Crypto Options Analytics, April 11th, 2021

Option positioning becomes more bullish but implied vol. fails to move higher

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

For best execution with multiple counter-parties and anonymity visit: Paradigm

Option positioning becomes more bullish but implied vol. fails to move higher!

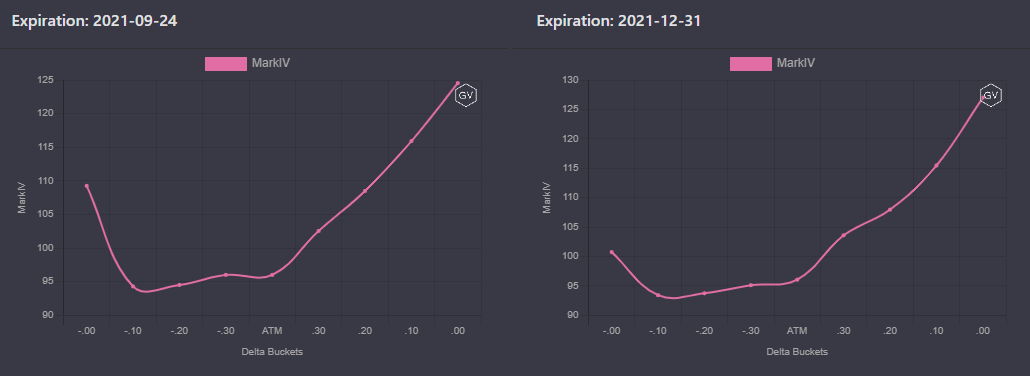

SKEWS

(April 11th, 2021 - Short-term and Medium-Term BTC Skews - Deribit)

Skews for all expiration months have inched higher over the past week.

As BTC has breached new ATH prices this past week, traders have been willing to pay a larger premium for call-options over puts.

The 25 delta skews are priced nearly identically across various expirations, with a slight premium to longer-dated options.

(April 11th, 2021 - Long-Dated BTC Skews - Deribit)

The longest-dated options have the most pronounced premium in the “tail” skews, meaning the .10 delta calls trade at a significantly large premium to .10 delta puts.

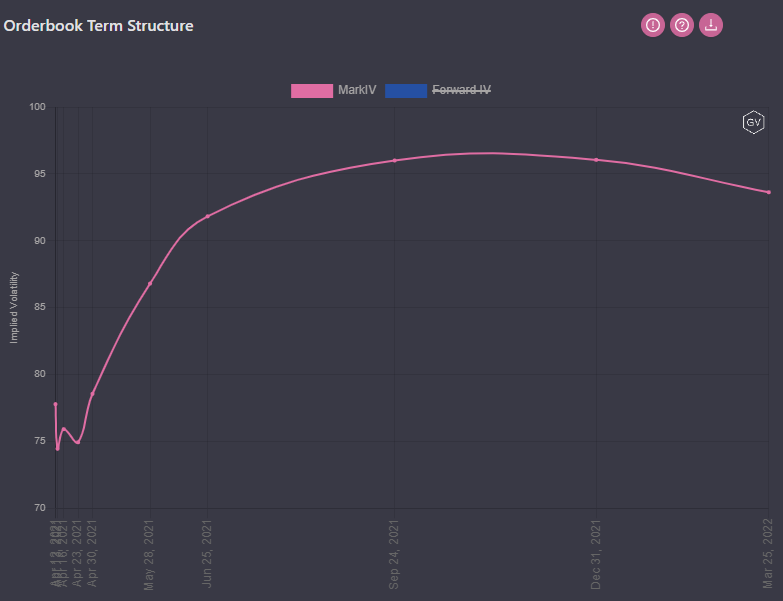

TERM STRUCTURE

(April 11th, 2021 - BTC’s Term Structure - Deribit)

For the exception of a very slight drop in implied vols. for near expiration options, the BTC term structure is nearly identical to last week’s term structure.

Options are still pricing a Contango term structure.

This type of term structure is consistent with lower realized volatility environments.

ATM/SKEW

(April 11th, 2021 - BTC ATM & Skews for options 10-60 days out - Deribit)

Looking at the left hand chart above, we can see that although implied vols. didn’t move higher since last week, the brief drop lower was also short-lived.

The main point of interest last week is indeed the 20/30 delta skew moving higher. Skews are now right back at the top of the range.

VOLUME

(April 11th, 2021 - BTC Premium Traded - Deribit)

(April 11th, 2021 - BTC’s Contracts Traded - Deribit)

Bitcoin option volumes actually picked up a little last week.

The large block-traded premiums seen on Paradigm on 04/09/21 are once again synthetic features spreads going through.

This trade has gained a lot of popularity in the recent months, as traders are capturing futures premiums in contracts that must be traded synthetically, since there isn’t any listed futures yet.

VOLATILITY CONE

(April 11th, 2021 - BTC’s Volatility Cone)

Consistent with a term structure in Contango, we see that realized volatility is currently around the lower 25% percentile for short-dated options.

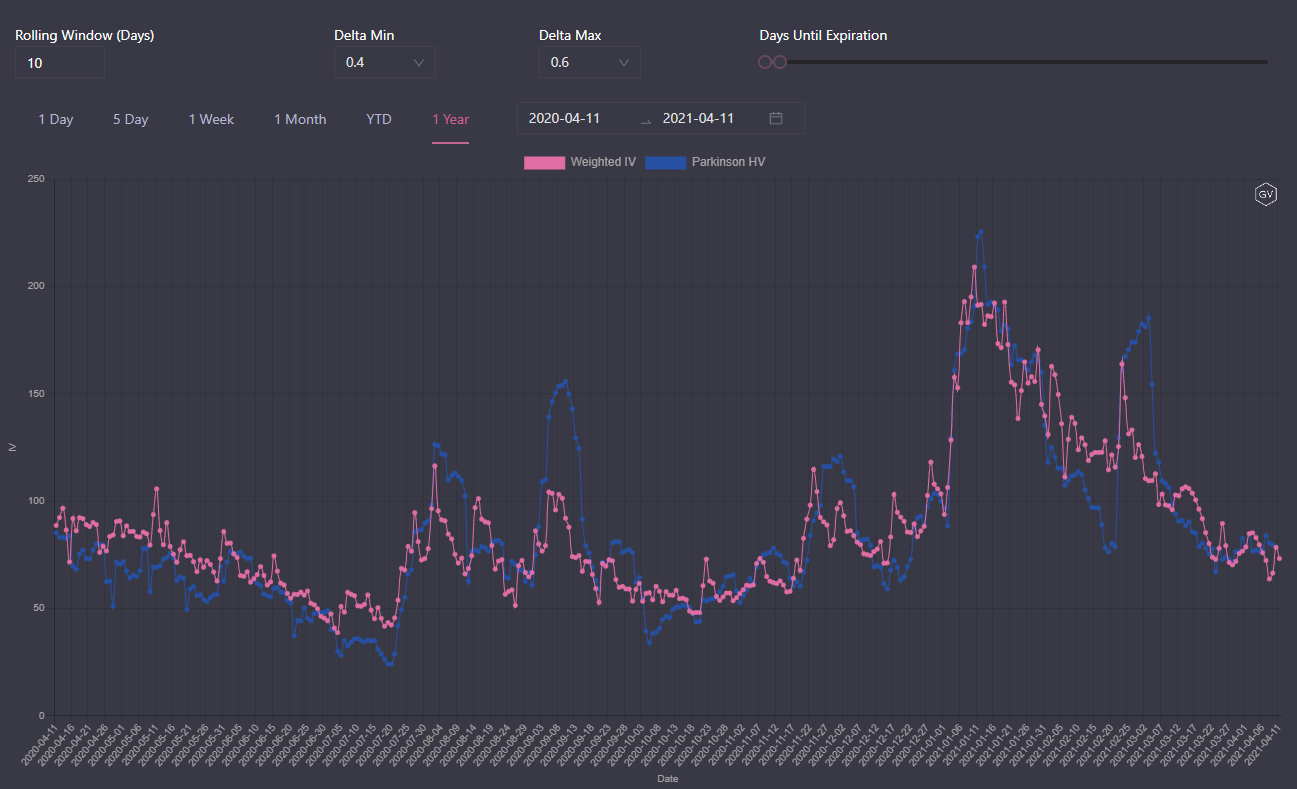

REALIZED & IMPLIED

(April 11th, 2021 - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

Looking at the implied and realized charts above… it’s interesting to note that volatilities have been consistently dropping lower, despite BTC making higher and higher ATH’s consistently.

SKEWS

(April 11th, 2021 - ETH’s Skews - Deribit)

ETH skews are consistently more positive than BTC skews.

There is noticeably larger premium being paid for ETH calls versus puts: nearly +15 IV points for 25 delta skews in the medium term expiration months. That’s +5 IV points higher than similar BTC skews.

This option positioning continues to be encouraging for ETH bulls.

(April 11th, 2021 - ETH’s Skews - Deribit)

TERM STRUCTURE

(April 11th, 2021 - ETH’s Term Structure - Deribit)

ETH implied volatility has shifted slightly lower, compared to last week.

What’s even more interesting is that the Sept. IV hump seen in the last newsletter is now gone.

This current term structure no longer displays a pronounced hump, and now displays a more common Contango shape.

ATM/SKEW

(April 11th, 2021 - ETH’s ATM & Skews for options 10-60 days out - Deribit)

Similar to BTC ATM IV, ETH ATM IV was unable to drop to new lows.

The most interesting phenomenon is the strong and stable positive ETH skew. There hasn’t been a lot of back-and-forth seen in the skew recently.

Option traders seem to have made up their minds with conviction; and as a result, ETH skews are now consistently very positive.

VOLUME

(April 11th, 2021 - ETH’s Premium Traded - Deribit)

(April 11th, 2021 - ETH’s Contracts Traded - Deribit)

ETH option volumes are pretty stable, compared to last week; there are no exciting big jumps, unfortunately.

VOLATILITY CONE

(April 11th, 2021 - ETH’s Volatility Cone)

ETH RV isn’t as low as BTC RV…

RV’s are hovering around the 12-month median, as opposed to the lower 25th percentile seen in BTC.

REALIZED & IMPLIED

(April 11th, 2021 - ETH’s 10-day Realized -, and Trade-Weighted-, Implied-Vol.-Deribit)

IV and RVs are sitting right on top of each other, providing fair and attractive pricing for option buyers.

It’s also worth noting that corporate investment into Ethereum could be an exciting catalyst to move ETH’s market cap. much higher and gain ground on BTC.