Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

The crypto volatility Gods giveth and taketh away!

DVOL: Deribit’s volatility index

(1 month, hourly)

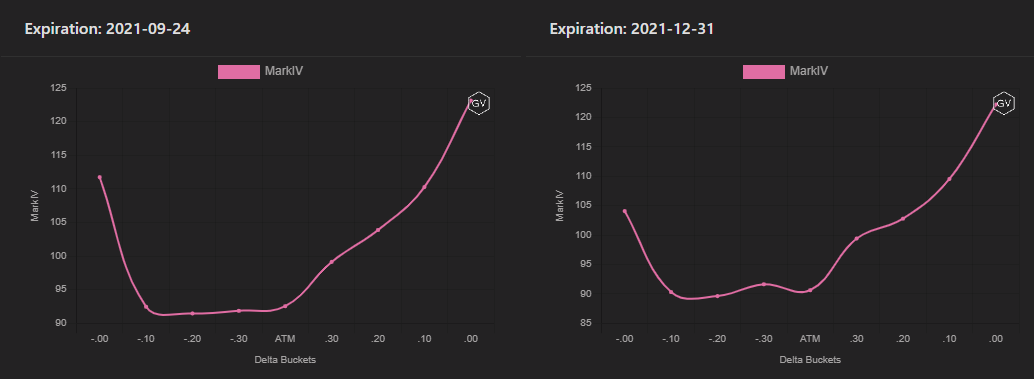

SKEWS

(April 18th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Earlier this week, we saw Bitcoin perform its favorite trick: make new all-time highs.

… Only to break lower over the weekend, erasing all its gains and then some.

This type of volatile spot-price activity has sent Bitcoin option skews in different directions.

Short-term options have a negative skew while medium-term options are nearly symmetrical.

(April 18th, 2021 - Long-Dated BTC Skews - Deribit)

Longer-term options maintain a positive skew, indicating that Bitcoin is most likely to have volatile bullish price action versus volatile bearish price action on average.

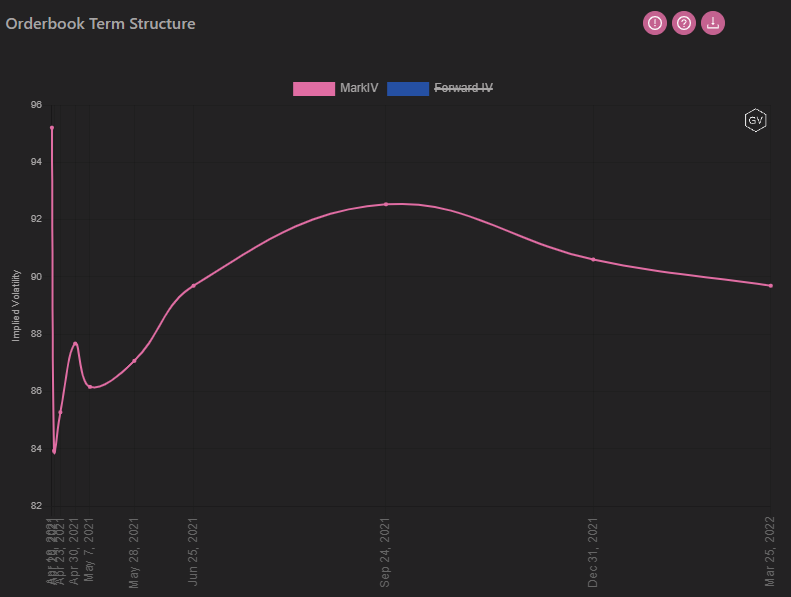

TERM STRUCTURE

(April 18th, 2021 - BTC’s Term Structure - Deribit)

Last week, the term structure was in steep Contango with the spread between short-dated options and long-dated options nearing 25pts.

This week, the spread between all expiration months is about 10pts.

This term structure is much more “flat”— an undecided structure— as Bitcoin spot-prices find their footing.

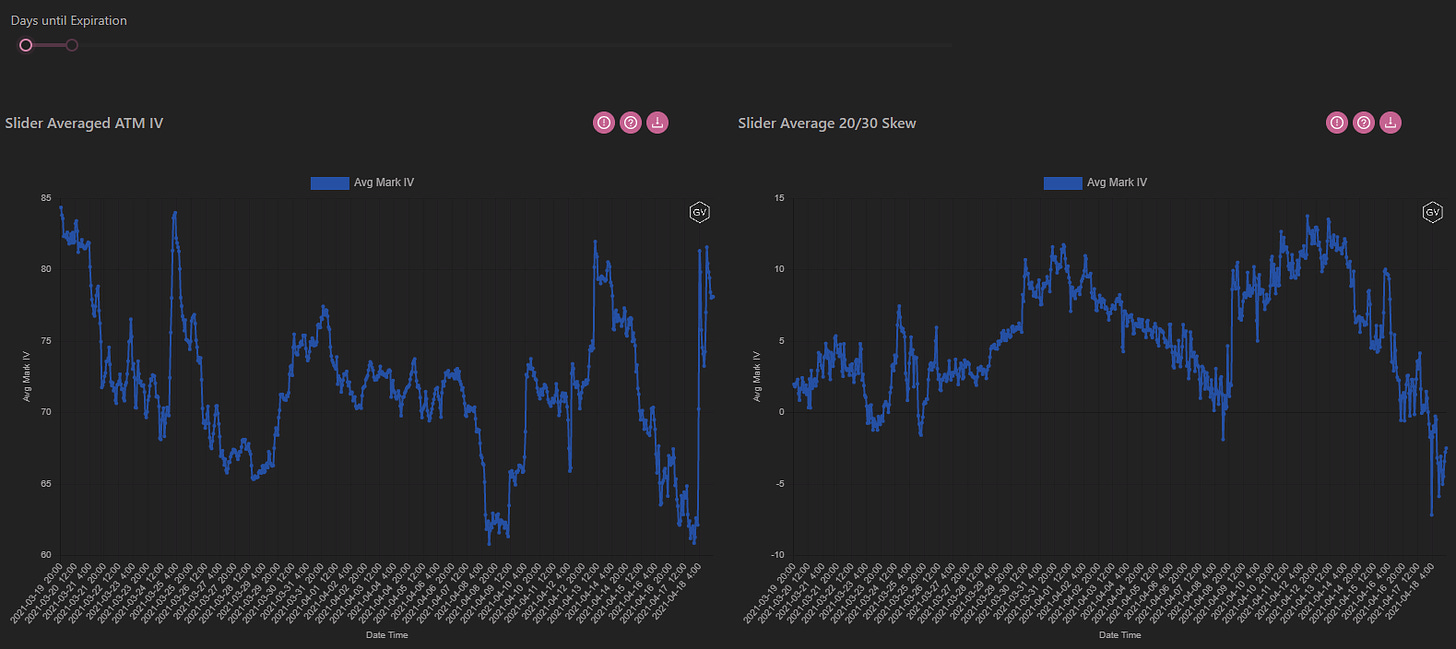

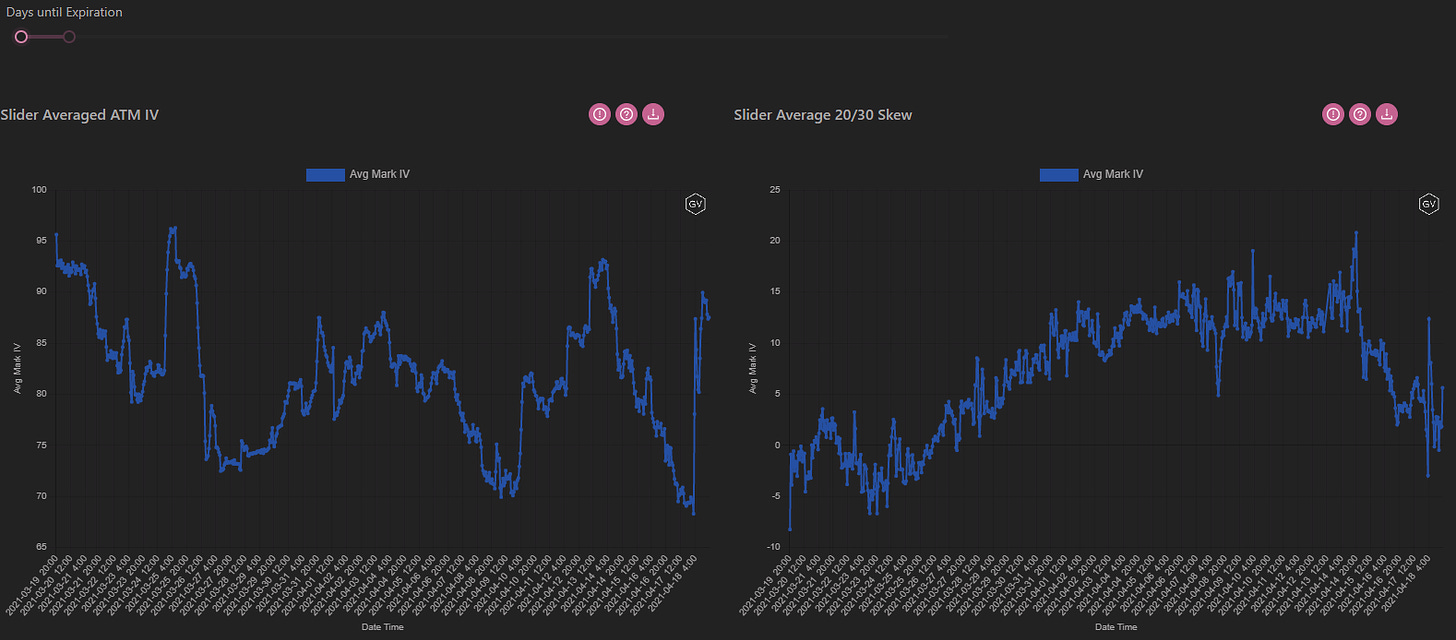

ATM/SKEW

(April 18th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

Notice the very FAST spike up in ATM implied volatility.

This reaction is due to the quick spot-price declines seen over the weekend.

Option-buying demand leaned towards the puts, which caused skews to turn decidedly negative.

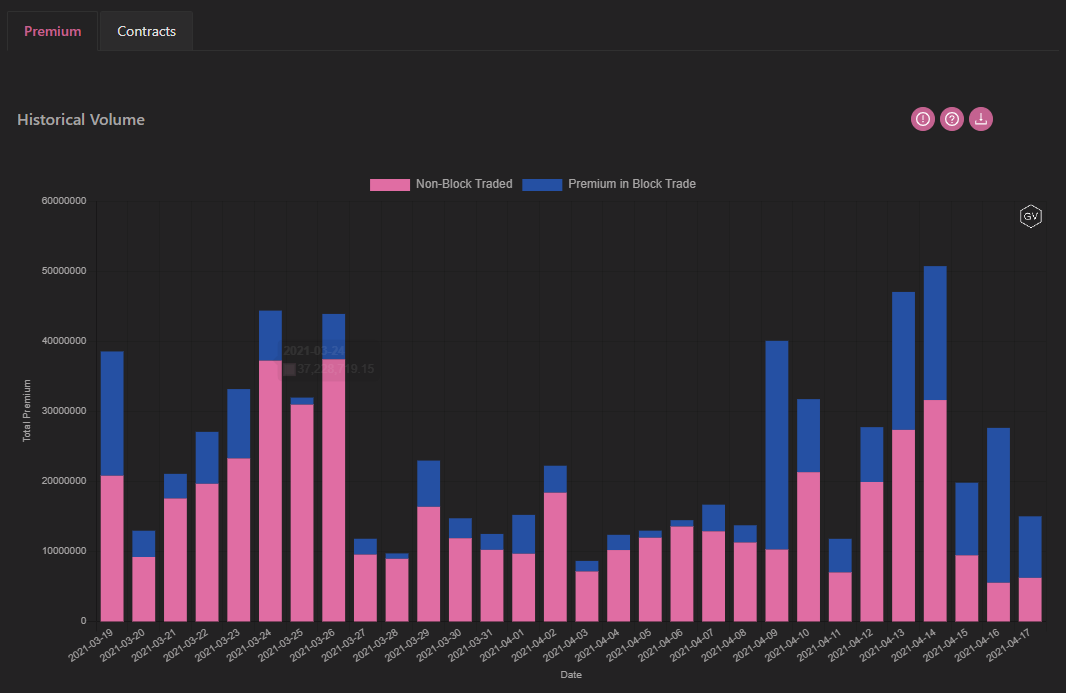

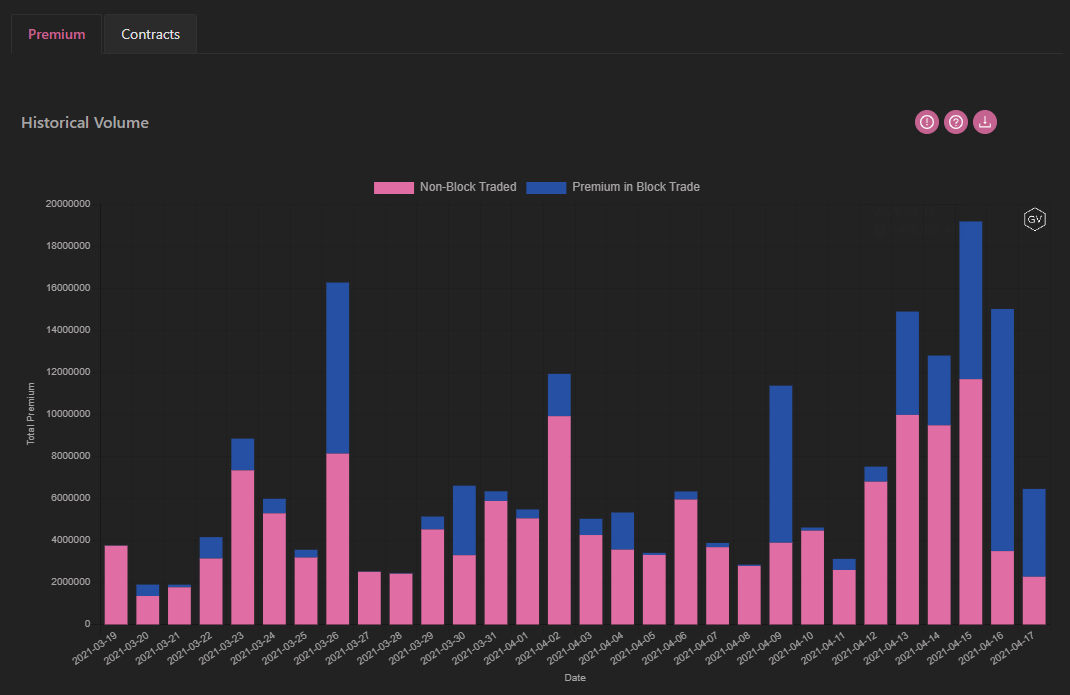

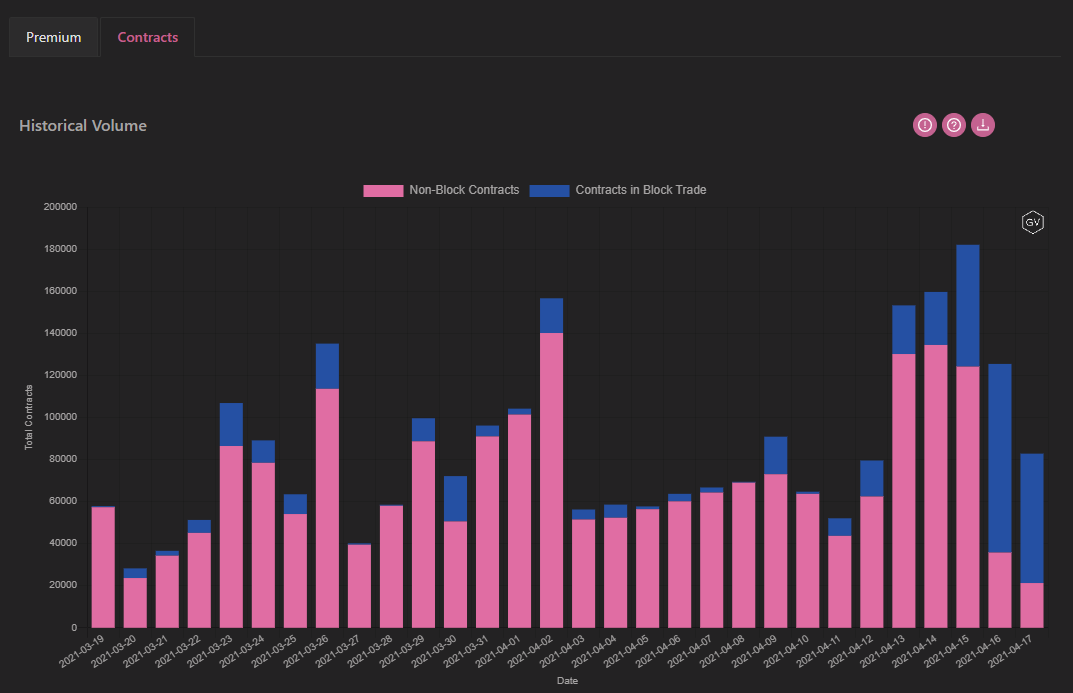

VOLUME

(April 18th, 2021 - BTC Premium Traded - Deribit)

(April 18th, 2021 - BTC’s Contracts Traded - Deribit)

Bitcoin option volumes saw a modest increase, with a disproportionate amount of the volume being block-traded on Paradigm.

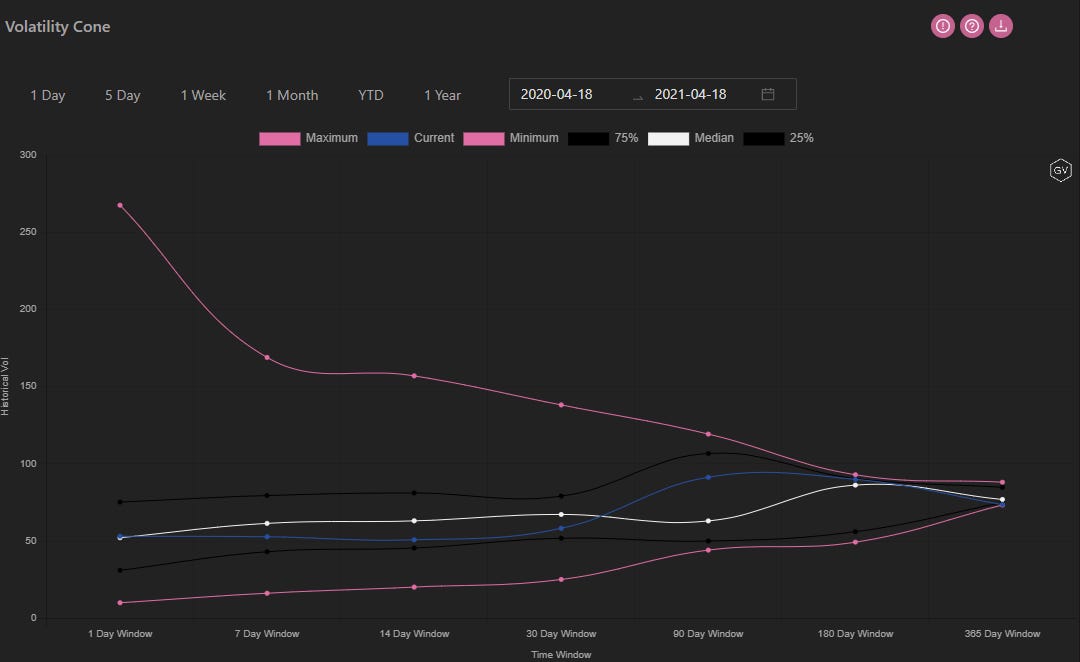

VOLATILITY CONE

(April 18th, 2021 - BTC’s Volatility Cone)

The realized volatility environment is near the lower 25th percentile for medium-term windows.

This type of environment is calm, with the exception of the recent spike lower in prices.

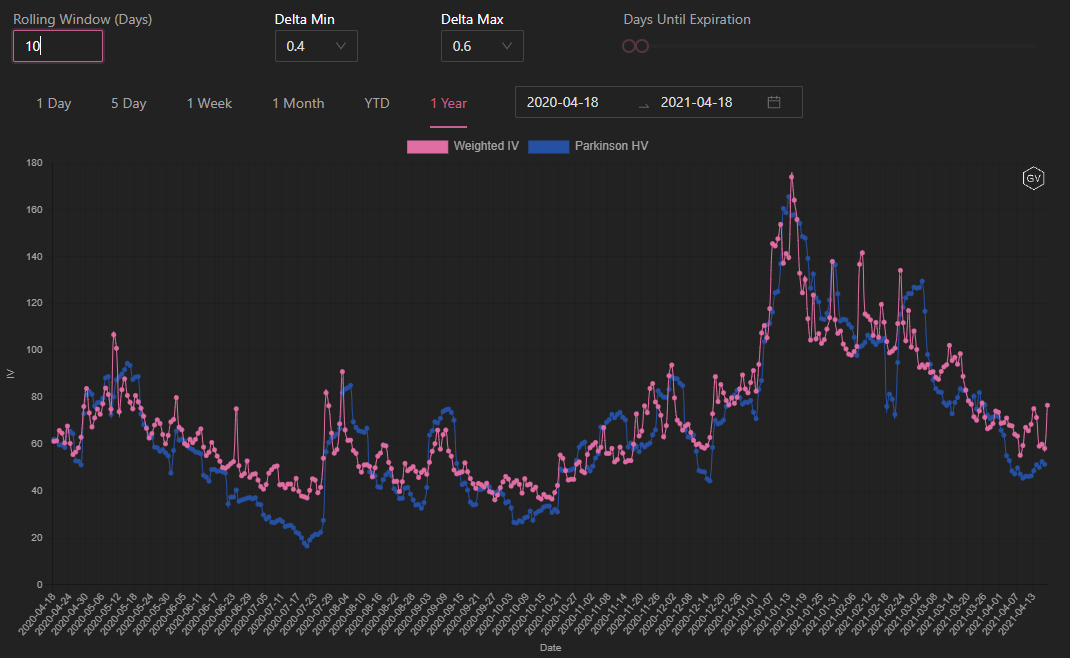

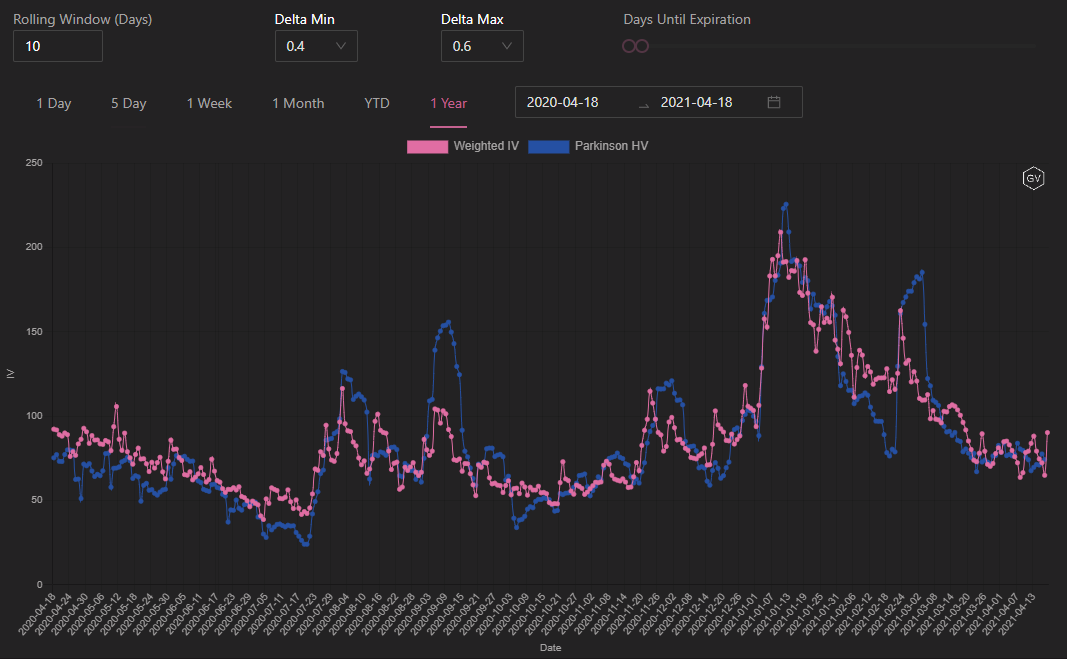

REALIZED & IMPLIED

(April 18th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

IV is trading at a premium to RV.

Option traders are expecting realized volatility to increase in the future, compared to its current levels.

DVOL: Deribit’s volatility index

(1 month, hourly)

SKEWS

(April 18th, 2021 - ETH’s Skews - Deribit)

Ethereum saw a volatile week this past week.

Early on, ETH made new ATH’s, which justified the persistently positive call skew.

By Saturday, nearly all— but not all— the gains made during the week were given back.

This has caused shorter-dated option skews to lean more negative due to put demand, in order to hedge further spot-price declines.

(April 18th, 2021 - ETH’s Skews - Deribit)

Longer-term volatility skews remain decidedly bullish due to large call skew premia.

Given the growth of DeFi, NFT’s and ERC20 token “alt-season”, there is much to be bullish regarding Ethereum future. Option traders are pricing more upside volatility in the long-term.

TERM STRUCTURE

(April 18th, 2021 - ETH’s Term Structure - Deribit)

The term structure has now moved away from Contango.

Almost all expirations are within an 8% IV range.

It’s safe to call this term structure “flat”, which signifies an undecided option market here. Typically, “flat” term structure don’t persist as long as other structures.

If spot-prices crash further, we could expect a Backward term structure, while a recovery or consolidation would likely cause a Contango structure to reemerge.

ATM/SKEW

(April 18th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Notice the SHARP increase in ATM volatility over the past 12hrs.

The spot-price decline caused a rather large scramble to purchase options.

This option-buying demand was geared towards put-options, which caused the skew (right) to turn down lower and erase a 15pts-premium that call-options displayed earlier this week.

VOLUME

(April 18th, 2021 - ETH’s Premium Traded - Deribit)

(April 18th, 2021 - ETH’s Contracts Traded - Deribit)

This past week saw HEAVY option volume nearly everyday.

This bodes very well for Ethereum. There is real demand for positioning, and traders used Paradigm to execute a large percentage of the volume via block-trades.

This shows that a high percentage of volume came from sophisticated traders.

VOLATILITY CONE

(April 18th, 2021 - ETH’s Volatility Cone)

With the exception of yesterday, most short-term and medium-term realized volatility windows remain on the 12-month median.

This shows a “business as usual” volatility environment.

REALIZED & IMPLIED

(April 18th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

Both IV and RV have been clustered on top of each other lately: a sort of consensus is emerging between RV and IV.