Crypto Options Analytics, December 5th, 2021

The ETH/BTC spot ratio is making new highs & the vol. surfaces agree!

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$48,914

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Dec. 5th, 2021 - Short-term and Medium-term BTC Skews - Deribit)

BTC spot-prices ended the week much lower.

Vol. path has had a negative beta with respect to spot-prices lately; this phenomenon was punctuated by a Friday price-crash, causing volatility levels to move drastically higher.

BTC option skews have been on a steady downward trend all month.

Options with expirations shorter than 90-days are all negative with weeklies, the most skewed to puts, displaying -5pts.

Surprisingly, option skews initially jumped higher on the spot-price crash: potentially a side effect of system liquidations.

(Dec. 5th, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Dec.5th, 2021 - BTC’s Term Structure - Deribit)

The term structure has flattened week-over-week, led by the short-end of the curve climbing over +15pts at the time of this writing.

The term structure is in Contango now but we saw extremely high backwardation Friday night when spot-prices dropped significantly… Weekly ATM IV hit 115% vol during the commotion.

ATM/SKEW

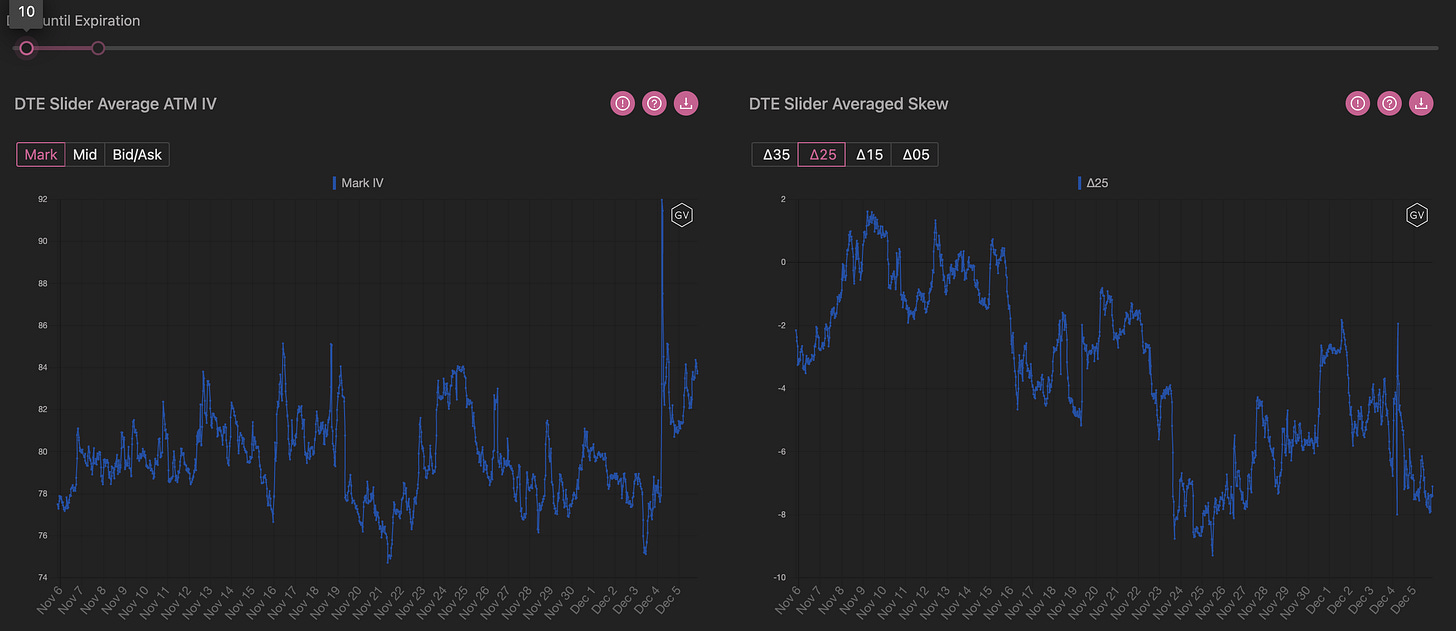

(Dec. 5th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left): ATM IV is currently at the top of the monthly range, after piercing sharply higher during the peak of the sell-off.

SKEW (right): Surprisingly, skew hasn’t made new lows for the month. Maybe the market feels that current liquidations “de-levered” the market and removed the potential for more sharp sell-offs.

Open Interest - @fb_gravitysucks

BTC

The weekly expirations showed signs of prudence. Prolonged price action in the $55k-$59k range increased activity for protection at key levels of support: $53k puts missed the premium for only 24 hours...

(Dec 3rd , 2021 – BTC Open interest – Deribit)

Top trades:

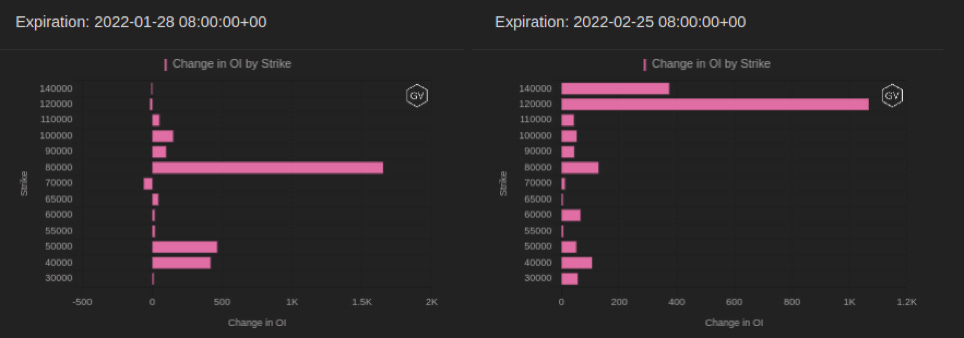

On Monday and Tuesday, with prices well above support line, flows showed bullish activity on call side: Dec $70k, Jan $80k partially financed with Feb $120k, and Mar $80k contracts.

(Nov 29th – Dec 5th 2021 – BTC - Biggest open interest change - Deribit)

(Dec $70k call and Jan $80k)

(Jan $80k call financed by Feb $120k)

(Mar $80k call)

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Dec. 5th, 2021 - BTC Premium Traded - Deribit)

(Dec. 5th, 2021 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (Nov. 29th - Dec. 5th) - Patrick Chu

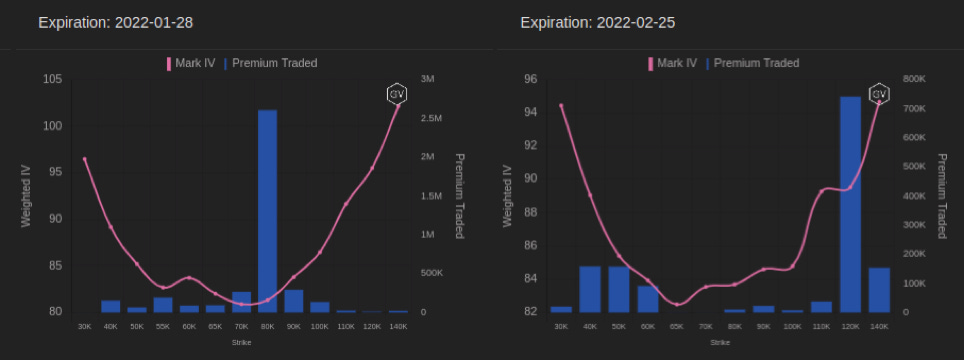

After treading water all week, BTC & ETH spiked lower on Dec 4th as macro concerns surrounding the change in Fed stance and spread of Omicron resulted in significant liquidations under thin liquidity conditions.

Both BTC & ETH 1w IV exploded with BTC trading up to 112 and ETH to 109 before stabilizing on Sunday to 78 & 90 respectively, as of current moment.

In BTC, while we saw significant demand for 50k puts across the tenors via outright puts and risk reversals, the dominant flow of the week was for calls via our rights, as well as vertical and diagonal call spreads, both before and after the large move on Saturday.

(Nov. 29th - Dec. 5th - Volume Profile - Deribit & Paradigm)

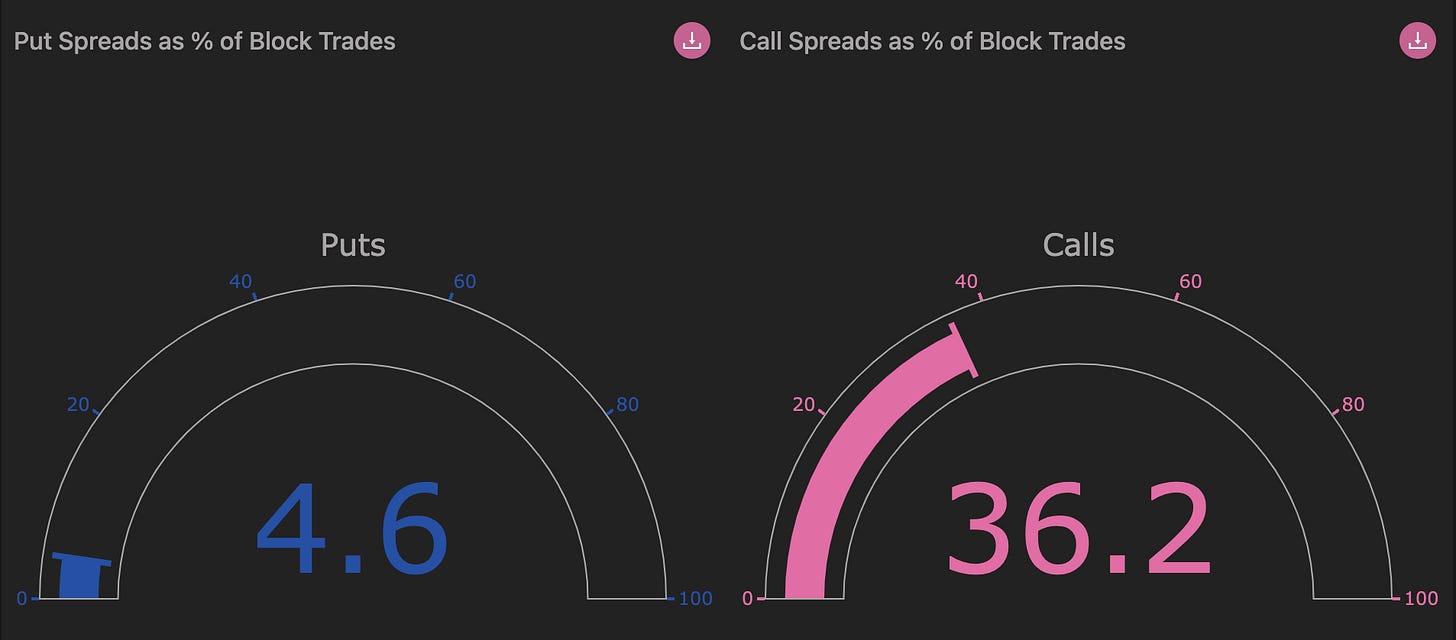

In particular, we saw strong demand for both the 60k (Dec expiries) and the 80k strikes (Jan/Mar expiries) as volume for calls represented almost 73% of our volumes for the week and call spreads representing 36% of the volume.

(Nov. 29th - Dec. 5th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Dec. 5th, 2021 - BTC’s Volatility Cone)

We found “lift-off” in the RV space.

The option market had been paying a large IV/RV premium for weeks, finally to be vindicated on Friday.

1-day and 7-day RV are near top readings for the year.

Down-side spot activity continues to hold the potential for higher vol…. while a spot recovery would likely merit lower vol.

REALIZED & IMPLIED

(Dec. 5th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The IV premium has now flipped into a discount.

IV has been surprisingly steady since August, while RV has been whipped around.

$4,123

DVOL: Deribit’s volatility index

(1 month, hourly)

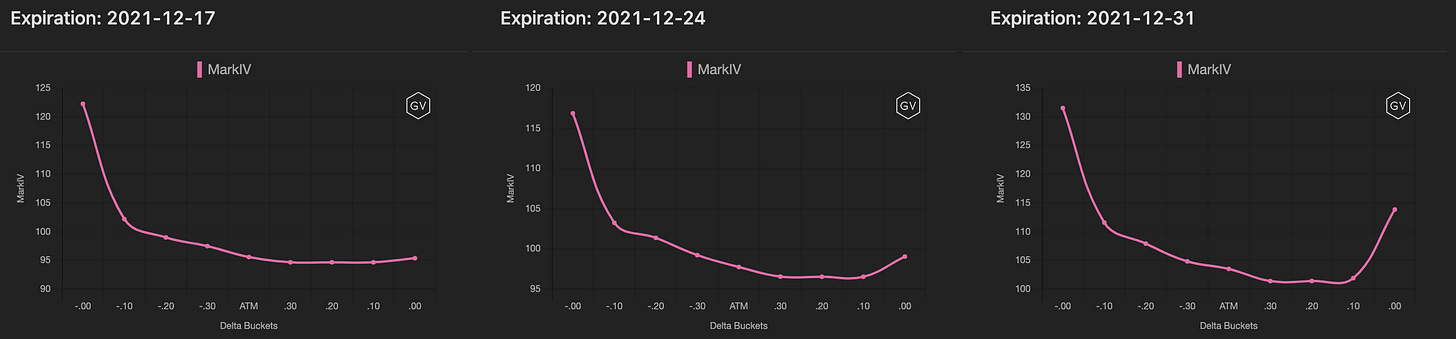

SKEWS

(Dec. 5th, 2021 - ETH’s Skews - Deribit)

ETH is gaining market share from BTC.

ETH spot-prices continue to be relatively strong compared to BTC; this activity has also been reflected in the ETH vol. surface.

ETH spot-prices dropped on Friday but option skew has remained nearly identical week-over-week.

Spot-prices have since recovered, ending the week nearly unchanged.

Option skews are positive for expirations beyond 60-days.

(Dec. 5th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Dec. 5th, 2021 - ETH’s Term Structure - Deribit)

The term structure flattened modestly since last week, and didn’t exhibit the same panic Backwardation as BTC on Friday.

We can see that ETH skew managed to become flat on Friday and quickly resumed a Contango shape hours later.

The option market seems to think ETH has a relatively stronger price floor than BTC.

ATM/SKEW

(Dec. 5th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left): ATM vol. is near the top of the monthly range, currently reading about 103% for select expirations displayed above.

Skew (right): Skew is actually higher week-over-week. Again, this bodes well for ETH relative to BTC.

Open Interest - @fb_gravitysucks

ETH

The weekly profile skewed versus puts, more a way of financing the bullish view than a form of protection. Early in the week, ETH started breaking up important resistance giving confidence to traders. All the work done got dismantled over Saturday morning with the big flush out.

(Dec 3rd , 2021 – ETH Open interest– Deribit)

Top trades:

On Nov 30th and 1st Dec, a trader bought on screen a striking $9mil of notional of Sep22 $10k calls.

Saturday sell-off didn’t change trader’s view. Strong hands.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(Dec. 5th, 2021 - ETH’s Premium Traded - Deribit)

(Dec. 5th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are holding relatively steady.

Paradigm Block Insights (Nov. 29th - Dec. 5th) - Patrick Chu

In ETH, volumes were dominated by diagonal spreads with more than 11000 contracts of 31 Dec 6,000C vs 25 Feb 11,000C changing hands throughout the week, and call spreads representing 42% of total interest. We also saw interest for year-end expiry 4000 strike puts, via outright & risk reversals.

(Nov. 29th - Dec. 5th - Volume Profile - Deribit & Paradigm)

(Nov. 29th - Dec. 5th - Put & Call vertical as % of trade “count” - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

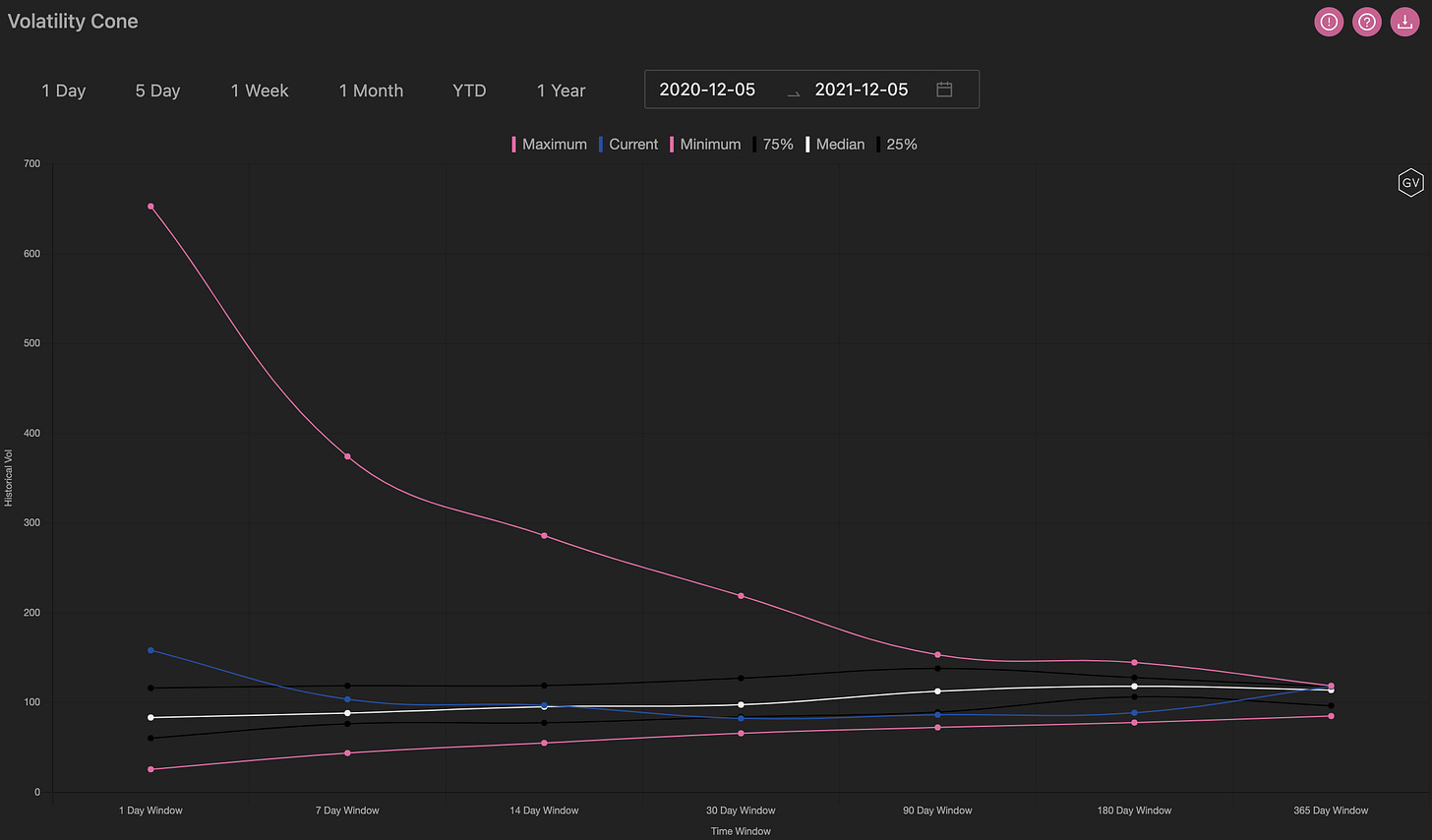

VOLATILITY CONE

(Dec. 5th, 2021 - ETH’s Volatility Cone)

ETH RV was much more tame compared to BTC.

Notice that 7-day RV hasn’t even exceeded the upper 75th percentile… Rather tame activity compared to where BTC RV currently sits.

REALIZED & IMPLIED

(Dec. 5th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

The ETH premium has also flipped to a discount, but barely.

Like BTC, ETH IV has been rather consistent throughout the 2nd half of 2021, while RV has moved much more.