Crypto Options Analytics, April 4th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

Here we go again!

Bitcoin and other cryptos have once again resumed their bullish trend.

SKEWS

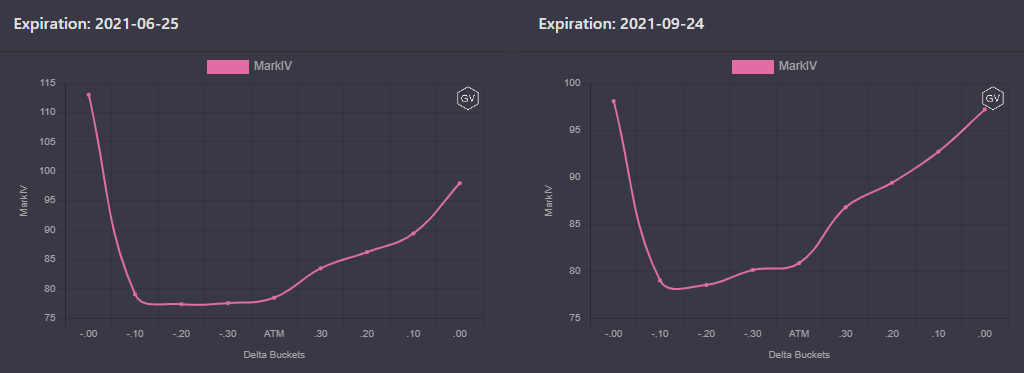

(April 4th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Bitcoin option skews saw an increase in call volatility this past week as Bitcoin resumed its bullish trend.

The 25 delta skew gained about +5pts this past week for the various maturities.

The resumption of the rally also brought implied volatilities higher as well.

(April 4th, 2021 - Long-Dated BTC Skews - Deribit)

Longer-term options have the most pronounced positive skew as traders are reluctant to sell calls.

TERM STRUCTURE

(April 4th, 2021 - BTC’s Term Structure - Deribit)

Although volatility has increased over the week, the term structure does not reflect it.

We continue to see the term structure hold the Contango shape.

If Bitcoin was to resume an aggressive rally higher, we could see the front-end volatility move up much more sharply, until the term structure reflected backwardation.

ATM/SKEW

(April 4th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

The charts above show the recent activity much more clearly.

Not only did ATM IV halt its steady drop lower, but we saw IV jump about +7pts from the lows.

As mentioned earlier, skew increased about +5pts throughout the week.

VOLUME

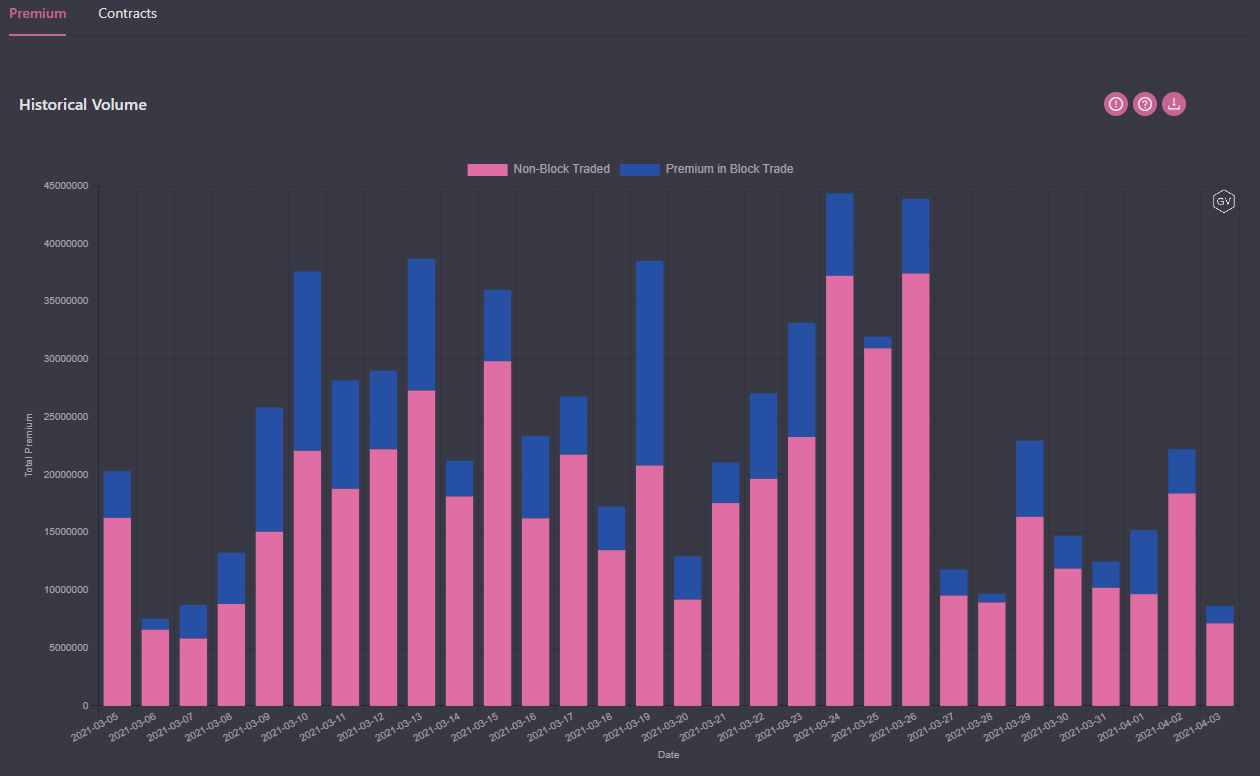

(April 4th, 2021 - BTC Premium Traded - Deribit)

(April 4th, 2021 - BTC’s Contracts Traded - Deribit)

Surprisingly, the option volume traded last week was lackluster.

We would expect higher volumes given the increase in spot prices and implied volatilities.

This lackluster volume implies that market makers merely moved up their implied volatility quotes, as opposed to traders engaging in heavy option buying.

VOLATILITY CONE

(April 4th, 2021 - BTC’s Volatility Cone)

Realized volatility is currently “fair”.

RVs are mostly hanging around the median of the past 12 months.

REALIZED & IMPLIED

(April 4th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol. - Deribit)

We can see that despite last week’s activity, the trend for realized and implied vols… is continuing to grind lower.

Taken together, the mixed signals of new BTC price ATH’s, brief increases of ATM IV and skews, lackluster option volume, the median RV, and longer term volatility grind lower, we conclude that BTC volatility positioning strikes us as inconclusive.

SKEWS

(April 4th, 2021 - ETH’s Skews - Deribit)

ETH options are painting a clearer picture than BTC options.

ETH not only made new spot price ATH’s but also stole market share from BTC’s dominance.

We clearly see more positive ETH skews.

The steep demand for ETH call options seems interesting to us.

If ETH is going to steal market share from BTC, we could see massive spot price rallies in ETH.

(April 4th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(April 4th, 2021 - ETH’s Term Structure - Deribit)

Although the ETH term structure is currently in Contango, we do notice an interesting hump-shape due to the relatively expensive SEPT24 contract.

If ETH is going to have an explosive rally, buying short-term options and selling longer-term September options would be a clever way to capture the volatility differential.

ATM/SKEW

(April 4th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Not only has ATM IV bounced for ETH, the ETH 20-30 delta skew is seeing no resistance and clear demand.

This steady grind higher bodes well for ETH bulls, as the option market signals heavy appetite for call options.

VOLUME

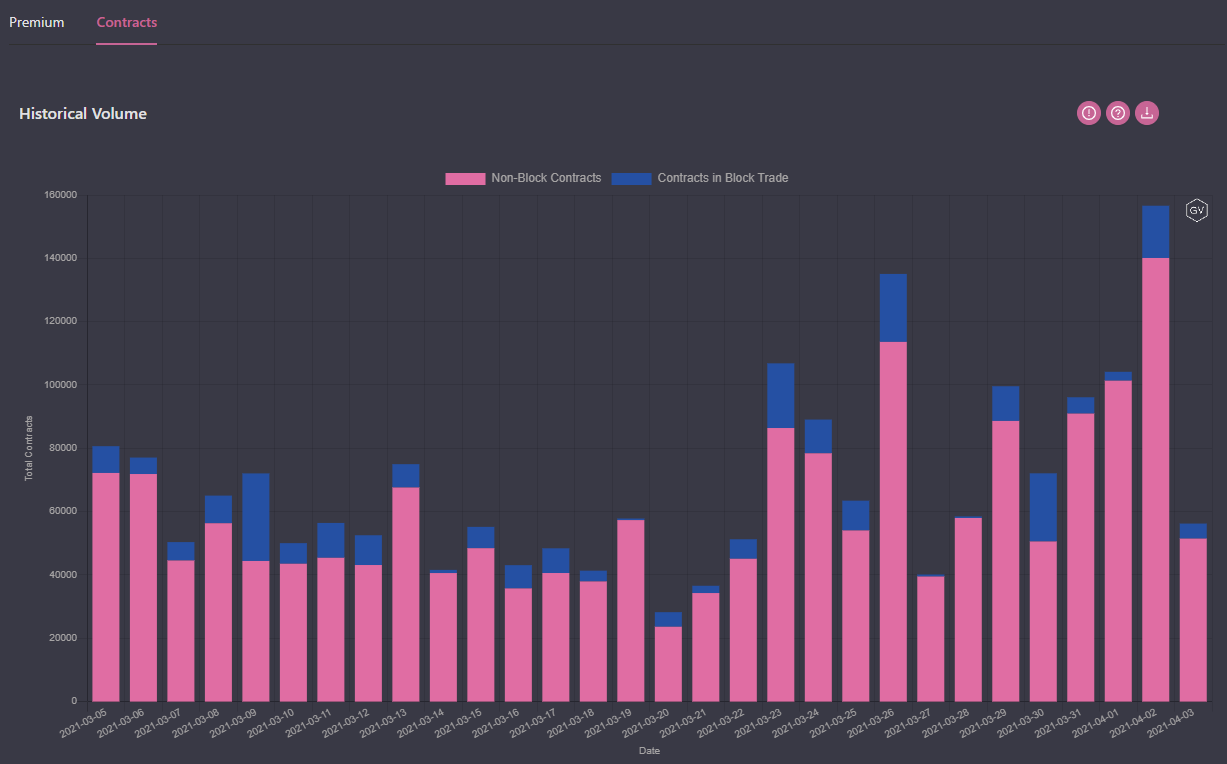

(April 4th, 2021 - ETH’s Premium Traded - Deribit)

(April 4th, 2021 - ETH’s Contracts Traded - Deribit)

Notice the massive increase in option volumes over the past week, compared to the rest of the month.

THIS is bullish option activity. Given that volatility has increased, it’s safe to assume that option buyers were willing to pay higher IVs.

Combine this with the increased ETH skew and we can see a clear picture of increased demand for upside ETH exposure.

VOLATILITY CONE

(April 4th, 2021 - ETH’s Volatility Cone)

Like BTC, ETH RV’s are hanging out around the median of the past 12 months.

REALIZED & IMPLIED

(April 4th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol. - Deribit)

Again, similar to BTC, we see median RV and a trend lower in realized and implied vols… That said, last week we witnessed a bullish appetite for ETH calls that we didn’t see for BTC.