Crypto Options Analytics, August 22nd, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$48,568

DVOL: Deribit’s volatility index

(1 month, hourly)

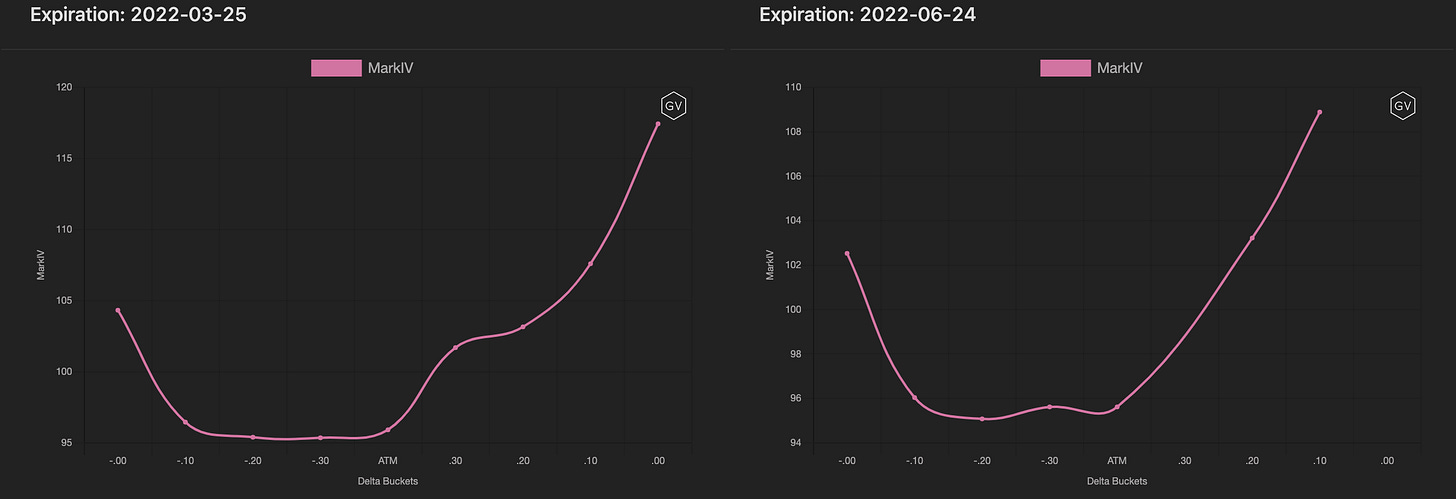

SKEWS

(Aug. 22nd, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Volatility has softened this week, both in terms of realized and implied.

Option skews came down slightly (calls IV - put IV) across the board and short-dated options (weeklies) briefly went negative as BTC dipped below $45k.

Spot prices are holding support nicely, but bets for explosive upside moves are slightly starting to lose their appeal… the psychology of a $50k price point could prove to be stubborn.

(Aug. 22nd, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Aug. 22nd, 2021 - BTC’s Term Structure - Deribit)

The term structure continues to be in an extremely steep Contango shape.

This shape has been a great benefit to vol sellers…

Vol sellers not only enjoyed a softening IV this week, but also a nice term structure “roll-down”.

ATM/SKEW

(Aug. 22nd, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) has continued to retrace lower in a steady and controlled fashion.

Skew (right) is slightly lower compared to last week. The brief dip lower in skew was short-lived as put-buying remains out of favor.

VOLUME

(Aug. 22nd, 2021 - BTC Premium Traded - Deribit)

(Aug. 22nd, 2021 - BTC’s Contracts Traded - Deribit)

Overall volumes were lower last week compared to previous activity this month.

That being said, 8/20 stands out both in terms of $$’s traded and contracts traded, much of which was executed on Paradigm.

PARADIGM FLOW HIGHLIGHTS - Patrick Chu @Paradigm

(Aug. 22nd, 2021)

The week's trading highlights included significant volumes going through in low delta BTC calls, with a focus on strikes between $70,000/$100,000.

Call Spreads were the preferred structure of expression, accounting for ~30% of total volume.

We also continued to see high volumes for outright calls on the Aug 20 & Aug 27 expiries, particularly in BTC, where strikes between 50-54k dominated trading.

This was especially apparent on Friday, where a flurry of demand for calls in the 50-54k strike range on the US open resulted in more than 3000 contracts being traded across the strikes.

70% of BTC block flow was focused on calls this week.

VOLATILITY CONE

(Aug. 22nd, 2021 - BTC’s Volatility Cone)

Realized volatility has continued to be lackluster.

RV is now bound to the lower 25th percentile for short-term measurement windows.

Long-term measurement windows continue to reflect mid-May volatility.

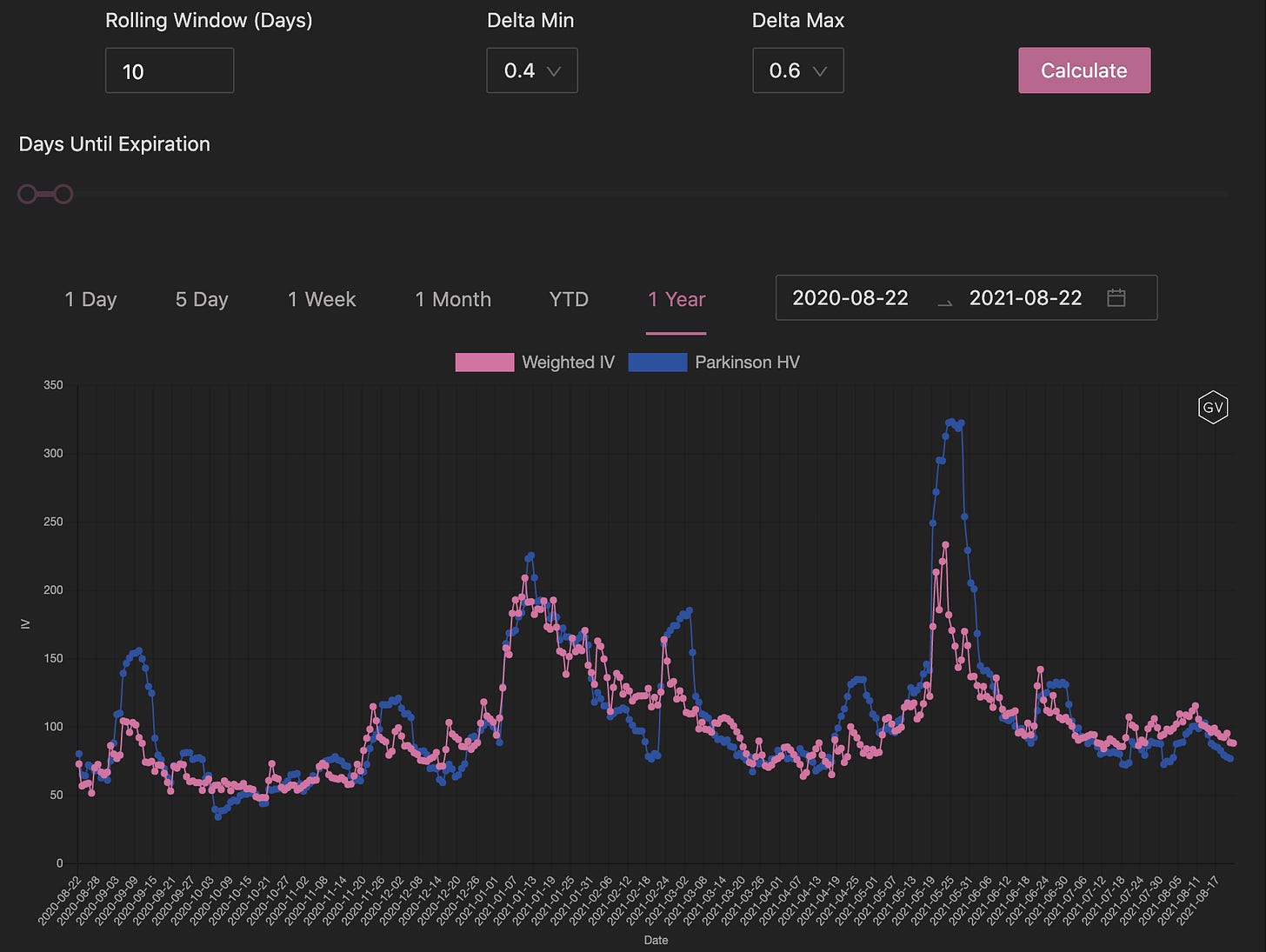

REALIZED & IMPLIED

(Aug 22nd, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

There’s a large variance premium currently being priced.

Combine this with a steep Contango and softening IV levels, overall the chips are currently stacked in the vol. sellers favor, for the time being.

$3,175

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Aug. 22nd, 2021 - ETH’s Skews - Deribit)

ETH (aka ultra sound $$) also saw a softening in volatility.

Overall, skew levels did drop slightly as traders gauge the potential for explosive upside moves, but the preference for calls remains air-tight.

ETH skews all held above the zero-line. The preference for ETH calls vs puts remains strong.

(Aug. 22nd, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(Aug. 22nd, 2021 - ETH’s Term Structure - Deribit)

Like BTC, the ETH term structure has become very steep.

There’s a 30-point IV differential between Dec 31 and Aug 27th… That’s about a 0.25-point daily “roll-down” decay in ETH volatility!

ATM/SKEW

(Aug. 22nd, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) had a sharp retracement lower.

SKEW (right) softened ever so slightly, but the zero-line remained unchallenged.

VOLUME

(Aug. 22nd, 2021 - ETH’s Premium Traded - Deribit)

(Aug. 22nd, 2021 - ETH’s Contracts Traded - Deribit)

ETH volumes softened this week versus last week, in line with a softening volatility profiles.

Both 8/17 and 8/19 showed strong $ volumes, thanks to large block-trading activity.

PARADIGM FLOW HIGHLIGHTS - Patrick Chu @Paradigm

(Aug. 22nd, 2021)

The week's trading highlights included significant volumes going through in low delta ETH calls, with a focus on strikes between $5,000/$10,000.

Call Spreads were the preferred structure of expression accounting for ~40% of total volume.

66% of ETH block flow was focused on calls this week.

VOLATILITY CONE

(Aug. 22nd, 2021 - ETH’s Volatility Cone)

Like BTC, the ETH vol. cone is dipping lower for short-term and medium-term measurement windows.

ETH RV is hovering around the lower 25th percentile.

REALIZED & IMPLIED

(Aug. 22nd, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

IV is also trading at a premium to RV as traders currently expect RV to rise back up in the near future, although the RV trend does seem to favor lower readings.

Like BTC, the ETH vol space is currently expensive for vol. buyers. Volatility pricing is currently favoring short volatility strategies.