Crypto Options Analytics, April 3rd, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$46,409

DVOL: Deribit’s volatility index

(1 month, hourly)

Monday started with a nice push higher to $48k after a breakout above $45k. The rally was sharp.

That said, implied and realized volatility continued lower, despite the trend higher in prices.

This is because the months before, BTC traded a $45k to $37k range ($8k / ~20%) 5x in the 60-day period between mid-Jan to mid-March.

As BTC prices trade between $45k and $48k this week, the overall range is consolidated, allowing vols. to drop.

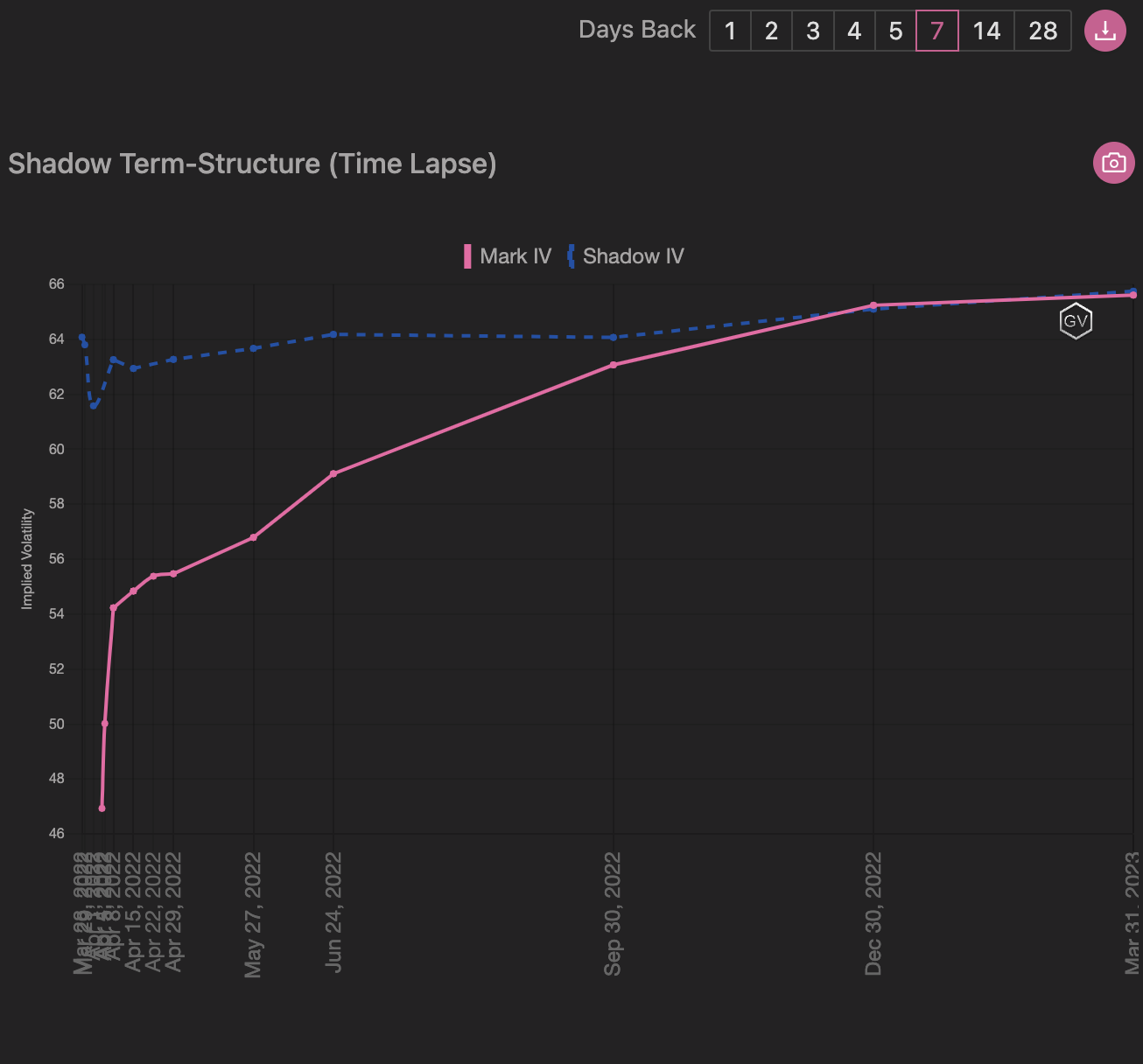

TERM STRUCTURE

(April 3rd, 2022 - BTC’s Term Structure - Deribit)

Week-over-week, the term structure has steepened as short-term vol. dipped about 10pts.

Long-term vols. haven’t moved.

Short-dated vol. and medium-term vol. are a good sell (capturing term structure “roll”), if spot prices respect $40k-$50k range. Prices could consolidate within these levels for weeks, as $50k is a rather psychological level.

Long-term vol. continues to be an interesting buy. Spot prices are bullish and a real bull-run will likely bring higher RV.

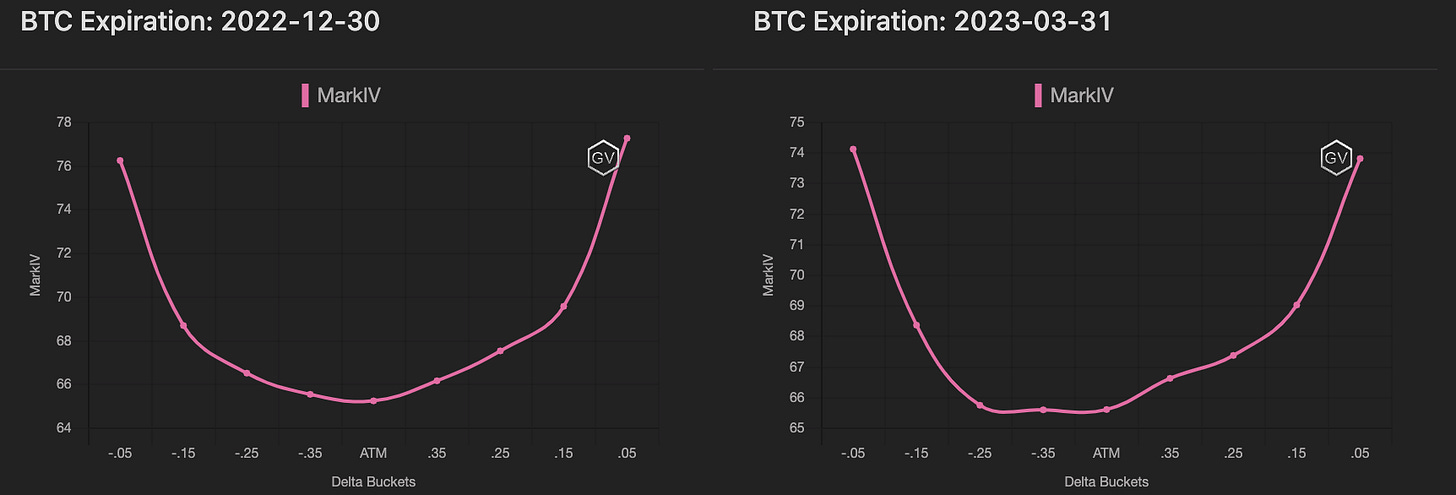

SKEWS

(April 3rd, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Long-term option skew has finally rallied to par. That said, par is still an interesting buy level for OTM ∆25 calls.

Short-term skews resumed negative levels.

The market is viewing higher spot prices as a trigger for lower volatility. This has proven true in the past couple weeks.

Short-term and medium-term skew is fairly priced from a vol. perspective but is also providing a good entry for those willing to hold long-delta risk.

(April 3rd, 2022 - Long-Dated BTC Skews - Deribit)

Open Interest - @fb_gravitysucks

BTC

The first weekly of the month was characterized by the initial rise in spot, which saw the flow with a bias towards calls.

The open interest profile shows where the action was most concentrated: protection at the $40k support and upside exposure in the $42k-$50k spread.

Unfortunately for call buyers, the settlement price has returned to almost the same level as a week ago.

(Apr 1st, 2022 - BTC Notional - Deribit)

BIG TRADES IN THE FLOW

The weekly flow saw the dynamism we expected after the monthly close in March; however, the trades were rather “light".

(Mar 28th - Apr 3rd, 2022 - Options scanner BTC - Deribit)

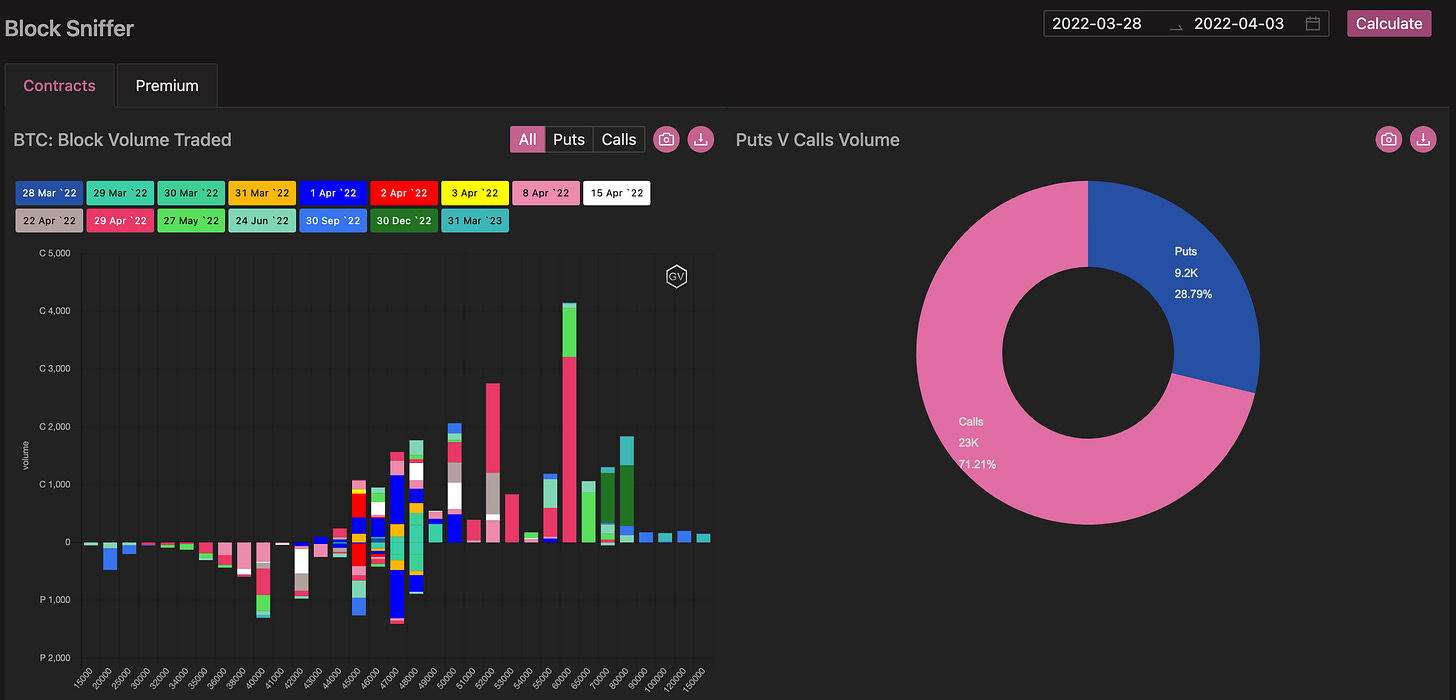

The week can be summarized in two major themes, one tactical and one strategic.

With the former, we essentially saw a constant flow of exposure with call spreads -some calendarized- in April, with strikes $52k-$60k.

The closing of about 30% of the open interest of $60k 29APR should be noted, even if difficult to interpret (e.g. MMs unloading inventory or a large player that closed a previous position).

The second, on the other hand, is the accumulation of upside exposure in the back-end maturities in the strikes $70k-$80k-$90k - certainly incentivized by the low IV - and which caused the long term skew to go into positive territory.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

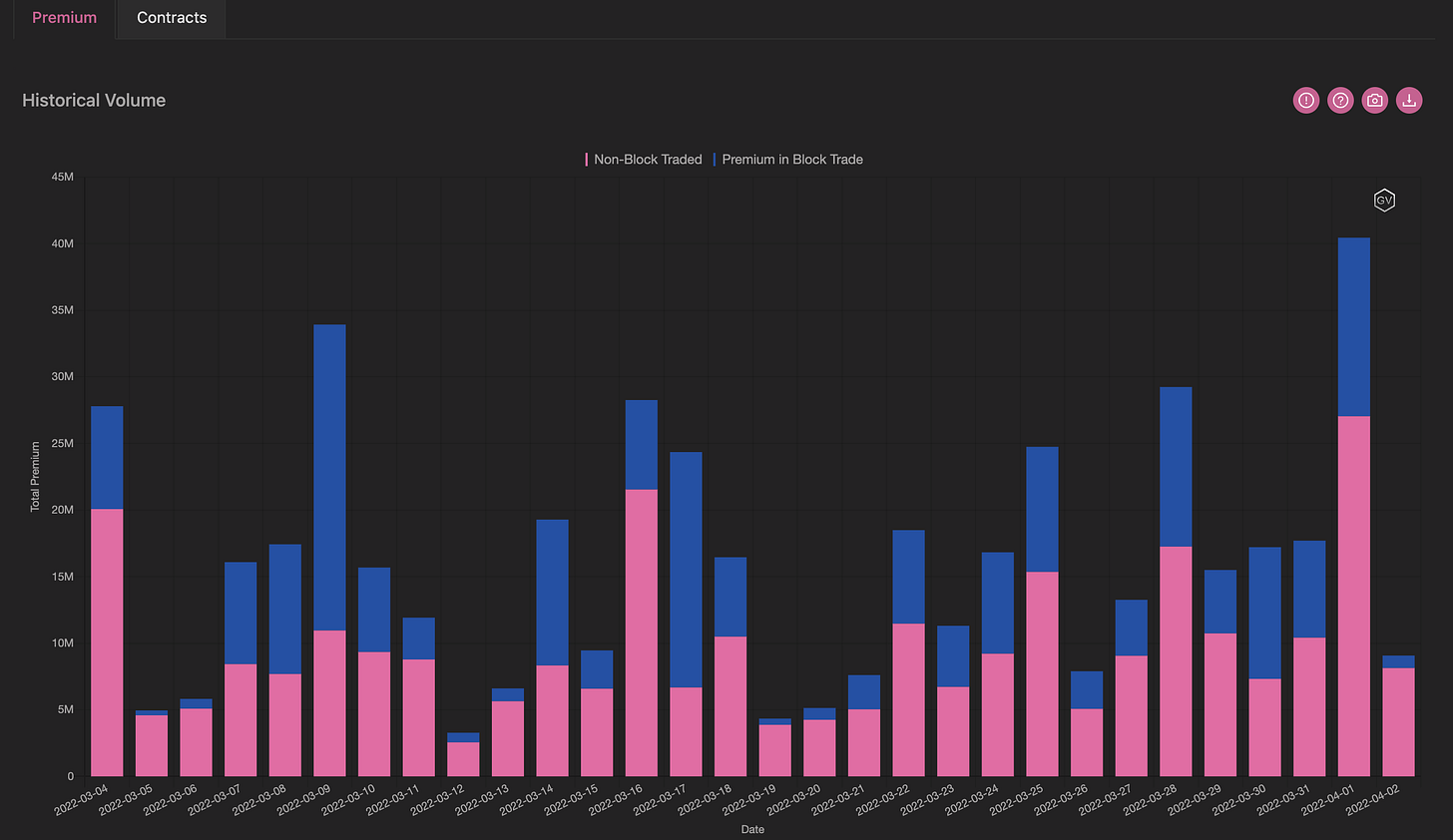

VOLUME

(April 3rd, 2022 - BTC Premium Traded - Deribit)

(April 3rd, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (21 Mar - 27 Mar)

(28 Mar - 3 Apr - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

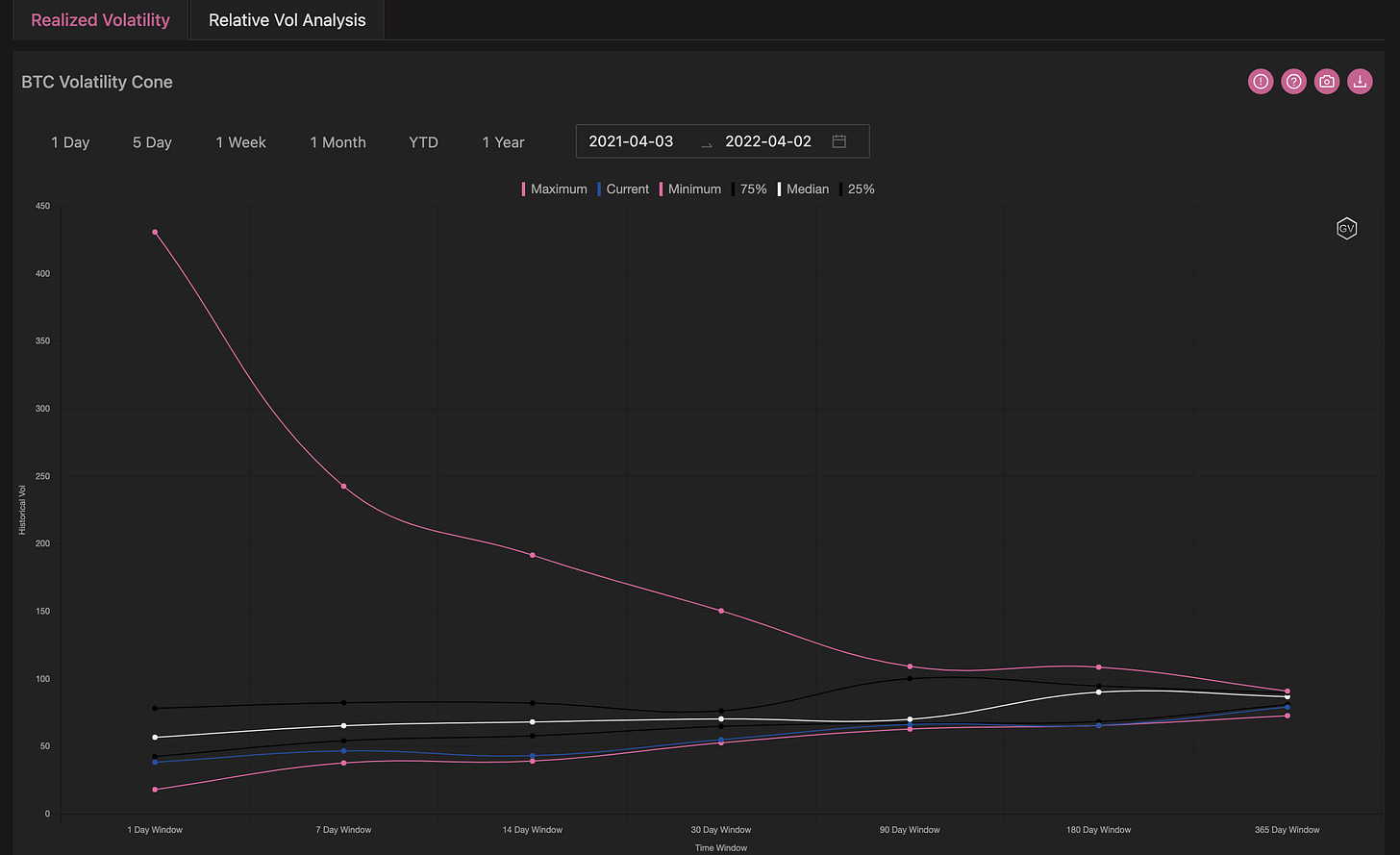

VOLATILITY CONE

(April 3rd, 2022 - BTC’s Volatility Cone)

Realized volatility is completely gassed out across the board.

The spot price levels of $42.5k-$50k will also provide clear consolidation boundaries for sustained lower RV.

Diagonals remain interesting here, to finance long-term call buys.

REALIZED & IMPLIED

(April 3rd - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The RV/IV gap between 10-day RV and ~15-day IV has good juice to be squeezed.

Assuming price remain within our $42.5k-$50k range, RV is unlikely to pick up…meaning there’s nearly 15pts-20pts of vol. premium here.

Something like -$50k 4/29 C (+$1500) against +65k 9/30 (-$3600) (give or take)

$3,500

DVOL: Deribit’s volatility index

(1 month, hourly)

TERM STRUCTURE

(April 3rd, 2022 - ETH’s Term Structure - Deribit)

ETH vol. is down in the dumps.

ETH Dvol index (VS) BTC Dvol index in only 10-pts apart.

This means that BTC/ETH relative volatility trades could become interesting here.

The term structure is in a rather steep Contango. Nearly 25-points between the front and back maturities.

SKEWS

(April 3rd, 2022 - ETH’s Skews - Deribit)

ETH option skew actually provides interesting opportunity here.

7-day option skew is about -8pts, while BTC is only -4pts, despite the overall ATM iv spread between ETH & BTC being rather close.

Another interesting element is the relative strength ETH is displaying versus BTC; the ETH/BTC price has rallied +0.005 week-over-week.

Short-term ETH calls are too cheap compared to similar BTC calls.

There’s an opportunity here in the ∆25 space.

(April 3rd, 2022 - ETH’s Skews - Deribit)

Open Interest - @fb_gravitysucks

ETH

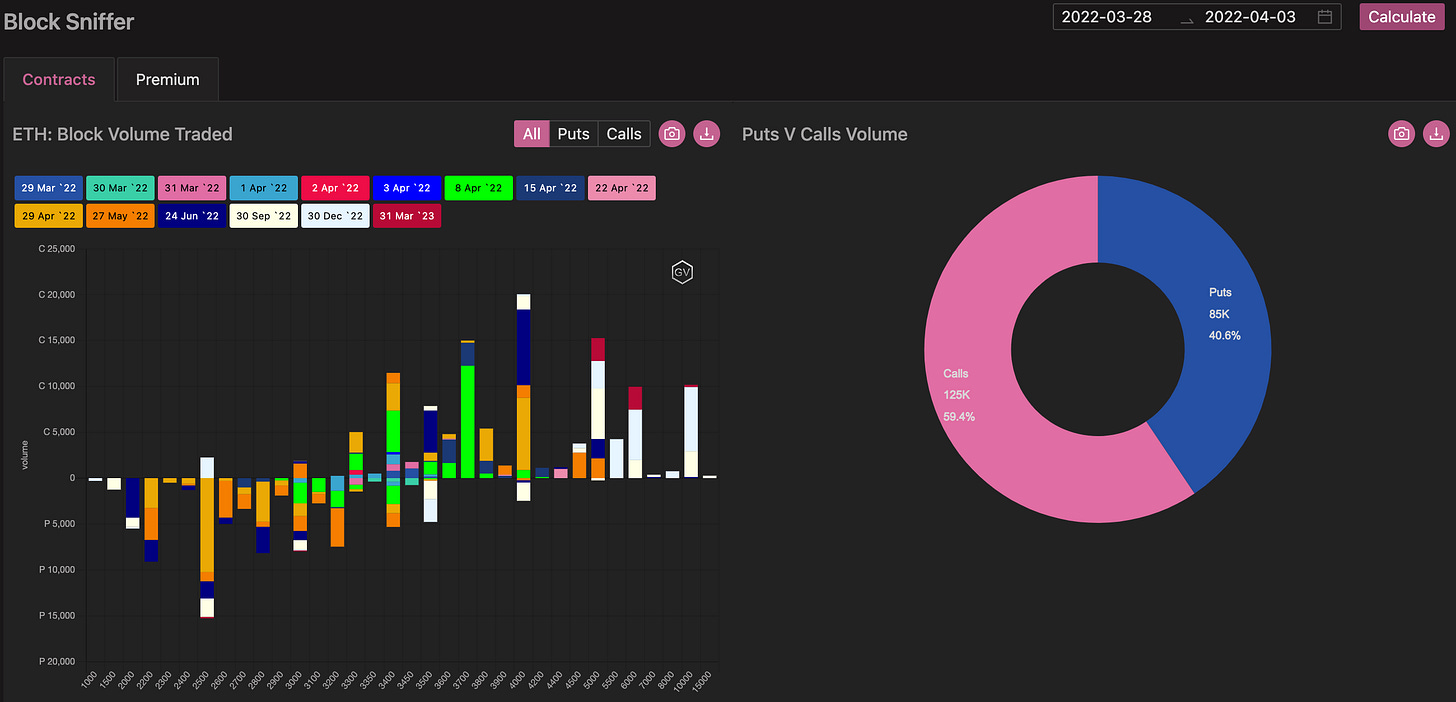

As we have been noticing for a few weeks now, the flow on Ether is mostly concentrated on puts.

It is difficult to establish with certainty whether it is a risk hedge or an upside exposure financing.

A two-way interest is likely, although the skew rally over the past two weeks has seen a predominance of selling puts.

(Apr 1st, 2022 - ETH Notional - Deribit)

BIG TRADES IN THE FLOW

The very active week on Ether makes it burdensome to identify clear themes.

In any case, what we saw was a rotation on calls with some important profit taking and the persistent interest towards puts.

After the recent rally, skew has been pretty steady this week, a sign that puts have been trading on both sides.

(Mar 28th - Apr 3rd, 2022 - Options scanner ETH - Deribit)

Color note of the week is that after Hayes’ recent article with the analysis of the expected merge on Ethereum where he predicts a price of $10k, some participants rushed to buy the December call.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(April 3rd, 2022 - ETH’s Premium Traded - Deribit)

(April 3rd, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (28 Mar - 3 Apr)

(28 Mar - 3 Apr - Volume Profile - Deribit & Paradigm)

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(April 3rd, 2022 - ETH’s Volatility Cone)

RV is down huge.

Near annual minimums for nearly all measurement windows.

REALIZED & IMPLIED

(April 3rd, ‘22 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

Without a clear catalyst for change, the IV/RV premium can be harvested in ETH (as well as BTC), although selling BTC vol. is likely the better play, given the relative vol. components.