Crypto Options Analytics, August 14th, 2022

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

THE BIG PICTURE THEMES:

This weeks CPI & PPI readings provided relief as the "rate” of inflation slowed down (although inflation is still strong).

VIX nearly touched the 19 handle and the S&P closed around 4,280.

Vol. trade came in, risk-assets rallied, now what?

This week, past FOMC meeting minutes will be released but this isn’t a big market mover.

No big US economic numbers are scheduled to be released.

TradFi/VIX Trading:

Now is the time to flatten MOST of my book. Close out UVXY and other VIX related shorts. Why?

I do think VIX could actually go lower from here.

VIX could wipe out anyone who dares to be long and risk assets could extend their gains far beyond what anyone thinks makes sense.

I do think that will probably happen, but the “easy” money, August Vol. smash trade, is done. Any extension farther is a trickier trade.

I plan to only hold a tiny position for this scenario.

Here’s a better set-up!

Wait to see if risk-assets rally farther and become extended.

Monitor the Taiwan/China situation. Let time passage bring us closer to November Mid-term elections and October seasonality.

An extended risk-asset rally, cheap VIX and macro catalyst could provide a fantastic bearish set-up. Wait for it to present itself.

That’s likely a better “Core” trade.

Crypto:

A risk-asset class that does NOT currently have an extended recovery is crypto.

If anything, crypto seems to be lagging TradFi (at least by my expectations).

The ETH 2.0 September merge is a fantastic catalyst to bring prices higher into the event. +$2.3k ETH, into the merge, seems like an “easy money” trade.

ETH option markets are seeing a lot of participation.

Implied Volatility is already expensive as traders are willing to “Pay-up” for the exposure.

ETH/BTC prices have recovered strongly and I expect new ratio, all-time highs in the medium term.

BTC: $24,245 +4.5%

ETH :$1,923 +12%

SOL: $45.09 +10%

DVOL: Deribit’s volatility index

BTC - (180-days w/ spot line chart)

ETH - (180-days w/ spot line chart)

ETH continues to hold a higher DVol plateau, relatively speaking.

ETH RV is also higher, making the ETH VRP lower.

The BTC/ETH IV spread is likely going to hold divergence, given:

1) The fundamental catalyst of ETH 2.0

2) Increasing ETH option OI

3) ETH/BTC rallying price ratio

Vol. sellers should therefore focus in BTC, while vol. buyers should focus in ETH.

Relative volatility is likely a smart play too, if you can manage the collateral issues.

Lastly, notice that ETH IV is stable despite a spot rally, not as true for BTC.

TERM STRUCTURE

(Aug.14th, 2022 - BTC’s Term Structure - Deribit )

BTC (Term Structure)

ETH (Term Structure)

(ETH-BTC IV Spread)

The BTC term structure has reverted to a steep Contango and 30-day RV is lower than most of the curve.

Again, looking at ETH’s term structure, the divergence is clear.

The bottom chart shows the time series analysis of ETH-BTC vol spread, for both realized and implied.

Both IV and RV are near the highest levels in the past 2.5 years… but what’s really interesting, is that these levels aren’t “short-lived” like in the past, but rather TRENDING and holding with stability!

SKEWS

(Aug.14th, 2022 - BTC’s RR SKEW (C-P) ∆25 - Deribit)

(Aug.14th, 2022 - ETH’s RR SKEW (C-P) ∆25 - Deribit)

Fascinating to see the ETH RR actually lower than the BTC RR, for short-term options.

From a qualitative perspective, chatter and rumors are clearly bullish on ETH price action… and Volatility should materialize with upside spot prices.

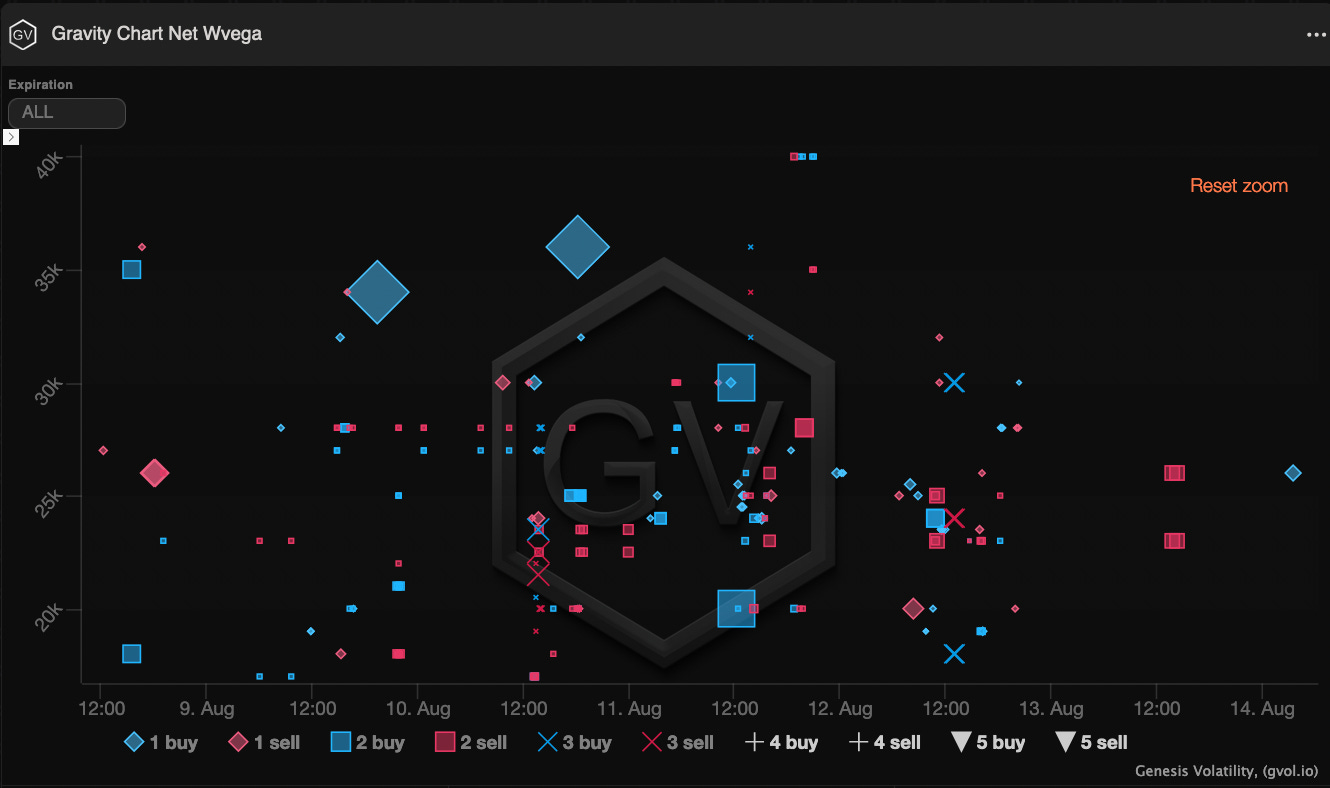

PROPRIETARY “GVOL-DIRECTION” FLOWS - @fb_gravitysucks

Volumes were contained during the first real week of summer holidays, with Ethereum outperforming Bitcoin by volumes (and open interest).

Anyway, among the most interesting trades we record for Bitcoin: long outright call delta hedged $34k and $36k on March 23 (activity we also reported last week), long strangle $20k-$30k October, puts sold onscreen $18k/$20k Sept22, a centered fly $18k-$24k-$30k Sept, and short strangles on Saturday $23k-$26k 19Aug.

For Ethereum: long call spread $1.75k/$2.1k-$2.2k (in small clips for over 80 blocks) on 26Aug, long call spread Oct/Dec/Mar $2.5k/$3k, $3.5k/$4k, $4k/$5k, and lastly some short vol trades as of Friday, $2.3k straddle Mar23.

The ETH-BTC spread has widened to 30% over September and some traders are positioning themselves for a mean-reversion, selling ETH against buying BTC long.

(8st Aug - 14th Aug, 2022 - BTC GVOL Gravity charts)

(8st Aug - 14th Aug, 2022 - ETH GVOL Gravity charts)

Paradigm Block Insights (8 Aug – 14 Aug)

A positive week as ETH +16% and SOL +10%, vs. BTC lagging behind +5%. ETH rally reaches 2k level. 📈 Positive economic data drove markets higher as we saw a lower CPI print indicating a likely peak in inflation. Traders maintain focus on 15Sep ETH merge.

BTC vols traded sideways for the most part this week, as markets grinded higher. ✍️

We noted outright weekly call buying early in the week.

1k Call 12Aug 25500 bot 👀

19Aug: 58.5, 26Aug: 61.3, 30Sep: 66.9, Oct: 67.9, Dec: 69.5, Mar: 70.9

BTC 🌊

Size BTC topside bought this week via Paradigm. ✍️

500x Call 31Mar 34000 delta neutral bot

500x Call 31Mar 36000 delta neutral bot

150x Call 31Mar 50000 bot

500x CCal 30Dec 35000 / 31Mar 40000 bot

500x CFly 30Sep 32000/34000/36000 bot

ETH 🌊

SIZEEE upside ETH printing via Paradigm as clients ride the rally and focus on 15Sep 💥

Bullish momentum likely to continue, considering the constructive macro backdrop, a more dovish Fed, inflation peaking and the bullish Merge story. 1 month price chart below.

25k CSpd 30 Dec 22 2500/3000 bot

10k 1x1.5 CSpd 31Mar 3500/4000 bot

10k CSpd 26 Aug 22 1750/2200 bot

10k CFly 30 Dec 22 2800/3000/3200 bot

While a lot of clients were positioned to capture this rally, we didn't see much chasing post CPI. 📈

We do expect more of this buying should spot continue to rally and people start chasing the move. ✍️

Outright bullish topside printing included:

7k Call 26 Aug 2000 bot, 5k Call 2 Sep 2200 bot, 2k Call 30 Dec 3000 bot

Likely hedging flows printed via Paradigm:

11k Call 30 Dec 22 7000 bot

10k PFly 30 Sep 22 500/1000/1500 bot

Futures Spreads

We are now live with FTX!!! 🔥💥🌊

We saw FSPD trading in all coins this week. We added APE, DOGE, LINK and LTC for FTX, enabling spread trades (like spot vs perp) for all of them! Stay tuned as more coins are coming soon!

Check out our official launch tweet for full story👇

🎀 Exciting week with 12 @ribbonfinance auctions

All prices beat screen by an average of 7% - AND new additions stETH and rETH trading at similar levels to the ETH!

Winners:

@GenesisTrading

@QCPCapital

@BastionTrading

@OrBit_Markets

Various ANON

BTC

ETH

SOL

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(Aug. 14th, 2022 - BTC’s Volatility Cone)

(Aug. 14th, 2022 - BTC IV-RV)

(Aug. 14th, 2022 - ETH IV-RV)

Despite ETH having a lower VRP with 30-day volatility measures, the short-term VRP is wide for both BTC and ETH.

ETH IV is still not cheap and both cryptos have expensive option carry.

That said, ETH IV is more likely to pay off, judging by all the elements we’ve noted previously.

Squeeth Weekly Review

As the summer months slowly come to an end, markets continue to remain bid. Squeeth ended the week +34.48% on the back of a positive CPI reading.

Volatility

Volatility slowly found its way lower to end the week, starting in the high 90s and ending in the low 90s. Parts of the week provided great opportunities for traders to buy cheap ETH exposure using Squeeth.

Squeeth Historical IV

ETH DVOL Index

Volume

Volume continues to be consistent week over week, with Wednesday and Friday being the most active trading days.

Crab Strategy

Crab strategy v1 continues to hedge equating to 141.79 ETH.

Crab strategy v2 performed multiple hedges equating to 186.339 ETH.