Crypto Options Analytics, August 21st, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE THEMES:

US stocks lost some of their gains last week, while Crypto took a significant hit.

Bear markets typically have strong relief rallies and the stock market “breadth” could be part of that relief rally.

I’m sticking to my thesis from last week.

We’re currently in “no-man’s-land” from a macro trade perspective. There are good reasons to be bearish from a fundamental perspective: Taiwan, European energy needs in winter, and US mid-terms. Three catalysts for uncertainty and volatility.

On the bullish perspective, this relief rally could surprise everyone. However, the breadth chart above has only briefly held the 90% mark, meaning some single stock names might head below the 50-MA again.

Crypto:

Crypto prices took a big hit last week and implied volatility came into the market as prices dropped.

The big fundamental catalyst around Crypto is the current regulatory crack-downs and the ETH 2.0 merge.

I’m not too sure what to make of it from a short-term directional perspective here. I assumed last week that the Crypto rally was “lagging” the TradFi relief; that assumption didn’t prove to hold.

Focusing on a vol. perspective without a directional bias will be my theme this week.

BTC: $21,571 -10.96%

ETH :$1,622 -15.65%

SOL: $36.69 -18.63%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

BTC prices dropped 11% this week and the DVOL is now back near the upper range.

$20k is likely a significant price level, while the DVol upper-bound might be a thoughtful inflection point to look at.

Should things go sideways (think China/Taiwan), LUNA peg break and 3AC vol. levels are the next logical inflection points.

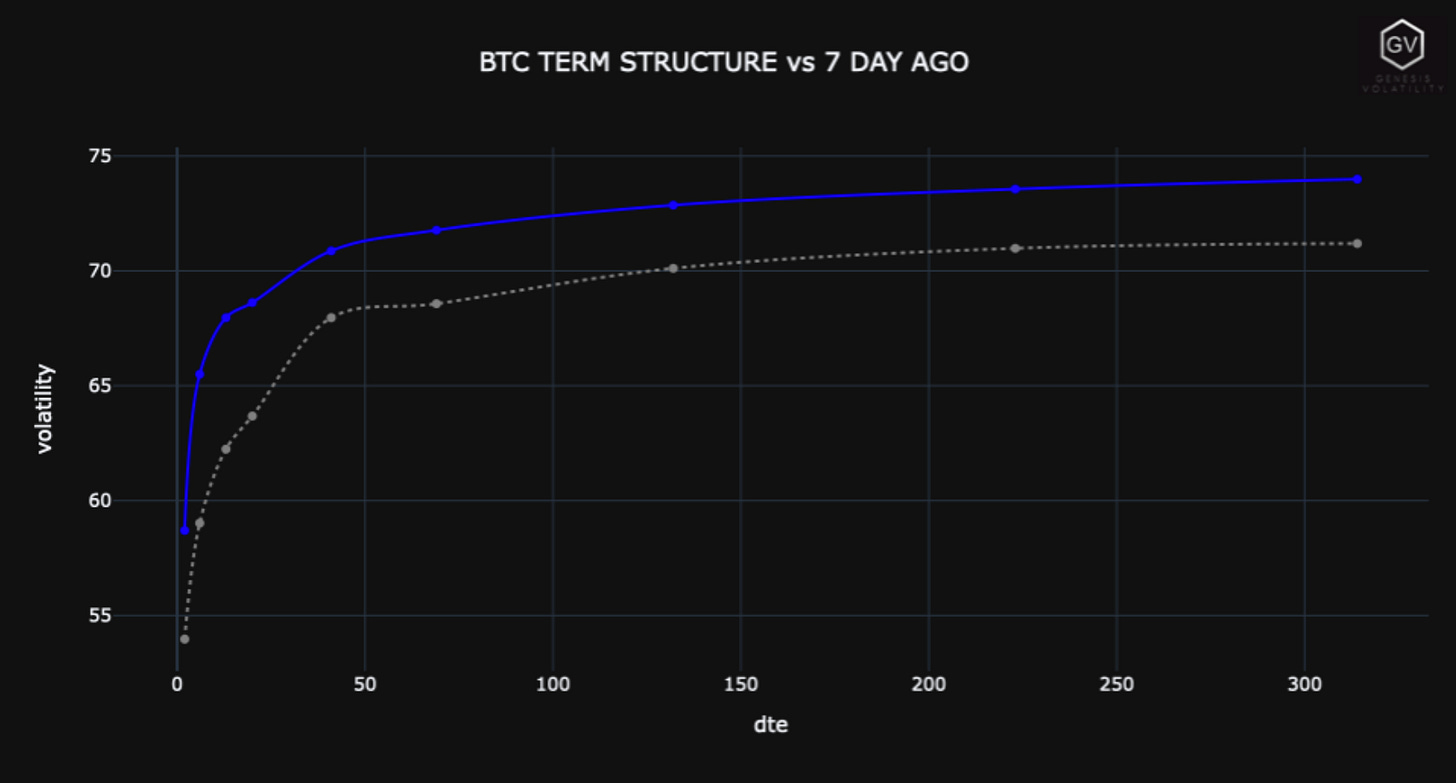

TERM STRUCTURE

(Aug.21st, 2022 - BTC’s Term Structure - Deribit )

BTC (Term Structure)

ETH (Term Structure)

Despite the rise in IV for both BTC and ETH, the term structures remain in Contango.

The ETH term structure has a vol. “kink” around the 2.0 merge timeline.

@WarrenMuppet in the GVOL/Paradigm VolPit pointed out the ETH Basis pricing in ETH.

We’re seeing a negative “kink” in the short-term as the value of an ETH PoW fork “airdrop” is being priced in.

Another consideration is that the ETH staking Yield should theoretically make long-term ETH basis negative, as the holding delta-hedged StakeETH / Short-Fut should have a “netted” yield.

(Think positive StakeYield minus Basis yield)… Something to consider.

(ETH & BTC ATM- IV Sept30 Expiration)

Using the BTC/ETH ATM-IV for September 30th quarterly expiration, we see a large ETH IV premium (highest all year). If 2.0 is a non-event, ETH options will get crushed.

I expected a break above $2.3k… with momentum before. That thesis isn’t looking to play out.

Without a solid upside break-out, ETH IV is likely too expensive.

SKEWS

(Aug.21st, 2022 - BTC’s RR SKEW (C-P) ∆25 - Deribit)

BTC-RR saw a drastic reversal from the optimistic recovery seen in the past 30-days.

The combination of spot prices dropping and Realized volatility increasing as well, has traders re-thinking the exposure and re-igniting demand for put purchases.

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

Low volumes for much of the week; on Friday -with markets drop - the sentiment was cautious for Bitcoin and of “buy-the-dip” for Ethereum.

Bitcoin trades: Buy calls Mar23 delta hedged, Sell 30SEP $22k call, Buy 30SEP $18k put, Buy 30SEP $32k call.

Ethereum trades: Call ratio spread 30SEP $2.5k/$3k, Call ratio spread 30SEP $3k/$4.5k, Call spread 30SEP $2k/$3k.

Enthusiasm for the merge seems not to be scratched by recent price action and OFAC compliance concerns.

As the event (or non-event, see the previous newsletter) approaches and with the 30SEP ETH-BTC iv spread still at its highest, the set-up for a relative volatility trade becomes increasingly attractive: long BTC financed by short ETH.

(15st Aug - 21th Aug, 2022 - BTC GVOL Gravity charts)

(19th Aug, 2022 - ETH GVOL Gravity charts - Call Spread/Ratio Spread 30SEP)

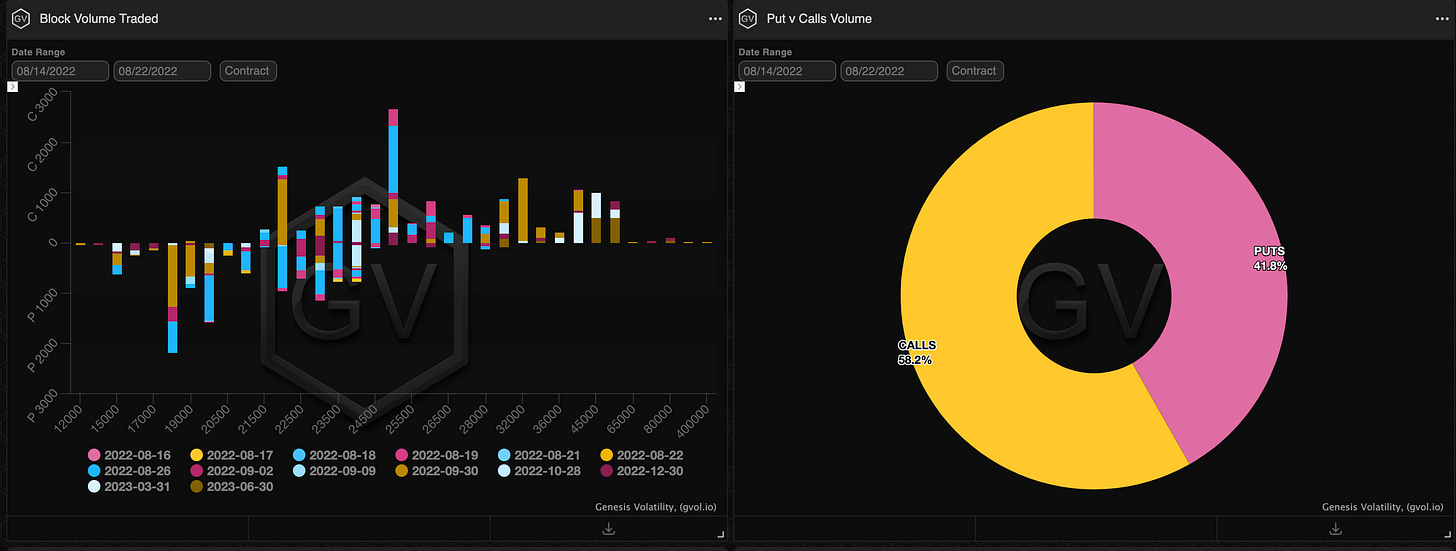

Paradigm Block Insights (14 Aug – 21 Aug)

Crypto majors traded flat to start the week, but took a significant turn lower on Friday as the market second guessed the pace of interest rate hikes. BTC -14% / ETH -19% / SOL -23%

BTC Notable Flows: Largest activity occurred on Thurs/Fri as spot moved lower. Two-way flows in Sept with 18k puts bot in large size before the sell-off accelerated.

We also saw buy-the-dip behavior on Friday via 1k Sept outright calls.

1250x Call 30 Sept 22 22000 sold

1150x Put 30 Sept 22 18000 bot

1025x Call 30 Sept 22 32000 bot

BTC ATMs off the lows, but still cheap considering Friday’s ~10% move. As these implies, dealers likely remain bid as the macro narrative shifts more hawkish, listed demand for vega remains high, and OTC overwriters deliver less vol to market makers.

ETH Notable Flows: Strong buy-the-dip activity on Friday as Sept call spreads / ratios were lifted in large size, ahead of the merge on Sep 19th.

24k Call Ratio 30 Sep 22 3000/4500 1x2 bot

17k Cspd 30 Sep 22 2500/3500 bot

10k CSpd 30 Sep 22 2000/3000 bot

ETH Sept “merge maturity” remains the highest vol on the term structure. We’ve seen very little interest to sell this bucket on Paradigm in case of any last minute merge delays.

Futures Spreads: FTX spreads on fire.🔥 70% more clients trading and volumes ⬆️ 300% WTW. Seeing trades in every listed com with largest trade in ETH, a $10 million notional September/December FSPD.

Size is flowing into the order books 👀📈🙏

🎀 This week’s @ribbonfinance auctions on @tradeparadigm

BTC call/ETH puts beat by a whopping 23% on average 🔥🔥🔥- AND ANONs continue to grab market-share with 10/12 auctions won by mysterious players!

Winners:

🏅@BastionTrading

🏅@OrBit_Markets

🏅Various ANON

We put out daily commentary at the Telegram link below. Subscribe for more content! 👇

BTC

ETH

SOL

VOLATILITY PREMIUM

(Aug. 14th, 2022 - BTC IV-RV)

The weekly volatility premium remains.

We saw a pickup in realized volatility last week, but not enough to catch-up with IV.

Unless we’re dropping below $20k, this VRP will likely go uncompensated.

For BTC, I don’t see an explosive upside volatility potential like we hoped for ETH last week.

Squeeth Weekly Review

With cascading liquidations hitting the tape to end the week, Crypto markets remained interesting as summer trading winds down. oSQTH ended the week -36.3% while ETH closed the week at roughly -18.5%.

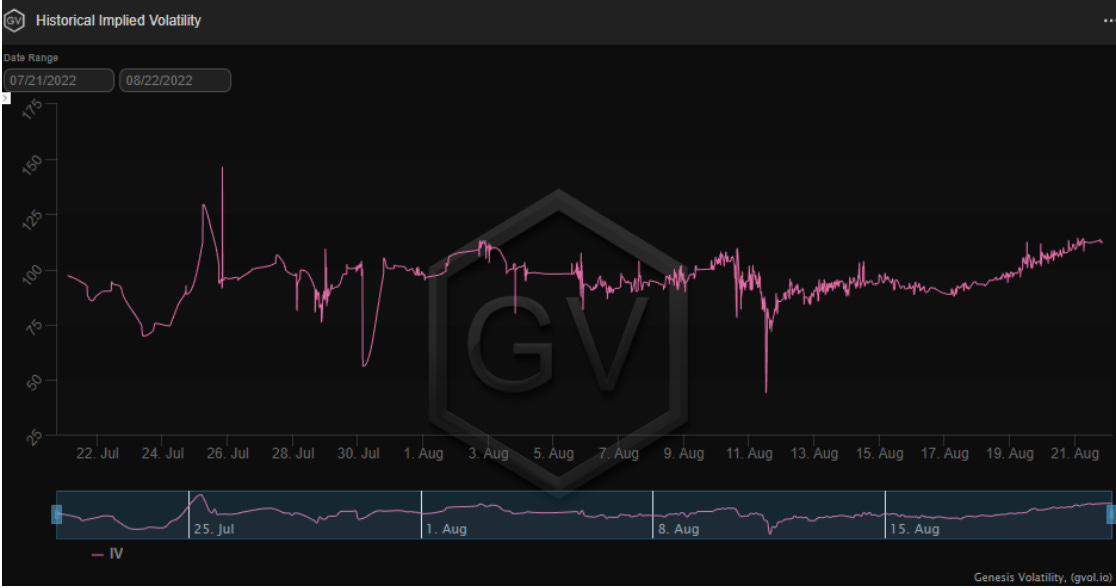

Volatility

Markets started the week relatively calm, with Squeeth IV trading in the low to mid 90s. On the back of massive liquidations in broader markets, Squeeth IV ended the week at roughly 112%.

Volume

The 7-day total for oSQTH via Uniswap-oSQTH/ETH pool was $9.57m. August 19th saw the most volume, with a daily total of $2.47m being traded.

Crab Strategy

Crab returned -1.16% in USD terms from August 14th - August 19th and accumulated 15.7% more ETH in the same time frame.

Crab v1 performed multiple hedges this week equating to 128.42 ETH

Crab v2 performed 3 hedges this week equating to 262.557 ETH

Hop in the discord: https://discord.gg/opyn to learn more about Squeeth and Crab v2!