Crypto Options Analytics, August 15th, 2021

The BIG story this week has been the term structure.

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

$46,068

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Aug. 15th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

This week has been filled with very interesting action.

Spot prices continue to rally, IV moves higher and option skews hold firm in positive territory.

Long-dated option skews are still the most elevated, while short-term skews have been able to maintain a positive level all week. This means the preference for calls remains strong.

(Aug. 15th, 2021 - Long-Dated BTC Skews - Deribit)

TERM STRUCTURE

(Aug. 15th, 2021 - BTC’s Term Structure - Deribit)

The BIG story this week has been the term structure.

IV has been lead higher while the term structure has steepened… and steepened by A LOT.

Notice that medium- and longer- dated expirations have surged higher while short-term expirations are actually lower.

This is atypical behavior in the volatility space as longer option expirations are an average of short-term expirations, loosely speaking.

This phenomenon is likely a combination of liquidity and call rolling activity.

There is a TON of opportunity here.

ATM/SKEW

(Aug. 15th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) has retraced after making new monthly highs, for select expirations.

Skew (right) is strong and holding the positive territory nicely. That’s exciting signaling for the crypto spot market.

VOLUME

(Aug. 15th, 2021 - BTC Premium Traded - Deribit)

(Aug. 15th, 2021 - BTC’s Contracts Traded - Deribit)

We see nice and strong volume for the BTC option market.

Although this looks good, wait until we check out ETH option volumes… VERY exciting stuff is coming.

VOLATILITY CONE

(Aug. 15th, 2021 - BTC’s Volatility Cone)

Despite the quirky BTC implied activity, realize vol. is rather meek.

RV is hanging out around the median and as BTC tests the $50k level, we expect further resistance…

Selling BTC vol.. given RV levels and the insanely steep term structure could be interesting.

REALIZED & IMPLIED

(Aug 15th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is pricing a variance premium to RV… meaning RV is expected to rise going forward.

We think pricing increased RV ahead of $50k (round number psychological resistance) could prove to be a great opportunity for BTC vol. sellers.

$3,175

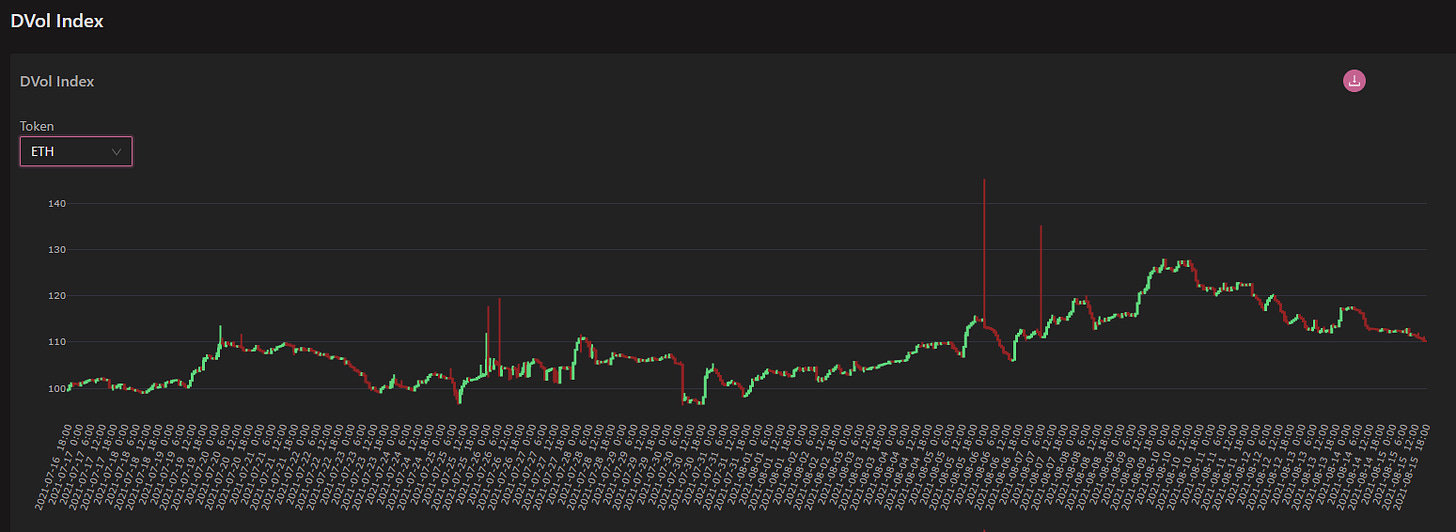

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(Aug. 15th, 2021 - ETH’s Skews - Deribit)

Ultra-sound money ETH is heating up.

Although BTC vol. selling could be interesting, ETH vol. selling seems less so.

There’s something brewing in the ETH space that could rocket spot prices much higher.

Option skews seem to agree as all expirations exhibit a positive skew but more importantly, all the skews continue to trend higher.

The consolidation theme seems to be bust for ETH and we could potentially see new ATH’s by the end of the year.

(Aug. 15th, 2021 - ETH’s Skews - Deribit)

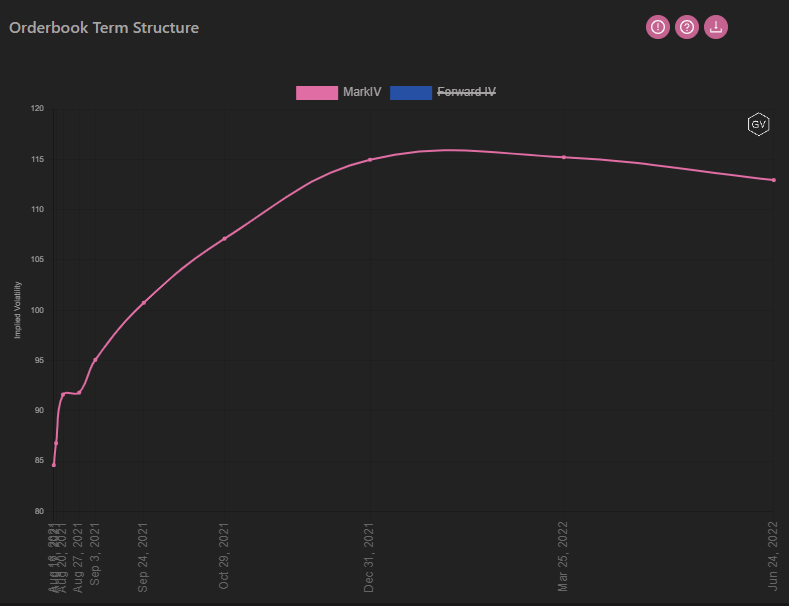

TERM STRUCTURE

(Aug. 15th, 2021 - ETH’s Term Structure - Deribit)

Like BTC, the ETH term structure has become very steep.

If ETH is truly going to exhibit continued bullish price action, the front-end of the term structure might be offering good opportunity for gamma exposure.

ATM/SKEW

(Aug. 15th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

ATM IV (left) is making new monthly highs and the trend doesn’t seem to be broken.

SKEW (right) looks stable for the selected expirations but breaking out skew in constant maturity buckets displays a trend higher.

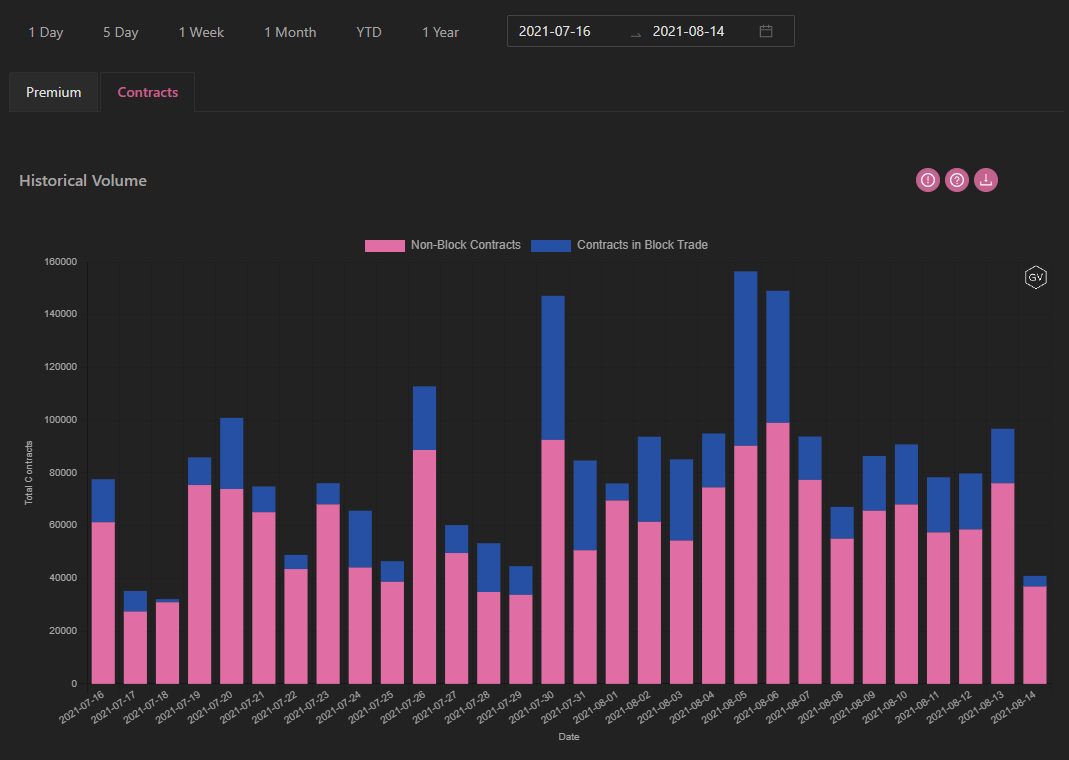

VOLUME

(Aug. 15th, 2021 - ETH’s Premium Traded - Deribit)

(Aug. 15th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volume is exploding higher… This is particularly apparent in terms of premiums traded (AKA $$$ allocated to ETH options)

A consistent portion of this volume is being done via RFQ Block trading on Paradigm.

VOLATILITY CONE

(Aug. 15th, 2021 - ETH’s Volatility Cone)

Like BTC, the ETH vol. cone is displaying RV near the median, while longer measurement windows are showing RV about the 75th percentile.

Mid-May vol. is responsible for most of this divergence.

REALIZED & IMPLIED

(Aug. 15th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is pricing current RV.

Given current RV levels and the IV price-tag, buying ETH vol. could be interesting.

Nice article! Can you briefly explain why you'd expect the long dated option is an average of short dated option in vol space?