Crypto Options Analytics, August 1st, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

$41,006

DVOL: Deribit’s volatility index

(1 month, hourly)

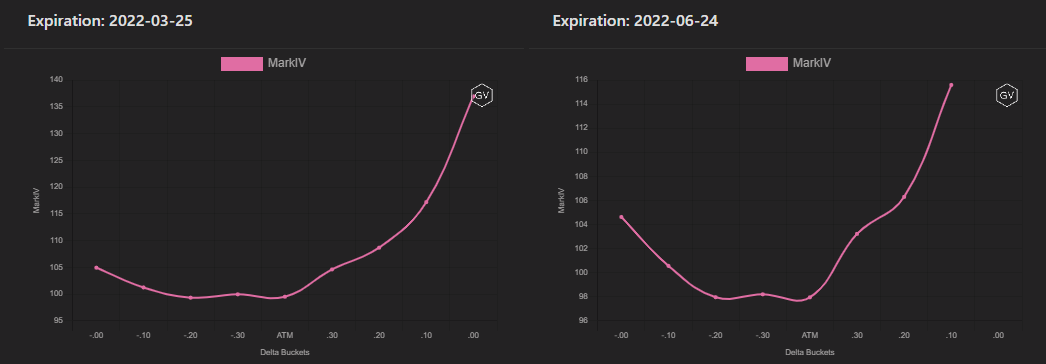

SKEWS

(Aug. 1st, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

What a week!!!

Spot prices have surged higher and the volatility markets have taken notice.

For the first time in nearly 10 weeks, we’ve seen short-term, medium-term and long-term option expirations display a positive skew (Call IV > Put IV).

We're also witnessing a shift to positive correlation between IV and spot prices.

(Aug. 1st, 2021 - Long-Dated BTC Skews - Deribit)

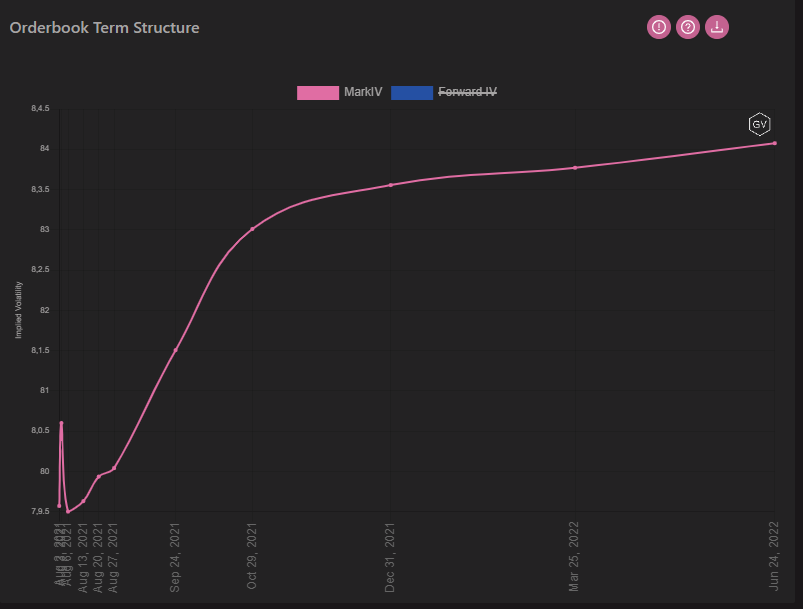

TERM STRUCTURE

(Aug. 1st, 2021 - BTC’s Term Structure - Deribit)

(Excuse the y-axis formatting bug)

Although the visual above resembles a Contango shape, the term-structure is very flat.

The differential between short-term and long-term implied vol. is about 4pts.

The surge in spot prices lead to a flattening of the term-structure as the short-dated options found a bid.

ATM/SKEW

(Aug. 1st, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) jumped right back to monthly highs and seems to be holding these levels.

Skew (right) is steadily climbing higher in a stable fashion. Skew is now, finally, beyond the 0-line, as appetite for calls increases.

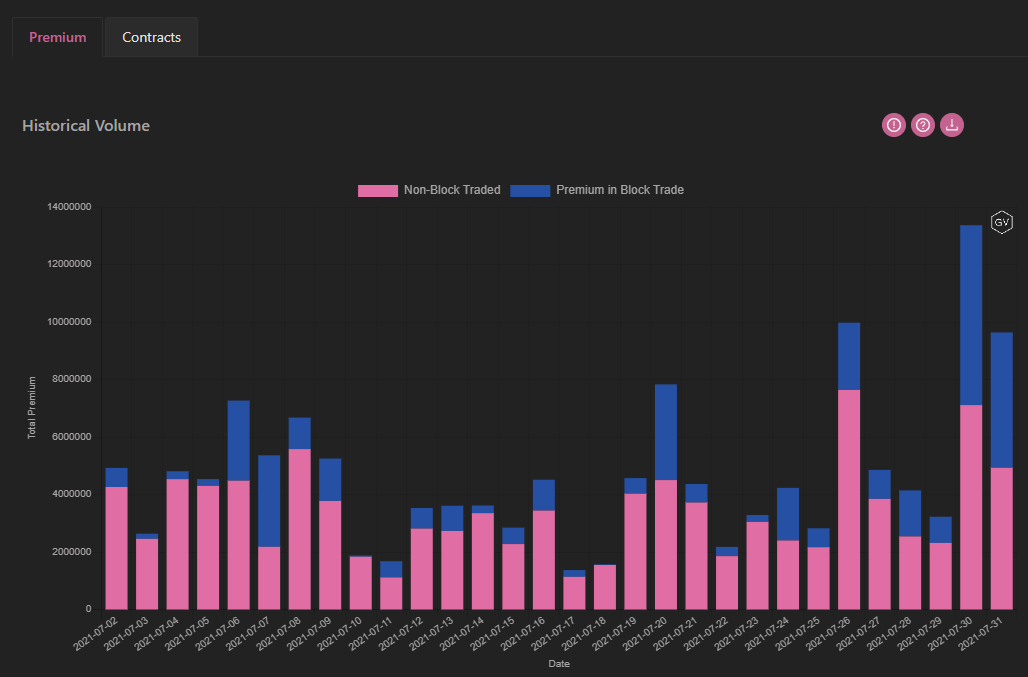

VOLUME

(Aug. 1st, 2021 - BTC Premium Traded - Deribit)

(Aug. 1st, 2021 - BTC’s Contracts Traded - Deribit)

We saw a huge jump in option volumes over the past week.

This rally has sparked a large uptick in crypto interest and participation, which is clearly displayed by option volumes.

VOLATILITY CONE

(Aug. 1st, 2021 - BTC’s Volatility Cone)

Realized volatility increased, although modestly, to return above the median.

RV is still in the “normal-zone” between 25th and 75th percentiles.

REALIZED & IMPLIED

(Aug 1st, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Looks like IV did a great job predicting future RV.

Last week IV was trading at a rather large premium to IV and this week RV moved higher, “catching-up” to IV.

CONCLUSION

Overall there is a ton of enthusiasm for this current rally.

The consolidation trend isn’t necessarily over and there’s a great chance consolidation proves to hold.

Spot prices are flirting with resistance levels and « fading » the enthusiasm is likely the play here; pricing is favorable.

$2,575

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Aug. 1st, 2021 - ETH’s Skews - Deribit)

ETH skew is more positive than BTC skew across the various maturities.

Overall volatility is slightly higher as well.

(Aug. 1st, 2021 - ETH’s Skews - Deribit)

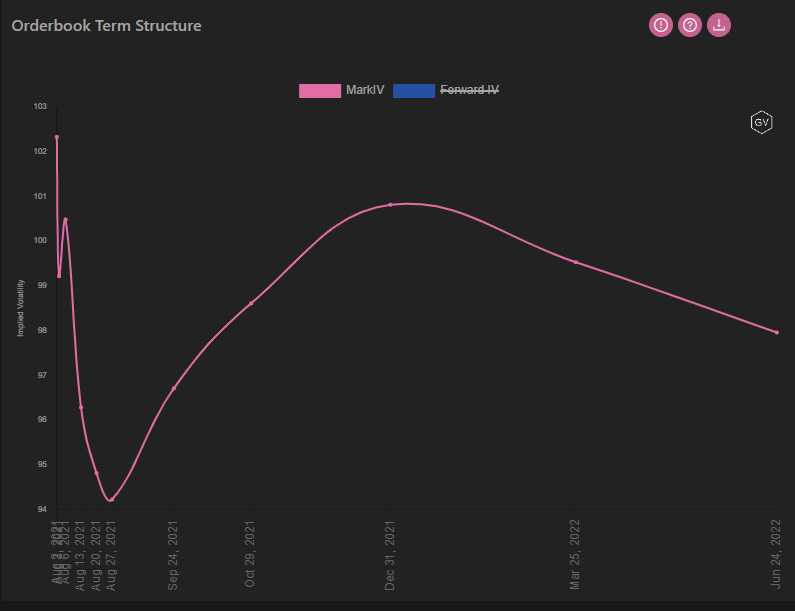

TERM STRUCTURE

(Aug. 1st, 2021 - ETH’s Term Structure - Deribit)

The ETH term structure is clearly flat with a slight DEC expiration hump that continues to persist.

We continue to think there are good volatility plays to be done around the DEC expiration, especially since DEC has the greatest liquidity.

ATM/SKEW

(Aug. 1st, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) seems erratic and stuck within a range.

Unless ETH gets above $3k, we’re favoring short IV plays versus long vol.

If this spot rally trend proves itself and crypto skyrockets higher to new ATHs, so be it. But overall it would be surprising to see the consolidation phase be over so quickly.

Skew (right) is decidedly strong and calls are finding a persistent bid.

VOLUME

(Aug. 1st, 2021 - ETH’s Premium Traded - Deribit)

(Aug. 1st, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes have also ticked up higher, although the higher volumes are not as drastic compared to BTC.

A lot of the volume that was executed on Deribit this past week has been routed as block trades via Paradigm.

VOLATILITY CONE

(Aug. 1st, 2021 - ETH’s Volatility Cone)

RV barely budged versus last week.

RV is still between the median and lower 25th percentile.

REALIZED & IMPLIED

(Aug. 1st, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV holds a slight premium to RV and is therefore predicting a continued uptick in RV.

This premium is favorable to vol. sellers, holding everything else constant.