Crypto Options Analytics: April 20th, 2025

Visit Amberdata.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Authors have holdings in BTC, ETH and Lyra and may change their holdings anytime.

Math-minded people here, pardon any typos.

*Fed governors speak everyday this week*

Monday 10a - US leading Indicators

Wednesday 9:45a - Flash PMI

Wednesday 10a - New Home Sales

Wednesday 2pm - Beige Book

Thursday 8:30a - Durable Goods

Thursday 10a - Existing Home Sales

Friday 10a - Consumer Sentiment

MACRO

Happy Easter, everyone!

Last week was a shortened trading week with markets closed for Good Friday. However, Powell’s speech on Wednesday (4/16) sent markets sharply lower.

During his remarks, Powell expressed uncertainty about the Fed’s ability to respond to an economic downturn, noting that tariffs could limit the effectiveness of rate cuts due to short-term, supply-side inflationary pressures.

This stagflationary tone weighed on equities and kept the VIX elevated, as the index hovered between 30 and 35 throughout the week.

In the chart above we can see that Powell’s comments spiked VIX up +5pts testing the weekly high of VIX-35.

Unhappy with the remarks Trump responded by suggesting that Powell is moving too slowly to support the economy and market. After the COVID inflation, Powell has leaned hawkish on rates… Any threats to Fed independence would likely be inflationary.

Regardless, Powell’s term ends next year and Trump is likely going to appoint someone dovish to head the central bank, which could also be inflationary.

Taken together, this provides strong ammunition for the Bitcoin “right-tail” thesis… Gold has is currently on it’s own “right-tail” path higher.

Not only is Gold breaking into new ATHs daily, but the associated volatility with Gold is also following the asset higher… Showing a rush into the asset.

Is digital Gold next to move higher? Why not?

Next week, we have the Fed Beige Book release and multiple Fed governors speaking throughout the week.

Any threats against the Fed’s independence could be a catalyst for Gold and BTC to head higher.

BTC: $87,018 (+3.1% / 7-day)

ETH :$1,612 (-0.1% / 7-day)

SOL :$141.59 (+8.1% / 7-day)

Crypto

Given the US monetary landscape and the reaction in the Gold market, owning the right-tail thesis hedge seems very interesting right now.

The associated volatility is also near historical lows.

The current IBIT term structure is pricing 54% 6-month vol and about 56% 2-year vol.

Looking at the Deribit BTC market since April 2019, we can put the 6-month at-the-money (ATM) implied volatility (IV) into context.

There have been four instances where 6-month ATM IV reached as high as 120%. In contrast, today’s level of 54% IV is hovering near the lower end of its historical range over the past six months.

(Of course, there are structural reasons that could explain this.)

As discussed on the Deribit podcast, there’s a strong case to be made for both right-tail and left-tail trades in BTC.

Bitcoin still occasionally trades in line with other “risk-on” assets, so an equity market downturn could easily drag crypto, including BTC, lower. With this in mind, owning options for right-tail exposure remains a compelling way to secure upside potential.

Paradigm Top Trades This Week

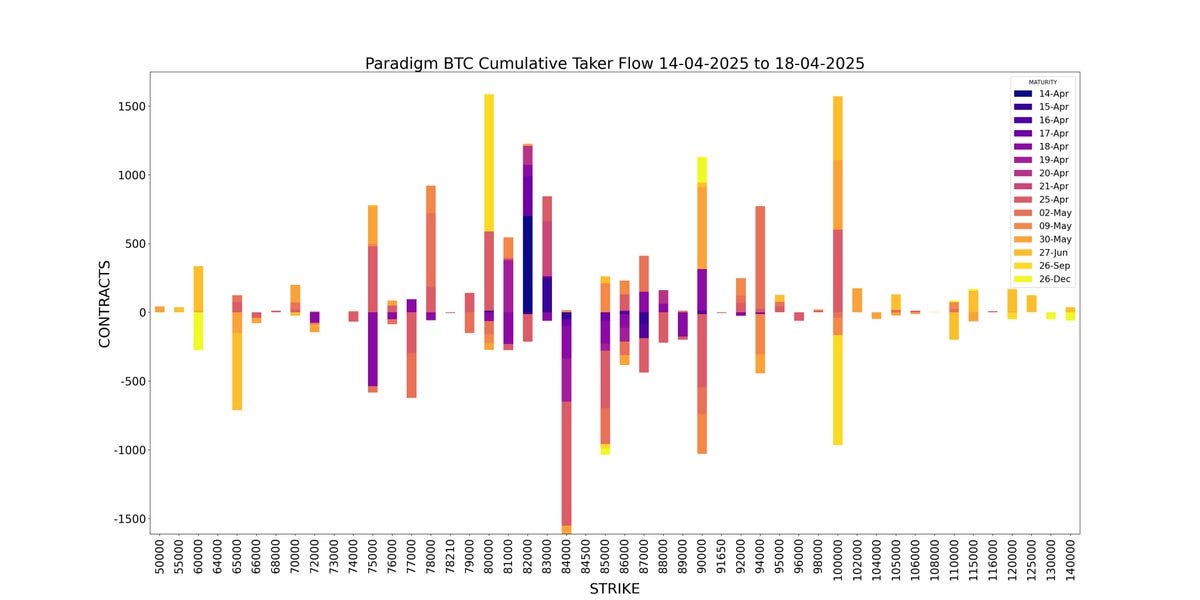

Weekly BTC Cumulative Taker Flow

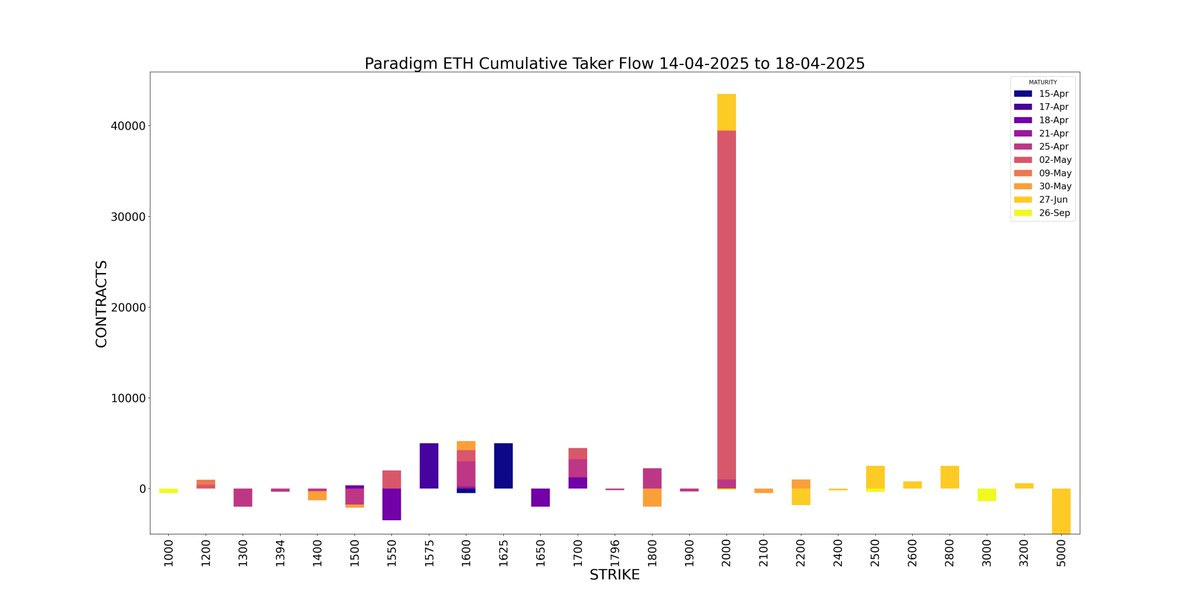

ETH Cumulative Taker Flow

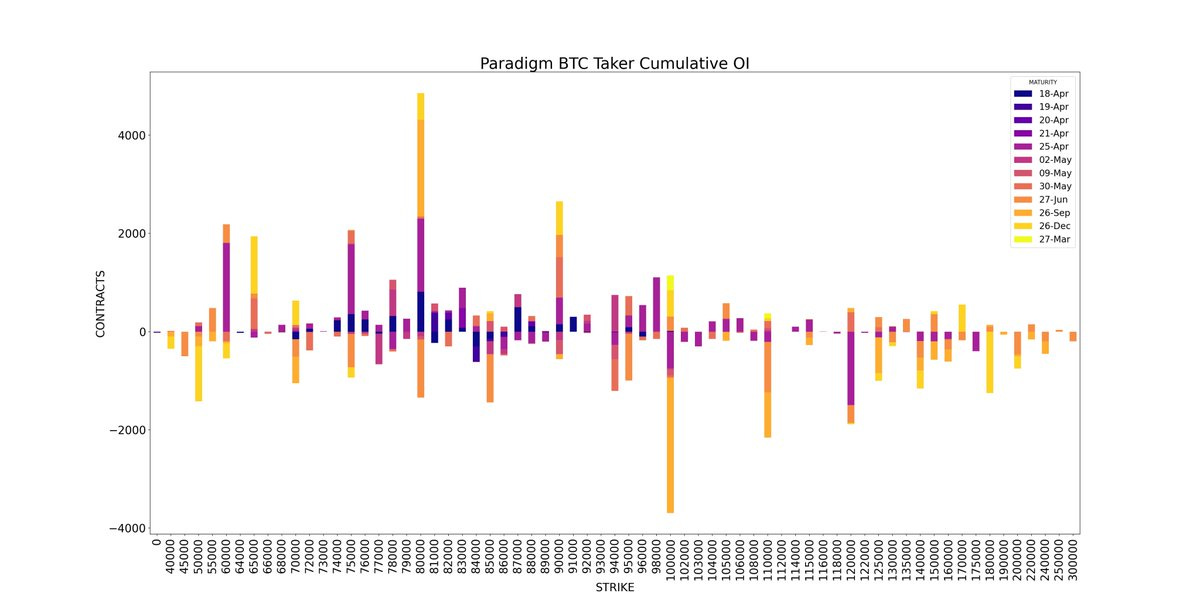

BTC Cumulative OI

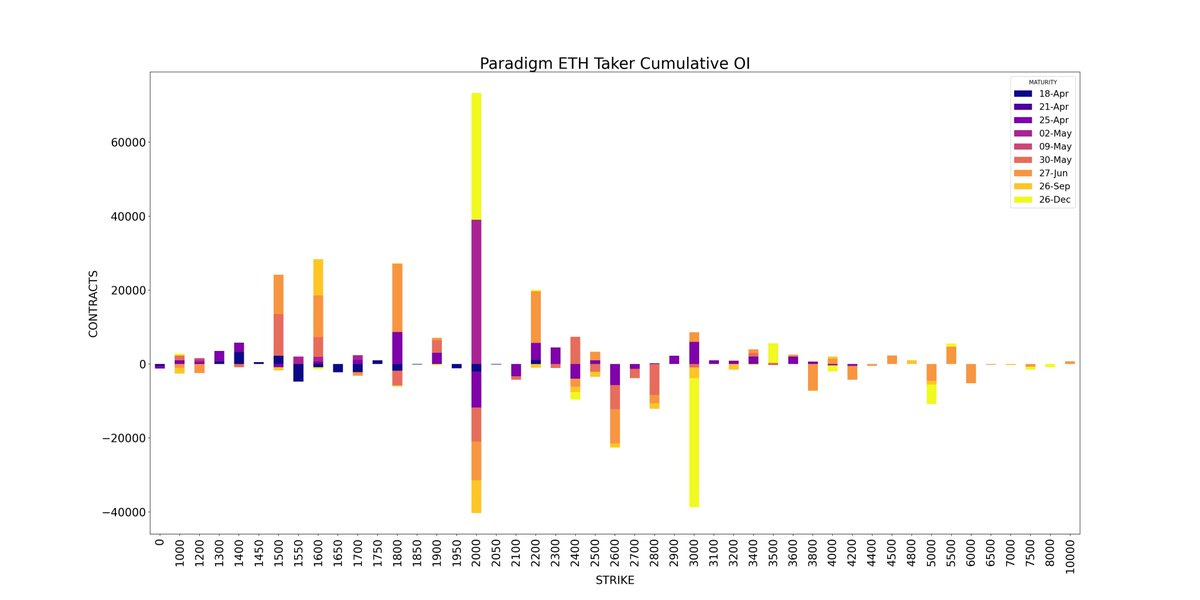

ETH Cumulative OI

BTC

ETH

AMBERDATA DISCLAIMER: The information provided in this research is for educational purposes only and is not investment or financial advice. Please do your own research before making any investment decisions. None of the information in this report constitutes, or should be relied on as a suggestion, offer, or other solicitation to engage in, or refrain from engaging, in any purchase, sale, or any other investment-related activity. Cryptocurrency investments are volatile and high risk in nature. Don't invest more than what you can afford to lose.