Crypto Options Analytics, April 24th, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$39,544

DOV auctions

*note: Protocols have different auction times & calculated vols. are estimates

DVOL: Deribit’s volatility index

(1 month, hourly)

Last week, fed speak moved the traditional markets but BTC held the $38k - $42k levels nicely.

This week, with the reaction of TradFi assets, we believe crypto is lagging but will ultimately feel the weight of massive rate hikes coming this year.

We’re looking for long volatility opportunities.

TERM STRUCTURE

(April 24th, 2022 - BTC’s Term Structure - Deribit)

(gvol API python module, pre-built notebook chart )

The term structure is beginning to “LIFT HIGHER”, led by the short-end.

Looking at the term structure percentile chart, we can see the overall term structure is moving up from a very LOW starting point. This means crypto volatility can move A LOT higher.

The caveat here is realized volatility.

(Background note)

Volatility is one of those counter-intuitive assets classes that rewards the non-obvious trade…

In low-volatility environments, the obvious trade is expecting volatility increase… this tends to create an IV/RV premium, as most trades bid up IV… Often times, the rewarding trade is to harvest that premium by selling IV in a low IV environment… and buying IV in high RV environments..

(end background note)

We need to figure out “smart” ways to buy volatility here, because the IV/RV premium is currently rather large.

SKEWS

(April 24th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Just as IV/RV premiums tend to price-in obvious trades, the current skew profile has priced-in negative spot/vol. correlations.

This trend has been consistent as of late… affording those willing to fade the skew a decent harvest.

We now think the skew-harvest is getting dangerous, given the larger risk-asset environment.

Selling skew lower isn’t an interesting trade to us here either though.

We need to combine instruments and surface position to create a smart “Buy-the-vol trade”.

Long-term skew is the most negative in the past 3-years…While the basis continues to hold a slight premium…

Delta hedged, 25∆ long 180-call, is a good long vol. trade here.

(April 24th, 2022 - Long-Dated BTC Skews - Deribit)

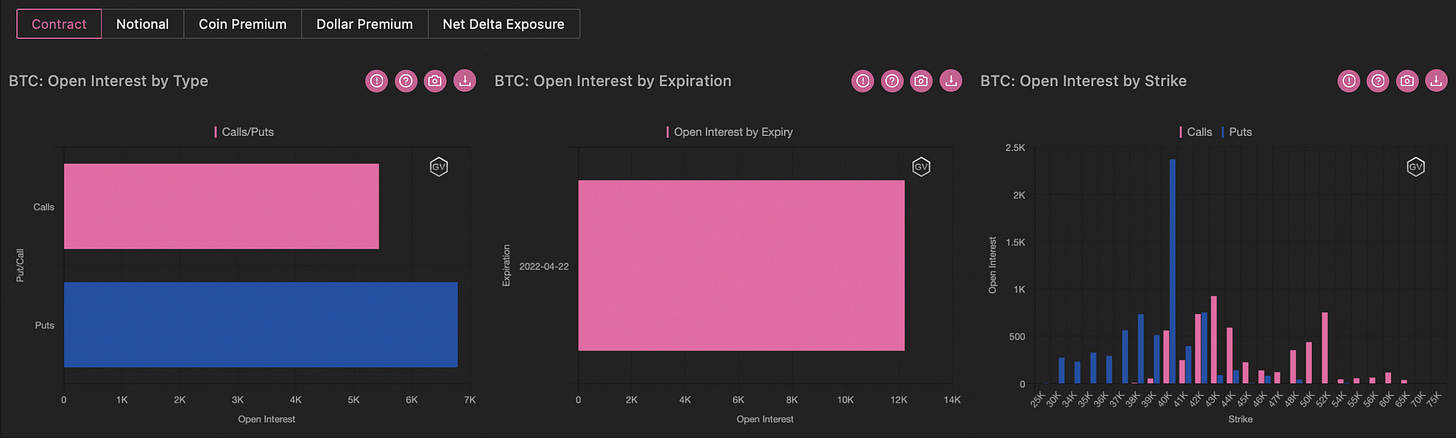

Open Interest - @fb_gravitysucks

BTC

Disappointing weekly expiry with just over 12k open contracts.

Among the possible causes of this lack of interest, we must certainly mention the price action in choppy mode of the last few weeks, which has hurt many volatility bidders.

Looking at the open interest profile, the $40k put stands out, bought massively last Friday.

A week that will soon be forgotten by traders, and that only gave a bit of a reward to put-holders who bought puts with the spot at the high end of the choppy range.

(Apr 22nd, 2022 - BTC Contract - Deribit)

(Apr 22nd, 2022 - BTC Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

Trading week for Bitcoin can be summarized by taking $41k of the spot as a reference threshold: above, with bullish directional strategies; below, selling volatility.

(18th - 24th Apr, 2022 - Options scanner BTC - Deribit)

On Monday, with the spot below $40k, the focus was for $30k strike on May 27th, with over 2000x puts traded, mostly bought, even though the flow was two-way.

Later in the week, with the spot well above $41k , which seemed to continue the rise, there was a more bullish flow: call spread $80k/$100k in September, long call $42k in April, and numerous diagonal calls +$48k May/-$60k June.

With the spot at $42.2k, there was a purchase of $40k puts on June: a single trade of almost $0.5M.

Friday, with the spot falling below $40k, volatility sales strategies returned: 100x Iron Condor $34k/$36k/$42k/$44k and short strangle $36k/$44k on May 6th, and $40k$ calls sold in September for over $2M premium.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(April 24th, 2022 - BTC Premium Traded - Deribit)

(April 24th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (18 April - 24 April) BTC

BTC and ETH spot took a round trip this week, peaking on Thursday AM UTC before following equities lower on Friday, to finish -1.75% and -4.3% WoW, respectively.

Local peaks in BTC and ETH have coincided with local peaks in NDX front-month futures. The store-of-value argument remains off the table. Crypto majors currently trade as a software bet.

BTC 1M ATM IV rallied from 56v to 58v on the late-week sell-off, but reversed course over the weekend as spot pinned at 40k. 30d realized remains lethargic at 45v.

Despite lethargic spot action, BTC upside dominated the tape, with calls outpacing puts over 2:1. The largest BTC blocks this week were upside structures: 29Apr outright calls, May / Jun call calendars, and wingy Sept call spreads.

BTC

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(April 24th, 2022 - BTC’s Volatility Cone)

RV is still low, there’s no doubt about that.

That said, we are moving higher and heading towards the median volatility level.

Buying a small IV/RV premium while RV lies significantly below the median is justifiable.

REALIZED & IMPLIED

(gvol API python module, pre-built notebook chart)

Although there is still a slight IV/RV premium, the magnitude is rather small.

Also, the current RV profile is low… meaning RV could quickly move higher and the size of the var. premium provides little buffer for vol. sellers, should that happen.

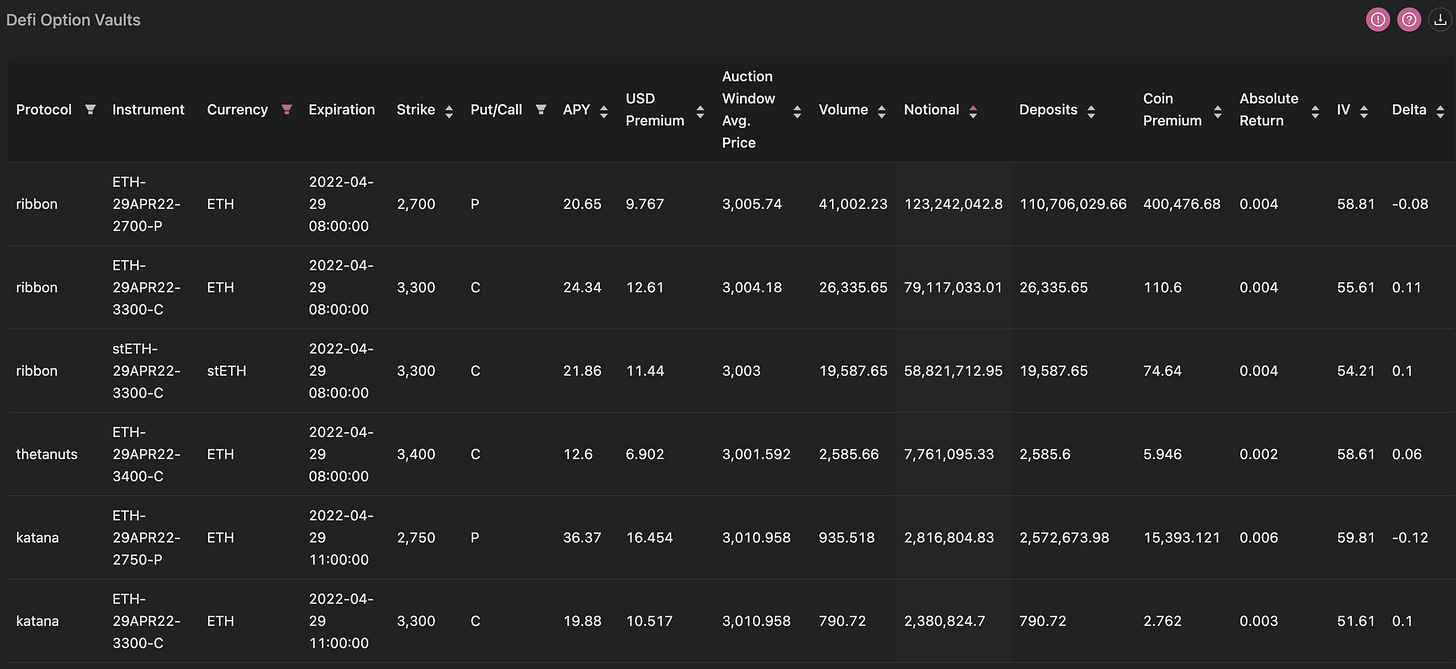

$2,952

DOV auctions

*note: Protocols have different auction times & calculated vols. are estimates.

DVOL: Deribit’s volatility index

(1 month, hourly)

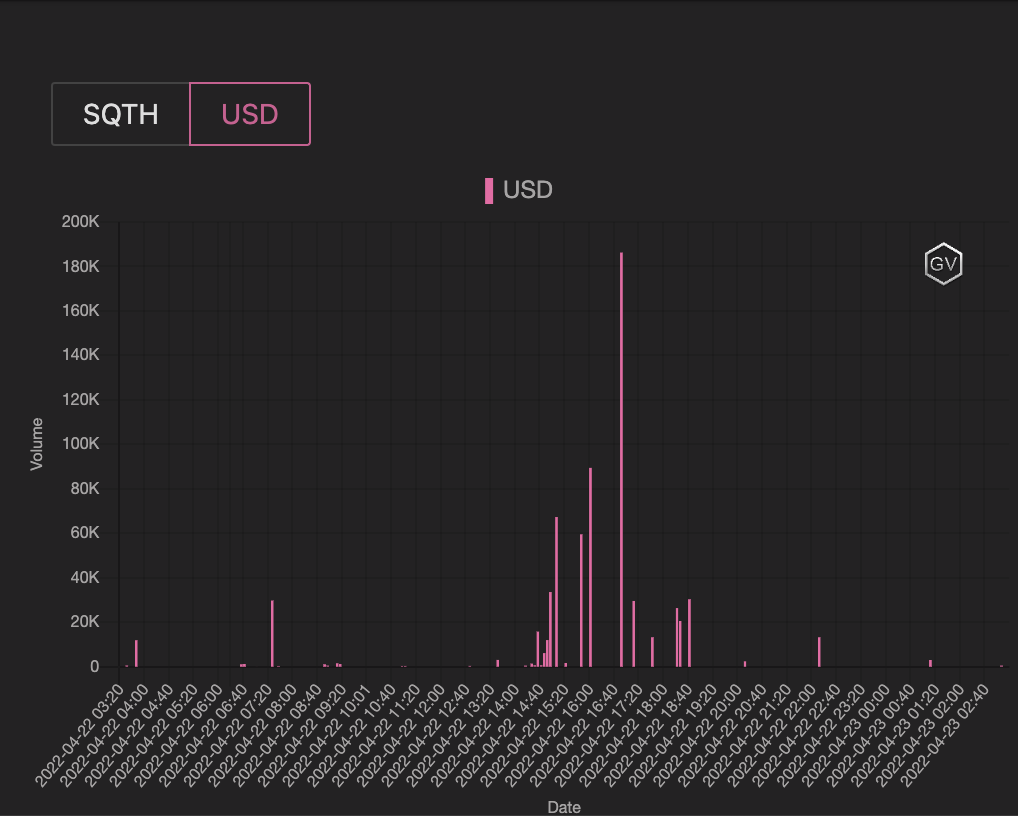

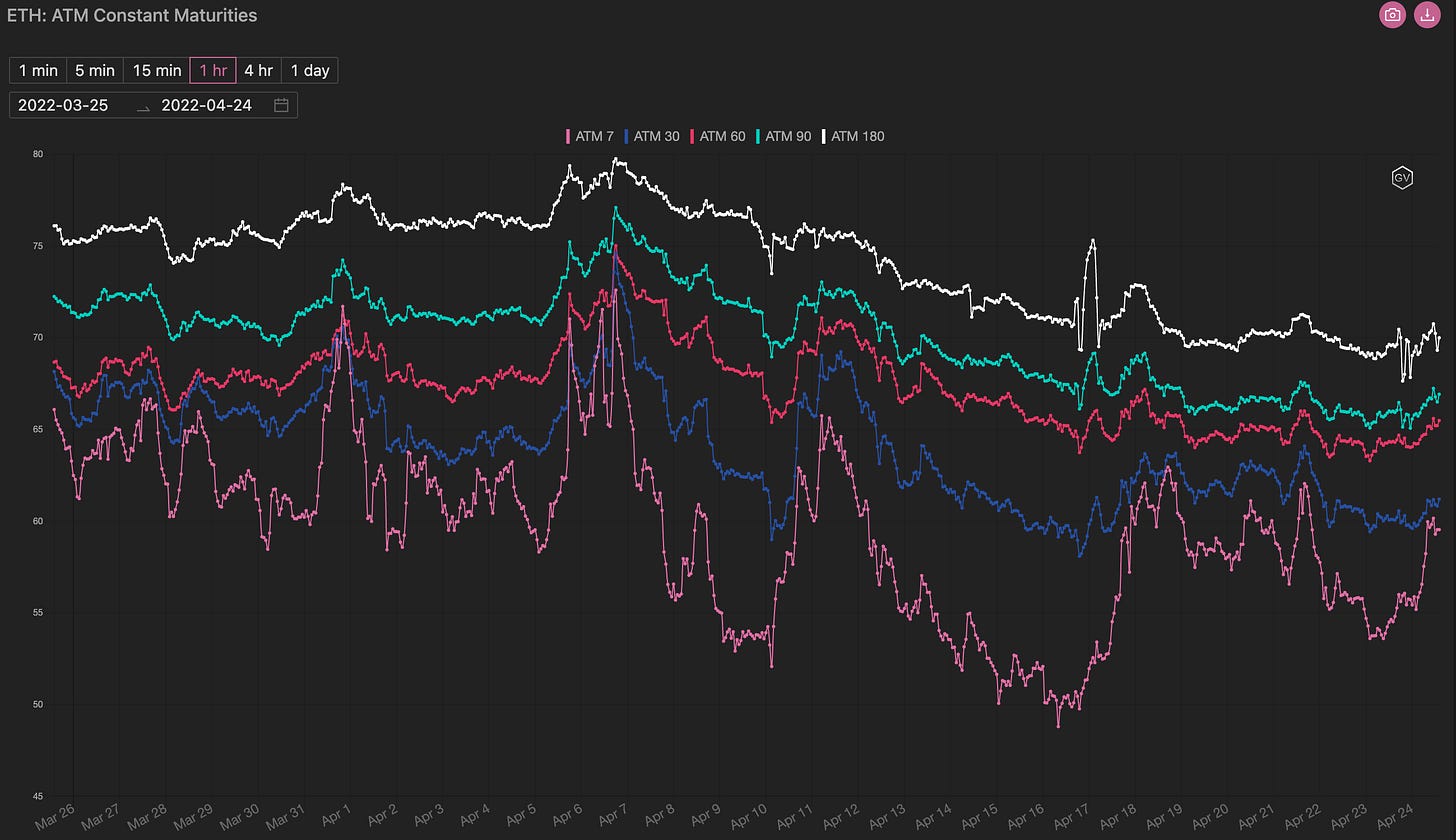

ETH implied volatility has been soft as well. DVol readings around 65%.

There’s been interesting opportunity in the Squeeth market to sell ETH IV.

Squeeth vol. was trading as high as 100% IV until someone slammed about $500k worth of size… re-pricing it lower to about 75% IV.

We’ll be releasing educational content around Squeeth soon.

Something to keep in mind: Squeeth is a relatively thin market, with about 17k contracts of OI. There’s liquidation risk on the short-side and therefore, incentive for toxic flows to spend a few $$$ million in buy-side orders and cause a liquidation cascade (which toxic flows can then use to realize a profit.)

TERM STRUCTURE

(April 24th, 2022 - ETH’s Term Structure - Deribit)

ETH volatility still remains steep.

The relative outperformance of ETH continues to create price buoyancy in the face of risk-off asset flows.

The term structure percentile distribution is even more drastically low in ETH, versus BTC.

SKEWS

(April 24th, 2022 - ETH’s Skews - Deribit)

ETH skew is still being lead lower by 30-day maturities.

The long-term skew (thinking 1y out) is interesting for the long-call hedged position.

Ethereum developments are likely going to make developments around PoS migration, and that could be a bullish catalyst.

(April 24th, 2022 - ETH’s Skews - Deribit)

Open Interest - @fb_gravitysucks

ETH

Ethereum also saw a subdued weekly expiration cycle, with total open contracts well below the historical average.

However, the open-interest profile shows more dynamism, with discrete positions for both puts ($2.7k/$2.8k) and calls ($3.2k/$3.4k). Remember the over 6000x $3.4k calls bought last Thursday.

However in the end, worthless expired contracts were a staggering 93%!

Beware, you, volatility buyers!

(Apr 22nd, 2022 - ETH Contract - Deribit)

(Apr 22nd, 2022 - ETH Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

The trading week for Ethereum was nothing short of eclectic, with a high total volume and different opinions implemented, with sometimes unusual executions.

(18th - 24th Apr, 2022 - Options scanner ETH - Deribit)

The week began with 3000x call $5k/$10k ratio 1x2 on September, a bullish view but a conservative strategy regarding temporal decay and exposure to Vega.

Although with the spot above $3.1k, we recorded a purchase of several protection strategies: a massive buy of $2k puts on September with a premium paid of over $1M, a put diagonal +$2.8k/-$2.5k June/September (also here to underline caution in exposure to Vega), and a put spread -$3k/+$2.4k ratio 1x3 on the May 27th expiry, “sell the body, buy the wings”.

In the middle of the week, with a sentiment turned decidedly in positive territory, traders bought $3.4k calls with hands down for May 6th.

But it’s Friday that Ethereum caught the attention of option flow readers, with two unusual on-screen executions:

In the morning, a purchase order was placed for over 17k contracts on $7k call for December. Order that was partially filled during the day for a total of about $1M premium paid;

Throughout the day, a trade of opposite sign but of the same modality for the call $5.5k on March 2023: sales orders placed in the book and filled with multiple trades for a total of over $4M premium!

Finally, it is worth noting the unwind by the MMs on the market of the weekly DOV flow, for strikes $2.7k and $3.3k.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(April 24th, 2022 - ETH’s Premium Traded - Deribit)

(April 24th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (18 April - 24 April) BTC

ETH 1M ATM IV ended the week at 59v and 30-day realized at 53v. ETH – BTC 1M ATM IV spread of 4.6v remains towards the lows. Explosive growth of DOVs is a large reason for the spread compression.

ETH flows were also dominated by upside, with 185k calls vs. 105k puts trading in the market. Large block activity in longer-dated wingy call spreads and ratios explains this week’s imbalance.

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(April 24th, 2022 - ETH’s Volatility Cone)

RV continues lower across the board for the reasons we touched upon.

Getting long IV on-screens and short in DeFi is interesting, although size is limited.

Otherwise, longing ∆25 options for extended maturities makes sense.

REALIZED & IMPLIED

(Gvol API python module, pre-built notebook chart)

IV/RV premium is thin and only slightly positive.