Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE THEMES:

CPI Wednesday @ 8:30ET

The US macro landscape is very interesting here.

Friday saw a MASSIVE job report gains, +528k (Vs +258k expected).

This is the weirdest recession ever, for sure.

How do we think through this?

Knee-jerk reaction: Risk assets should drop and the dollar should rally, as the market anticipates even BIGGER rate hikes.

Risk asset price direction is going to be determined by the interplay between inflation and the Fed “REACTION”.

2.1 If the Fed is ahead of inflation and sufficiently hawkish, risk assets should drop as the market finds credibility with respect to fed making the necessary hikes.

2.2 If the fed is behind the curve… Risk assets should massively rally. If the Fed isn’t going to control inflation and hard assets, income-producing equities and other "purchasing power” shelter should become VERY sought after (bought and rallied).

On Friday, we saw equities drop and recover, post NFP#.

I’m sticking to my “VIX touches 19 in August” call.

I think the market is starting to think that the Fed is behind the curve; the government keeps spending but,most importantly, “recession downside” is already too hedged… The pain trade seems like higher risk assets and lower vol.

This is my thinking in the short-term.

Maybe CPI will ruin my thesis, we’ll see.

September and October might be providing opportunities to think more bearishly, but that’s too far away for me to think about right now…

BTC: $23,245 -2.3%

ETH :$1,717 0.00%

SOL: $40.89 -6%

DVOL: Deribit’s volatility index

BTC (Top) - (180-days w/ spot line chart)

ETH (Bottom) - (180-days w/ spot line chart)

ETH IV is far from the early June lows, while BTC is hanging out right at those lows.

This relative divergence is showing us the enthusiam for ETH vol; my spider senses are tingling for some ETH upside.

TERM STRUCTURE

(Aug.7th, 2022 - BTC’s Term Structure - Deribit )

(Aug.7th, 2022 - ETH’s Term Structure - Deribit )

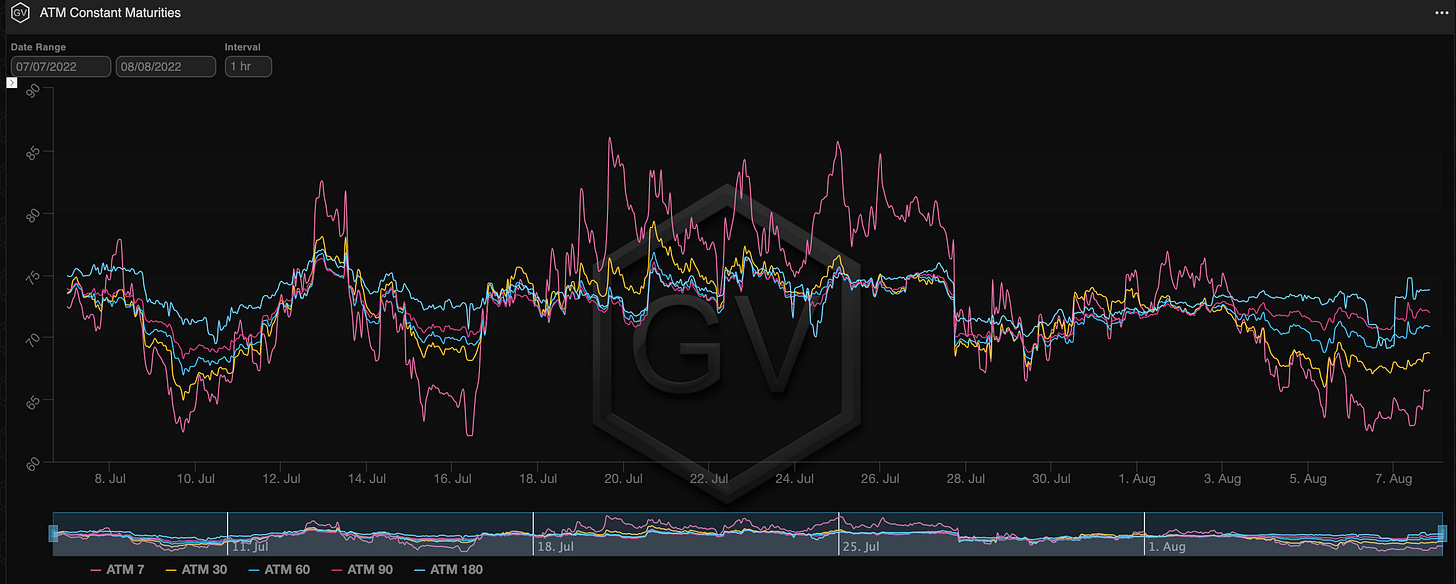

BTC (gvol API python module, pre-built notebook charts )

ETH (gvol API python module, pre-built notebook charts )

(ETH-BTC IV Spread)

We’re seeing a massive spread between ETH IV and BTC IV…

Week-over-week,this spread has increased for all expirations, while the term structure shapes are are slightly divergent.

BTC is in Contango through all maturities and ETH’s term structure is “twisted” (Contango in the front, Backwardation in the back).

Getting long ETH options is expensive but at the same time, the market is enthusiastically pricing movement.

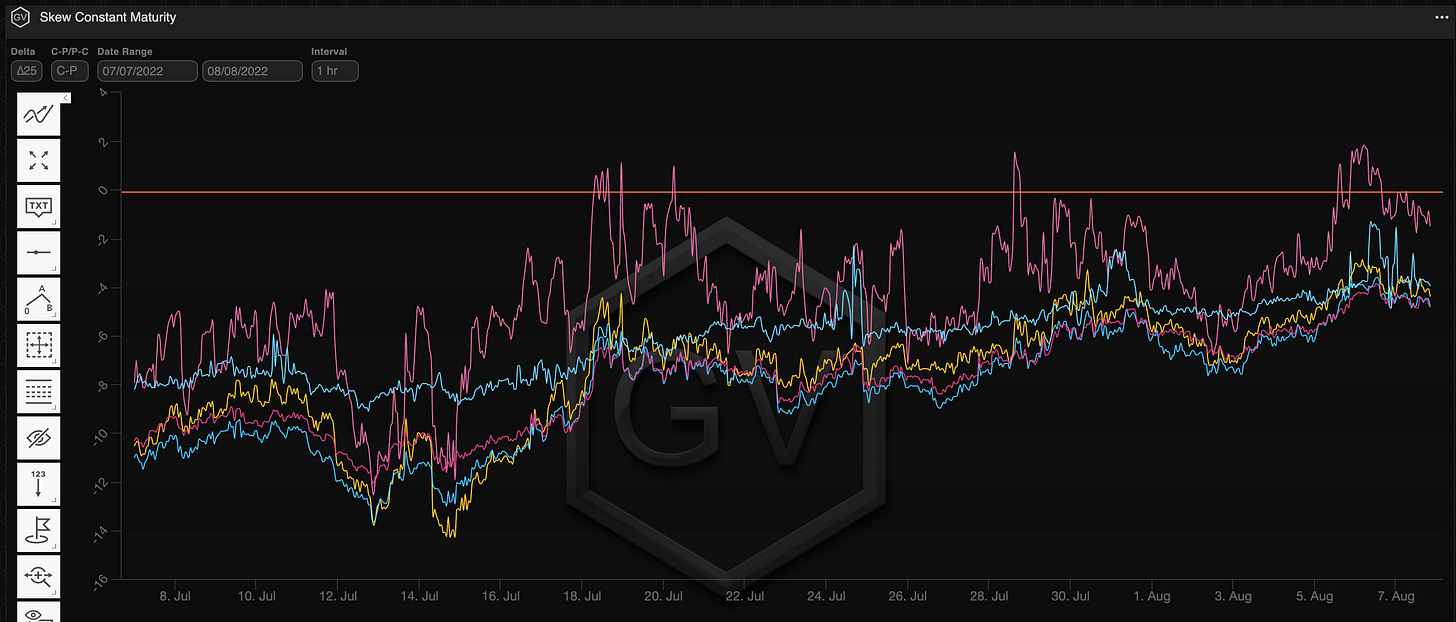

SKEWS

(Aug.7th, 2022 - BTC’s RR SKEW (C-P) - Deribit)

(Aug.7th, 2022 - ETH’s RR SKEW (C-P) - Deribit)

BTC RR-Skew is about symmetric, while ETH RR-Skew is still slightly negative.

I think the opportunity lies in ETH. The way the option market is positioning itself in ETH is encouraging for something to the upside.

We’re seeing ETH option OI sustain a higher level than BTC.

ETH DVol sustains a higher relative plateau versus BTC.

And lastly, looking through the “Block Sniffer” volumes, we’re seeing massive OTM call activity.

Traders are getting ready for a POS transition catalyst and a spike high in ETH (call it $2.3k area) seems like a reality.

(ETH Block Sniffer)

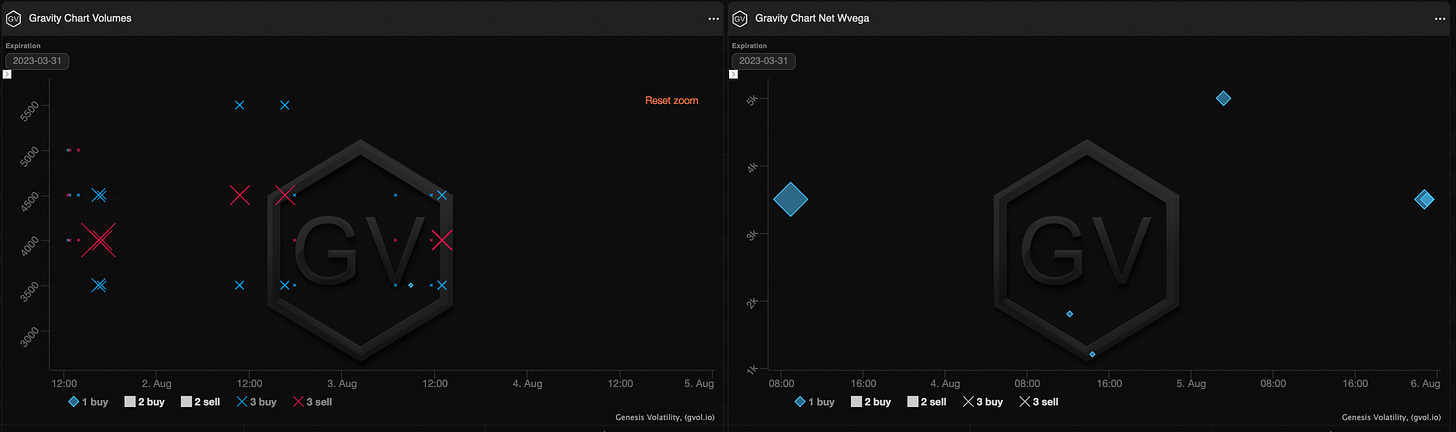

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

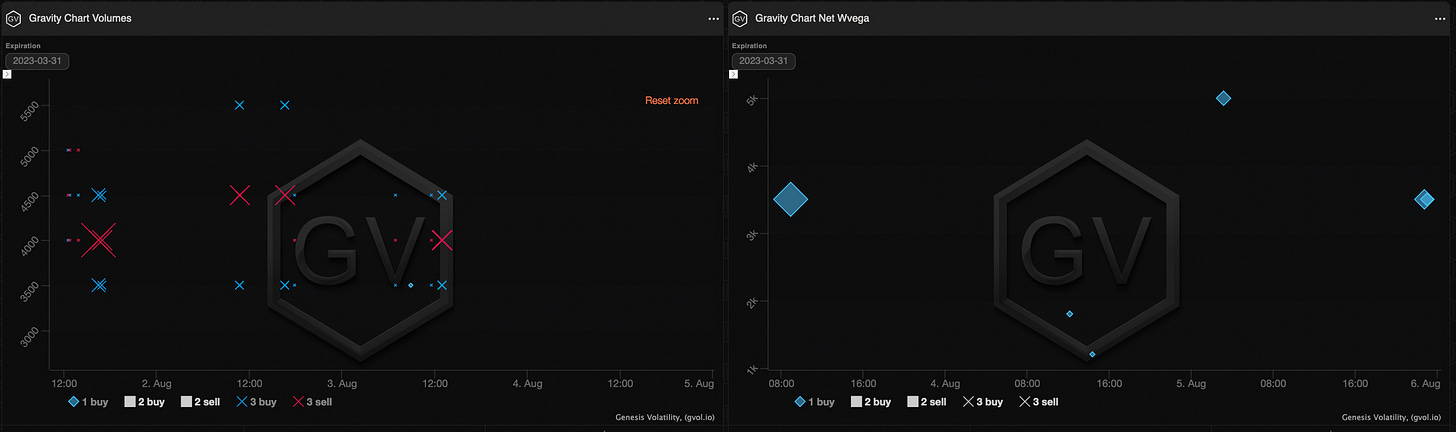

Relatively light week in terms of volumes, although something more defined seems to take shape.

The Ethereum merge dominates the scene and is very likely given for September; an official confirmation is still lacking. Added to this was the possibility of a fork, with the ETH-POW chain having support from the majority of miners. The transition to proof of stake doesn’t seem to be as smooth as many had predicted.

On the Bitcoin side, the speculation of the mtgox distribution in August continues, and beyond the veracity of the thing (no it’s not, word of the creditor), this narrative leaves room for further uncertainty.

If we add a few “pinches of macros” we get the perfect recipe for well-defined stances about volatility.

Bitcoin: long call 31MAR23 $36k (delta hedged) and $40k + strangle $15k-$55k, long call 30SEP $25k/$28k (delta hedged); short 12AUG: $20k-$26k strikes-range + short straddle $23.5k + short put spread $20k-$18k.

Ethereum: usual conspicuous activity of flies on 31MAR23 and long outright call 30DEC $3k + 31MAR23 $3.5k/$5k.

Participants are accumulating September-December-March volatility, while selling the front-end. Short/neutral gamma, long vega.

A bet that seems rational, even considering all possible outcomes mentioned above.

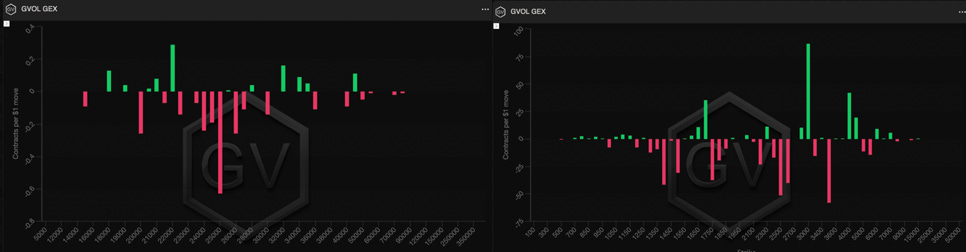

The most interesting GVOL_GEX strikes are 25k Bitcoin (negative gamma) and 3k Ethereum (positive range).

(1st Aug - 7th Aug, 2022 - BTC GVOL Gravity charts - 31MAR23)

(1st Aug - 7th Aug, 2022 - ETH GVOL Gravity charts - 31MAR23)

(1st Aug - 7th Aug, 2022 - BTC/ETH Gvol Gex)

(1st Aug - 7th Aug, 2022 - BTC/ETH Gvol Gex)

VOLUME

(Aug.7th, 2022 - BTC Premium/Contracts Traded - Deribit)

(Aug.7th, 2022 - ETH Premium/Contracts Traded - Deribit)

Paradigm Block Insights (1 Aug – 7 Aug)

Crypto majors continue to trade sideways. ✍️ ETH long-dated topside buying continues to dominate top flows. 🌊 Market has 1-way interest heading into Sep ETH MainNet merge.

BTC -1% / ETH +0.3% / SOL -5.8%

BTC implied vols continued to puke on another week of range-bound spot action 📉

The muted activity is likely stemming from market participants focused on ETH / MainNet merge. We did note large BTC topside buying late in the week 🔥

750x 31Mar 36k Call Delta Neutral bot

500x 30Sep 28k Call Delta Neutral bot

ETH SIZE butterfly buying via Paradigm is the headline story 📈

The relentless bid has left dealers quite long the 4k and 4.5k strikes 👀

🌊75k 31Mar CFly 3500/4000/4500 bot

🌊50k 31Mar CFly 3500/4500/5500 bot

With ETH-MainNet merge slated for 19Sep, ST vols have rolled over, while Sep/Oct vols are being bid✍️

We think these vols continue to richen significantly as we approach 19Sep, especially with FOMC Sep20/21.

30Sep 1400/1800 Strangle

28Oct 1500/2000 Strangle

Additional Notable Weekly Flows 🙌

BTC 🌊

525x PCal 26Aug 20000 / 30Sep 15000 sold

500x Mar Strangle 15000/55000 bot

500x Call 12Aug 22 23000 sold

ETH 🌊

12k CCal Dec 3500 / Mar 3500 bot

10k CSpd 31Mar 3400/3500 sold

10k CSpd 30Sep 3000/3500 sold

Paradigm’s FSPD volume totaled over 1.5 Billion YTD!🔥(Driven by tight markets in more than 48 Deribit futures spreads, as well as new clients trading FTX futures spreads.)

Message us here to learn more!

pdgm.co/tgsupport

This week’s @ribbonfinance auctions on @tradeparadigm 🥳

ALL auctions beat screen ✅ with an avg of 10% 🔥 and MOST auctions being won by ANON!🤫

Winners:

🥇 @QCPCapital

🥇 @BastionTrading

🥇 @OrBit_Markets

🥇 @GenesisTrading

🥇 Various ANON

WAVAX; SAVAX; AAVE; WBTC; ETH🎉

We put out daily commentary at the Telegram link below. Subscribe for more content!

👇

https://t.me/para_client_support

BTC

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Aug. 7th, 2022 - BTC’s Volatility Cone)

(Aug. 7th, 2022 - ETH’s Volatility Cone)

(Aug. 7th, 2022 - BTC IV-RV)

(Aug. 7th, 2022 - ETH IV-RV)

Although, my tilt is to get long delta via upside calls, especially because IV has finally come down a lot… We can see here that the VAR-PREM is alive and well.

Getting long vol. is overpriced here from a pure vol. perspective, unless something changes.

My thoughts are not too sophisticated from a vol. perspective right now, but I can’t help but want to participate in ETH upside speculation.

This massive ramp-up in ETH option positioning, big OTM block-trades and excited chatter around POS, has me jazzed on spot ETH and I do think price action could become explosive from here to $2.3k.

Squeeth Weekly Review

Risk-on markets across the board remain bid, while continuous negative chatter is all you see. Squeeth ended the week -1.5%, but didn’t fail to have a decent range. Looking at the week ahead the CPI should provide a great environment for traders to utilize oSQTH.

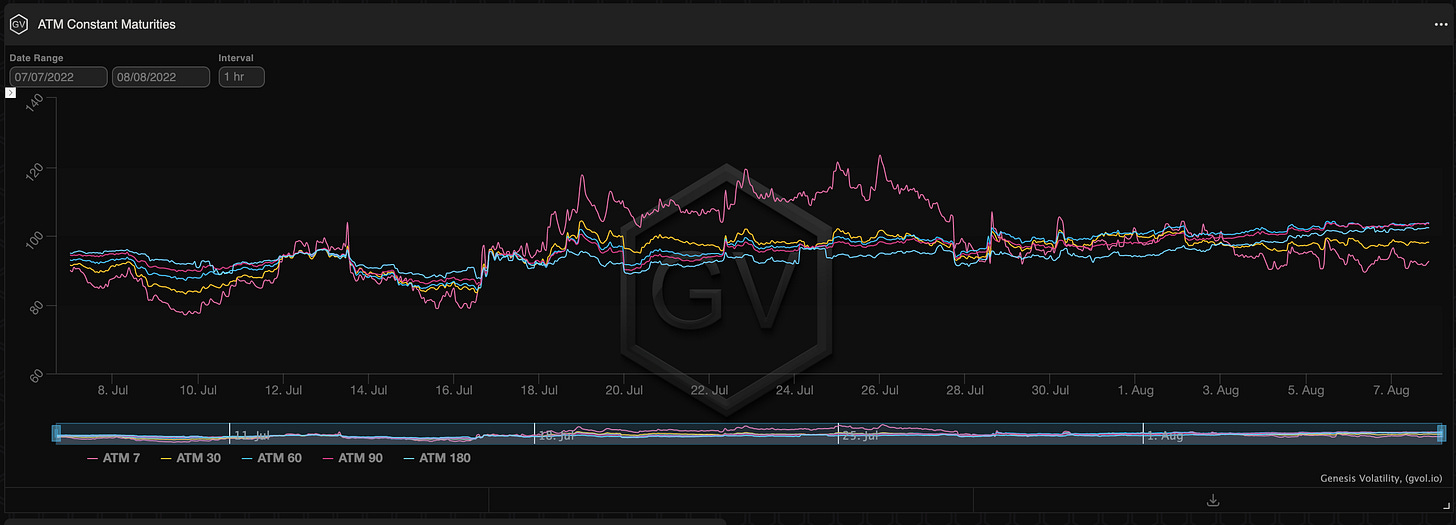

Volatility

Squeeth IV found its way lower throughout the week, fading back to the low 90s. Crab v2 raises continued to create shorter-term IV drops as the vault continued to be a seller of oSQTH upon deposits.

Volume

Volume stayed relatively constant to begin the week. August 5th - 6th Squeeth saw upticks, with daily volume hitting a combined total of $3.79m via Uniswap ETH/USDC pool.

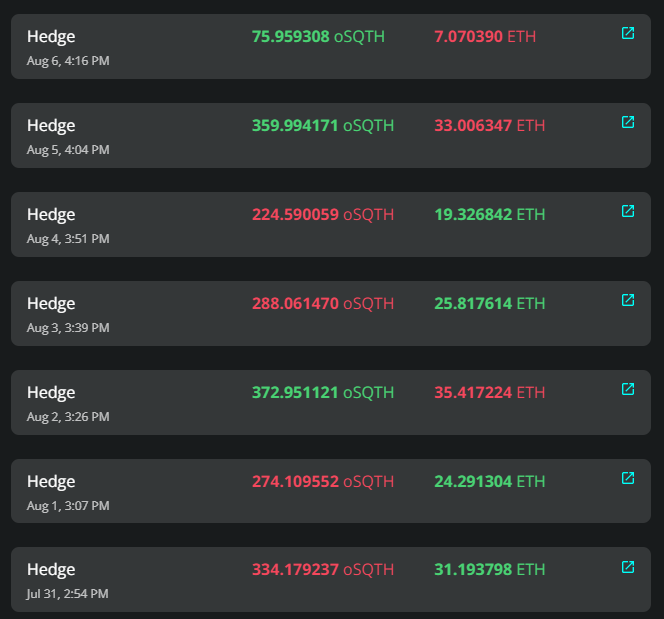

Crab Strategy

Crab v1 continues to perform hedges equating to 176.1144ETH this week.

Crab v2 performed three hedges this week equating to 65.4ETH.

Raw Crab data is showing further appreciation in Crab, relative to USD.