Crypto Options Analytics: April 6th, 2025

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

*Fed governors speak everyday this week*

Wednesday 2p - FOMC minutes

Thursday 8:30a - CPI

Friday 8:30a - PPI

MACRO

Wow, markets got smoked this week. Liberation day tariffs came in much hotter than expected.

A Goldman Sachs survey showed participants expected tariffs to be raised +8.6% through 2025 but now the effective tariff rate is nearly +20%.

Markets crashed -10% on the week, while VIX exploded to 45 vol and CLOSED at the highs, as China responded in-kind with it’s own set of tariffs.

There was some positive economic data from the US employment report, but that has quickly been discounted as antiquated data.

Past economic performance just doesn’t matter right now, given the global shift in trade policy and the associated impact.

That said, payrolls increased +228k (vs +140k expected) and the unemployment rate came in at +4.2%.

Powell also spoke on Friday.

Powell is weary of lowering interest rates right now and is still waiting to see how tariffs impact inflation, jobs and the real economy.

Traders have projected more interest rate cuts into 2025 after the trading session Friday. This suggests the markets expect a deeper impact on the economy from tariffs as opposed to inflation.

We can see that the distribution of EOY rates, using the CME FedWatch Tool, shows 5x 25bps cuts down to 3%-3.25% as the most likely outcome.

This upcoming week we have CPI on Thursday and PPI on Friday.

We also have the Fed minutes on Wednesday at 2pm.

Although these numbers are usually market moving, given the unknown of future tariff impacts, the historical nature of these numbers likely makes them non-events for now.

BTC: $82,698 (-0.5% / 7-day)

ETH :$1,767 (-3.1% / 7-day)

SOL :$115.59 (-7.1% / 7-day)

Crypto

Surprisingly, the vol buyers in BTC weren’t rewarded last week, despite a complete meltdown in global equities and risk-assets.

Some believe the strength in crypto, BTC specifically, is due to the market anticipating monetary liquidity in the future (as a response to a global recession) but I’m not sure.

Crypto might have been the “first mover” in terms of price weakness since inauguration and Friday’s move was possibly met with a pause due to positioning.

I continue to believe that if equity vol (VIX), gold vol (GVZ), bond volatility and FX volatility all go screaming higher, Crypto volatility will follow.

We can clearly see DVOL hasn’t made it’s move higher yet, when compared to VIX and GVZ.

That doesn’t necessarily mean to “get long vol here…” but it makes me suspicious of being long BTC (or even worse ETH) expecting calm and bullish sentiment to resume soon.

Volatility clustering is true across the time dimension, but it’s also true across asset classes.

Correlation goes to 1.00 is a universal phenomenon during price panics.

We can see that short-term option skew has been able to react accordingly as puts have priced a +10 vol premium to ∆25 Calls for 7-dte expirations.

Short-dated options have seen even more premium.

However, zooming out over the past 6-years of data (check it) we can see that BTC ∆25 RR-Skew is basically hanging out around the 0-line for 30-dte and 90-dte maturities.

How would a recession affect crypto prices?

For the exception of the COVID madness in March 2020, crypto has only existed during a massive US bull market…

Let’s not forget SPX rallied 667 → 6120 from 2009 to 2025, since the BTC white paper launch, nearly 10x!

What does a dual bear market (Crypto & SPX) look like then? I would keep that scenario in mind trading these markets. I think opportunity favors crypto shorts (the laggard theory) as opposed to longs right now (the safe haven theory).

Paradigm Top Trades This Week

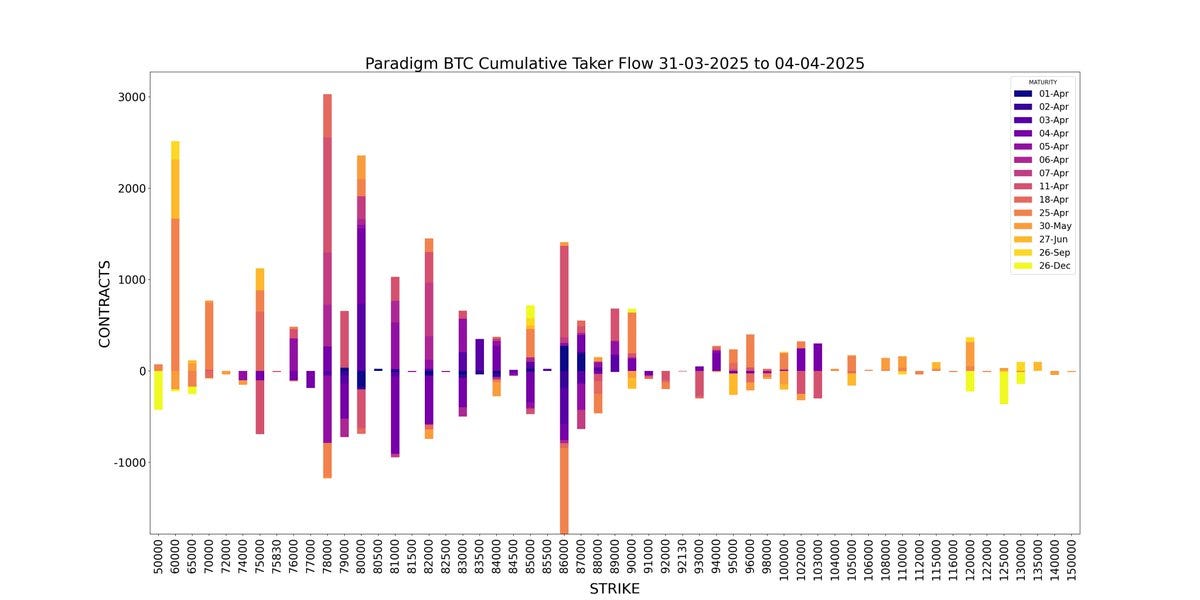

Weekly BTC Cumulative Taker Flow

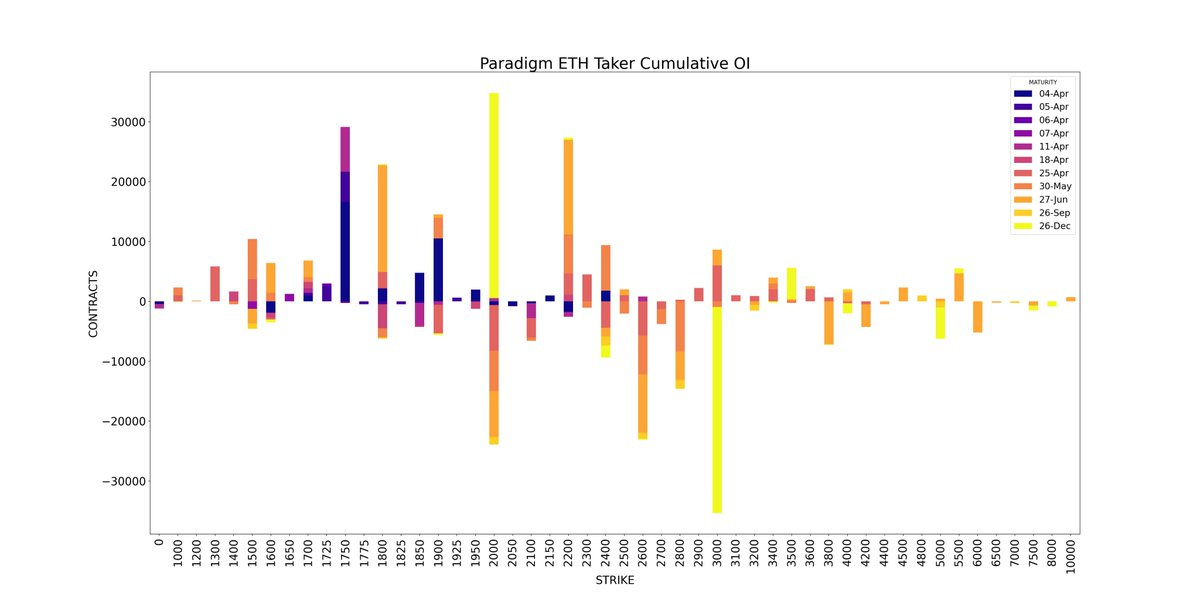

ETH Cumulative Taker Flow

BTC Cumulative OI

ETH Cumulative OI

BTC

ETH

Huge trade of 207 BTC September calls in the 20-40 delta range collateralized by LBTC printed last week earning a trader $1.1M USDC of premiums.

Derive’s LBTC and weETH basis trading vaults now executing with expected yield in the 5-20% range.

Derive OI for both ETH and BTC options remains overwhelmingly call focused as users aim to lever up in volatile times.

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.