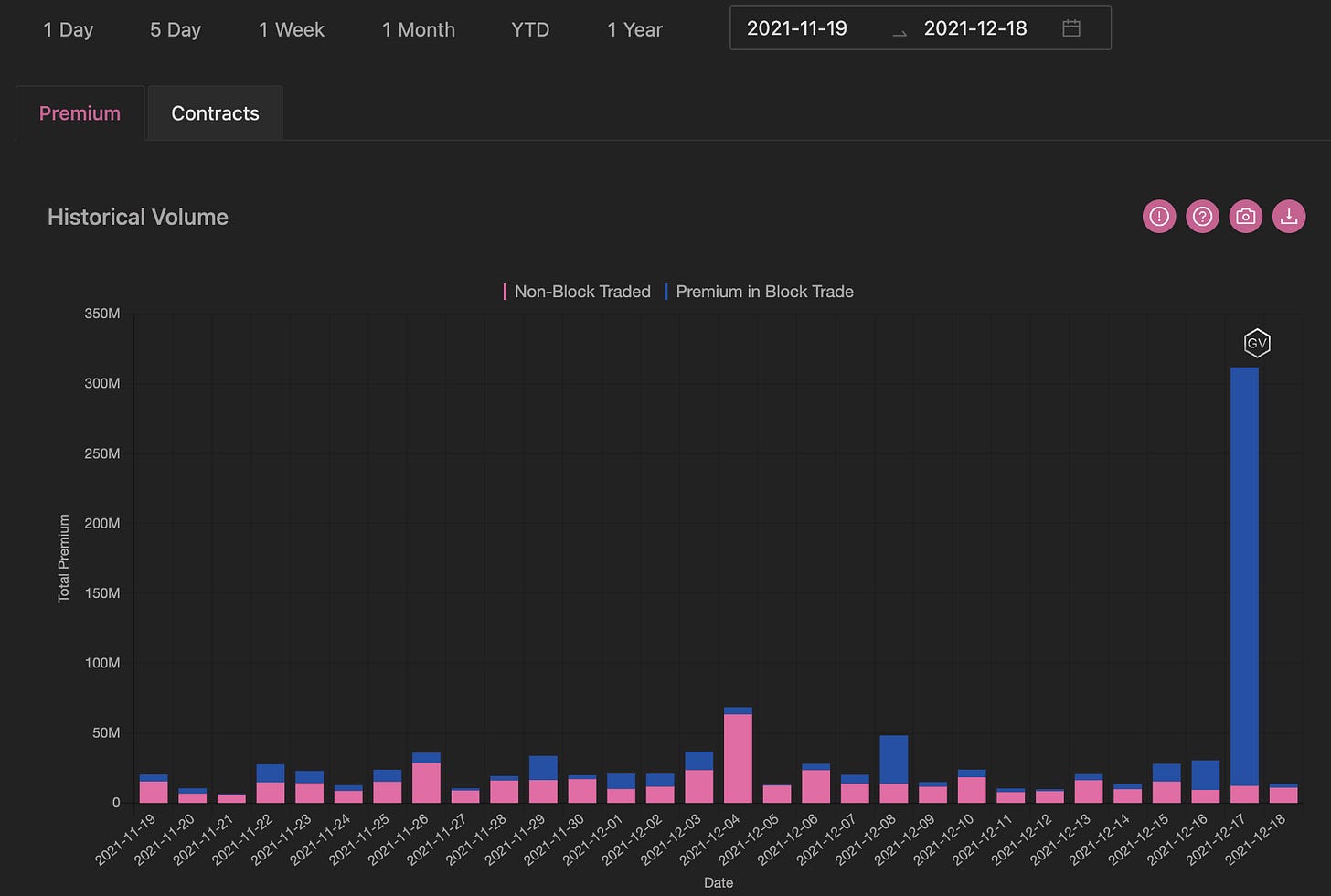

(Dec. 19th, 2021 - BTC Premium Traded - Deribit)

(Dec. 19th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (13 Dec. - 19 Dec.) - Patrick Chu

FOMC on Wed indicated three interest rate hikes and double the speed of tapering. Overall risk assets held well & rallied post meeting. IV traded lower throughout the week as BTC/ETH mostly traded in range.

Overall, volume from this week was mostly driven by hedging ahead of FOMC where we saw sellers in topside BTC and ETH, and short dated rolling of calendar spread 24 vs 31Dec.

Post FOMC, we saw two-way interest to roll expirations across the year-end and IV found a bottom on Sat.

(13 Dec. - 19 Dec. - Volume Profile - Deribit & Paradigm)

DVOL traded lower from 93 to 84 IV post FOMC. Volumes were particularly high for the 50k strike as strong interest for straddles, call calendars & outright calls was seen thru the week.

In BTC, our highest volume day came on 16 Dec, after FOMC, where we were ~45% of market volumes.

Notably we saw interest in the 31Dec vs 7Jan & 28Jan calendar spreads.

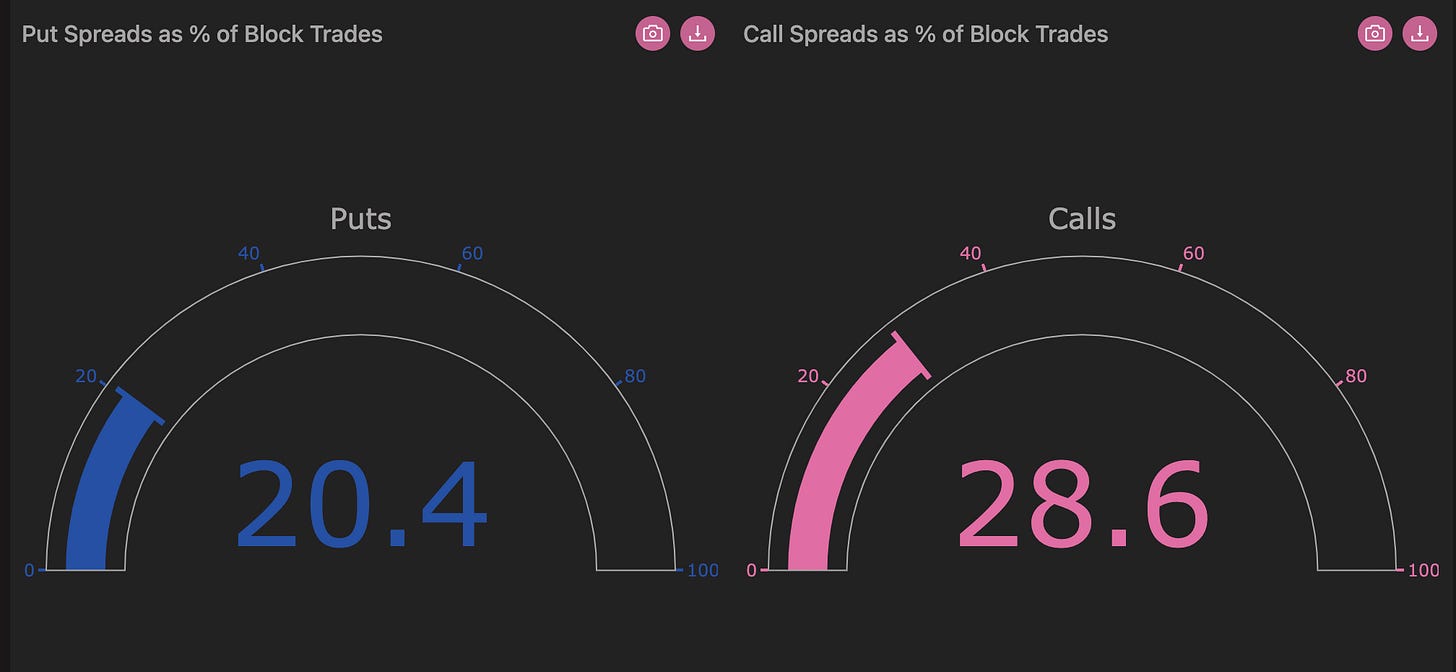

(13 Dec. - 19 Dec. - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Dec. 19th, 2021 - BTC’s Volatility Cone)

RV has calmed down and is trading along the lower 25th percentile.

We don’t expect fireworks until 2022.

REALIZED & IMPLIED

(Dec. 19th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The recent flash-crash has dropped out of the RV measurement window and now IV/RV are back in proximity.

$3,922

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

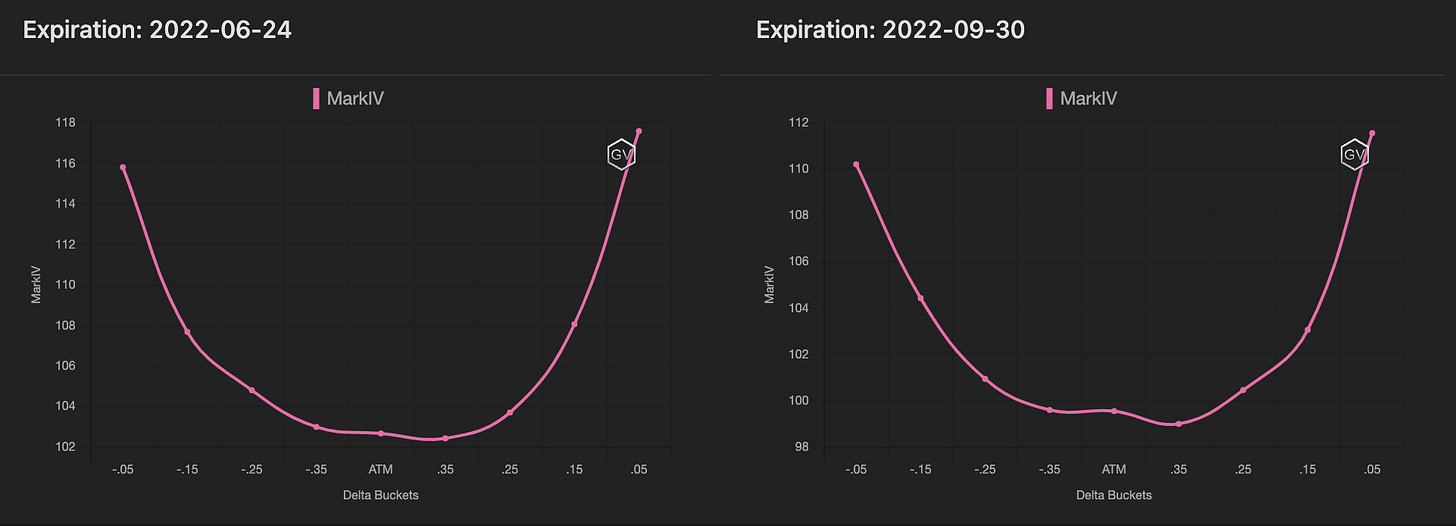

(Dec. 19th, 2021 - ETH’s Skews - Deribit)

DVol lost a noticeable amount of “juice” post FOMC.

The skew profile received a bit of relief for shorter-term maturities, but we currently have negative skew 180-days out.

Rarely have we seen negative skew that far out.

Another interesting note is the relatively strong ETH/BTC pair being unaccompanied by similar ETH vol. dynamics.

(Dec. 19th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Dec. 19th, 2021 - ETH’s Term Structure - Deribit)

The term structure quickly steepened post FOMC accompanied by a parallel shift lower across all maturities.

March 2022 saw a big drop in IV, losing nearly -10 vol points.

It’s rather unusual to see longer expirations lose as much IV as shorter expirations given the amount of future FOMC events those longer expirations will witness.

ATM/SKEW

(Dec. 19th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

We can see that ETH IV finally deflated a significant amount this past week.

Skew is rather stable and around the middle of the range.

Open Interest - @fb_gravitysucks

ETH

The weekly showed more interest compared to BTC, with 164k contracts in open interest. Puts have been bought and calls showed a two way interest. With a delivery price of $3890, 87% of options expired worthless.

(Dec 17th , 2021 – ETH Open interest– Deribit)

(Dec 17th , 2021 – ETH Dollar premium – Deribit)

Flow in ETH has been disappointed for all the week. To mention, on Friday’s downside move some player buy-the-dip with more than 8000 calls blocked in $3.9k-$4.5k strikes.

Overall interest has been towards protection with good amount of puts bought and some two-way interest in the calls side. Slightly more bullish on end of the week.

(Dec 13th - Dec18th , 2021 – ETH Options scanner– Deribit)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Dec. 19th, 2021 - ETH’s Premium Traded - Deribit)

(Dec. 19th, 2021 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (13 Dec. - 19 Dec.) - Patrick Chu

In ETH our top volume structure for the week was 24Dec risk reversals for 3700P/4400C (5000x). We also saw good interest in outrights and spreads, especially from 24Dec expiry 3900, 4400 & 4500 calls.

(13 Dec. - 19 Dec. - Volume Profile - Deribit & Paradigm)

(13 Dec. - 19 Dec. - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Dec. 19th, 2021 - ETH’s Volatility Cone)

ETH realized volatility is holding a bit higher than the BTC counterpart.

We are currently witnessing median RV.

REALIZED & IMPLIED

(Dec. 19th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Both IV and RV are currently tightly bound, with a bit of a simultaneous direction lower.