Crypto Options Analytics, August 28th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE THEMES:

Friday we had a speech from Fed Chairman Powell, concluding the Jackson Hole meeting.

Powell essentially explained that he isn’t going to shy away from fighting inflation.

Rates will likely continue to be hiked up to around 4%, and then held there.

As long at the employment rate remains strong, the Fed has a lot of wiggle-room for these hawkish maneuvers.

Two key insights into the current Fed thinking are as follows:

Powell is afraid of inflation’s EXPECTATIONS resetting higher and a wage-price spiral (1970’s style) occurring again.

Powell wants to AVOID Volcker-style hikes (which essentially SHOCK front end yields higher and throw the yield curve into the negative… as back end yields fall, pricing-in recession probabilities).

We’ve mentioned this before, but Powell’s style is going to be HOLDING rates higher, for longer, allowing higher rates to “trickle” into the backend.

This week is crucial to see if there’s bearish follow-through from Friday’s Powell speech.

Hedge funds are already short the markets and Powell’s rate regime likely won’t create a PANIC shock lower on its own.

That said, the China/Taiwan situation, Europe/Russia, US-politics/mid-terms, a mix of ALL-THREE… these situations are catalysts for a PANIC vol. shock.

The most likely themes this week are lower equities, stronger dollar, weak precious metals and weak Euro & Yen.

Long-put flies seems like a good play, assuming a grind lower.

Lastly, we have NFP this Friday and a holiday weekend for US markets, as Monday will be closed for Labor Day.

Crypto:

Crypto is looking ESPECIALLY weak.

This asset class could get hit hard and find some panic selling.

BTC IV has a slight VRP but RV could easily move much higher.

BTC spot prices were unable to find any buying at the $20k whole number, a level I think worth gauging risk around.

BTC: $19,663 -8.85%

ETH :$1,432 -11.45%

SOL: $30.44 -17.53%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

Mid-week, IV was quick to drop lower, but this move was pre-mature. There’s a lot of uncertainty going forward with risk-assets and crypto would be the first risk-asset to easily drop a lot.

I think IV is providing a decent buy here.

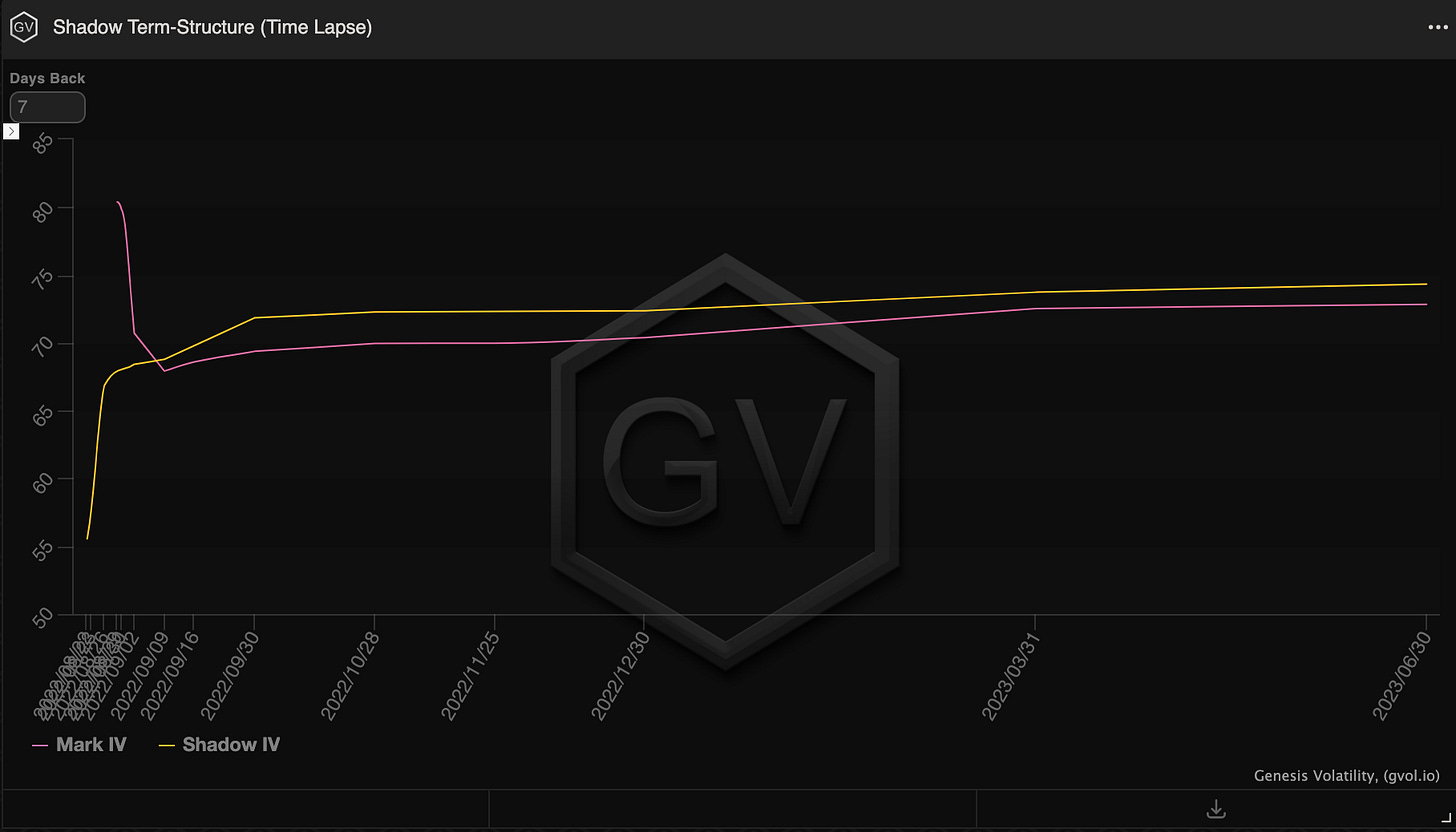

TERM STRUCTURE

(Aug.28th, 2022 - BTC Term Structure - Deribit)

(Aug.28th, 2022 - ETH Term Structure - Deribit )

BTC (Term Structure)

ETH (Term Structure)

Both term structures were able to flatten up post-Powell.

Something interesting to note, we didn’t see much of a pre-Powell IV pump into the speech. The very front end reacted higher, but options 30-days or more basically flat-lined through.

That could be an interesting opportunity to think about going forward.

Short-term IV could explode higher this week, if there’s a bearish follow-through.

This week is a CRUCIAL “digestion” period for the markets, given the future rate path.

If markets continue lower, I’d expect a fully backwardated term-structure.

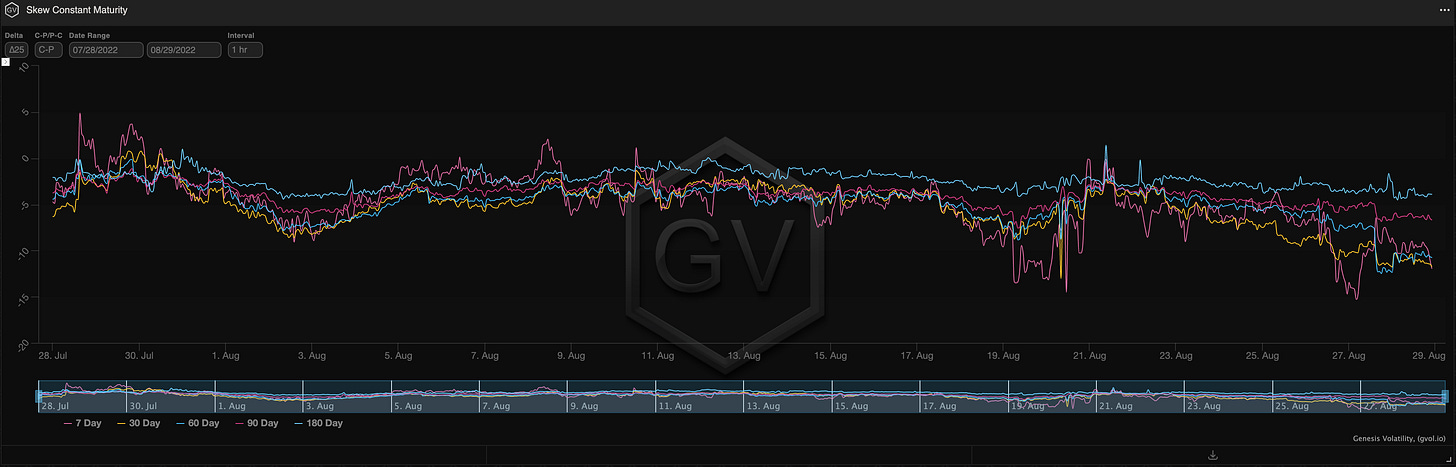

SKEWS

(Aug.28th, 2022 - BTC RR SKEW (C-P) ∆25 - Deribit)

(Aug.28th, 2022 - ETH RR SKEW (C-P) ∆25 - Deribit)

Risk-Reversals are negative for both BTC and ETH.

BTC is more of a pure-play on macro risk-assets, while ETH has crypto-specific risk around the ETH 2.0 merge.

The hype around ETH 2.0 merge is likely a bullish catalyst - assuming no major hiccups - which could provide interesting divergences.

Betting the BTC-RR goes lower, especially in the long-end, seems asymmetric to an extent. I can’t imagine any scenarios right now for BTC-RR to zoom higher, but I’ve pointed out a few macro scenarios that could smash BTC lower.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

In the last newsletter we talked about how the broken price structure had not affected the enthusiasm for the expected merge in the slightest. Something seems to have changed this week, with many trades of caution and protection hitting the tape (many of them ahead of Friday’s dump).

Bitcoin trades: calls bought JUN23 $45k/$50k (delta hedged), put spreads bought 2SEP $19k-$18k, puts bought SEP $19k/$19.5k/$20k (end of the week)

Ethereum trades: put spreads bought 30SEP $1k-$0.7k (x20000 on Monday), strangle bought 28OCT $0.8k/$3k, call spread/ratio 30SEP $3k-$5k

Now that August is ending, many big players will return to their desks, volumes will return to their usual levels and flow indications will be clearer and sharper.

I still believe there are interesting opportunities to be seized.

For the first time since June, ETH-BTC 30d realized volatility was lower than the implied.

As we approach the merge date, taking a position “against” the market by shorting the September hump will be increasingly tempting…

(GVOL ETH-BTC RV/IV spread 30days)

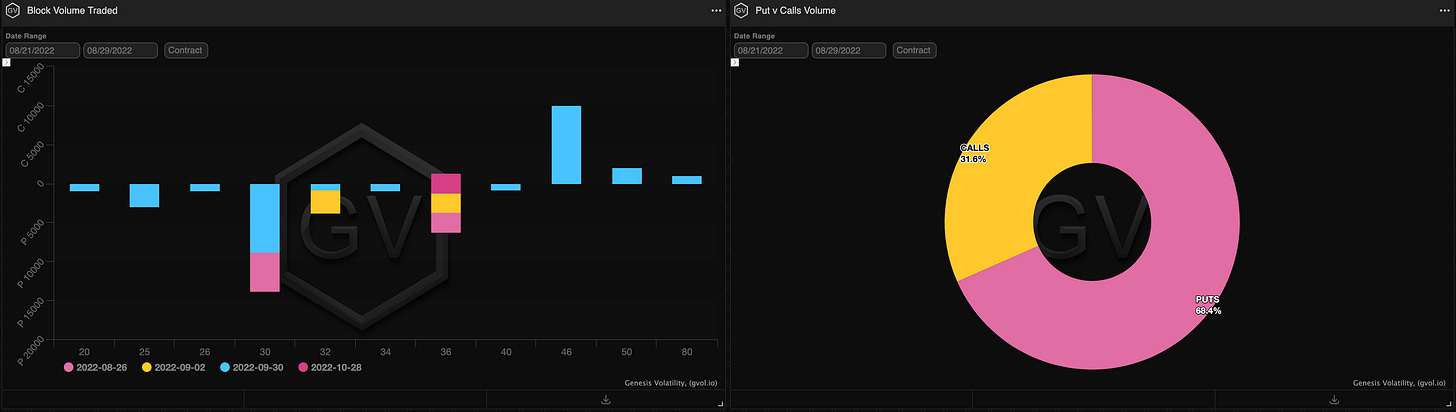

Paradigm Block Insights (21 Aug – 28 Aug)

Crypto majors traded range bound for the week, but dipped lower on Friday as markets sold off on the heels of Powell’s comments in Jackson Hole.

BTC -5% / ETH -4% / SOL -7%

BTC Notable Flows:

500x Call 30Jun 45k bot

500x Call 30Jun 50k bot

Heavy downside buying printed on Paradigm Friday

1800x PSpd 2Sep 19k/18k bot

As the sell-off accelerated we saw an increased flurry

525x Put 9Sep 19.5k bot

250x Put 30Sep 20k bot

250x Put 30Sep 19k bot

Amidst the spot sell-off, implieds continue to trade sideways, with realized vol monotonously lagging behind. We maintain the posture that dealers likely remain bid as the macro narrative shifts more hawkish, listed demand for vega remains high, and OTC overwriters deliver less vol to market makers.

ETH Notable Flows:

15k PSpd 30 Sep 22 1000/700 bot

15k Strg 28 Oct 22 800/3000 bot

7.5k CFly 31 Mar 23 3500/4000/4500 bot

7k 1x2 CSpd 30 Sep 22 3000/5000 bot

5k Call 31 Mar 23 5000 bot

Heavy ETH topside selling on Paradigm following Powell’s comments Friday.

4k Call 30 Sep 22 1600 sold

3k Call 2 Sep 22 1600 sold

3k Call 9 Sep 22 1550 sold

2.5k Call 9 Sep 22 1600 sold

Futures Spreads:

FTX spreads heating up on Paradigm 🔥 Orderbooks are flush with resting orders waiting to be filled!

Full list of FTX strategies now include: BTC, ETH, SOL, AVAX, APE, DOGE, LINK, LTC FTM, MATIC,BNB and BCH! ✍️

🎀 This week’s @ribbonfinance auctions on @tradeparadigm 🥳

All auctions continue to beat the screen 🔥 - and the continuing story is WstEth options trading ~flat to ETH🤯🤯! #merge

Winners:

🏅 @GenesisTrading 🏅 @QCPCapital🏅 @OrBit_Markets🏅 @BastionTrading 🏅 Various ANON

Check out our blog! More content being added frequently! 👇👇👇

This week's post focusing on leg risk and mitigating it through trading @FTX_Official futures spreads on @tradeparadigm !

https://paradigm.co/blog/watch-your-legs…

H/t @KrisMachowski 🙏

We put out daily commentary at the Telegram link below. Subscribe for more content!

https://t.me/para_client_support

BTC

ETH

SOL

VOLATILITY PREMIUM

(Aug. 28th, 2022 - BTC IV-RV)

The BTC VRP is still elevated for 7-day maturity.

RV hasn’t seen a panic rise higher yet. This would be needed to justify current option premiums but just keep in mind, as witnessed in mid-June, 7-day RV can easily hit 150%, should there actually be some panic.

This is the kind of week where we could see some rise in RV (although not to the 150% extent) as the market “digests” the repercussions of the Powell speech.

Squeeth Weekly Review

Jackson Hole did not disappoint, ETH spot markets found a bid early just to let it go, and some to end the week down -5.41% on a continued harsh hawkish tone out of Powell. oSQTH ended the week down -12.3%

Volatility

Markets remained relatively calm with oSQTH IV hanging around 113 to start the week. Volatility mid-week found lower prices and created some great opportunities for traders to buy ETH exposure cheap.

Volume

The 7-day total for oSQTH via Uniswap oSQTH/ETH pool was $9.57m. August 19th saw the most volume, with a daily total of $2.47m being traded.

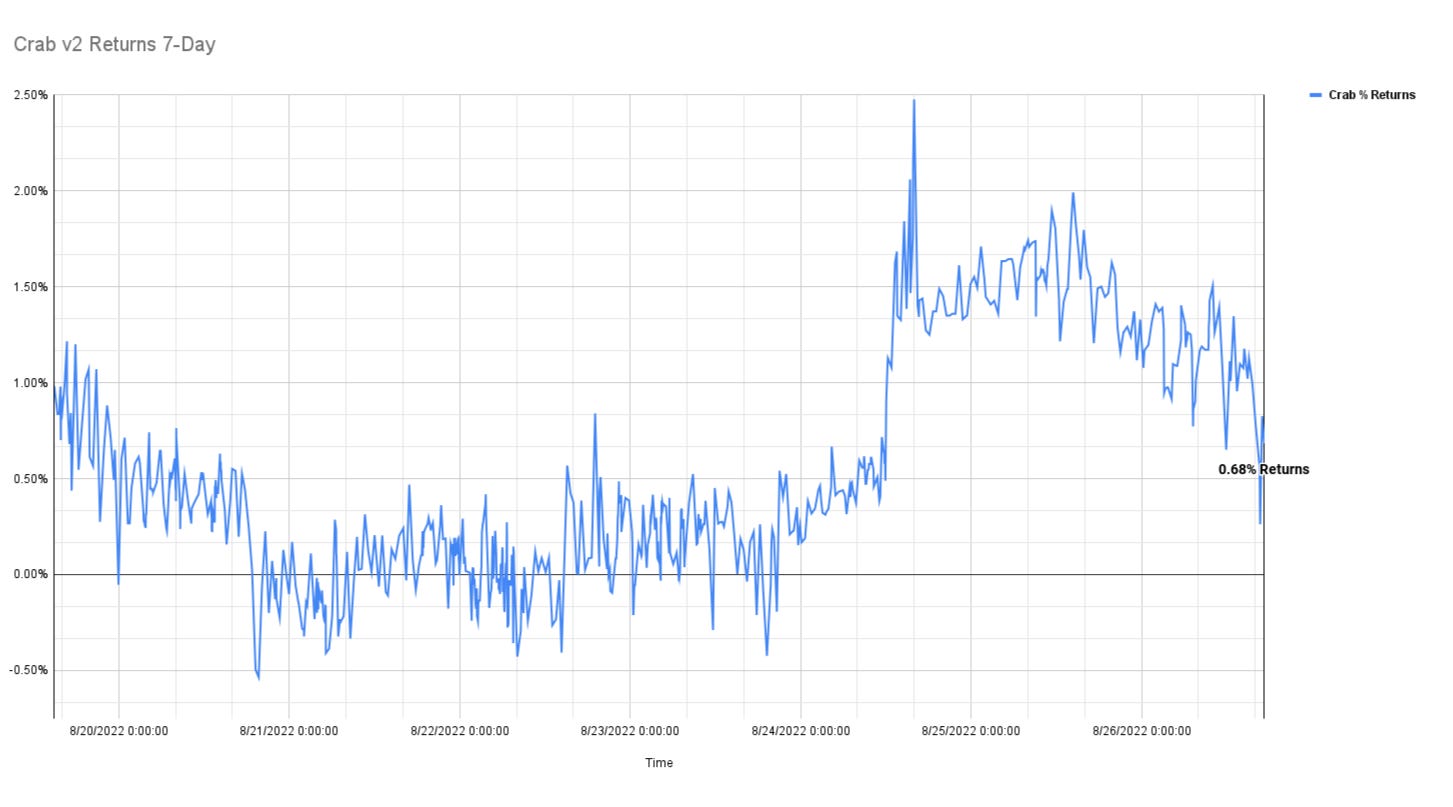

Crab Strategy

Crab v2 has returned roughly 2.09% since inception (July 28th, 2022). This week, Crab returned roughly .68% at the close of NYC trading on Friday.

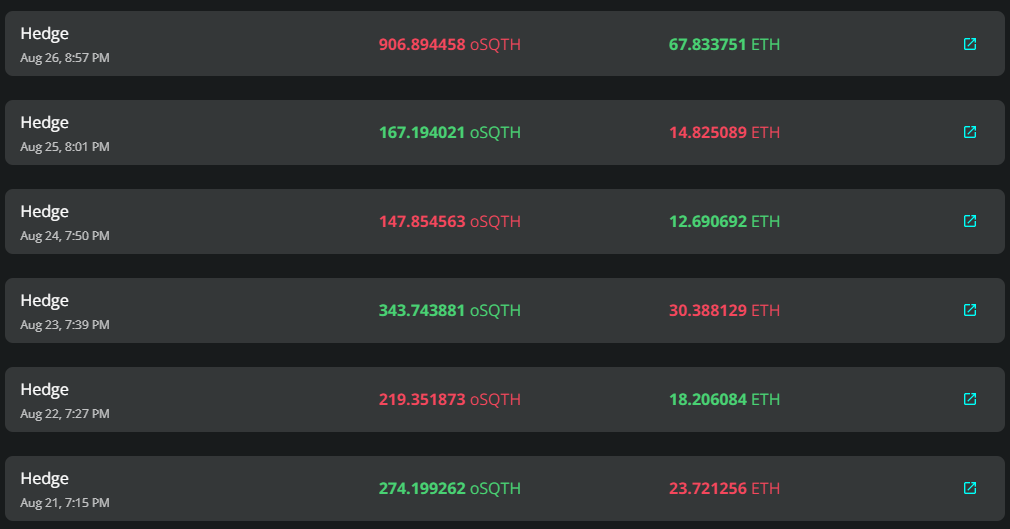

Crab v1 performed hedges equating to 167.665 ETH.

Crab v2 performed hedges equating to 524.584 ETH.