Crypto Options Analytics, April 17th, 2022

How far do treasuries need to drop before negative spot/vol. correlations bleed into risk-assets? <-- monitor this for trading -P/+C RRs. Assuming no Fed surprises.

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$40,354

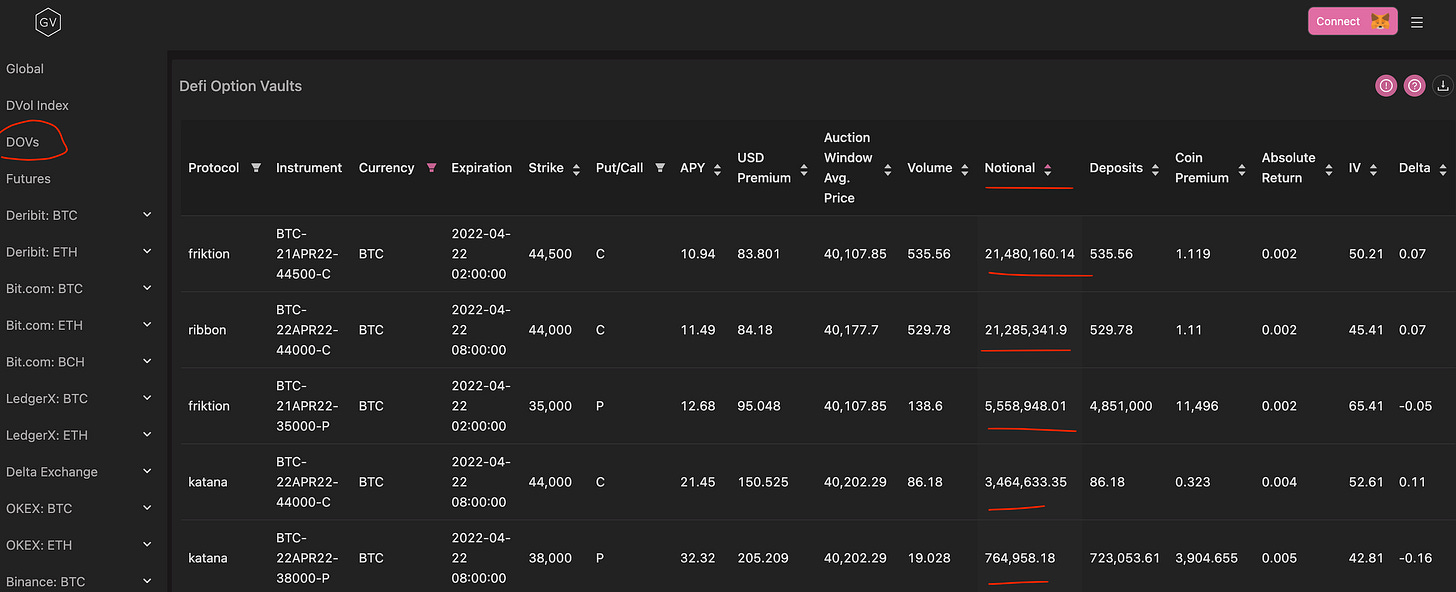

DOV auctions

*note: Protocols have different auction times

DVOL: Deribit’s volatility index

(1 month, hourly)

We’re happy to announce we now have DOV analytics incorporated into gvol.io

More protocols to come.

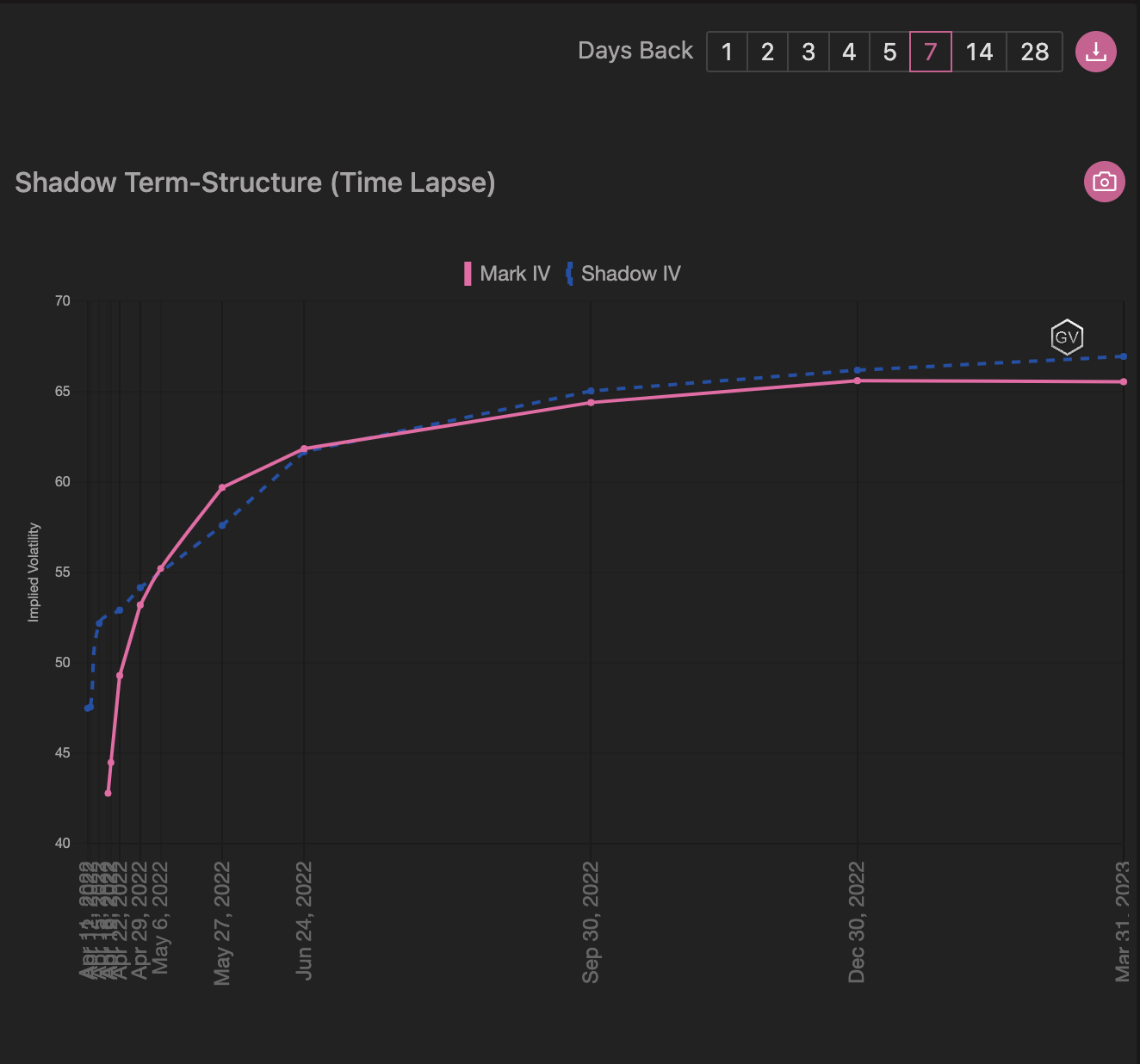

TERM STRUCTURE

(April 17th, 2022 - BTC’s Term Structure - Deribit)

The term structure has continued to steepen week-over-week, lead by the 7-day expirations.

The medium and long-term IV has been stable.

What’s quite interesting here is the weakness in spot prices seems to be having little impact on IV & RV.

Various fed presidents are speaking this week. Everyone has already signaled a strong preference for 50bps hikes and the market has been pricing this in… I expect this week to be a non-event and $38k-$42k to act like a magnet.

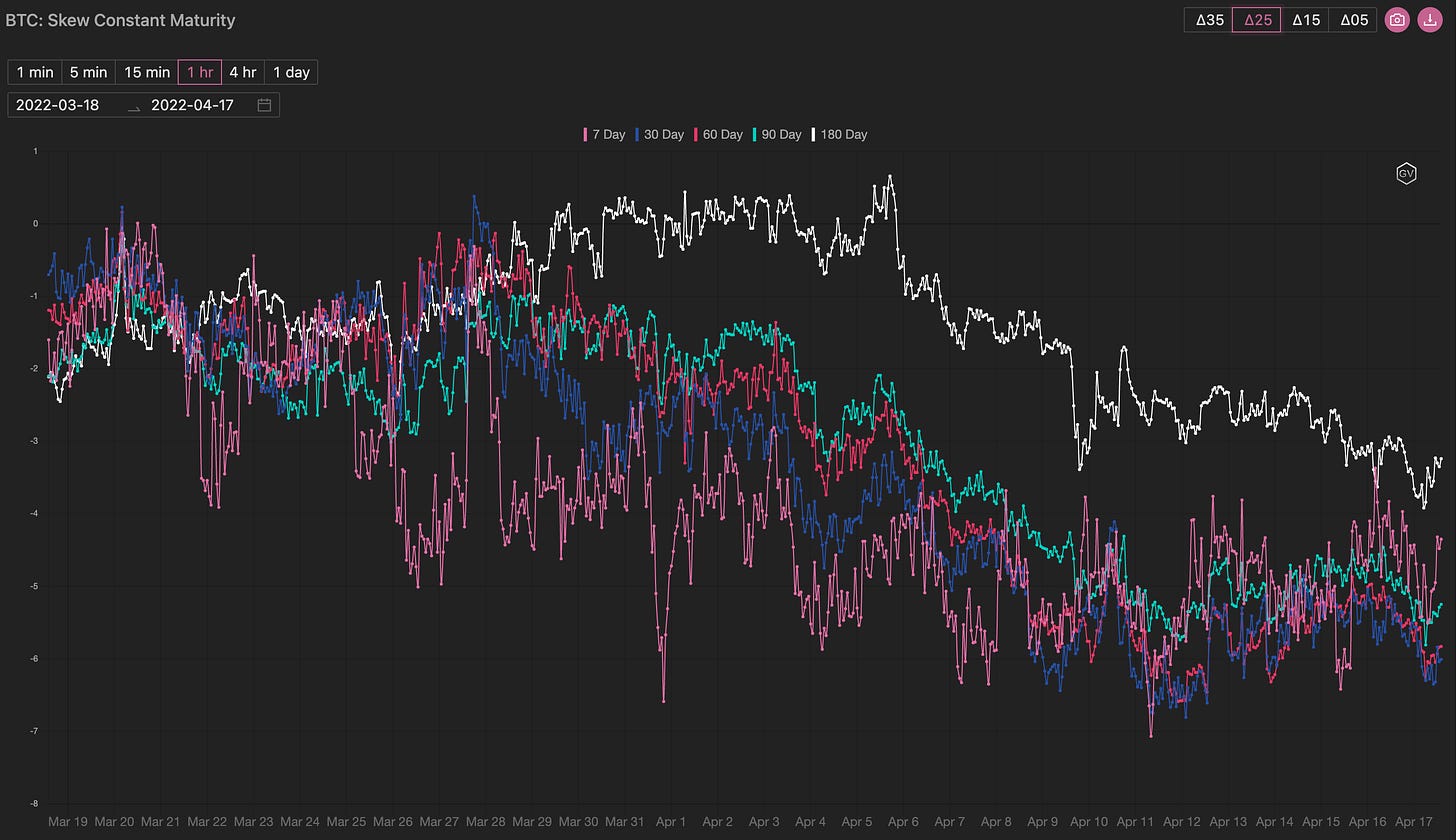

SKEWS

(April 17th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Short-term and Medium term skew has held negative levels throughout the week.

The follow-through in vol isn’t materializing, despite lower spot prices.

Long-term skew has fallen further this week.

-P/+C risk-reversals will be a great trade for Fed talks… Assuming I’m correct about the non-event.

Option markets are pricing a negative spot/vol. correlation that we just haven’t been seeing lately.

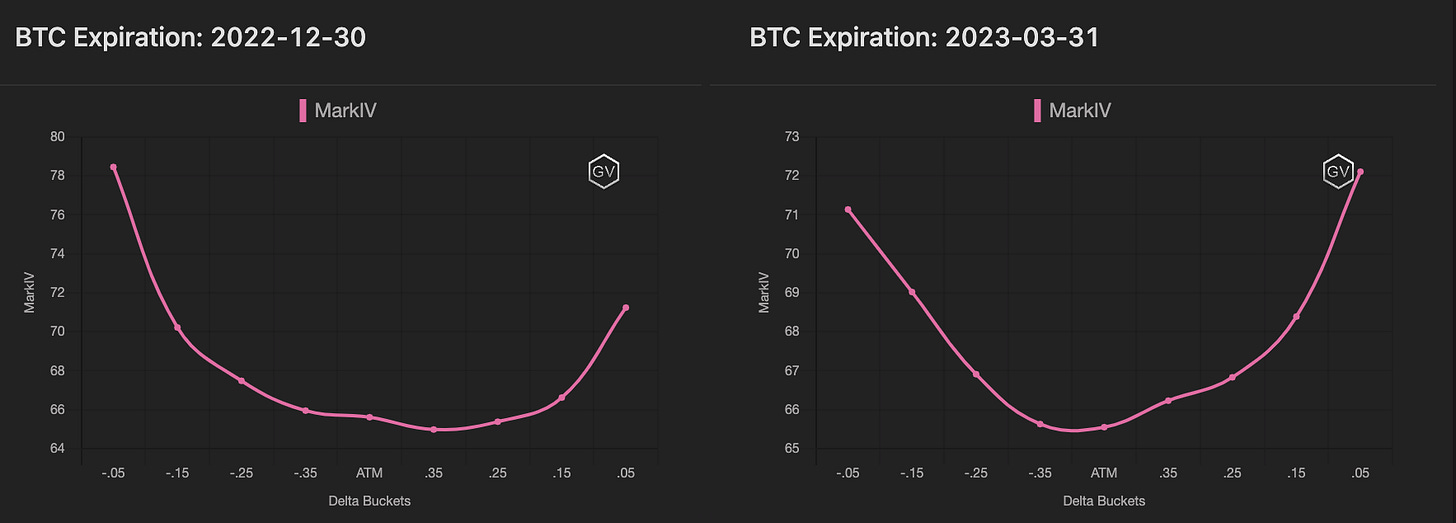

(April 17th, 2022 - Long-Dated BTC Skews - Deribit)

Open Interest - @fb_gravitysucks

BTC

In the last two weeks of trading, along with higher volumes in the weekly expirations, spot prices went from $37k to $48k, then back below $40k.

Intuitively, the open interest profile demonstrates the greatest concentration in the $50k (when a break-out seemed possible) and $40k strikes.

The latter is the strike with the greatest OI. A good number for both calls and puts.

The prize was distributed to traders who were skeptical of breaking resistance and who had accumulated puts at relative highs.

(Apr 15th, 2022 - BTC Contract - Deribit)

(Apr 15th, 2022 - BTC Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

The main theme of the week was very clear: seeking protection. The key level of $40k is the one that has received the most attention.

(11th - 17th Apr, 2022 - Options scanner BTC - Deribit)

On Monday, with spot down from $42k to $39k, the flow saw short-term put demand: $35k and $40k outrights and $40k-$36k put spreads. There was also a more refined trade: a $35k May/September put calendar, long gamma and short vega.

On Tuesday with the spot stabilized, we saw some profit taking on the $40k puts of April 15th.

The week ended with trades in the weekly 4/22 expiration: a $40k straddle signaling directional uncertainty, and >2000x $40k puts bought with a very strong bearish view instead.

Finally, we report the only two big bullish trades: a risk reversal on December -$25k +$70k, ratio’d to be Vega neutral (participants continue to see downward pressure on IV), and a diagonal +$45k/-$70k April/September.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(April 17th, 2022 - BTC Premium Traded - Deribit)

(April 17th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (11 April - 17 April) BTC

BTC and ETH drifted lower this week (-4.4 % / -4.75% WoW). We saw an unfavourable backdrop of eyewatering CPIs and further signalling of a potential 50bps Fed hike in May. The BTC/NDX 40-day correlation reached an all-time high of 0.70 on Wednesday.

The BTC vol crush persists with 1M ATM IV trickling lower to 56v and 30-day realized touching 44.5v, the lowest level since Q4 2020. The ETH 1M ATM IV ended at 60v and 30-day realized at 54v

BTC and ETH IV term structures continue to steepen, driven by front-month implied resetting lower from vol harvesting strategies and a persistent bid for Vega further out the curve.

Composition of block trades.

In BTC, 40000 calls and puts dominated the volume, with open interest increasing by 2700 contracts on this strike. We saw consistent buying on Friday of 22Apr 40k puts, totalling 1250 contracts.

BTC

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(April 17th, 2022 - BTC’s Volatility Cone)

RV is in the bottom 25th percentile across the board.

Macro asset vol. (TradFi) has also relaxed quite a bit, except for treasuries.

How far do treasuries need to drop before negative spot/vol. correlations bleed into risk-assets?

This is the big catalyst to look at and keep in mind, otherwise we’re likely seeing sustained low RV.

REALIZED & IMPLIED

(April 17th - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

RV drastically lead vol. lower into April.

IV dropped on convergence.

RV struggled to climb a few points during the current spot price drop.

$3,052

DOV auctions

*note: Protocols have different auction times

DVOL: Deribit’s volatility index

(1 month, hourly)

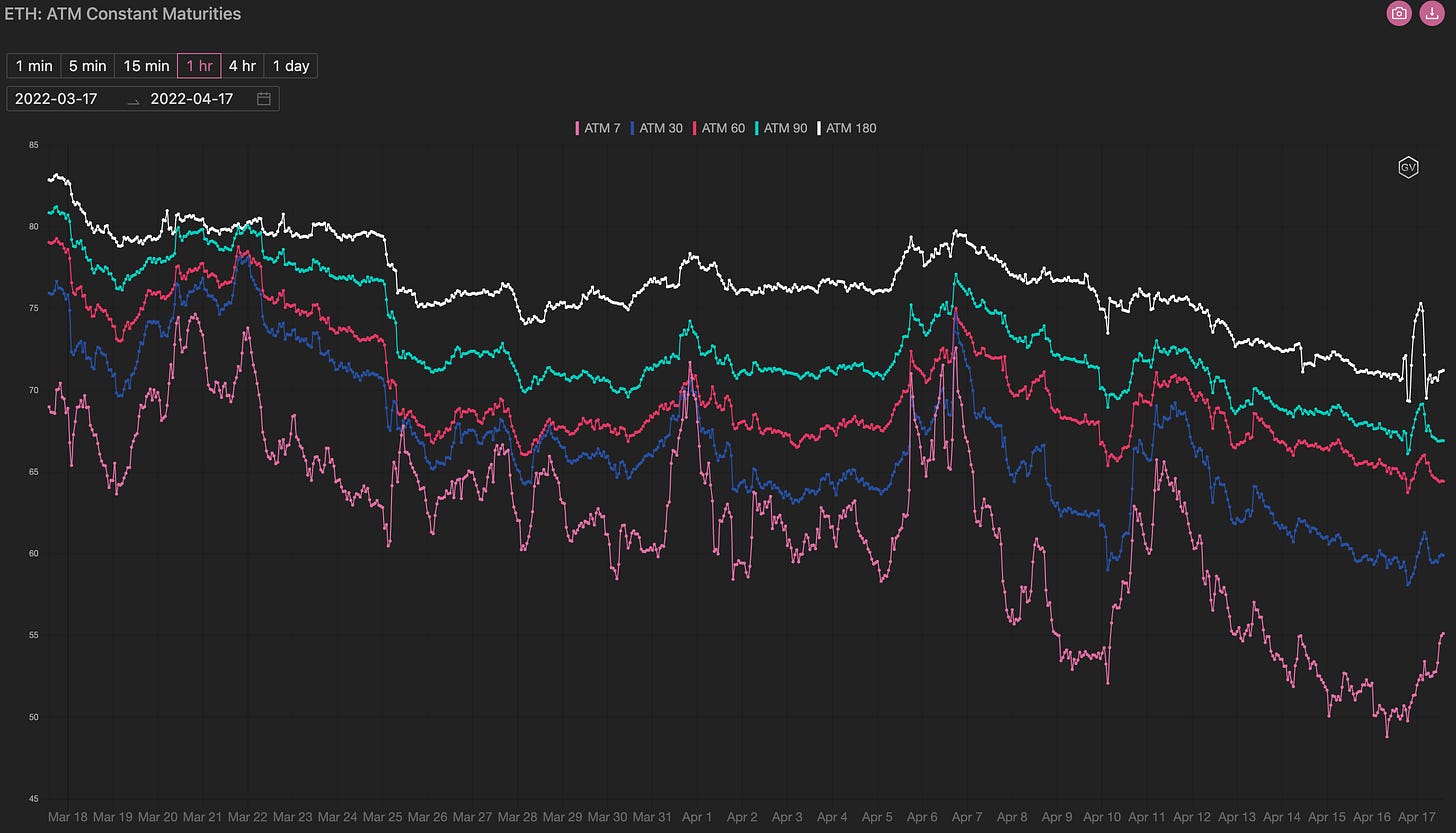

TERM STRUCTURE

(April 17th, 2022 - ETH’s Term Structure - Deribit)

ETH prices have been able to hold $3k.

ETH strength, combined with crypto weakness, has caused ETH prices to remain stable.

IV has dropped across the board to reflect this reality.

SKEWS

(April 17th, 2022 - ETH’s Skews - Deribit)

Skew is bearish for all expirations.

Lower vol. with relative ETH strength, make the -P/+C risk-reversal interesting here.

Notice the 30-day expiration is more negative than 7-day, this relationship has historically been the opposite.

This makes the 30-day risk-reversals a good fade candidate.

(April 17th, 2022 - ETH’s Skews - Deribit)

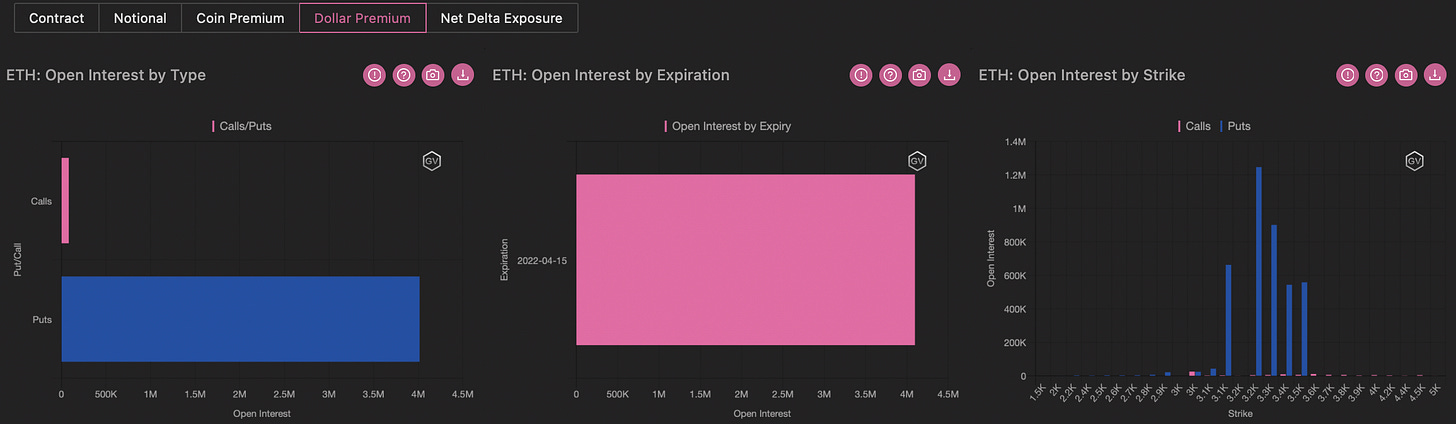

Open Interest - @fb_gravitysucks

ETH

Last week we reported the relentless flow of put sales, which has been a dominant theme in Ethereum for a while.

The open interest profile clearly highlights the $2.9k and $3.0k strikes sold last week.

Once again the sellers were right, with 85% of the expiring worthless.

(Apr 15th, 2022 - ETH Contract - Deribit)

(Apr 15th, 2022 - ETH Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

The flow in Ethereum has been more bullish than in Bitcoin with new contracts opening on the call side.

(11th - 17th Apr, 2022 - Options scanner ETH - Deribit)

The beginning of the week saw spot falling below $3k and a lot of activity in puts: some profit taking, rolled positions and new protections on strikes below $3k.

Despite the long-term support level of $3k, and the prevalence of flow in puts, we have seen some interesting bullish trades, in a "buy-the-dip" perspective.

Over 6,000x call spreads $3.4k/$3.7k bought for the 22nd April, betting on a short-term rebound. An anomalous trade for the choice of a second short leg with a very low premium collected.

And lastly, in the June expiry over 10,000 contracts of the $3.8k call were bought on screen. The trader seems unconcerned regarding the delayed

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(April 17th, 2022 - ETH’s Premium Traded - Deribit)

(April 17th, 2022 - ETH’s Contracts Traded - Deribit)

Paradigm Block Insights (11 April - 17 April) BTC

In ETH, two-way flows in short-dated 3400 calls, with over 15k contracts trading in the 22Apr and 29Apr buckets. These volumes were a combination of tactical outright upside earlier in the week, then DOV hedging of the Ribbon and Thetanuts auctions that sold the 3400 strike calls

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(April 17th, 2022 - ETH’s Volatility Cone)

Absolute minimum realized.

Nothing suggests buying short-term or medium-term options.

REALIZED & IMPLIED

(April 17th, ‘22 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

There’s no IV to RV divergence.

Markets expect RV to continue hold these levels.