Crypto Options Analytics, August 8th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

$43,806

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Aug. 8th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

The option markets provided a lot of insight last week.

Option skews became positive (call IV > put IV) last week, for the first time in a long time, and this proved to be correct.

Today, skews remain positive for nearly all expirations.

There is a lot of optimism being priced in that this rally has legs behind it.

From a trading perspective we do think consolidation can continue and we’re reluctant to shift away from that position until the market can really prove itself.

That being said, $40k held as support really nicely this week.

(Aug. 8th, 2021 - Long-Dated BTC Skews - Deribit)

Long-term option skews are the highest when compared to other expirations.

Looking at the past 1-year of 180-day skew, we could see skew go even higher.

TERM STRUCTURE

(Aug. 8th, 2021 - BTC’s Term Structure - Deribit)

The options term structure is in Contango.

Any sort of explosive move could send the term structure into backwardation.

A quick jump to $50k would likely send short-dated options screaming higher and therefore the short-dated options could provide good opportunity for such a scenario.

ATM/SKEW

(Aug. 8th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is holding monthly highs nicely.

Skew (right) has started to plateau a little bit, but because these levels are holding nicely we see this as positive for spot prices… The potential for an explosive upward move is higher than a downward move of similar magnitude.

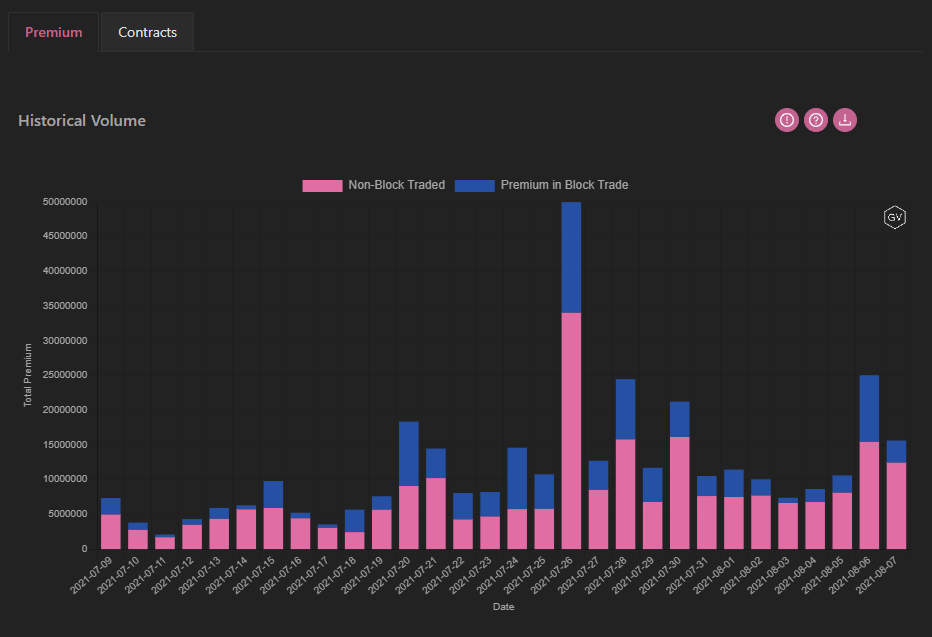

VOLUME

(Aug. 8th, 2021 - BTC Premium Traded - Deribit)

(Aug. 8th, 2021 - BTC’s Contracts Traded - Deribit)

Option volumes are holding steady after a dismal volume profile over the past 2 months.

Although there were no large volume spikes seen last week, the volume profile is much healthier now than in mid-July.

VOLATILITY CONE

(Aug. 8th, 2021 - BTC’s Volatility Cone)

Realized volatility is holding steady around the median.

RV is hanging out around typical levels seen over the past year.

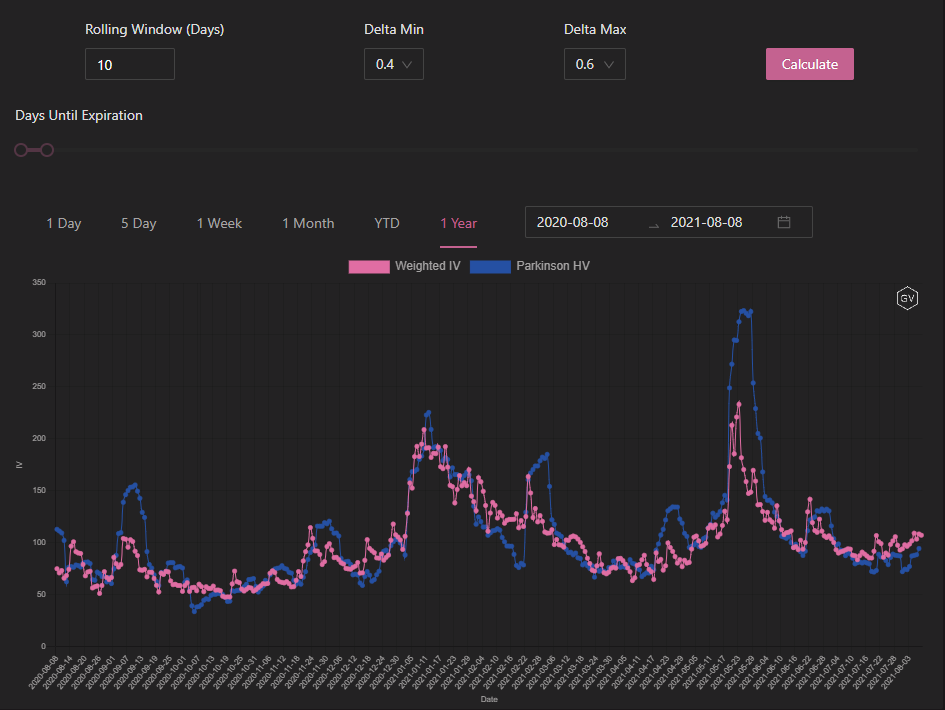

REALIZED & IMPLIED

(Aug 8th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The option market is pricing IV near RV.

The options market did a good job pricing future RV a couple weeks ago and option traders continue to expect RV to remain around these levels in the near term.

$2,975

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Aug. 8th, 2021 - ETH’s Skews - Deribit)

ETH had a huge upgrade over the past week. The London Hard-Fork provided a new catalyst for ETH bulls, given the EIP-1559 roll-out.

Short-term ETH skew dropped slightly compared to last week, but medium-term and long-term skew continued to march even higher.

(Aug. 8th, 2021 - ETH’s Skews - Deribit)

There is good reason to be structurally bullish on ETH and expect more upside volatility for ETH versus downside volatility.

PoS and EIP-1559 (Ultra-Sound Money) could bring ETH to new ATH’s by the end of the year.

TERM STRUCTURE

(Aug. 8th, 2021 - ETH’s Term Structure - Deribit)

Unlike BTC, the ETH term structure is flat and not displaying a Contando shape.

This type of volatility term structure supports the “potential” for a massive upside move in ETH.

ATM/SKEW

(Aug. 8th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is making new monthly highs. This is no surprise, given the fundamental catalysts coming into play.

As traders and institutions wake up to ETH, the potential for large spikes in price increases.

SKEW (right) is nice and positive, although the trend seems to be plateauing here.

VOLUME

(Aug. 8th, 2021 - ETH’s Premium Traded - Deribit)

(Aug. 8th, 2021 - ETH’s Contracts Traded - Deribit)

The option volume profile for ETH is very telling.

There is a strong renewed enthusiasm for ETH’s optionality and this is even more apparent when compared to BTC’s volume profile.

Keep this in mind.

Let’s see how ETH handles the $3k price zone, but we think there’s more potential for ETH trend resumption and potential breakout to new ATH’s than BTC.

VOLATILITY CONE

(Aug. 8th, 2021 - ETH’s Volatility Cone)

RV is picking up.

Short-term measurement windows are now flirting with the upper 75th percentile.

This activity in realized volatility bodes well for a sustained rally going forward.

REALIZED & IMPLIED

(Aug. 8th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is pricing in higher future RV.

This “variance premium” can often be interesting for vol. sellers but in this case, the fundamental catalysts are there to justify higher future RV.