Crypto Options Analytics, Dec. 31st, 2022

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

USA Week Ahead:

Wednesday 2pm: FOMC Minutes release

Thursday 8:15am: ADP Payroll Preview

Friday 8:30am: Non-farm payroll

THE BIG PICTURE THEMES:

This holiday season saw much more action than anticipated in the Traditional equity space.

Equity weakness invalidated hopes for a “Santa Rally”.

On the crypto side of things, the space acted exactly as hoped.

Extremely quiet price action as BTC traded within a $500 range for nearly two weeks.

7-day RV dropped from 35% down to 16%.

BTC: $16,600 -1.38%

ETH :$1,203 -1.26%

SOL: $10.07 -10.82%

DVOL: Deribit’s volatility index

BTC - (365-days w/ spot line chart)

DVOL closed the year on annual lows.

Short-term vols. dropped down to 30pts meaning that DVOL has a lot of term structure and wing premium continuing to hold it up in the 60-handle.

Although we expect RV to pick-up with early 2023 trading, it isn’t likely enough to close the VRP gap anytime soon.

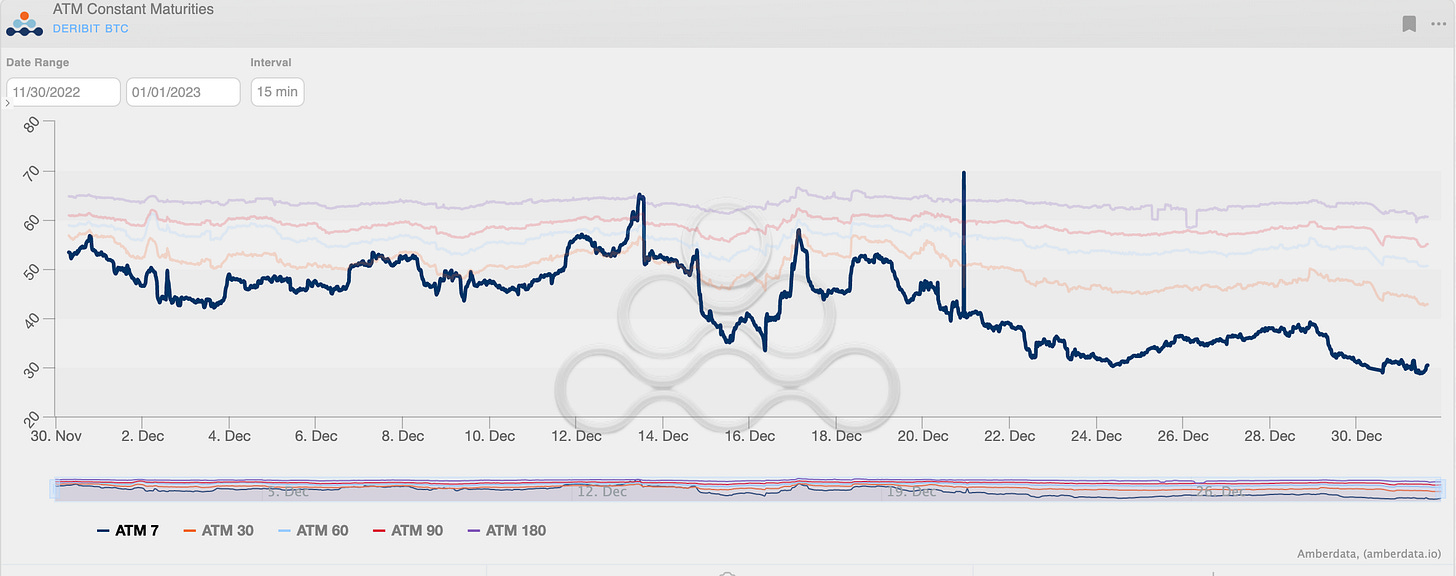

TERM STRUCTURE

(Dec. 31st, 2022 - BTC Term Structure - Deribit)

The term structure roll-down widened significantly as short-term 7-day IV lead the way lower, reflecting the holiday season quiet.

The widest gap is found between the 30-day and 7-day IV, with about 15points of roll-down.

(7-day highlight)

Christmas Ever and NYE were the low points for the 7-day IV.

SKEWS

(Dec. 31st, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

We can see the lull in volatility began to provide relief in short-term RR-Skew as BTC options began to trade “crash” risk-premium away.

7-day RR-Skew briefly hit parity around Christmas.

VOLATILITY PREMIUM

(Dec. 31st, 2022 - BTC IV-RV)

The VRP continues to remain persistent despite the drop in IV as RV drops even further, faster. We can see between 15-20pts of VRP in the 7-day option expirations.

The Squeethosystem Report (12/24/22 - 12/31/22)

With the year coming to an end, it was one for the books, to say the least. For those that thought we would be near record low vols after the chaos that transpired you are an anomaly. Markets still remain quiet with ETH historical vol sub 30%, gearing up for what should be an exciting 2023. ETH closed the week -1.91% and oSQTH ended the week -4.31%.

Volatility

Squeeth IV saw a slight uptick in implied vols to begin the week, which was quickly sold back down over the next few sessions. Squeeth implied vol is currently trading higher than its reference vol.

Volume

The 7-day total volume for oSQTH via Uniswap oSQTH/ETH pool was $2.41m. December 26th saw the highest single-day volume, with a daily total of $974.16k traded.

Crab Strategy

Crab strategy saw slight gains to end the week +0.45% in USD terms, bringing the returns since inception to +9.84%.

Zen-Bull Strategy

Zen-Bull continues to find ways to stack ETH for depositors closing the week +0.25% in ETH terms.

Twitter: https://twitter.com/opyn

Discord: discord.gg/opyn