Crypto Options Analytics, April 25th, 2021

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

Volatility spikes up as Bitcoin prices leg lower!

DVOL: Deribit’s volatility index

(1 month, hourly)

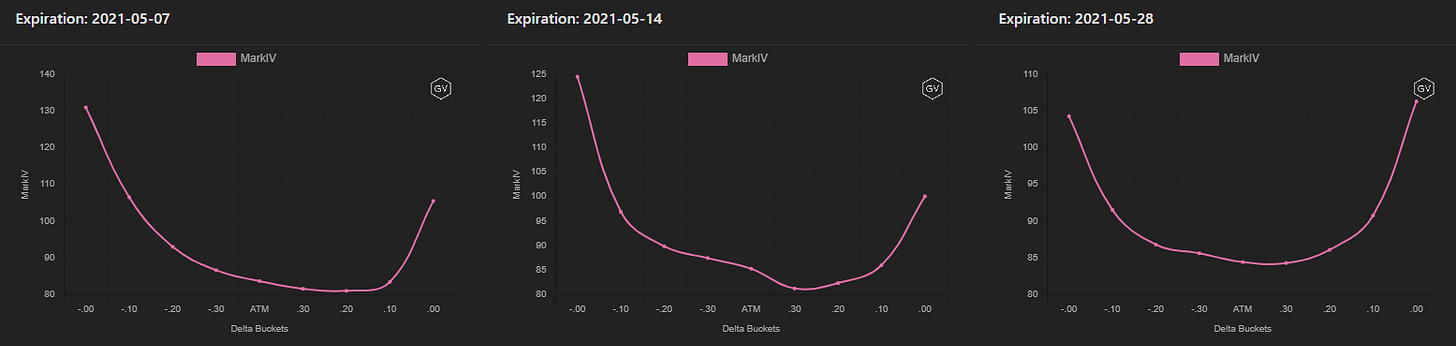

SKEWS

(April 25th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

As an extension to last week’s theme, short-dated option skews continue to be negative.

We are experiencing the first meaningful price correction in months for Bitcoin; this has caused option traders to seek out put-protection to hedge immediate price swings.

(April 25th, 2021 - Long-Dated BTC Skews - Deribit)

Although longer-term options continue to price positive skew, we’ve seen implied volatility increase in the Sept. (-.10 to - .00) delta range, as demand for tail risk increased.

TERM STRUCTURE

(April 25th, 2021 - BTC’s Term Structure - Deribit)

The term structure is now decidedly Backward.

This term structure signifies immediate realized volatility and price swing risks.

Implied volatility is most expensive in the short-term, and put demand is leading this implied volatility spike higher.

ATM/SKEW

(April 25th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

What’s interesting, when looking at ATM implied volatility (or the DVol BTC index), is the “jumpy” nature of volatility as of late. Instead of IV steadily moving higher, we see IV move higher with surprise spikes.

The BTC option skew is clearly negative with very little deviation. Skew is rarely negative by this magnitude or duration; option traders are seeing downside risk.

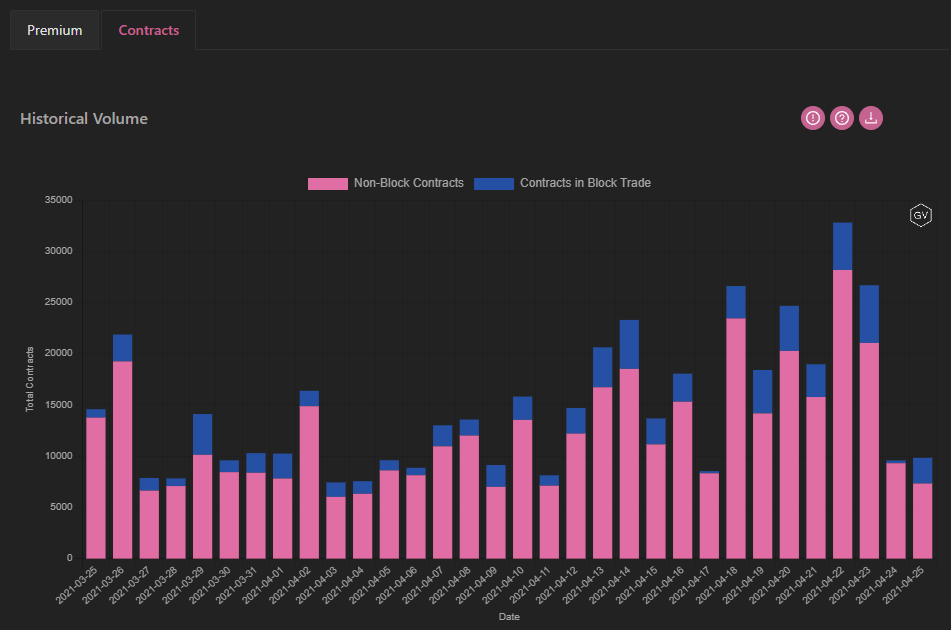

VOLUME

(April 25th, 2021 - BTC Premium Traded - Deribit)

(April 25th, 2021 - BTC’s Contracts Traded - Deribit)

This past week, we saw option volumes climb steadily higher for Bitcoin.

The increase in option activity solidifies the narrative of meaningful spot-price activity, as market-participation is seen across instruments.

VOLATILITY CONE

(April 25th, 2021 - BTC’s Volatility Cone)

7-day and 30-day realized volatility has increased above the upper 75th percentile.

These downside moves are significant and there remains risk on the table.

REALIZED & IMPLIED

(April 25th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV is driving IV higher, after a short-lived volatility vacation.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(April 25th, 2021 - ETH’s Skews - Deribit)

ETH short-date options are also negative but not as negative as BTC.

There is relative strength in ETH spot-prices compared to BTC, and the option skew is reflecting that.

(April 25th, 2021 - ETH’s Skews - Deribit)

Long-dated ETH options saw an increase in IV of about +5pts, but the shape remains similar to last week’s.

TERM STRUCTURE

(April 25th, 2021 - ETH’s Term Structure - Deribit)

Once again, we have a hump-like term structure.

We find these structures peculiar and think there is opportunity in trading around these unique shapes.

ATM/SKEW

(April 25th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Once again, we witness sharp jumps in ATM IV.

It’s almost as if the market was surprised by the spot-price corrections, and traders were rushing to buy optionality all at the same time, causing IV to jump higher.

Notice that the option skew is only slightly negative. This is due to the relative strength that ETH prices are displaying.

VOLUME

(April 25th, 2021 - ETH’s Premium Traded - Deribit)

(April 25th, 2021 - ETH’s Contracts Traded - Deribit)

We saw some of the absolute largest ETH option volumes on record last week.

There is a ton of activity and interest in ETH.

We think the ETH relative strength story will continue, given this level of activity.

VOLATILITY CONE

(April 25th, 2021 - ETH’s Volatility Cone)

Realized vol. is back in the upper 75th percentile for many rolling windows.

Expect large swings to continue, especially given the counteracting forces of relative strength and crypto price correction, both battling for dominance.

REALIZED & IMPLIED

(April 25th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

RV is greatly outpacing IV. This might be due to trend-less ETH prices displaying large swings back and forth… A gamma scalpers dream!