Crypto Options Analytics, April 10th, 2022

Author: Greg Magadini

Visit gvol.io

Disclaimer: Nothing here is trading advice or solicitation. This is for educational purposes only.

Math minded people here, pardon any typos.

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

$43,359

DVOL: Deribit’s volatility index

(1 month, hourly)

The macro environment is likely the main driving force across risk assets for the time being.

FOMC minutes and hawkish postering from Fed members has caused the interest rate environment to react strongly this week.

Higher yields and Fed Fund guidance are likely the culprit behind the weakening BTC spot prices.

TERM STRUCTURE

(April 10th, 2022 - BTC’s Term Structure - Deribit)

Despite skew pricing-in more volatility should BTC prices head lower, the vol. complex has remained nearly unchanged week-over-week as BTC prices dropped about -10%.

Last week, we expected $42,500 to hold… the next lower levels are $40k and $35k.

The consolidation channel, although slightly expanded, likely remains in play.

The term structure is currently pricing a rather steep Contango, with June expiration as an inflection point.

This means volatility sellers will likely capture nice premiums by selling the June expiration, as Theta is enhanced by Vega “roll-down”.

(GVol Python Module API Jupyter Notebook: built by @GravitySucks)

Week-over-week, diagonal positions have been benefiting from the steepening of Contango as short/medium expirations see lower IV, while long-term IV remains buoyant.

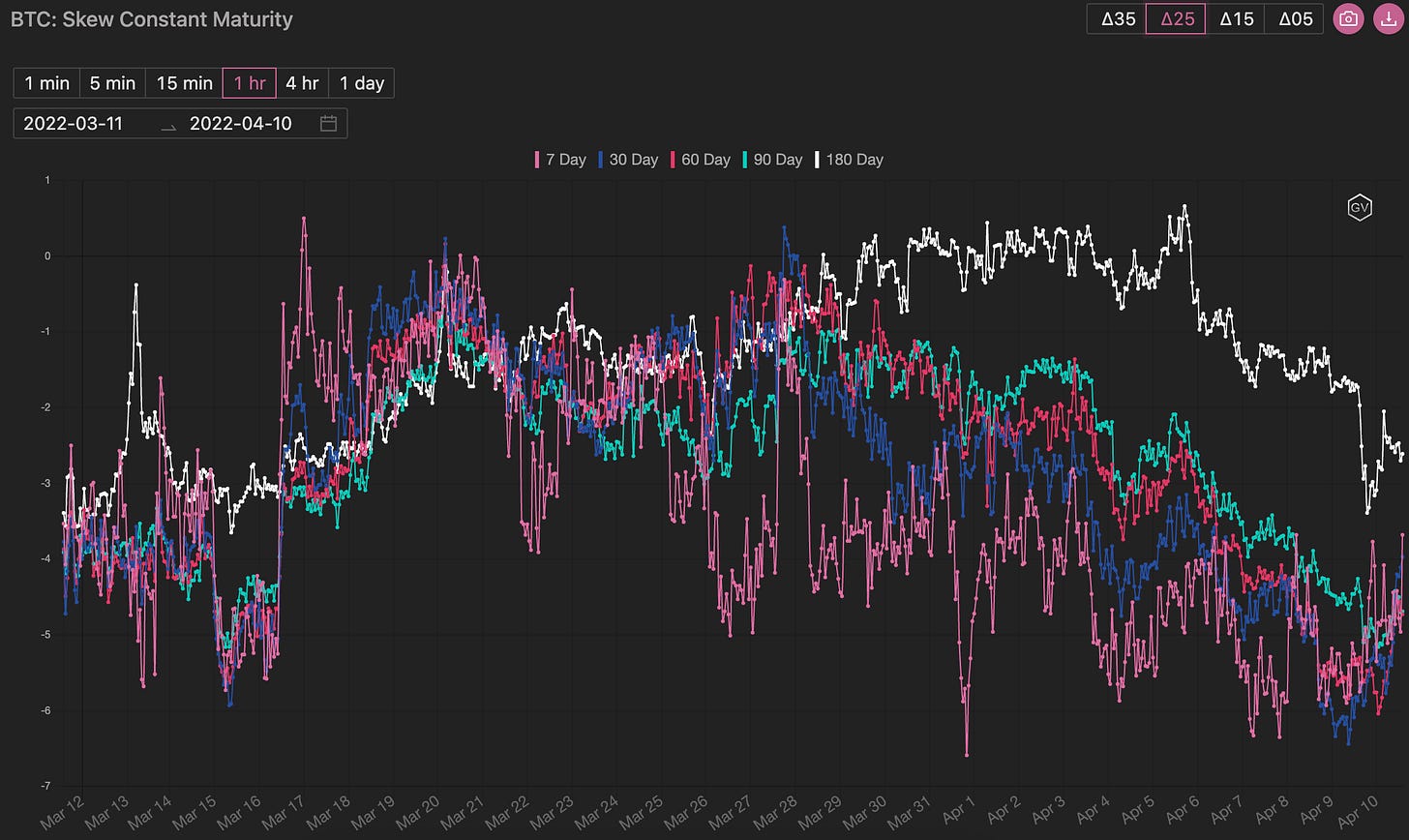

SKEWS

(April 10th, 2022 - Short-term and Medium-term BTC Skews - Deribit)

Option skew has repriced lower across the board.

Although spot prices justify hedging sentiment (for delta), increased volatility from lower prices has failed to materialize.

In our opinion, the option skew, especially for long-term expirations, has overreacted.

We aren’t seeing increased vol. on this drop.

Assuming continued consolidation, ∆25 and ∆15 risk-reversals could be a great trade.

Selling the put and buying the call could capture flow inefficiencies.

(April 10th, 2022 - Long-Dated BTC Skews - Deribit)

Open Interest - @fb_gravitysucks

BTC

Disappointing weekly for bitcoin with 12k contracts, the lowest value since March 2021.

Those who thought (myself included) that the Bitcoin conference in Miami could bring a little desire for speculation were disappointed.

In fact, the market was right, given the lightness of the news of the event.

The sharply discounted settlement, compared to the previous week, rewarded the holders of puts.

(Apr 8th, 2022 - BTC Contract - Deribit)

(Apr 8th, 2022 - BTC Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

The week can be summarized this way: shorting the shorter, longing the longer. Participants are reading our newsletter as it is the preferred trade of ours at the moment.

(4th - 10th Apr, 2022 - Options scanner BTC - Deribit)

The first days of the week saw an incessant sale of straddles on the dailies in strikes $47k-$46k-$45k, adjusting the trade on the direction of the spot price.

On Tuesday, the largest weekly trade with over 5$M premium was recorded: a purchase of $80k calls 1350x for December. The IV and the chosen strike suggest a rather rational bet.

On the same day, there were good short-term buys on strike $50k, the only true gamma trade for the Bitcoin conference.

On Thursday, the trade that caused the most hype: the sale of over 1200x strangles $38k-$49k on 29th April. At the moment, the most successful trade.

Last note, a trade I wrote about on my twitter account (where you can find greeks details), a not-centered short put fly in strikes $36k-$38k-$40k. Done in mediocre quantities, it is however worth noting for the flexibility that the options offer for the expression of one's own ideas.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

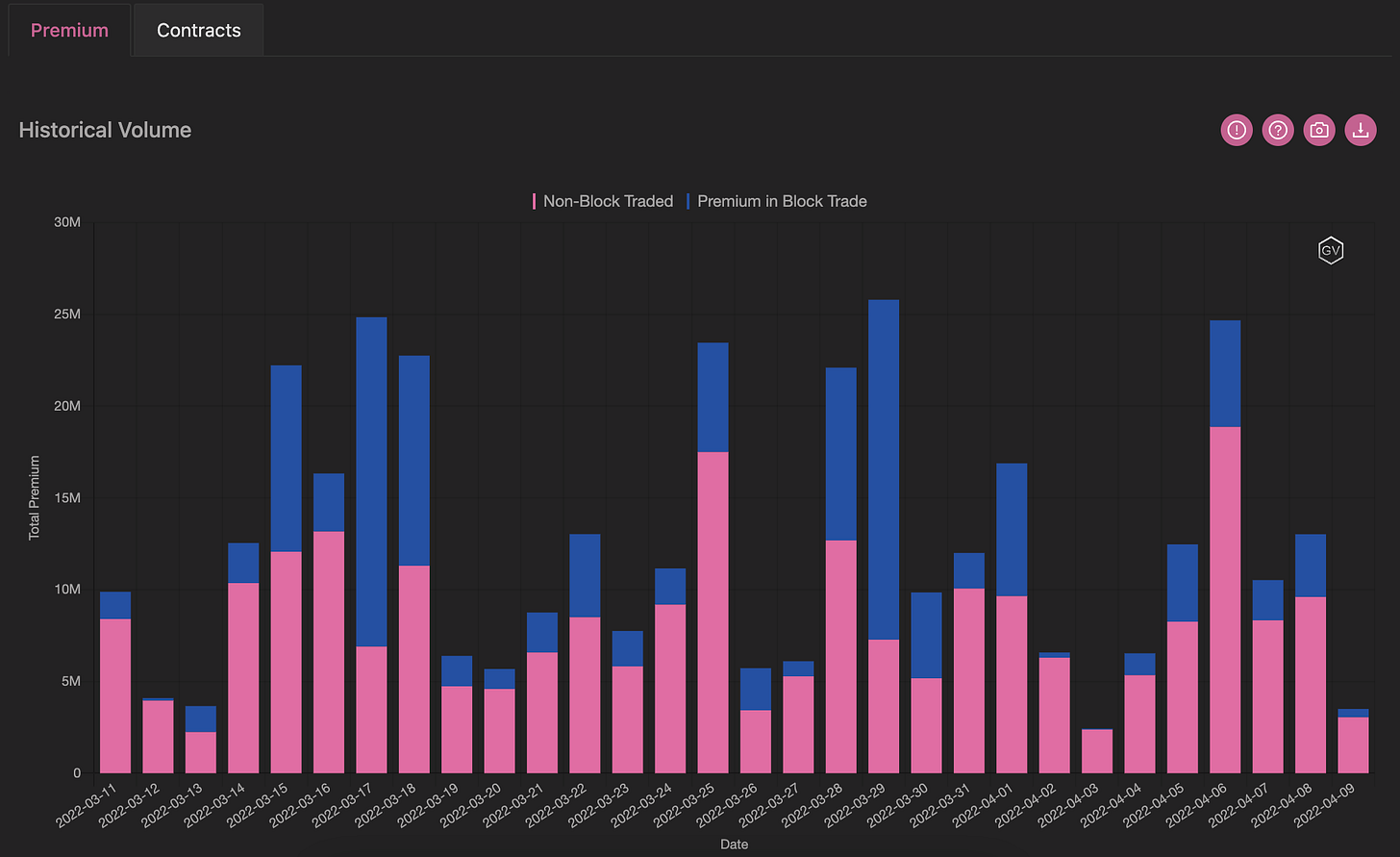

VOLUME

(April 10th, 2022 - BTC Premium Traded - Deribit)

(April 10th, 2022 - BTC’s Contracts Traded - Deribit)

Paradigm Block Insights (4 April - 10 April) BTC & ETH

BTC and ETH gave up their gains of the prior week, drifting lower to $42500 and $3200 respectively. BTC implied volatility ticked up in the middle of the week, but closed at recent lows around 55, while skew continued to shift in favor of puts. IV in ETH also drifted lower, closing well below the recent range lows at 65, despite the downward drift in spot.

Volume-wise, the week started slow, but volume picked up on Tuesday, April 5, with $420 million traded. Block trades over Paradigm accounted for 40.8% (BTC) and 28.8% (ETH) on April 5th, as Paradigm’s overall market share continued to trend higher, following a strong March. (https://paradigm.co/stats).

The main flow at the beginning of the week was strangle buying in April and June, for both BTC and ETH, as well as buying of longer-dated out-of-the-money calls in both (December 2022 and March 2023).

In BTC, out-of-the-money outright calls remained popular, in particular the 30 December 80k calls, where we saw 1350 BTC contracts trading.

In ETH, the interest in out-of-the-money calls was in June expiration, with the 10000 contracts trading in the 4000 and 5000 strikes.

BTC

ETH

Feel free to contact us at https://t.me/tradeparadigm & follow us at @tradeparadigm on Twitter to access the best pricing and liquidity for large trades in crypto derivatives.

VOLATILITY CONE

(April 10th, 2022 - BTC’s Volatility Cone)

Realized Volatility has not picked up at all this week.

Despite the reversal in spot direction, we continue to hug annual lows across nearly all measurement windows.

REALIZED & IMPLIED

(April 10th - BTC’s 10-day Realized-, and Trade-Weighted-, Implied-Vol.-Deribit)

The IV/RV gap has narrowed a bit.

We continue to see a slight premium, but most of the edge for volatility sellers will likely come from a risk-reversal premium and a term structure “roll-down”- as opposed to a raw variance premium- should spot prices find support and continue a consolidation channel.

$3,291

DVOL: Deribit’s volatility index

(1 month, hourly)

TERM STRUCTURE

(April 10th, 2022 - ETH’s Term Structure - Deribit)

ETH spot-prices have been stronger than BTC week-over-week.

The relative strength of ETH has meant that spot-prices haven’t moved nearly as much, allowing implied volatility to drop lower across the curve.

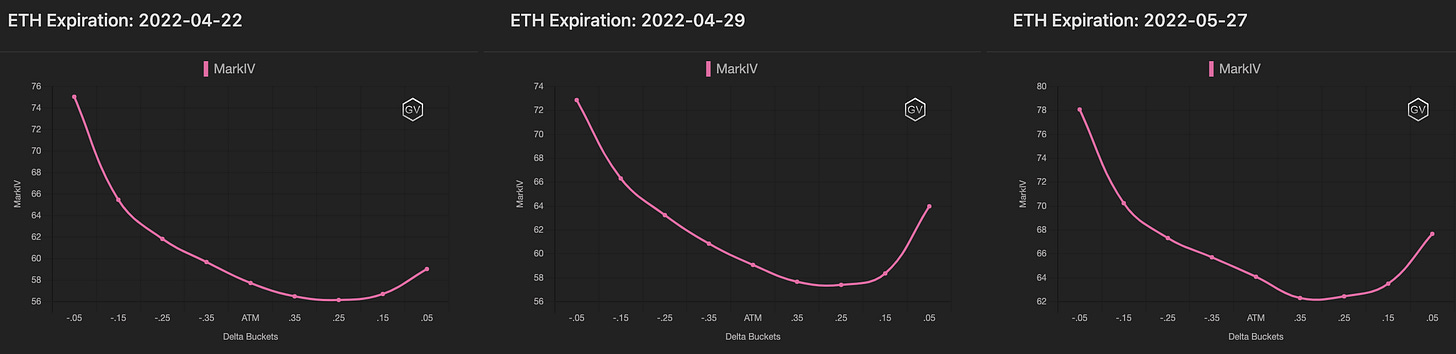

SKEWS

(April 10th, 2022 - ETH’s Skews - Deribit)

With spot-prices, ETH skew has remained constant over the week.

Although constant, ETH skew is negative for every expiration.

Fading the skew and engaging in risk-reversals in ETH is interesting, but for different reasons.

ETH spot is relatively stronger than BTC and the relative volatility between ETH and BTC is narrow. ETH calls, therefore, are very interesting buys.

Vol. sellers on the other hand can focus on selling OTM puts.

We’ve seen traders sell OTM $1K PUTS in SIZE recently, taking advantage of the negative skew. Most of this flow was NOT blocked.

(Sept. ETH $1k PUT sells, ramp up open interest)

(April 10th, 2022 - ETH’s Skews - Deribit)

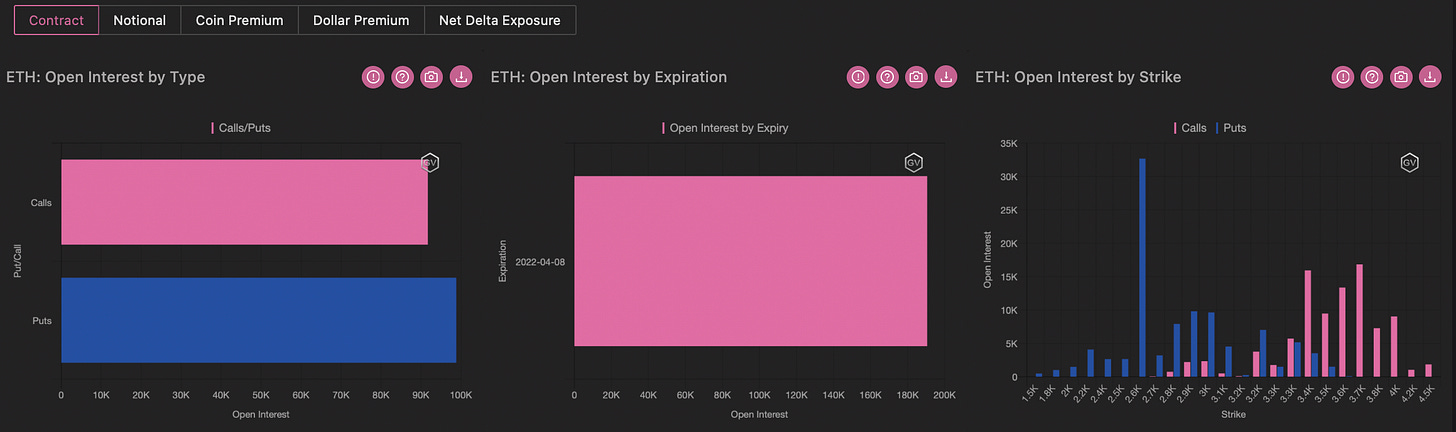

Open Interest - @fb_gravitysucks

ETH

The weekly of Ethereum was superior to that of Bitcoin in every respect: open contracts, notional and distributed premium.

The Ethereum merge is not only supporting the spot price, it is also focusing the attention of options traders.

Nonetheless DOV was right again, with 88% of the options expiring worthless.

(Apr 8th, 2022 - ETH Contract - Deribit)

(Apr 8th, 2022 - ETH Dollar Premium - Deribit)

BIG TRADES IN THE FLOW

The main theme for weeks on Ethereum continues again, with puts that are sold non-stop (mostly on screen).

(Mar 28th - Apr 3rd, 2022 - Options scanner ETH - Deribit)

The preferred deadline for selling puts was April 29th. Contracts previously sold in strikes $2.2k and $2.6k were rolled up to $3k on Monday, while midweek, a new sales flow in strikes $2.9k-$3k was recorded.

Among the few truly bullish trades, we point out the $4k-$5k spread call on June and the purchase of December $6k of outright calls.

Finally, the sale in 1000 clips on screen of the September $10k call should be highlighted. The market is beginning to take the opposite stance to Raoul’s call.

For more insights, follow veteran crypto options trader Fabio on twitter @fb_gravitysucks

VOLUME

(April 10th, 2022 - ETH’s Premium Traded - Deribit)

(April 10th, 2022 - ETH’s Contracts Traded - Deribit)

VOLATILITY CONE

(April 10th, 2022 - ETH’s Volatility Cone)

Realized volatility hugging annual lows for all measurement windows.

A whole lot of “nothing” happening.

REALIZED & IMPLIED

(April 10th, ‘22 - ETH’s 10-day Realized -, and Trade-Weighted-, ImpliedVol.-Deribit)

IV to RV premium is gone.

Vol. selling doesn’t seem particularly interesting, but risk-reversals could pay nicely given the relative strength of ETH/BTC.